|

市場調查報告書

商品編碼

1430692

日本小客車潤滑油:市場佔有率分析、產業趨勢、成長預測(2021-2026)Japan Passenger Vehicles Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

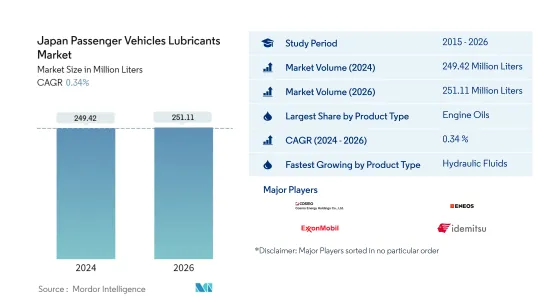

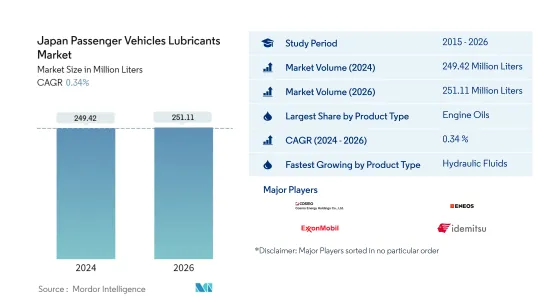

預計2024年日本小客車潤滑油市場規模為2.4942億公升,預計2026年將達到2.5111億公升,複合年成長率預計為0.34%。

主要亮點

- 依產品類型分類最大的區隔市場 - 機油:引擎油是一種主要產品類型,因為它用於高溫和高壓應用,導致所需量大且排放間隔短。

- 依產品類型分類最快的區隔市場:液壓油:經濟從 COVID-19 的影響中復甦後,國內小客車銷量的成長預計將推動 2021 年至 2026 年的液壓油需求。

日本小客車潤滑油市場趨勢

依產品類型分類最大的區隔市場:引擎油

- 在日本,小客車(PV)是汽車潤滑油消費的主要領域。 2015年至2019年,由於小客車行駛里程下降以及引擎動力變化,乘用車潤滑油消費量量複合年成長率為2.7%。

- 2020年,PV將佔日本汽車潤滑油總消費量的約49%。今年,機油佔光電潤滑油消費量的最大佔有率,達到 72%。 2020 年,受新冠肺炎 (COVID-19) 影響,光伏潤滑油消費量下降了 12.66%,導致光伏銷量下降和維修間隔延遲。

- 從2021年到2026年,液壓油產業可能是成長最快的產業,複合年成長率為1.99%。這一成長預計將由平均年行駛里程的增加和小客車銷量的增加所推動。

日本小客車潤滑油產業概況

日本小客車潤滑油市場整合度較高,前五家企業佔比高達94.94%。市場的主要企業是(依字母順序排列):Cosmo Energy Holdings、ENEOS Corporation、ExxonMobil Corporation、Idemitsu Kosan 和 Royal Dutch Shell Plc。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第3章 產業主要趨勢

- 汽車產業趨勢

- 法律規範

- 價值鍊和通路分析

第4章市場區隔

- 依產品類型

- 機油

- 潤滑脂

- 油壓

- 變速箱和齒輪油

第5章競爭形勢

- 主要策略趨勢

- 市場佔有率分析

- 公司簡介

- AKT Japan Co. Ltd(TAKUMI Motor Oil)

- BP PLC(Castrol)

- Cosmo Energy Holdings Co. Ltd

- ENEOS Corporation

- ExxonMobil Corporation

- Idemitsu Kosan Co. Ltd

- Motul

- Royal Dutch Shell Plc

- Royal Purple(REDTREE Co. Ltd)

- Wako Chemical Co. Ltd

第6章 附錄

- 附錄1 參考文獻

- 附錄-2 圖表清單

第7章 CEO 面臨的關鍵策略問題

The Japan Passenger Vehicles Lubricants Market size is estimated at 249.42 Million Liters in 2024, and is expected to reach 251.11 Million Liters by 2026, growing at a CAGR of 0.34% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Product Type - Engine Oils : Engine oil is the leading product type due to its high volume requirements and shorter drain intervals, as it is used for high-temperature and high-pressure applications.

- Fastest Segment by Product Type - Hydraulic Fluids : The growth in passenger vehicle sales in the country, post the economic recovery from the COVID-19 impact, is likely to drive the demand for hydraulic fluids during 2021-2026.

Japan Passenger Vehicles Lubricants Market Trends

Largest Segment By Product Type : Engine Oils

- In Japan, passenger vehicle (PV) is the leading segment in terms of automotive lubricant consumption. During 2015-2019, the country recorded a negative CAGR of 2.7% in PV lubricant consumption due to a decline in the annual average distance traveled by passenger vehicles and changes in engine dynamics.

- In 2020, PVs accounted for about 49% of the total automotive lubricant consumption in Japan. Engine oils accounted for the largest share of 72% in PV lubricant consumption during the year. During 2020, PV lubricant consumption declined by 12.66% due to COVID-19, which led to a dip in PV sales and delays in service intervals.

- During 2021-2026, the hydraulic fluids segment is likely to be the fastest-growing segment, with a CAGR of 1.99%. The growth is expected to be driven by an increase in the annual average distance traveled and a rise in sales of passenger vehicles.

Japan Passenger Vehicles Lubricants Industry Overview

The Japan Passenger Vehicles Lubricants Market is fairly consolidated, with the top five companies occupying 94.94%. The major players in this market are Cosmo Energy Holdings Co. Ltd, ENEOS Corporation, ExxonMobil Corporation, Idemitsu Kosan Co. Ltd and Royal Dutch Shell Plc (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Product Type

- 4.1.1 Engine Oils

- 4.1.2 Greases

- 4.1.3 Hydraulic Fluids

- 4.1.4 Transmission & Gear Oils

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 AKT Japan Co. Ltd (TAKUMI Motor Oil)

- 5.3.2 BP PLC (Castrol)

- 5.3.3 Cosmo Energy Holdings Co. Ltd

- 5.3.4 ENEOS Corporation

- 5.3.5 ExxonMobil Corporation

- 5.3.6 Idemitsu Kosan Co. Ltd

- 5.3.7 Motul

- 5.3.8 Royal Dutch Shell Plc

- 5.3.9 Royal Purple (REDTREE Co. Ltd)

- 5.3.10 Wako Chemical Co. Ltd

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures