|

市場調查報告書

商品編碼

1433520

物聯網晶片:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global IoT Chip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

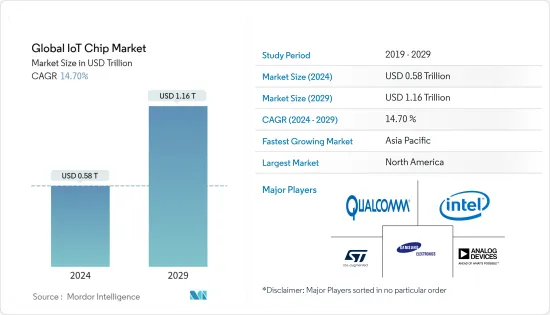

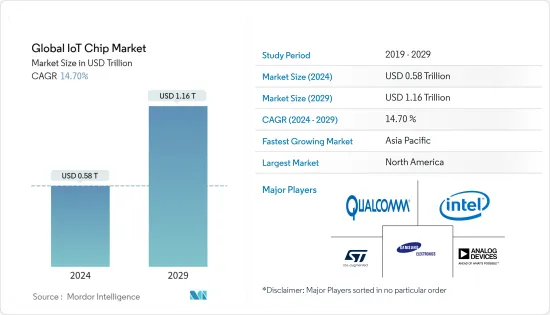

2024年全球物聯網晶元市場規模估計為5800億美元,預計到2029年將達到1.16萬億美元,在預測期間(2024~2029年)以14.70%的複合年增長率增長。

疫情期間,需求側和供給側因素減緩了部分產業物聯網連結數的成長。隨著公司倒閉或削減支出,一些物聯網合約被取消或推遲。醫療保健、消費性電子、工業、汽車、BFSI 和零售等各個最終用戶領域對自動化的需求不斷成長,物聯網設備的應用不斷擴大,進一步推動了物聯網設備的採用。

主要亮點

- 這一成長主要歸因於不同通訊協定,這顯著推動了跨多個最終用戶行業的物聯網晶片市場的成長。

- 2022 年 3 月,在麻省理工學院 (MIT) 工作的兩位印度研究人員開發了一款低功耗安全晶片,旨在防止物聯網 (IoT) 裝置上的旁道攻擊 (SCA)。 SCA 利用漏洞允許從系統硬體行為的間接影響中收集資訊,而不是直接攻擊程式或軟體。

- 隨著物聯網設備數量的快速增加,建構這些物聯網設備的晶片需求預計也會在預測期內增加。這使得降低消費量和晶片小型化成為製造商的首要任務。

- 5G 的日益普及將為物聯網 (IoT) 設備提供快速且有效率的連接。預計對 5G 技術部署的投資將在預測期內及以後推動市場成長。 5G技術的整合被認為是下一代行動網際網路連接,預計將提供比當前技術更快、更可靠的連接。因此,快速成長的物聯網領域和配套晶片製造商預計將在預測期內增加對物聯網晶片的需求。

- 軟體漏洞和網路攻擊等日益嚴重的安全問題可能會阻止許多客戶使用物聯網設備。物聯網中的這些安全問題對於醫療保健、金融、製造、物流、零售和其他已經開始實施物聯網系統的行業的組織來說尤其重要。

- COVID-19大流行導致全球供應鏈嚴重短缺,對市場產生了重大影響。此外,世界各國政府對人員流動的限制也影響了生產。然而,隨著世界從大流行中恢復,對更自動化和複雜流程的需求已成為成功的關鍵方面。因此,未來更多物聯網設備的市場預計將擴大,將對全球物聯網晶片產生強勁需求。

物聯網晶片市場趨勢

工業部門預計將顯著成長

- 工業4.0和物聯網已成為開發、生產和物流鏈的主流新技術手段。由於機器對機器連接性、嵌入式感測器的增加以及車間和現場對工廠效率日益成長的需求,工業 4.0 的日益普及使製造業對物聯網的需求保持在頂峰。

- 根據《經濟時報》的一項研究,2022 年 7 月印度蜂巢式物聯網模組和晶片組的出貨有所增加,其中高通以 42% 的佔有率領先市場。該公司正在擴大其物聯網晶片組產品組合,瞄準零售、工業和智慧城市等行業的優質 4G 和 5G 解決方案。

- 大多數製造商正在部署物聯網設備,以利用預測性維護和進階資料分析。這可以提高生產力和可用性,從而增加您的業務產品的價值。例如,GE 正在透過工業分析探索物聯網機會。此外,Apotex 還升級了其製造流程,以實現手動流程自動化。這包括實施 RFID、分類和流程追蹤,以確保批量生產的一致性。這使公司能夠即時了解其製造業務。

- 此外,工業物聯網趨勢是由美國智慧製造領導聯盟 (SMLC) 等智慧工廠舉措推動的。由於需要收集、處理大量機器和感測器資料並形成決策,這將促進和促進製造智慧的廣泛採用。

- 2022年6月,外交部宣布歐洲物聯網(IoT)解決方案市場正在加速發展。德國、英國和荷蘭在物聯網採用方面領先歐洲,其次是東歐和北歐國家。製造業、家庭、醫療保健和金融業處於他採用物聯網的最前沿,但零售和農業也出現了令人印象深刻的成長。這些多個領域的進步將利用整個歐洲的物聯網晶片市場。

- 將eLTE、NB-IoT晶片等無線晶片引入製造終端多年來一直備受關注。例如,華為與產業合作夥伴合作生產用於傳統製造的智慧終端,用於上傳設備資料和接收命令。透過在製造終端上添加eLTE或NB-IoT晶片,並將終端產生的資料透過eLTE或NB-IoT網路傳輸,可以擷取製造資料並下發指令。

亞太地區預計將出現顯著成長

- 亞太地區佔物聯網支出的最大佔有率,其中新加坡和韓國是採用物聯網晶片的主要市場。根據經濟合作暨發展組織,韓國是第一個每個棲息地網路連線數量最多的重要市場。

- 2022 年 7 月,鎧俠株式會社和西部數據公司宣布,其位於四日市工廠的合資企業 Fab7 製造工廠獲得日本政府批准最多 929 億日圓的核准。這筆贈款是政府特別計畫的一部分,旨在鼓勵企業投資尖端半導體製造設施並確保日本半導體生產的穩定性。該地區的此類合作可能有助於物聯網晶片市場的成長。

- 隨著智慧城市對物聯網晶片和 IC 的需求不斷成長,以及連網型車輛和智慧交通系統等領域對家庭自動化的需求不斷成長,物聯網基礎設施有潛力推動自動化和交通進入新階段,其中包括對更好的無線技術的需求連接解決方案。

- 此外,亞洲各國政府正將物聯網深度融入長期發展計劃中。例如,中國中央政府已選擇200多個城市試辦智慧城市計劃。城市包括北京、上海、廣州和杭州。此外,印度將 100 個城市轉變為智慧城市的願景預計將透過智慧家庭和汽車產業推廣電子產品。

- 2022 年 5 月,Cyient 與印度海得拉巴理工學院 (IITH) 以及 IITH 內成立的新興企業WiSig Networks 合作,推出印度首款設計和工程晶片 Koala NB-IoT SoC(窄頻SoC)。釋出。雙方簽署的合作備忘錄(MOU)建立了充滿活力的半導體設計和創新生態系統,服務全球,進一步促進印度發展成為全球電子製造和設計中心。技術、印度)目標打造

- 由於製造業等行業擴大使用連網型設備,預計該地區將成為物聯網支出的主要提供者。 5G 的日益普及將增加物聯網服務並推動未來幾年的市場成長。

物聯網晶片產業概況

全球物聯網 (IoT) 晶片市場競爭適中,存在大量區域參與者。兩家公司都利用策略聯合舉措和收購來增加市場佔有率和盈利。

- 2021 年 6 月 - RAIN RFID 供應商和網路業者Impinj Inc. 協助物聯網設備製造商滿足零售、供應鏈、物流和消費性電子產品等市場對連網產品不斷成長的需求。宣布推出三款新的RAIN RFID讀取器晶片。

- 2021 年 6 月 - 高通推出七款全新物聯網晶片組,針對物流、倉儲、智慧相機、視訊協作和零售等應用。該公司還表示,這些新的物聯網解決方案為智慧設備提供了廣泛的連接解決方案和關鍵功能,提供長壽命的硬體和軟體選項,並提供至少八年的長期支援。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對連網型設備和穿戴式裝置的需求增加

- 工業 4.0 趨勢不斷發展,採用尖端技術

- 市場限制因素

- 資料安全和隱私問題阻礙了物聯網設備的普及

- 不同平台之間的通訊協定缺乏標準化

第6章市場區隔

- 依產品

- 處理器

- 感應器

- 連線IC

- 儲存裝置

- 邏輯元件

- 其他產品

- 依最終用戶

- 衛生保健

- 消費性電子產品

- 工業的

- 車

- BFSI

- 零售

- 建築自動化

- 其他最終用戶

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Qualcomm Technologies Inc.

- Intel Corporation

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Cypress Semiconductor Corporation

- Mediatek Inc.

- Microchip Technology Inc.

- Samsung Electronics Co. Ltd

- Silicon Laboratories Inc.

- Invensense Inc.

- STMicroelectronics NV

- Nordic Semiconductor ASA

- Analog Devices Inc.

第8章投資分析

第9章市場的未來

The Global IoT Chip Market size is estimated at USD 0.58 trillion in 2024, and is expected to reach USD 1.16 trillion by 2029, growing at a CAGR of 14.70% during the forecast period (2024-2029).

Due to demand-side and supply-side factors, the growth in the number of IoT connections slowed down in specific sectors during the pandemic. Some IoT contracts were canceled or postponed due to firms going out of business or scaling back their spending. The rising demand for automation and the growing application of IoT devices across various end-user verticals, such as healthcare, consumer electronics, industrial, automotive, BFSI, and retail, are further driving the adoption of IoT devices.

Key Highlights

- The growth is primarily attributed to the integration of connectivity competence in a wide range of devices and applications, coupled with the development of different networking protocols that have appreciably driven the growth of the IoT chip market across multiple end-user industries.

- In March 2022, two Indian researchers working at the Massachusetts Institute of Technology (MIT) built a low-power security chip designed to prevent side-channel attacks (SCA) against Internet of Things (IoT) devices. SCA uses vulnerabilities to allow information gleaned from the indirect effects of the behavior of system hardware rather than directly attacking programs and software.

- With the rapid increase in the number of IoT devices, the chip requirement for building these IoT devices is also expected to rise over the forecast period. Along with this, reducing energy consumption combined with the miniaturization of chips will be the priority of manufacturers.

- The increased deployment of 5G provides quick and efficient connectivity for Internet-of-Things (IoT) devices. Investments in the deployment of 5G technology are expected to drive market growth during the forecast period and beyond. The integration of 5G technology is seen as the next generation of mobile internet connectivity and is expected to offer faster and more reliable connections than current technologies. Thus, the booming IoT space and the supporting chip makers are expected to increase demand for IoT chips during the forecast period.

- Rising security concerns, such as software vulnerabilities and cyberattacks, may discourage many customers from using IoT devices. Such security concerns in the Internet of Things are particularly essential to organizations in healthcare, finance, manufacturing, logistics, retail, and other industries that have already started adopting IoT systems.

- With the COVID-19 outbreak worldwide, the market was significantly affected as severe supply chain shortages occurred across the globe. Moreover, the restriction imposed by governments across the globe on the movement of people also impacted production. However, as the world recovers from the pandemic, the need for more automated and advanced processes has become a key aspect of success. As such, the market for more IoT-enabled devices is anticipated to rise in the future, thereby creating strong demand for IoT chips across the globe.

IoT Chip Market Trends

Industrial Segment is Expected to Witness Significant Growth

- Industry 4.0 and the IoT have become mainstream for new technological approaches in development, production, and logistics chains. The growing adoption of industrial 4.0 has kept IoT demand in manufacturing at maximum through increasing machine-to-machine connections and embedded sensors and the increasing need for factory efficiency on the floor and on the field.

- In July 2022, according to Economic Times's survey, cellular IoT module chipset shipments grew in India, and Qualcomm led the market with a 42% share. The company has been broadening its IoT chipset portfolio, targeting premium 4G and 5G solutions for verticals such as retail, industrial, smart cities, and more.

- Most manufacturers implement IoT devices to leverage predictive maintenance and sophisticated data analytics. This improves productivity and availability and adds value to their business offerings. For instance, GE is looking for opportunities in the IoT with industrial analytics. In addition, Apotex upgraded its manufacturing processes to automate manual processes. This includes ensuring consistent batch production by introducing RFID, sorting, and process flow tracking. Due to this, the company had real-time visibility into manufacturing operations.

- Furthermore, the industrial IoT trend is aided by smart factory initiatives, such as the Smart Manufacturing Leadership Coalition (SMLC) in the United States. This drives and facilitates the broad adoption of manufacturing intelligence due to massive amounts of machine and sensor data that need collection, processing, and formation of decisions.

- In June 2022, the Ministry of Foreign Affairs stated that the European market for Internet of Things (IoT) solutions is accelerating. Germany, the UK, and the Netherlands lead Europe in IoT adoption, while Eastern European and Nordic countries follow closely. The manufacturing, home, healthcare, and financial sectors are at the forefront of his IoT adoption, but retail and agriculture are also seeing impressive growth. Such advancement in multiple sectors will leverage the IoT chip market across Europe.

- The deployment of the wireless chip, including eLTE or NB-IoT chip for their manufacturing terminal, has been gaining traction over the years. For instance, Huawei collaborated with industrial partners to make smart terminals used in traditional manufacturing for uploading equipment data and receiving commands. eLTE or NB-IoT chip is added to the manufacturing terminal for transmitting data generated by the terminal via the eLTE or NB-IoT network, enabling manufacturing data to be collected and commands issued.

Asia Pacific is Expected to Witness Significant Growth

- Asia-Pacific accounts for a significant share of spending in IoT, with Singapore and South Korea as major markets adopting IoT chips. According to the Organization for Economic Co-operation and Development, South Korea is the first prominent market to connect more to the internet per habitat.

- In July 2022, KIOXIA Corporation and Western Digital Corporation announced their joint venture Fab7 manufacturing facility at Yokkaichi Plant had received approval from the Japanese government for a subsidy of up to JPY 92.9 billion. The subsidy is granted under a special government program to promote corporate investment in state-of-the-art semiconductor manufacturing facilities and ensure the stable production of semiconductors in Japan. Such collaborations in the region will help the IoT chip market to grow.

- IoT's infrastructure includes the demand for better wireless connectivity solutions to enable new phases in automation and transportation owing to the rise in demand for IoT chips and ICs in smart cities and domestic automation in the areas such as connected automobiles and smart transportation systems.

- Further, Asian governments are deeply integrating IoT in their long-term development projects. For instance, China's central government selected over 200 cities to pilot smart city projects. The cities include Beijing, Shanghai, Guangzhou, and Hangzhou. Furthermore, India's vision to transform 100 cities into smart cities is expected to promote electronics through smart homes and the automotive sector.

- In May 2022, Cyient partnered with IIT Hyderabad, India (IITH) and WiSig Networks, a start-up company founded in IITH, to launch India's first designed and engineered chip, Koala NB-IoT SoC (Narrowband IoT SoC). The Memorandum of Understanding (MOU) signed between the two aligns with the goals of MEITY (Ministry of Electronics and Information Technology, India) to build a vibrant semiconductor design and innovation ecosystem to serve the Indian world and further promote its development into a global electronics manufacturing and design hub.

- The region is expected to be a prominent provider of IoT spending as there is increased use of connected devices in sectors such as manufacturing. Increased adoption of 5G is helping the market grow in the upcoming years as there is an increase in IoT services.

IoT Chip Industry Overview

The Global Internet of Things (IoT) Chip Market is moderately competitive, with a considerable number of regional players. The companies are leveraging strategic collaborative initiatives and acquisitions to increase market share and profitability.

- June 2021 - Impinj Inc., which is a RAIN RFID provider and Internet of Things provider, announced the introduction of three new RAIN RFID reader chips that enable IoT device manufacturers to meet the increasing demand for item connectivity in applications such as retail, supply chain and logistics, and consumer electronics, among other markets.

- June 2021 - Qualcomm launched seven of its new IoT chipsets that were targeted at devices meant for logistics, warehousing, smart cameras, video collaboration, and retail, among other applications. The company also stated that these new IoT solutions offer significant capabilities for a wide range of connected solutions and smart devices with extended life hardware and software options to achieve long-term support for a minimum of eight years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand of Connected and Wearable Devices

- 5.1.2 Adoption of Advance Technologies Due to Rising Trend of Industry 4.0

- 5.2 Market Restraints

- 5.2.1 Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices

- 5.2.2 Lack of Standardization of Communication Protocol across Different Platforms

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Processor

- 6.1.2 Sensor

- 6.1.3 Connectivity IC

- 6.1.4 Memory Device

- 6.1.5 Logic Device

- 6.1.6 Other Products

- 6.2 By End-user

- 6.2.1 Healthcare

- 6.2.2 Consumer Electronics

- 6.2.3 Industrial

- 6.2.4 Automotive

- 6.2.5 BFSI

- 6.2.6 Retail

- 6.2.7 Building Automation

- 6.2.8 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 NXP Semiconductors NV

- 7.1.5 Cypress Semiconductor Corporation

- 7.1.6 Mediatek Inc.

- 7.1.7 Microchip Technology Inc.

- 7.1.8 Samsung Electronics Co. Ltd

- 7.1.9 Silicon Laboratories Inc.

- 7.1.10 Invensense Inc.

- 7.1.11 STMicroelectronics NV

- 7.1.12 Nordic Semiconductor ASA

- 7.1.13 Analog Devices Inc.