|

市場調查報告書

商品編碼

1436129

虛擬活動:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Virtual Events - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

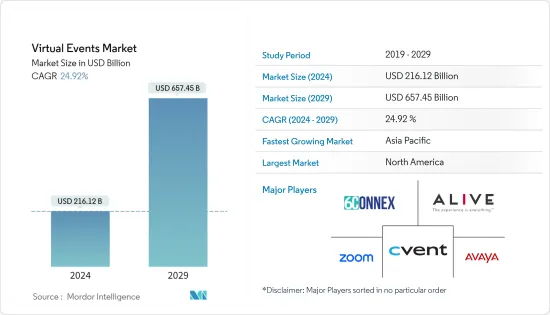

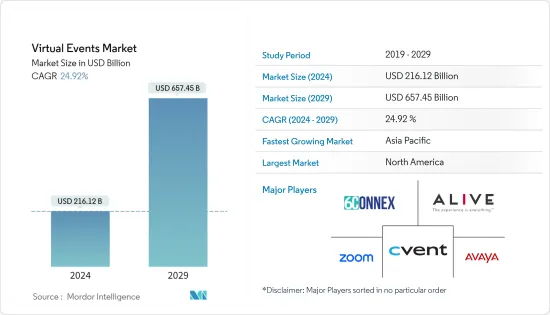

虛擬活動市場規模預計到 2024 年為 2,161.2 億美元,預計到 2029 年將達到 6,574.5 億美元,在預測期內(2024-2029 年)複合年成長率為 24.92%。

結合實體和虛擬元素的混合活動概念越來越受歡迎。隨著組織尋求透過同時提供面對面和線上體驗來吸引更廣泛的受眾,這種趨勢可能會繼續推動虛擬活動市場。

主要亮點

- 虛擬活動為組織者和參與者提供了便利和彈性。參與者可以在舒適的家中或辦公室參加,無需花費時間和精力安排旅行。虛擬活動允許與會者以自己的步調參與,並能夠根據需要觀看錄音和存取資料。

- 包括學術機構在內的各種組織和企業擴大採用基於統一通訊即服務 (UCaaS) 的解決方案,使員工和其他資源能夠虛擬參與所有業務流程,從而提高效率。這將幫助您實現更準確、更有效的工作流程。這對市場成長來說是個好徵兆。

- 人工智慧(AI)、擴增實境(AR)和虛擬實境(VR)等現代技術的融合進一步補充了線上交流和協作,以補充實體組織活動的各個方面。此外,企業正迅速採用虛擬模擬平台來有效管理時間和資源,從而推動市場成長。

- 然而,虛擬活動嚴重依賴科技基礎設施,例如穩定的網路連線、串流平台和協作工具。連線問題、頻寬限制、軟體故障和相容性問題等技術問題可能會影響使用者體驗並阻礙虛擬活動的採用。

- COVID-19 大流行對活動產業產生了積極影響。由於大型聚會和旅行的限制,組織迅速轉向虛擬活動作為替代方案。這場流行病加速了虛擬活動作為可行解決方案的採用和接受,即使情況有所改善,這一趨勢預計仍將持續下去。

- 此外,一些人推出了在家工作(WFH)政策,作為應對世界各國政府為阻止感染疾病。由公司。冠狀病毒已成為推動市場的主要因素之一。目前,虛擬活動對於幫助企業與遠端員工建立聯繫並執行業務流程至關重要。

虛擬活動市場趨勢

商業活動頻率的增加可能會推動市場成長

- 虛擬活動使公司能夠克服地理障礙並接觸到世界各地的觀眾。參與者可以在世界任何地方參與,無需出差,使企業可以輕鬆地與世界各地的客戶、合作夥伴和員工建立聯繫。

- 此外,虛擬活動在時間安排和可訪問性方面提供了彈性。參與者可以在家中或辦公室參加,無需出差或離開工作時間。虛擬活動中還提供隨選節目,讓與會者可以輕鬆存取簡報、研討會和資源。

- 此外,科技的進步使得舉辦虛擬活動比以往任何時候都更加容易。可靠的視訊會議平台、互動式虛擬環境和網路工具提高了虛擬活動期間的整體體驗和參與程度。公司利用這些技術進步為觀眾創造身臨其境型的互動式虛擬體驗。

- 此外,虛擬活動提供有價值的資料分析和見解,幫助公司衡量活動的成功並做出資料驅動的決策。可以即時追蹤和分析與會者參與度、會議受歡迎程度和潛在客戶生成等指標,為企業提供有價值的資訊來最佳化未來的活動。隨著公司尋求改進活動策略和結果,像這樣的資料主導的見解的可用性將進一步推動對虛擬活動的需求。

- 這些因素對於實現虛擬活動在各種業務中的潛力並推動市場成長非常重要。十時報網站資料顯示,2022年5月至2023年4月期間,美國活動平台上發布了約33,000場活動,成為這段時期會議、商務會議和展覽會展數量最多的國家,也是計畫舉辦的國家。英國以 6,400 場跨所有行業的活動位居第二。

北美保持最高市場佔有率

- 北美地區有美國、加拿大等已開發國家,網路基礎設施先進。該地區因較早採用最新技術而聞名,並被視為商業中心。主要在醫療保健行業的數位模擬平台應用的快速成長預計將在預測期內推動加拿大市場的成長。

- 可支配收入的增加、UCaaS 應用程式的持續發展、這些地區新興企業和企業集團數量的增加是推動所研究市場成長的因素。

- 此外,北美擁有強大的技術基礎設施,包括可靠的網路連接和先進的數位平台。此基礎架構可實現虛擬活動的無縫託管和參與,從而提高市場的採用率和成長。例如,根據 GSMA 報告,到 2025 年,北美將有約 2.8 億個 5G 連接,約佔所有行動連線的三分之二。

- 此外,哈里斯最近對美國成年人進行的一項民意調查發現,大多數受訪者(61%)將安全問題視為選擇虛擬活動的主要原因。然而,43% 的人享受這種便利,39% 的人歡迎能夠遠離家鄉參加活動,這是虛擬活動的主要推動趨勢。

- 北美擁有涵蓋技術、金融、醫療保健、娛樂和教育等多個行業的蓬勃發展的商業生態系統。每個領域對虛擬活動都有獨特的要求和機會。這些行業的公司正在認知到虛擬活動的好處和潛力,並擴大採用和投資虛擬活動解決方案,推動市場成長。

虛擬活動產業概述

虛擬活動市場競爭激烈,區域和全球參與者眾多。該行業的特點是不同的參與者為虛擬活動的不同方面提供不同的解決方案和服務。這種碎片化在虛擬活動平台、軟體供應商、串流媒體服務、活動管理工具和其他支援技術的多樣性中表現得很明顯。

2023 年 2 月,虛擬和混合活動技術提供商 Hubilo 宣布收購 Fielddrive,這是一家在比利時設有辦事處的公司,專門從事簽到、徽章和訪問管理等現場活動技術。此次收購延續了虛擬活動公司提高現場技能的趨勢。例如,Hopin 增加了 Boomset,MeetingPlay 與 Aventri 和 Eventcore 合併建立了 Stova。

2022 年 8 月,Zoom 收購了新興企業Liminal 及其兩位創辦人,以開發一家基於 Zoom 的廣播工具公司。作為交易的一部分,Zoom 將把 Liminal 用於製作專業虛擬活動的附加元件ZoomOSC 和 ZoomISO 直接整合到其軟體中。 Zoom 聲稱,透過從 Liminal 購買這些資產,該平台將有助於彌合新興事件控制技術與傳統事件控制技術之間的差距。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 技術進步,例如統一通訊即服務 (UCAAS)、VR 等的接受度不斷提高。

- 商務活動頻率增加

- 全球影響力、可近性和成本效率

- 市場限制因素

- 資料安全和隱私問題

- 技術限制和經驗限制

第6章市場區隔

- 服務類型

- 溝通

- 招募

- 銷售與行銷

- 訓練

- 應用

- 會議

- 展覽/展覽會

- 高峰會

- 其他

- 最終用戶產業

- 教育機構

- 公司

- 組織

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- 6Connex International sp. zoo

- Alive Events Agency

- Zoom Video Communications, Inc.

- Avaya LLC

- Cvent, Inc.

- ALE International

- Arkadin Cloud Communications

- Cisco Systems, Inc.

- Cvent Inc.

- Eventxtra

- George P. Johnson

- GES

第8章投資分析

第9章市場機會與未來趨勢

The Virtual Events Market size is estimated at USD 216.12 billion in 2024, and is expected to reach USD 657.45 billion by 2029, growing at a CAGR of 24.92% during the forecast period (2024-2029).

The concept of hybrid events, which combine physical and virtual elements, has gained popularity. This trend may continue to drive the virtual events market as organizations seek to reach a wider audience by simultaneously offering in-person and online experiences.

Key Highlights

- Virtual events provide convenience and flexibility for both organizers and participants. Attendees can join from the comfort of their homes or offices, eliminating the need to spend time and effort on travel arrangements. Virtual events also offer the ability to watch recordings or access materials on demand, allowing participants to engage at their own pace.

- The increasing adoption of Unified Communication as a Service (UCaaS)-based solutions by various organizations and enterprises, including academic institutions, has allowed employees and other resources to virtually engage with all the business proceedings and help in realizing a more efficient and effective workflow, which bodes well for market growth.

- The convergence of modern technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) is further complementing online communication and collaborative activities to compensate for all the aspects of a physically organized event. Further, companies are rapidly adopting virtual simulation platforms to effectively manage time and resources, driving the market's growth.

- However, virtual events rely heavily on technology infrastructure, including stable internet connections, streaming platforms, and collaboration tools. Technical issues such as connectivity problems, bandwidth limitations, software glitches, or compatibility issues can impact the user experience and hinder the adoption of virtual events.

- The COVID-19 pandemic had a positive impact on the events industry. With restrictions on large gatherings and travel limitations, organizations quickly shifted to virtual events as an alternative. The pandemic accelerated the adoption and acceptance of virtual events as a viable solution, and this trend is expected to continue even as the situation improves.

- Additionally, the Work-From-Home (WFH) policy was adopted as a workaround by several companies in response to the lockdowns and restrictions on the movement of people imposed by various governments across the world as part of the efforts to arrest the spread of the coronavirus and has emerged as one of the major factors driving the market. At this juncture, virtual events are decisive in allowing businesses to connect with the remote workforce and conduct business procedures.

Virtual Events Market Trends

Increased Frequency of Business Events may Drive the Market Growth

- Virtual events allow businesses to overcome geographical barriers and reach a global audience. Attendees can join from anywhere worldwide without needing to travel, making it easier for enterprises to connect with customers, partners, and employees worldwide.

- Moreover, virtual events offer flexibility in terms of timing and accessibility. Attendees can join from their homes or offices, eliminating the need for travel and time away from work. Virtual events also allow on-demand content, allowing attendees to conveniently access presentations, workshops, and resources.

- Further, technological advances have made it easier than ever to host virtual events. Reliable video conferencing platforms, interactive virtual environments, and networking tools have improved the overall experience and engagement levels during virtual events. Businesses use these technological advancements to create immersive and interactive virtual experiences for their audiences.

- Additionally, virtual events offer valuable data analytics and insights that can help businesses measure the success of their events and make data-driven decisions. Metrics such as attendee engagement, session popularity, and lead generation can be tracked and analyzed in real time, providing businesses with valuable information to optimize future events. The availability of such data-driven insights further fuels the demand for virtual events as businesses seek to improve their event strategies and outcomes.

- Such factors are significant in recognizing the potential of virtual events across various businesses and driving the market growth. According to the Ten Times website data, approximately 33 thousand events were published on an event platform for the United States between May 2022 and April 2023, making it the country with the most conferences, business meetings, and trade exhibitions scheduled during that time. With 6.4 thousand events spanning all industries, the United Kingdom came in second.

North America to Hold the Highest Market Share

- North America is home to developed economies like the United States and Canada, which further drive advanced networking infrastructure. The region is widely recognized as an early adopter of the latest technologies and is considered a business hub. The rapid increase in the application of digitally simulated platforms, primarily in the healthcare industry, is expected to drive market growth in Canada over the forecast period.

- The rising disposable income, continued development of UCaaS applications, and the growing number of start-ups and conglomerates in these regions are among other factors driving the growth of the studied market.

- In addition, North America has a robust technological infrastructure, including reliable internet connectivity and advanced digital platforms. This infrastructure enables seamless hosting and participation in virtual events, leading to increased adoption and growth in the market. For instance, as per GSMA reports, there will be about 280 million 5G connections in North America by 2025, or roughly two-thirds of all mobile connections.

- Furthermore, according to a recent Harris poll among adults in the United States, most respondents (61%) pointed to safety concerns as the major reason for choosing a virtual event. However, 43% enjoyed the convenience, and 39% welcomed the ability to attend events far from home as some of the major driving trends for virtual events.

- North America has a thriving business ecosystem across various industry verticals, including technology, finance, healthcare, entertainment, education, and more. Each of these sectors has unique requirements and opportunities for virtual events. As businesses within these industries recognize the benefits and potential of virtual events, they are increasingly adopting and investing in virtual event solutions, driving the market's growth.

Virtual Events Industry Overview

The virtual events market is highly competitive and has several regional and global players. The industry is characterized by various players offering various solutions and services to cater to different aspects of virtual events. This fragmentation is evident in the diversity of virtual event platforms, software providers, streaming services, event management tools, and other supporting technologies. A few prominent players in the market include 6Connex International sp. z.o.o., Zoom Video Communications, Inc., Alive Events Agency, Cvent, Inc., and Avaya LLC.

In February 2023, Hubilo, a virtual and hybrid event technology provider, disclosed that the firm acquired Fielddrive, a business with offices in Belgium specializing in on-site event technology such as check-in, badging, and access management. The trend of virtual event firms enhancing their in-person skills is continued with this acquisition. Examples include Hopin's addition of Boomset and MeetingPlay's combination with Aventri and Eventcore to establish Stova.

In August 2022, Zoom acquired Liminal, a startup, and two founders, and the Zoom-based broadcast tools company developed. Zoom would directly integrate Liminal's add-ons for generating professional virtual events, ZoomOSC and ZoomISO, into its software as part of the deal. Zoom claimed that purchasing these assets from Liminal would help the platform bridge the gap between emerging and traditional event control technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technology Advancements such as Growing Acceptance of Unified Communication as a Service (UCAAS), VR, etc.

- 5.1.2 Increased Frequency of Business Events

- 5.1.3 Global Reach, Accessibility, and Cost Efficiency

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy Issues

- 5.2.2 Technology Constraints and Experiential Limitations

6 MARKET SEGMENTATION

- 6.1 Service Type

- 6.1.1 Communication

- 6.1.2 Recruitment

- 6.1.3 Sales & Marketing

- 6.1.4 Training

- 6.2 Application

- 6.2.1 Conferences

- 6.2.2 Exhibitions/Trade Shows

- 6.2.3 Summits

- 6.2.4 Others

- 6.3 End-User Industry

- 6.3.1 Educational Institutions

- 6.3.2 Enterprise

- 6.3.3 Organizations

- 6.3.4 Other End-User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 6Connex International sp. z.o.o.

- 7.1.2 Alive Events Agency

- 7.1.3 Zoom Video Communications, Inc.

- 7.1.4 Avaya LLC

- 7.1.5 Cvent, Inc.

- 7.1.6 ALE International

- 7.1.7 Arkadin Cloud Communications

- 7.1.8 Cisco Systems, Inc.

- 7.1.9 Cvent Inc.

- 7.1.10 Eventxtra

- 7.1.11 George P. Johnson

- 7.1.12 GES