|

市場調查報告書

商品編碼

1433765

AaaS(自動化即服務):市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automation-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

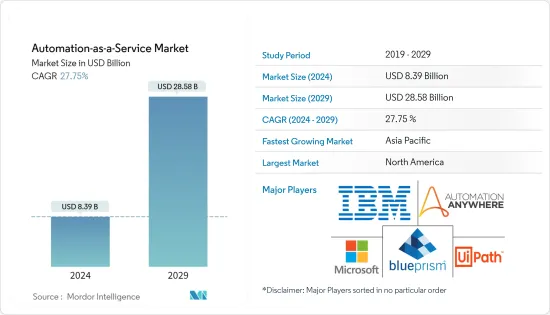

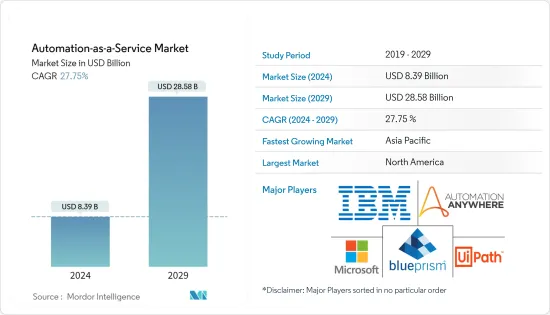

2024年,全球AaaS(自動化即服務)市場規模將達到83.9億美元,並在2024-2029年預測期內以27.75%的複合年成長率成長,到2029年將達到285.8億美元。預計這一數字將達到。

推動所研究市場成長的關鍵原因包括所有最終用戶領域對自動化的接受程度不斷提高、雲端運算範圍的擴大以及物聯網設備數量的增加。預計未來幾年對醫療保健服務的需求將會增加。隨著大多數國家的醫療保健基礎設施不斷發展並能夠管理大量患者資料,包括入院和患者病歷的許多業務都需要自動化。

人工智慧(AI)、機器學習、雲端運算和物聯網(IoT)等新技術的快速發展及其在企業中的廣泛使用,促進了自動化即服務(AaaS)業務的顯著擴展。 )。摩根士丹利預計,到 2050 年,人工智慧業務收入預計將達到 1 兆美元,並有望直接影響 AaaS 市場。隨著企業探索加速價值實現的部署選項,雲端基礎的解決方案的採用預計將迅速增加。隨著數位勞動力的成長,公司正在投資私有雲端雲或公共雲端,以實現集中且難以自動化的流程的自動化。

業務流程自動化著重於自動化日常 IT 程序和業務服務,以提高生產力、減少支出並維持平穩營運。 BPA 在整個組織中有多種常見用途,包括當公司準備將其基礎設施遷移到雲端、增強業務連續性和增強公司流程時。由以下因素產生。例如,歐洲大型保險公司忠利保險公司(Generali)從手動操作轉向自動化業務操作,節省了時間和金錢。可重複的步驟可節省高達 90% 的成本,並將執行困難任務所需的時間減少 50%。

隨著企業尋求能夠更快獲得收益的部署選項,雲端解決方案的採用將很快顯著成長。公司投資私有雲端雲或公共雲端,是因為他們在發展數位化勞動力以實現任務自動化時需要靈活的部署和授權選擇。因此,大多數市場相關人員主要關注雲端基礎的解決方案。 Amperity 是一家成立於 2022 年的新公司,提供企業資料平台,將碎片化的消費者資料轉化為創新的雲端體驗。

由於資料遺失的可能性,資料安全和隱私是企業的重要因素。如果不支付贖金來恢復資料的解密金鑰,AlienBot、Wannacry、Cryptojackling、Fireball、Zeus 等新案例將帶來資料遺失的威脅。這些威脅包括垃圾郵件、可移動磁碟機、潛在有害軟體、可疑網站等。名為 Clop 的最新惡意軟體已封鎖 600 多個 Windows 進程。因此,許多組織現在正在將安全性涵蓋其計劃中,以節省成本、保護資料並降低攻擊風險。

COVID-19感染疾病加速並再次強調了全球對自動化的需求。雲端原生機器人、智慧資料擷取和流程發現機器人在各個產業中都有所增加。人們迫切希望透過自動化來簡化任務並減少開支,自動化軟體供應商報告的使用率很高,從 60% 到 95%。

AaaS(自動化即服務)市場趨勢

BFSI預計持有主要股份

BFSI 等客戶服務產業擴大採用虛擬助理和機器人,進一步擴大了所研究的市場成長。銀行業參與者眾多,業界競爭激烈。激烈的競爭迫使公司實施具有成本效益的解決方案以保持優勢。

流程的透明度、改進的客戶服務、入職流程的最佳化、資料完整性、正確遵守各個執法機構法規的能力以及整個銀行和金融部門的資料主導性質。這些是一些促成因素。使用機器人自動化流程促進 BFSI 市場的成長。

由於 BFSI 在業務應用過程中的自動化採用率很高,因此成為所研究市場的主要採用者和投資者之一。自動提款機、票據存款機和現金存款機是自動化解決方案在該領域的一些早期應用。為了未來的成功,BFSI 的 RPA 數位自動化浪潮需要受到監管。

Tangentia 是加拿大頂級自動化服務供應商之一,將於 2022 年 7 月協助銀行和金融業利用 RPA 和 AI。 TiA Core AI 採用機器學習、自然語言處理、電腦視覺、深度學習和 RPA 等創新技術建構。 TiA Core AI 為任務挖掘工具市場領導Soroco 提供協助處理客戶資料的服務。該組織認知到創新和自動化對於滿足 BFSI 客戶的高服務需求的重要性,因此使用 TiA Core AI 進行資料庫安裝。

2022 年 7 月,印度領先的私人保險公司之一的 Bajaj Allianz General Insurance Company 推出了 Amazon Textract,這是一項機器學習 (ML) 服務,可自動從掃描文件中提取文字、手寫內容和資料,用於自動化保險流程。這使得 Bajaj Aliens 能夠縮短交貨時間並提高客戶滿意度。

預計北美將佔據主要佔有率

由於領先的 IT 公司的存在以及大多數頂級供應美國的所在地,北美是所研究市場的最大貢獻者和投資者之一。此外,該國對本土新興企業的股權投資激增,為該行業帶來了創新。例如,美國鋼鐵公司和卡內基鑄造廠正在製定策略,以加速和擴大由先進機器人技術和人工智慧(AI) 驅動的工業自動化,涉及先進製造、工業機器人、整合系統、自主移動、語音分析等領域。夥伴關係。

在實施方面,美國目前在自動化即服務業務中佔據主導地位,而該領域的需求正在增加。全球大部分人工智慧技術支出僅由美國吸收。美國是世界上聯繫最緊密的國家之一,大約 85% 的公民訪問網際網路,為該國自動化即服務的擴張做出了貢獻。

此外,美國擁有強大的基於物聯網的互聯設備整合度,每秒鐘都會產生大量數位資料。埃森哲、IBM、微軟等主要IT和雲端基礎企業也集中在全國各地。多個金融和技術領域對自動化日益成長的需求也對該行業產生了重大影響。

除了製造業等核心產業外,其他產業自動化程度的提高正在進一步擴大該地區的市場覆蓋範圍。 2022 年 6 月,賽普拉斯宣布推出一款一體化測試自動化平台,用於整合自動化測試並將其轉變為持續測試。 Celtra Creative Automation (CA) for Marketing 是一種製作自動化解決方案,適合希望簡化整個製作工作流程中的創新流程和協作的公司。據該公司稱,Spotify 和阿迪達斯轉向創新自動化來解決各種內容擴展和製作挑戰。

自動化即服務業概述

AaaS(自動化即服務)市場需要透過關鍵參與者的存在變得更加凝聚。 IBM 等許多國際市場參與者擴大採用收購策略來擴大市場佔有率和產品創新。為了增強產品功能並為客戶提供最新技術,UiPath 和 Pegasystems Inc. 正在逐步實施協作或夥伴關係策略。產品創新是市場供應商的主要差異之一。

2022 年 8 月,Re: infer 是一家位於倫敦的非結構化文件和通訊自然語言處理 (NLP)Start-Ups,被 UiPath 收購。 UiPath 軟體機器人現在將能夠理解電子郵件、線上聊天和音訊會話的上下文和音訊,從而利用自動化和人工智慧來改善客戶支援互動。

2022 年 2 月,Healthnet Global 推出了名為 AutoMaid 的智慧住院病房自動化系統,這是滿足所有住院患者需求的一站式解決方案。這包括具有非接觸式感測器、通訊吊艙和人工智慧的雲端基礎的患者監測工具。動力分診系統。這些功能可即時捕捉人體生命徵象,為以前必須手動監測的患者提供24小時監測。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對工業的影響評估

第5章市場動態

- 市場促進因素

- 跨業務流程的自動化需求不斷成長

- 雲端服務的採用率增加

- 市場限制因素

- 資料安全和隱私問題

第6章市場區隔

- 依部署類型

- 本地

- 雲

- 按業務功能

- 資訊科技

- 金融

- 人力資源

- 銷售與行銷

- 手術

- 按公司規模

- 主要企業

- 中小企業

- 按最終用戶產業

- BFSI

- 通訊/IT

- 零售/消費品

- 醫療保健/生命科學

- 製造業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Automation Anywhere, Inc.

- Blue Prism Group PLC

- IBM Corporation

- Microsoft Corporation

- Uipath Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise

- Kofax Inc.

- Nice Ltd.

- Pegasystems Inc.

第8章投資分析

第9章市場的未來

The Automation-as-a-Service Market size is estimated at USD 8.39 billion in 2024, and is expected to reach USD 28.58 billion by 2029, growing at a CAGR of 27.75% during the forecast period (2024-2029).

Some key reasons propelling the growth of the studied market are the increasing acceptance of automation across all end-user sectors, expanding the reach of cloud computing, and rising IoT device numbers. The need for healthcare services is anticipated to increase in the upcoming years. Many operations, including admissions and patient histories, need to be automated as most countries' healthcare infrastructure develops to manage massive amounts of patient data.

The rapid development of new technologies like artificial intelligence (AI), machine learning, cloud computing, and the Internet of Things (IoT), as well as their widespread use by businesses, have contributed to the significant expansion of automation as a service (AaaS). According to Morgan Stanley, the estimated USD 1 trillion in sales for the AI business by 2050 will directly impact the AaaS market. The adoption of cloud-based solutions will rapidly grow as firms look for deployment options that hasten value realization. Due to the growth of their digital workforces, businesses invest in private or public clouds to automate labor-intensive, challenging-to-automate processes.

Business process automation focuses on automating routine IT procedures and business services to increase productivity, cut expenses, and maintain smooth operations. The general use of BPA throughout organizations results from several factors, including businesses preparing to move their infrastructure to the cloud, bolstering business continuity, and enhancing corporate processes. For instance, Generali, a significant insurance provider in Europe, went from manual to automated business operations, saving time and money. Through repeatable procedures, this led to savings of up to 90% and a 50% decrease in the time required to underwrite challenging tasks.

Adopting cloud solutions will expand significantly shortly as companies demand deployment options that enable them to gain benefits more quickly. Companies invest in a private or public cloud because they require flexible deployment and licensing choices as they increase their digital workforces to automate tasks. Consequently, the majority of market players focus primarily on cloud-based solutions. Amperity, a brand-new company founded in 2022, offers an enterprise data platform to transform fragmented consumer data into revolutionary cloud experiences.

Data security and privacy are factors that companies should focus on as data loss is possible. Data loss is a threat from new cases like AlienBot, Wannacry, Cryptojackling, Fireball, Zeus, and others if a ransom is not paid for the decryption key to restore the data. These threats include spam emails, removable drives, potentially unwanted software, and suspicious websites. Over 600 Windows processes are blocked by the most recent malware, called Clop. Therefore, many organizations now include security in their plans to save money, protect the data, and lower the risk of an attack.

The global demand for automation was accelerated and reemphasized by the COVID-19 pandemic. Across industries, there was an increase in cloud-native bots, intelligent data capture, and process discovery bots. There was a significant desire for automation to streamline tasks and cut expenses, as seen by the high rises in utilization rates from 60 percent to 95 percent reported by automation software vendors.

Automation as a Service Market Trends

BFSI is Expected Hold Major Share

The growing adoption of virtual assistants and bots across customer service industries, like BFSI, further expands the studied market growth. The banking industry has intense industrial competition due to many players. Due to the fierce competition, companies are attempting to introduce cost-effective solutions to help them stay ahead.

Process transparency, improved customer service, process optimization during onboarding, data integrity, and the capacity to successfully comply with regulations of various enforcement agencies, as well as the data-driven nature of the overall banking and financial sector, are some of the factors contributing to the growth of the BFSI Market using robotic automation process.

BFSI is one of the significant adopters and investors in the studied market, owing to a high automation adoption rate across business process applications. Automated tellers, draft deposits, and cash deposit machines are some of the initial applications of automation solutions in the sector. The digital automation wave of RPA for BFSI needs to be regulated for future success.

In July 2022, Tangentia, one of Canada's top automation services providers, will assist businesses in utilizing RPA and AI in the banking and finance industries. TiA Core AI has been built with innovative technologies, including machine learning, natural language processing, computer vision, deep learning, and RPA. TiA Core AI provides services to Soroco, a market leader in task mining tools, to assist with client data. The organization used TiA Core AI for database installations because it recognizes the significance of technological innovation and automation in achieving the high service demands of BFSI clients.

In July 2022, Bajaj Allianz General Insurance Company, one of the leading private insurers in India, automated insurance processes using Amazon Textract, a machine learning (ML) service that automatically extracts text, handwriting, and data from scanned documents. This helps Bajaj Allianz to speed up turnaround times and enhance customer satisfaction.

North America is Expected to Major Share

North America is one of the biggest contributors and investors in the studied market owing to the existence of leading IT companies and the fact that the USA is the home to the bulk of the top suppliers. Additionally, the country is seeing a surge in equity investments in homegrown startups, bringing innovation to the industry. For instance, United States Steel and Carnegie Foundry announced a strategic investment and partnership to accelerate and scale industrial automation driven by advanced robotics and artificial intelligence (AI) in advanced manufacturing, industrial robotics, integrated systems, autonomous mobility, voice analytics, and more.

Regarding installation, the US now dominates the automation-as-a-service business, increasing demand for the sector. The majority of global expenditure on artificial intelligence technologies is absorbed by the US alone. The US is one of the best-connected countries in the world, with around 85% of its people accessing the internet, which contributes to the expansion of automation-as-a-service in the country.

Additionally, the US has a strong integration of linked IoT-based devices, which produce enormous amounts of digital data every second. Leading IT and cloud-based businesses, such as Accenture, IBM, Microsoft Corporation, and others, are also concentrated nationwide. The industry is also heavily impacted by the increased need for automation in several financial and technological sectors.

Apart from core industries, like manufacturing, the growing automation in other sectors further expands the region's studied market. In June 2022, Cypress launched an all-in-one test automation platform to integrate and transform automated testing into continuous testing. Celtra Creative Automation (CA) for Marketing is a production automation solution for enterprises looking to simplify the creative process and collaboration along the entire production workflow. According to the company, Spotify and Adidas have embraced Creative Automation to solve various content scaling and production challenges.

Automation as a Service Industry Overview

The automation-as-a-service market needs to be more cohesive due to the presence of significant players. Numerous international market players, like IBM, are becoming increasingly involved in acquisition tactics to increase their market share and product innovation. To increase the capabilities of their products and give their clients the newest technology, UiPath, and Pegasystems Inc. are progressively implementing collaboration or partnership strategies. Product innovation is one of the significant differentiating factors among market vendors.

In August 2022, Re: infer, a London-based natural language processing (NLP) startup for unstructured documents and communications, was acquired by UiPath. UiPath software robots can now comprehend the context and semantics of emails, online chats, and audio sessions, resulting in better customer support interactions using automation and Artificial Intelligence.

In February 2022, Healthnet Global introduced an intelligent in-patient room automation system as a one-stop shop for all in-patient requirements called AutoMaid, which contains a contactless sensor, communication pod, and cloud-based patient monitoring tool having an AI-powered triaging system. These features capture real-time body vitals and offer round-the-clock monitoring for previously manually monitored patients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Automation Across Business Processes

- 5.1.2 Increasing Adoption of Cloud Services

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Security and Privacy

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Business Function

- 6.2.1 Information Technology

- 6.2.2 Finance

- 6.2.3 Human Resources

- 6.2.4 Sales and Marketing

- 6.2.5 Operations

- 6.3 By Enterprise Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium-sized Enterprises

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Telecom and IT

- 6.4.3 Retail and Consumer Goods

- 6.4.4 Healthcare and Life Sciences

- 6.4.5 Manufacturing

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Automation Anywhere, Inc.

- 7.1.2 Blue Prism Group PLC

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Uipath Inc.

- 7.1.6 HCL Technologies Limited

- 7.1.7 Hewlett Packard Enterprise

- 7.1.8 Kofax Inc.

- 7.1.9 Nice Ltd.

- 7.1.10 Pegasystems Inc.