|

市場調查報告書

商品編碼

1432854

汽車潤滑油:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

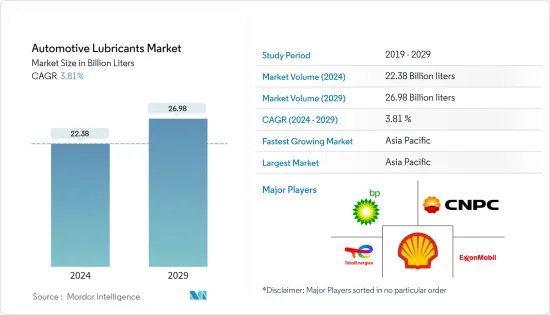

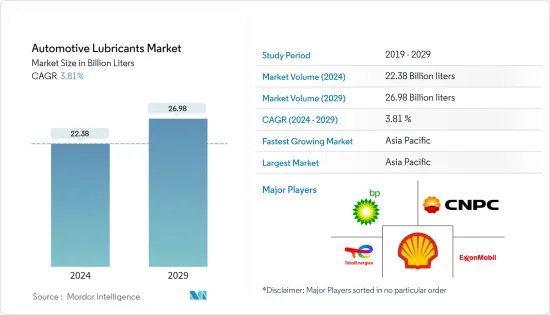

預計2024年汽車潤滑油市場規模為223.8億公升,預計2029年將達到269.8億公升,在預測期間(2024-2029年)複合年成長率為3.81%。

2020 年,COVID-19 的爆發導致全球範圍內的封鎖、製造活動和供應鏈中斷以及生產停頓,對市場產生了負面影響。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 短期內,市場預計將受到全球電動車產量增加和汽車零件產業需求擴大的推動。

- 另一方面,由於廢油處理方面嚴格的環境法規,合成潤滑油的採用率較低,預計將阻礙市場成長。

- 生物基潤滑劑的開發預計將成為所研究市場的市場機會。

- 預計亞太地區將在預測期內主導市場。

車用潤滑油市場趨勢

增加引擎機油使用量

- 機油廣泛用於潤滑各類汽車的內燃機。它有多種用途,包括減少磨損、防止腐蝕以及確保引擎內部平穩運行。

- 油在運動部件之間形成一層薄膜,促進熱傳遞並緩解接觸過程中的張力。

- 德國汽車製造業是整個歐洲地區汽車生產的最大股東之一。該國是主要汽車製造品牌的所在地,包括大眾、梅賽德斯-奔馳、奧迪、寶馬和保時捷。該國對研發活動的持續投資和汽車產量的增加可能會支持潤滑油市場的成長。

- 儘管該國的整體汽車銷量有所下降,但過去幾年電動車的註冊數量卻大幅增加。支撐這一成長的是政府的政策,即到 2040 年普及。

- 截至2022年3月,福斯汽車已核准投資一座新的電動車工廠。新的德國工廠將建在集團歷史悠久的沃爾夫斯堡總部旁邊,預計將於 2023 年開始建設,並於 2026 年開始生產。

- OICA公佈的資料顯示,全球汽車產量將從2021年的80,205,102輛增加至2022年的85,016,728輛,帶動引擎油需求。

- 所有上述因素預計將推動所研究市場的成長。

亞太地區預計將主導市場

- 亞太地區的快速工業化預計將推動市場成長。該地區汽車工業和其他行業的成長可能會導致潤滑油的成長。

- 汽車產業也消耗潤滑油用於汽車零件的精加工,預計將推動市場成長。亞太地區預計將佔據中國、馬來西亞、印度、泰國、印尼和斯里蘭卡等新興國家消費量最高的最大市場佔有率。

- 根據OICA的數據,2022年該地區汽車產量達到50,020,793輛,比2021年的46,768,800輛成長7%。到2022年,中國將成為最大的生產國,其次是日本、印度和韓國。

- 此外,由於儲蓄、較低的偏好和對個人出行偏好的提高,印度的小客車銷售在 2022 年 1 月至 9 月期間保持強勁,說服客戶購買新車。受此影響,2022年前第三季印度新車註冊量成長約20.2%,達到280萬輛。 「Aatma Nirbhar Bharat」和「印度製造」計畫等政府改革也支持了印度汽車工業。

- 此外,隨著消費者越來越喜歡電池驅動的汽車,印度汽車產業正在見證趨勢的轉變。

- 此外,中國政府預計2025年電動車普及將達20%。這反映在該國的電動車銷售趨勢上,2022年電動車銷量創下歷史新高。根據中國小客車協會的數據,2022年中國電動車和插電式混合動力車銷量為567萬輛,幾乎是2021年銷量的兩倍。預計該市場對汽車潤滑油的需求將會增加,我們準備繼續以這種速度進行銷售。

- 上述因素和政府法規導致該地區潤滑油需求增加。

汽車潤滑油產業概況

汽車潤滑油市場已部分整合,主要企業之間競爭激烈。這些主要公司包括殼牌公司、中國石化集團公司、英國石油公司、埃克森美孚公司和道達爾能源公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 全球電動車生產需求增加

- 新興國家汽車零件需求不斷擴大

- 其他司機

- 抑制因素

- 關於廢油處理的嚴格環境法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔:市場規模(數量)

- 產品類別

- 機油

- 變速箱齒輪油

- 油壓

- 潤滑脂

- 車輛類型

- 小客車

- 商用車

- 摩托車

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMSOIL INC.

- Bharat Petroleum Corporation Limited

- BP PLC(Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil Lubricants India Ltd(Hinduja Group)

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- LUKOIL

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- SK Lubricants Co. Ltd

- TotalEnergies

- Valvoline Inc.

- Veedol International Limited

第7章 市場機會及未來趨勢

- 生物基潤滑劑的開發

- 其他機會

The Automotive Lubricants Market size is estimated at 22.38 Billion liters in 2024, and is expected to reach 26.98 Billion liters by 2029, growing at a CAGR of 3.81% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- In the short term, one of the major factors, like increasing EV production globally and demand from the automotive components industry, is expected to drive the market.

- On the flip side, low adoption rates of synthetic lubricants due to stringent environmental regulations for waste oil disposal are expected to hinder the market's growth.

- The bio-based lubricants development is expected to act as a market opportunity for the market studied.

- Asia-Pacific region is expected to dominate the market studied during the forecast period.

Automotive Lubricants Market Trends

Increasing Usage of Engine Oils

- Engine oils are widely used for lubricating internal combustion engines in different types of automobiles. It is used for various applications such as wear reduction, corrosion protection, and ensuring the smooth operation of the engine internals.

- The oils create a thin film between the moving parts to enhance heat transfer and reduce tension during contact.

- The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc. The consistent investments in R & D activities and the increasing automotive production in the country are likely to support the lubricants market growth.

- Even though general car sales in the country declined, electric vehicle registrations grew tremendously over the past few years. This growth is supported by the government's push toward all-electric cars by 2040.

- As of March 2022, Volkswagen approved an investment in a new electric car plant. The new German factory construction, which would be built next to the group's historic home in Wolfsburg, would begin in 2023, with production set to begin in 2026.

- According to data published by OICA, global automobile production increased from 80,205,102 in 2021 to 85,016,728 in 2022, boosting engine oil demand.

- All the factors above are expected to propel the market's growth studied.

Asia-Pacific is Expected to Dominate the Market

- Rapid industrialization in the Asia-Pacific region is expected to drive market growth. The growth of industries such as automotive in the region will result in lubricant growth.

- Also, the automotive industry consumes lubricants in automotive parts for finishes which are anticipated to boost the market's growth. Asia-Pacific is anticipated to hold a major market share, with the largest consumption coming from developing and emerging countries such as China, Malaysia, India, Thailand, Indonesia, and Sri Lanka.

- According to OICA, automotive production in the region reached 50,020,793 units in 2022, increasing by 7% from 46,768,800 units produced in 2021. China was the largest producer in 2022, followed by Japan, India, and South Korea.

- Furthermore, in the first nine months of 2022, Indian passenger car sales remained strong due to savings, lower interest rates, and an increasing preference for personal mobility, which convinced customers to buy new cars. As a result, new car registrations in India grew by around 20.2% in the first three quarters of 2022 to reach 2.8 million units. Also, Government reforms such as "Aatma Nirbhar Bharat" and "Make in India" programs supported the automotive industry in the country.

- Further, the automobile industry in India is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side.

- Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. It is reflected in the electric vehicle sales trend in the country, which went record-breaking high in 2022. As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. The market is anticipated to increase the demand for automotive lubricants in the country, poised to continue sales at this momentum.

- The factors above and supportive government regulations are contributing to the increased demand for lubricants in the region.

Automotive Lubricants Industry Overview

The automotive lubricants market is partially consolidated, with intense competition among the top players. These major companies include Shell PLC, China Petrochemical National Corporation, BP PLC, Exxon Mobil Corporation, and TotalEnergies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from EV Production Worldwide

- 4.1.2 Growing Demand for Automotive Components in Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regardng Used Oil Disposal

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Greases

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Motorcycles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP PLC (Castrol)

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petroleum & Chemical Corporation

- 6.4.7 ENEOS

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 FUCHS

- 6.4.10 Gazprom Neft PJSC

- 6.4.11 Gulf Oil Lubricants India Ltd (Hinduja Group)

- 6.4.12 Hindustan Petroleum Corporation Limited

- 6.4.13 Indian Oil Corporation Ltd

- 6.4.14 LUKOIL

- 6.4.15 Motul

- 6.4.16 Petrobras

- 6.4.17 PETRONAS Lubricants International

- 6.4.18 Phillips 66 Company

- 6.4.19 PT Pertamina Lubricants

- 6.4.20 Repsol

- 6.4.21 Shell PLC

- 6.4.22 SK Lubricants Co. Ltd

- 6.4.23 TotalEnergies

- 6.4.24 Valvoline Inc.

- 6.4.25 Veedol International Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio Based Lubricants

- 7.2 Other Opportunities