|

市場調查報告書

商品編碼

1437915

語音辨識:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Voice Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

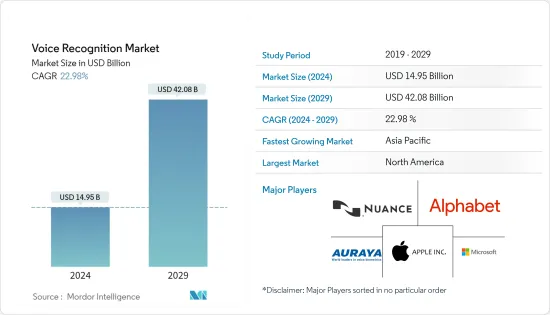

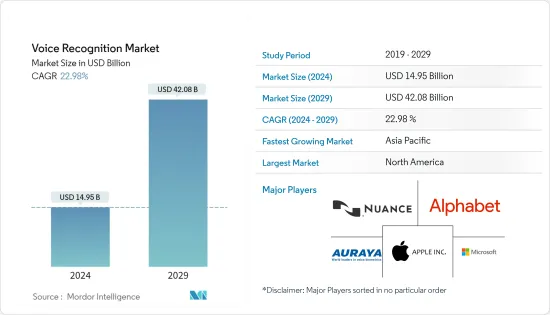

2024 年語音辨識市場規模估計為 149.5 億美元,預計到 2029 年將達到 420.8 億美元,在預測期間(2024-2029 年)以 22.98% 的複合年增長率增長。

零售、銀行、連網型設備、智慧家庭、醫療保健和汽車領域不斷成長的應用增加了對語音啟動系統、語音虛擬助理系統和語音設備的需求,推動了市場成長。

主要亮點

- 透過在行動電話上使用語音辨識軟體,醫生和治療師可以將他們的聲音轉化為豐富、詳細的臨床陳述,並可以儲存在電子健康記錄 (EHR) 平台上。在預測期內,智慧家庭自動化中擴大採用語音連接系統可能會推動該行業的發展。物聯網設備透過提供創造性的使用者介面和標準方法(例如觸控顯示器和依鈕)來增強各種通常離線的設備。

- 許多工業領域擴大使用透過語音智慧進行語音識別,從而增加了全球需求。多家公司正在將創新與語音辨識技術相結合,使公司更容易實施為其互動中心提供基於人工智慧的數位工作場所的系統。例如,2022 年 6 月,ArkX Laboratories 宣布發布 EveryWord Voice Control,其中包含 Sensory TrulyHandsfree SDK 軟體堆疊。當與可立即投入生產的 EveryWord音訊前端 (AFE) 或語音控制單元相結合時,公司創新的遠場語音採集和語音辨識技術使OEM能夠創建客製化的喚醒詞、中小型命令集等。(21 種方言),以及語音介面的說話者驗證的概念。

- 包括醫療機構在內的最終用戶行業擴大採用人工智慧和語音輔助技術,預計將在預測期內推動市場發展。例如,亞馬遜最近為醫院推出了一種新的解決方案,將語音智慧大規模整合到醫療保健環境中。該服務由 Alexa 智慧設施組成,使醫院和高級護理機構可以輕鬆地在其設施內安裝和操作支援 Alexa 的設備,以改善醫療保健服務。

- COVID-19感染疾病對該行業產生了積極影響。隨著大多數人在家工作,對智慧型設備和小工具的需求激增。這為音訊和語音命令供應商創造了可能性。此外,作為一種與人類非接觸式的互動方式,大多數人都採用語音技術來進行娛樂、交流以及醫療領域的搜尋和幫助。

語音辨識市場趨勢

日益嚴重的安全問題推動語音辨識市場

- 網路攻擊可能會竊取數百萬用戶的真實姓名、電子郵件地址、出生日期和電話號碼。最近雅虎的資料外洩事件使雅虎的售價降低了約 3.5 億美元。根據 HIPAA Journal 報導,2021 財政年度美國醫療保健產業發生了最嚴重的資料外洩事件,影響了 42,431,699 條個人記錄。 AccuDoc Solutions Inc.、UnityPoint Health 和德克薩斯州僱員退休系統等組織均受到此漏洞的嚴重影響。

- IBM 的一項研究顯示,全球金融、醫療保健和飯店業每筆被盜記錄的資料外洩造成的損失為 435 萬美元,位居榜首。個人資料很有價值,為網路犯罪分子提供了犯罪機會。個人資料在暗網上的售價為信用卡號 5 美元、完整個人資料 30 美元、醫療記錄 1,000 美元。

- 隨著線上交易的增加,身份驗證要求變得越來越重要。更好的身份驗證服務(例如語音辨識技術)可以降低安全漏洞的可能性。花旗銀行引入了語音生物識別來驗證聯繫客服中心的客戶的身份。當致電客戶服務負責人描述問題時,語音身份驗證使用生物識別識別技術來驗證客戶的身份。

- 此外,語音輔助數位付款系統的不斷發展預計將推動市場成長。例如,2022 年 9 月,Tonetag 與一家主要公共部門機構合作,向消費者提供 UPI 123Pay 解決方案。功能電話用戶可以聯繫適當的 IVR 號碼並使用其語音作為輸入來進行金融交易。據該公司稱,其VoiceSe服務允許客戶完成金融交易、支付公用事業收費、查詢帳戶餘額、充值等。

亞太地區語音辨識市場預計將高速成長

- 中國作為世界上人口最多的國家,預計語音辨識技術的採用率將很高。根據CNNIC的報告,2021年有9.0363億行動用戶在其設備上使用付款服務,進一步需要採用語音辨識軟體。

- 中國語音產業聯盟(SIAC)理事會主席、中國知名人工智慧企業科大訊飛董事長表示,由於對語音參與度的需求不斷增加,智慧型裝置的數量正在迅速增加。此外,2021 年該公司語音助理管理的參與服務數量與前一年同期比較增加了 84%。

- 此外,2022 年 7 月的 Homepod 軟體 15.6 增加了日語、粵語和普通話的語音辨識。預計此類案例將在預測期內推動市場成長。

- 2022 年 2 月,ICICI Home Finance Company 推出了多語言 IVR(互動式語音應答)系統,無需人工干預即可處理一半的客戶請求。 IVR 可以接受 8 種印度語言的服務請求。

- 該地區零售和電子商務行業的成長促使基於語音的搜尋數量增加。阿里巴巴、百度、谷歌和亞馬遜等組織觀察到各自語音輔助智慧型裝置的銷售量有所成長。例如,根據Ascential Digital Commerce的最新分析,2022年東南亞的電子商務收益預計將成長18%,達到382億美元。

語音辨識行業概況

隨著市場領導投資於產品創新和開發以獲得優勢,語音辨識市場正在變得碎片化。本土企業的數量也不斷增加,市場競爭更加激烈。主要企業包括Nuance Communications Inc.、Auraya Systems Pty Ltd、微軟公司、蘋果、Alphabet Inc.等。

2022 年 10 月,伊利諾大學芝加哥分校 (UIUC) 宣布與 Apple 和其他數位企業合作進行語音輔助計劃。該計劃旨在增強針對患有言語異常和殘疾的個人的語音辨識技術,而當前版本難以捕獲這些異常和殘疾的個人。

2022 年 9 月,薪資、社會福利、人力資源和保險支援嵌入式人力資本管理軟體解決方案的領先供應商 Paychex Inc. 宣佈於 9 月為其 Paychex Flex 推出一項名為 Paychex Voice Assist 的新型通訊人工智慧服務2022年,宣布了智慧(AI)功能。基於 SaaS 的 HR 軟體解決方案。 Paychex Voice Assist 允許薪資經理使用與 Google Assistant 相容的小工具免持管理薪資,透過經過驗證的使用者語音簡化和自動化薪資核算流程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場研究

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 認證市場成長

- 基於語音的搜尋增加

- 連網型設備的需求

- 市場課題

- 高成本和準確性問題

第6章市場區隔

- 依發展

- 雲

- 本地

- 依最終用戶

- 車

- 銀行業

- 通訊

- 衛生保健

- 政府

- 消費性應用

- 其他最終用戶

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Nuance Communications Inc.

- Auraya Systems Pty Ltd

- Microsoft Corporation

- Apple Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Sensory Inc.

- Fulcrum Biometrics LLC

- Neurotechnology

- Advanced Voice Recognition Systems Inc.

- IBM Corporation

- Baidu Inc.

- Brainasoft

第8章投資分析

第9章市場的未來

The Voice Recognition Market size is estimated at USD 14.95 billion in 2024, and is expected to reach USD 42.08 billion by 2029, growing at a CAGR of 22.98% during the forecast period (2024-2029).

Increasing demand for voice-activated systems, voice-enabled virtual assistant systems, and voice-enabled devices, owing to the rising applications in retail, banking, connected devices, smart homes, healthcare, and automobile sectors, is driving the market growth.

Key Highlights

- Adopting speech recognition software in cell phones allows doctors and therapists to convert their speech into a rich, thorough clinical statement stored in the Electronic Health Record (EHR) platform. Over the forecast period, the industry is likely to be driven by the rising adoption of voice-enabled connected systems in smart home automation. IoT gadgets enhance a variety of typically offline equipment by providing creative user interfaces and standard methods, including touch displays and buttons.

- The growing use of voice identification with speech intelligence in numerous industrial sectors drives global demand. Several players are merging innovations with speech identification techniques to make it simpler for enterprises to implement systems that augment their interaction centers with an AI-based digital workplace. For instance, in June 2022, ArkX Laboratories unveiled the release of EveryWord Voice Control, which incorporates the Sensory TrulyHandsfree SDK software stack. When combined with the manufacturing-ready EveryWord Audio Front End (AFE) or Voice Control unit, the two businesses' innovative far-field voice acquisition and speech recognition advancements facilitate OEMs to generate tailored wake-words, small to medium-sized command sets (21 dialects), and speaker confirmation concepts for voice interfaces.

- Increasing adoption of AI and voice assistance technologies across end-user verticals, including healthcare institutions, are expected to propel the market during the forecast period. For instance, Amazon recently introduced a novel solution for hospitals that integrates speech intelligence into healthcare environments at a larger scale. The service, composed of Alexa Smart Facilities, will make it easier for hospitals and senior care institutions to install and operate Alexa-enabled equipment throughout their properties to improve healthcare services.

- The COVID-19 pandemic positively impacted the industry. With the majority of people working from home, the need for intelligent equipment and gadgets skyrocketed. This generated a potential for suppliers of audio and voice commands. Furthermore, as a method of contactless human engagement, most people embraced speech technology for finding and aiding in the entertainment, communication, and medical fields.

Voice Recognition Market Trends

Growing Security Concerns Drive the Market for Voice Recognition

- Cyberattacks can steal millions of users' real names, email addresses, dates of birth, and telephone numbers. The recent Yahoo breaches knocked an estimated USD 350 million off Yahoo's sale price. According to HIPAA Journal, during fiscal 2021, the US Healthcare industry saw the most significant data breach, affecting 42,431,699 individual records. AccuDoc Solutions Inc., UnityPoint Health, and the Employees Retirement System of Texas were the organizations that were significantly affected by the breach.

- According to a study done by IBM, the cost per stolen record, USD 4.35 million, in data breaches globally in the finance, healthcare, and services industry was placed at the top position. Personal data is valuable, which prompts cybercriminals to commit crimes. Personal information is sold on the dark web for USD 5 for a credit card number, USD 30 for an entire identity, or USD 1,000 for medical records.

- The increasing number of online transactions emphasizes authentication requirements. Better authentication services, such as voice recognition technologies, can reduce the possibility of security breaches. Citi Bank has introduced voice biometrics to verify customers' identities contacting their call centers. Voice authentication uses biometrics to verify customers' identities while explaining an issue to a customer service representative over the phone.

- Furthermore, increasing developments in voice-assist digital payment systems are expected to drive market growth. For instance, in September 2022, Tonetag collaborated with big public sector institutions to provide its consumers with UPI 123Pay solutions. Users of feature phones may contact the appropriate IVR number and conduct financial transactions utilizing their voice as input. As per the company, its VoiceSe service enables customers to complete financial transactions, pay their utility bills, inquire about account balances, and recharge, among other things.

Asia-Pacific Region is Expected to Have High Growth in the Voice Recognition Market

- Having the world's largest population, China is expected to have high adoption rates for voice recognition technologies. CNNIC reported that 903.63 million mobile users utilized payment services on their devices in 2021, which provides a further need to implement voice recognition software.

- According to the head of the council of the Speech Industry Alliance of China (SIAC) and chairman of iFlytek, a renowned Chinese AI business, the number of smart gadgets is rapidly expanding due to increasing demand for speaking engagement. Furthermore, the number of engagement services managed by the company's voice assistants increased by 84% year-over-year in 2021.

- Furthermore, in July 2022, Homepod Software 15.6 added Japanese, Cantonese, and Mandarin voice recognition. Such instances are expected to propel the growth of the market over the forecast period.

- In February 2022, ICICI Home Finance company launched a multilingual IVR (Interactive Voice Response) system, which handles half of its customer requests without human intervention. The IVR can capture service requests in eight Indian languages.

- The growing retail and e-commerce industry in the region has increased the number of voice-based searches. Organizations such as Alibaba, Baidu, Google, and Amazon observed increased sales of their respective voice-assisted smart devices. For instance, according to the latest Ascential Digital Commerce analysis, eCommerce revenues in Southeast Asia were expected to increase by 18% in 2022, climbing up to USD 38.2 billion.

Voice Recognition Industry Overview

The voice recognition market is becoming fragmented as market leaders invest in product innovation and development to gain an edge. The number of local players is also increasing, creating intense rivalry in the market. Key players are Nuance Communications Inc., Auraya Systems Pty Ltd, Microsoft Corporation, Apple Inc., Alphabet Inc., etc.

In October 2022, the University of Illinois at Chicago (UIUC) announced a collaboration with Apple and other digital conglomerates on the Speech Accessibility Project, which aims to enhance voice recognition technologies for individuals with speech abnormalities and impairments that current versions struggle to grasp.

In September 2022, Paychex Inc., a leading supplier of incorporated human capital management software solutions for payroll, benefits, human resources, and insurance assistance, declared a new communicative artificial intelligence (AI) function called Paychex Voice Assist for Paychex Flex, the firm's SaaS-based HR software solution. Paychex Voice Assist allows payroll administrators to manage payroll hands-free using any Google Assistant-compatible gadget, streamlining and automating the payroll procedure with the audio of a verified user's voice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Authentication Market

- 5.1.2 Increase in Voice-based Searches

- 5.1.3 Demand for Connected Devices

- 5.2 Market Challenges

- 5.2.1 High Cost and Accuracy-related Issues

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Banking

- 6.2.3 Telecommunication

- 6.2.4 Healthcare

- 6.2.5 Government

- 6.2.6 Consumer Applications

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nuance Communications Inc.

- 7.1.2 Auraya Systems Pty Ltd

- 7.1.3 Microsoft Corporation

- 7.1.4 Apple Inc.

- 7.1.5 Alphabet Inc.

- 7.1.6 Amazon.com Inc.

- 7.1.7 Sensory Inc.

- 7.1.8 Fulcrum Biometrics LLC

- 7.1.9 Neurotechnology

- 7.1.10 Advanced Voice Recognition Systems Inc.

- 7.1.11 IBM Corporation

- 7.1.12 Baidu Inc.

- 7.1.13 Brainasoft