|

市場調查報告書

商品編碼

1432525

電信分析:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Telecom Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

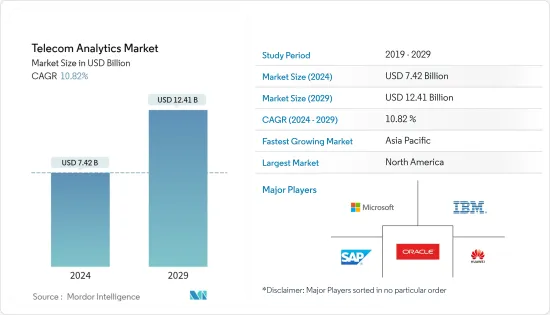

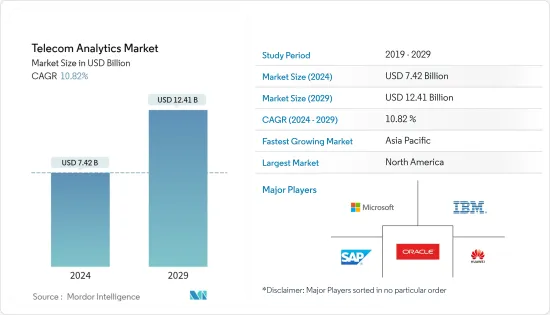

電信分析市場規模預計到 2024 年為 74.2 億美元,預計到 2029 年將達到 124.1 億美元,預測期內(2024-2029 年)複合年成長率為 10.82%。

隨著新進業者的出現,競爭加劇,減少客戶流失的需要比以往任何時候都更加重要,這些新進業者通常以比現有企業更低的價格提供更好的交易。此外,越來越多的非結構化和結構化資料需要有效的分析來更深入地了解客戶行為和偏好。即時服務使用模式促使這些公司部署分析。

主要亮點

- 電信分析市場結合了各種先進的商業智慧(BI)技術,以滿足通訊業的複雜需求。其中包括增加銷售、減少客戶流失和欺騙、加強風險管理以及降低營運成本。因此,通訊組織正在採用先進的分析主導的資料解決方案,以便更快速、更輕鬆地僅處理相關資料,並使用資料挖掘和預測分析等網路分析來提供及時、準確的數據。

- 此外,電訊業正在進入一個新時代,以新的客戶為中心,即企業而不是消費者,5G和雲端的新技術,以及利用分析和資料科學來提供敏捷和快速的服務。全新的工作方式。截至 2023 年 1 月,GSA 報告稱,全球已有 243 個商用 5G 部署,112 家通訊業者投資獨立 5G。這種商業化將帶來新的 B2B 和 B2B2X 應用程式。為此,通訊業者需要能夠透過簡單地增加容量或靈活改變服務水準和資源來服務這些客戶。

- 例如,2023 年 2 月, Oracle宣布發布 Oracle Network Analytics Data Director,這是其網路分析產品組合中的第二個應用程式。這使通訊業者能夠靈活地將 5G 核心整合到其現有的營運工具中,即使對於未提供的網路功能也是如此。 Oracle Communications Network Analytics Data Director 本質上從各種來源(例如服務通訊代理程式 (SCP) 和網路儲存庫功能 (NRF) 等 Oracle 5G 網路功能)獲取流量,並將其分發到訂閱者應用程式。由於傳入和資料資料資料加密,因此使用者可以放心進行端對端資料傳輸。

- 由於世界各地有大量行動用戶,電信分析服務預計將託管在雲端。因此,由於消費群的不斷增加,雲端託管也必定會進一步擴大。因此,通訊服務供應商(CSP)對該技術的採用顯著增加。

- 電信分析幫助通訊服務供應商(CSP) 提高生產力、提高客戶滿意度並增加收益。例如,諾基亞公司的諾基亞 AVA 分析和見解已幫助許多主要電信業者重新設計了其市場衡量產品。一級服務供應商POST Luxembourg 使用諾基亞 AVA 在影響用戶之前主動識別並解決 97% 的網路問題。此外,Hutchison 3 India 將網路頻譜效率提高了 17%。此外,沃達豐使用貝爾實驗室機器學習演算法檢測異常並幫助自動進行根本原因分析,解決網路問題的速度提高了 30%。

- 資料基礎設施的改進使得分析技術能夠在通訊業中得到應用,從而使資料豐富的通訊業者能夠產生有意義的情報來實現業務轉型。透過 Electric Telecom Analytics,您可以在頁面上整合和分析與支出和規劃相關的客戶資料,以及網路使用情況和網路活動持續時間等行為資料。

- 隨著智慧型裝置的普及和IP網路使用的增加,通訊業中通訊詐騙再次出現。詐騙已成為通訊市場最棘手的問題,因為攻擊可能來自任何來源。為此,當局已開始監管通訊部門的安全。在印度,印度電訊監管機構對未達到語音品質基準的行為實施嚴格的規則和處罰。預計這將增加該國對網路分析解決方案的需求。

- 在 COVID-19感染疾病期間,電信分析的整體使用增加。在在家工作、線上串流平台的興起、內部流程可見度的提高以及電信分析的關鍵業務等因素,對電信分析的需求增加。時期。

電信分析市場趨勢

減少客戶流失的需求迅速增加

- 在電訊業中,客戶流失可以定義為在指定時間內更換服務供應商的用戶的百分比。公司投入了大量精力來降低解約率,因為如果這個比例逐年增加,就會損害公司的品牌。這將對公司未來的銷售和業務產生負面影響。根據 krtrimaiq 的數據,新澤西州和加州的解約率是美國最高的。

- 通過使用電信分析,流失率降低了 15%。 電信服務提供者正在尋找客戶流失分析解決方案,以防止收入損失、增強客戶服務並節省營銷和銷售費用。 通過實施電信分析解決方案,電信公司可以從使用者使用數據中廣泛學習,以識別用戶行為模式並改善客戶體驗。 此外,電信供應商可以進行交叉銷售和追加銷售。

- 電信分析非常重要,因為它為電信業者提供了客戶概況,並允許他們識別盈利最高的公司、盈利最低的公司等。同時,您還可以追蹤客戶關係的演變(購買、續訂、問題)。並了解每位客戶在其客戶旅程中的位置。

- 此外,電信分析的好處之一是,在客戶管理中,所有客戶資料都安全地儲存在一個系統中,並且可以隨時存取。這是因為以一致的方式收集每個消費者的詳細資訊以供以後分析非常重要。

- 此外,Bharti Airtel、Reliance Jio 和 Vodafone 等行動營運商正試圖找到利用人工智慧的方法,透過呼叫中心和網路服務(作為客戶服務接觸點)改善客戶體驗,以提高使用者保留率並減少客戶流失。

- 此外,市場上的公司正在提供電信分析解決方案,其中結合了機器學習來了解態度,幫助通訊業者識別面臨風險的用戶以及當前和未來流失的原因。您將能夠做到。因此,公司正在部署行銷和客戶服務工作以減少銷售額。此外,您還可以識別準備升級資料方案的用戶以及新服務的潛在客戶。在電訊領域,客戶流失分析還可以預測客戶何時可能更換通訊業者或服務供應商。

- 通訊客戶可以從多種服務供應商中進行選擇,並主動在營運商之間切換。在這個競爭激烈的市場中,通訊業的平均年解約率15-25%。現在,保留客戶比獲取客戶更重要,因為獲取新客戶的成本是客戶維繫現有客戶的 5 到 10 倍。留住盈利的消費者是許多現有通訊業者的首要商業目標。為了減少客戶離職率,電訊公司需要找出最有可能流失的消費者。

- 沃達豐2021/2022會計年度第一季,德國預付解約率11.3%。沃達豐是英國(UK) 預付費客戶解約率最高的公司,解約率91.9%。這些地區的高解約率大大增加了減少流失的需求。

北美佔最大市場佔有率

- 預計北美將在電信分析市場中佔據重要的市場佔有率,這主要是由於商業智慧解決方案的高支出。此外,由於通訊之間的激烈競爭,該地區的電訊高度發達,預計將進一步擴大該地區的電力電信分析市場。

- 用於客戶支援的IT基礎設施基礎設施和技術的持續進步、眾多市場供應商的存在以及管理最新客戶體驗和幫助台軟體方面熟練技術專業知識的可用性,使該地區獨一無二。正在為電信分析的成長做出貢獻市場。此外,北美企業也積極進行策略併購。例如,美國科技巨頭IBM收購了Sanobi Technologies,以加強其雲端服務。 Shanovi 為企業資料中心和雲端基礎架構提供雲端遷移、業務連續性和混合雲端恢復軟體。

- 此外,BYOD 政策可能是受到平板電腦和智慧型手機在美國日益普及的推動。例如,2022年1月,美國人口普查局和消費者科技協會預測,美國智慧型手機銷售額將從2021年的730億美元增加到2022年的747億美元。隨著物聯網的快速採用,這一數字預計將進一步增加。許多部門和公司。因此,隨著智慧型手機用戶的增加,詐騙和詐騙的機會也在增加,這正在推動這個電信分析市場的指數級成長。

- 北美是一些全球最大的行動電話服務供應商的所在地,他們嚴重依賴消費者的回饋。因此,透過選擇Telecom Analytics,該地區的CSP可以高效率地提供高品質的服務。例如,美國電訊供應商 Verizon 在公司內部擁有各種分析解決方案和人工智慧團隊。同時,資料科學和認知智慧小組專注於在 Verizon 的客戶互動中實施分析和認知技術。隨著其他供應商也致力於類似的努力,該地區對電信分析解決方案的需求將會增加。

- 此外,政府增加支持網路普及的措施和投資預計將增加對電信分析市場的需求。例如,2022 年 7 月,美國農業部 (USDA) 宣布投資 4.01 億美元,為 11 個州的企業和 31,000 名農村居民提供高速網路存取。這是美國政府對負擔得起的高速網路和農村基礎設施投資的承諾的一部分。

- 在 Stormforge 於 2021 年 4 月發布的一項研究中,北美 18% 的受訪者聲稱他們的組織每月在雲計算上的支出在 100,000 美元到 250,000 美元之間。 此外,32% 的受訪者預計其組織的雲支出將在未來 12 個月內大幅增長,44% 的受訪者預計同期雲支出將略有增加。 此外,Statista 全球消費者調查 2022 年在美國進行的一項研究發現,44% 的受訪者使用在線存儲來存儲檔和照片,40% 的受訪者使用在線應用程式創建辦公文檔。 這種在雲服務上的高支出趨勢將推動該地區電信分析市場的增長。

電信分析產業概述

電信分析市場目前競爭非常激烈,因為它由許多公司組成,並且正在走向零碎階段。全球電信分析市場的幾家主要企業正在不斷努力推動其產品的進步。幾家知名公司已結盟,以擴大其在發展中地區的足跡並鞏固其市場地位。主要公司有華為科技公司、SAP SE 和甲骨文公司。

- 2023 年 3 月 - IBM 公司宣布將為埃及電信 (TE) 提供智慧自動化軟體,為行動、固定和核心網路上的所有營運支援系統 (OSS) 實施全面的解決方案。埃及電信將採用部署在 RedHat OpenShift 上的 IBM Cloud Pak for Watson AIOps 來實施其 IBM 機器人流程自動化 (RPA) 解決方案。該解決方案為 TE 提供了整個 IT 環境的全面視圖,幫助其更快地創新、降低營運成本並最大限度地縮短排除故障和解決網路相關事件所需的時間。

- 2023 年 2 月 - Bharti Airtel 宣布將與 NVIDIA 合作建置基於 AI 的解決方案,以改善客服中心所有來電的整體客戶體驗。該公司對進入客服中心的84% 的呼叫運行自動語音辨識演算法。這有助於企業在與消費者互動時確定代理商需要改進的領域,從而帶來更好的客戶體驗。該公司利用 NVIDIA NeMo 對話式 AI套件來開發這款專用語音應用程式和 NVIDIA AI 企業軟體套件。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

- 市場動態

- 減少取消的需求迅速增加

- 詐欺的脆弱性增加

- 市場限制因素

- 通訊業者缺乏意識

第5章市場區隔

- 依用途

- 客戶分析

- 網路分析

- 市場分析

- 價格分析

- 服務分析

- 其他

- 依發展

- 雲

- 本地

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Dell Inc.

- Oracle Corporation

- IBM Corporation

- SAP SE

- Microsoft Corporation

- InfoFaces Inc.

- Accenture PLC

- Huawei Technologies Co. Ltd

- Teradata Corporation

- Wipro Limited

- Nokia Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Telecom Analytics Market size is estimated at USD 7.42 billion in 2024, and is expected to reach USD 12.41 billion by 2029, growing at a CAGR of 10.82% during the forecast period (2024-2029).

The need for reducing churn is more important than ever, as the competition is increasing with the incidence of new entrants, who provide lucrative deals that are generally inexpensive than the incumbents. In addition, the increasing amount of unstructured and structured data requires effective analysis to get more profound insights into customer behavior and preferences. Real-time service usage patterns motivate these companies to adopt analytics.

Key Highlights

- The telecom analytics market combines various sophisticated business intelligence (BI) technologies that satisfy the complex demands of the telecom industry. These include developing sales, reducing churn and deception, enhancing risk management, and decreasing operational costs. Hence, telecom organizations are adopting advanced analytics-driven data solutions for faster and simpler processing of only relevant data, helping them achieve timely and accurate insights using network analytics such as data mining and predictive analytics.

- Moreover, the telecommunications industry is entering a new era and increasing need for a new customer focus - enterprises instead of consumers, new technologies in 5G and the cloud, and fundamentally new ways of working to deliver agile, faster services using analytics and data science. As of January 2023, the GSA reports that there are 243 commercial 5G deployments worldwide, with 112 operators investing in standalone 5G. This commercialization will lead to new B2B and B2B2X applications. In doing so, operators need to ensure that they can serve these customers beyond simply expanding capacity or flexibly changing service levels and resources.

- For instance, in February 2023, Oracle Corporation announced to release the second application in our Network Analytics portfolio, the Oracle Network Analytics Data Director which enables operators to flexibly integrate their 5G core into their existing operational tools, even for network functions that are not provided by Oracle. Oracle Communications Network Analytics Data Director basically ingests traffic from various sources such as Oracle 5G network functions such as Service Communication Proxy (SCP) and Network Repository Function (NRF) and distributes it to subscriber applications.Both incoming and outgoing data are encrypted, allowing users to guarantee end-to-end data transfer.

- Telecom analytics service is expected to be hosted on the cloud because of the large number of mobile users worldwide. Hence, cloud hosting is also set to expand further due to the continuous rise in the consumer base. Thus, the adoption of this technology by communications service providers (CSPs) is growing significantly.

- Telecom analytics has been helping communications service providers (CSPs) to boost productivity, enhance customer satisfaction, and grow revenues. For instance, Nokia Corporation's Nokia AVA analytics and insights helped many leading telecom companies re-engineer their market measurement products. POST Luxembourg, a Tier-1 service provider, used Nokia AVA to proactively identify and solve 97% of network issues before they could affect subscribers. Moreover, Hutchison 3 Indonesia improved the spectral efficiency of its network by 17%. Additionally, Vodafone solves network issues up to 30% faster by using Bell Labs machine learning algorithms that detect anomalies and help automate root cause analysis.

- The improvements in data infrastructure have enabled the use of analytics in the telecom industry, owing to which data-rich carriers can yield meaningful intelligence to transform their businesses. Telecom analytics allows pages to merge and analyze customer data related to spending and plans and behaviour data like internet usage or duration of networking activities.

- Due to the proliferation of smart devices and the increasing use of IP networks, the telecom industry is experiencing a resurgence of communications fraud. As attacks can come from any source, scam has emerged as the most troublesome problem for the telecom market. Due to this, authorities are initiating regulations for the telecoms sector safety. In India, the Telecom Regulatory Authority of India has issued stringent rules and penalties for failing to meet the voice quality benchmark. It is expected to increase the demand for network analytics solutions in the country.

- During the COVID-19 pandemic outbreak, the overall utilization of telecom analytics has expanded. Due to the factors like the increased pressure on broadband caused by the ability to work from home, the rise in online streaming platforms, improved visibility of internal processes, and essential operations by telecom analytics, the demand for telecom analytics has grown during the active lockdown period.

Telecom Analytics Market Trends

The surge in need for churn reduction

- In the context of the telecom sector, churn can be defined as the percentage of subscribers who switch service providers within a predetermined time frame. Companies are putting a lot of effort into lowering churn since if the percentage increases year over year, it damages the company's brand. This badly impacts future sales and business for the corporation. According to krtrimaiq, New Jersey and California have the highest churn percentage in the US.

- By using telecom analytics, it cut churn by 15%. Telecom service providers demand customer churn analytics solutions to prevent revenue loss, enhance customer service, and save marketing and sales expenses. By implementing telecom analytics solutions, carriers can learn extensively from subscriber usage data to identify subscriber behavior patterns and enhance customer experiences. Additionally, it gives telecom providers the ability to cross-sell and up-sell.

- Telecom analytics is very important as it gives telecom companies an overview of their customers and allows them to identify the most profitable, least profitable, etc. At the same time, it also allows tracking the evolution of customer relationships (purchases, renewals, issues) and seeing where each customer is in the customer journey.

- Furthermore, one of the benefits of telecom analytics is in customer management all customer data is securely stored in one system and can be accessed at any time. As it's important to have a consistent way to collect details about each consumer for later analysis.

- Moreover, mobile phone companies such as Bharti Airtel, Reliance Jio, and Vodafone are using artificial intelligence to enhance customer experience through their customer service touchpoints call centers, and network offerings and try to find ways to improve subscriber stickiness and reduce churn.

- Additionally, companies in the market are providing telecom analytics solutions laced with machine learning to understand attitudes, enabling carriers to identify at-risk subscribers or the causes of current and prospective churn. As a result, businesses are developing marketing or customer service initiatives to reduce turnover. Additionally, it can spot subscribers ready for data plan upgrades and prospective customers for new services. In the telecom sector, churn analytics also makes it possible to predict when customers will likely transfer carriers or service providers.

- Customers in the telecom sector have a variety of service providers to select from, and they can actively switch between operators. The telecoms sector has an average annual churn rate of 15 to 25 percent in this fiercely competitive market. Customer retention has now surpassed customer acquisition in importance since it is 5-10 times more expensive to gain new customers than to keep existing ones. Retaining highly profitable consumers is the top business objective for many established operators. Telecom businesses must identify the consumers who are most likely to leave to reduce customer turnover.

- In the first quarter of Vodafone's financial year 2021/2022, the prepaid churn rate in Germany was 11.3 percent. Vodafone has the highest churn rate among its prepaying customers in the United Kingdom (UK), where the churn rate is 91.9 percent. Since the churn rate is higher in these regions, the need for churn reduction is growing significantly.

North America to Hold the Largest Market Share

- North America is anticipated to occupy a significant market share in the telecom analytics market, primarily owing to the region's high expenditure on business intelligence solutions. Besides, telecommunications in the region is highly developed with intense competition among the communication providers, which is expected further to boost the region's telecom analytics market.

- The continuous advancements in IT infrastructure and technology used for customer support, the presence of a large number of market vendors, and the accessibility of proficient technical expertise in managing the modern customer experience and helpdesk software contribute to the telecom analytics market growth in the region. Furthermore, North American companies actively make strategic mergers and acquisitions. For instance, American technology giant IBM acquired Sanovi Technologies to bolster its cloud offerings. Sanovi provides cloud migration, business continuity, and hybrid cloud recovery software for enterprise data centres and cloud infrastructure.

- Moreover, the BYOD policy is probably driven by the growing popularity of tablets and smartphones in the US. For instance, the US Census Bureau and Consumer Technology Association predicted in January 2022 that sales of smartphones in the US would rise from USD 73 billion in 2021 to USD 74.7 billion in 2022. This is anticipated to increase further with the quick adoption of IoT across numerous sectors and companies. Hence, with the rise of smartphone users, the probability of fraud or scams is also increasing, which in turn is fueling the growth of this telecom analytics market exponentially.

- North America has a few of the world's largest cellular service providers, who rely enormously on consumer feedback. Thus, by opting for telecom analytics, CSPs in the region can offer better quality service at high efficiency. For instance, Verizon, a telecommunications provider in the United States, has deployed various analytic solutions and AI groups around the company. On the other hand, the Data Science and Cognitive Intelligence group focus on implementing analytics and cognitive technology in Verizon's customer interactions. The increased focus of other vendors in order to follow the same would boost the demand for telecom analytics solutions in the region.

- Furthermore, the rising government initiative and investment to support the internet penetration in the country will increase the demand for telecom analytics market. For instance, in July 2022, the United States Department of Agriculture (USDA) has announced a USD 401 million investment to bring high-speed Internet access to businesses and 31,000 rural residents in 11 states. This is part of the US government's commitment to investing in affordable high-speed internet and rural infrastructure.

- In a research study released by Stormforge in April 2021, 18% of respondents from North America claim that their firm spends between $100,000 and $250,000 per month on cloud computing. In addition, 32% of respondents predict that their organization's cloud spending will expand significantly over the following 12 months, while 44% predict a slight increase in cloud spending over the same period. Additionally, as per the research study by Statista Global Consumer Survey conducted in the United States in 2022, it has been found that 44 percent of respondents use online storage for files and pictures, while 40 percent of respondents use online applications to create office documents. This trend of high spending on cloud services will drive the growth of the telecom analytics market in the region.

Telecom Analytics Industry Overview

The Telecom Analytics Market is very competitive and moving towards the fragmented stage as the market currently consists of many players. Several key players in the global telecom analytics market are in constant efforts to bring product advancements. A few prominent companies are entering into collaborations and expanding their footprints in developing regions to consolidate their positions in the market. The major players are Huawei Technologies, SAP SE, and Oracle Corp.

- March 2023- IBM Corporation announced to provide intelligent automation software to Telecom Egypt (TE) to implement an umbrella solution for all its operations support systems (OSS) on mobile, fixed, and core networks. Telecom Egypt will adopt IBM Cloud Pak for Watson AIOps deployed on RedHat OpenShift to implement an IBM Robotic Process Automation (RPA) solution. The solution provides TE with a holistic view of its entire IT environment to help them innovate faster, reduce operating costs, and minimize the time to troubleshoot and resolve network-related incidents.

- February 2023- Bharti Airtel announced to build an AI-based solution by collaborating with NVIDIA to improve the overall customer experience for all inbound calls to its contact center. The company runs an automated speech recognition algorithm on 84% of its calls coming into its contact centers. This will help the company identify improvement areas for the agent when interacting with the consumers, leading to a better customer experience. The company has leveraged the NVIDIANeMo conversational AI toolkit to develop this specialized speech application and NVIDIA AI enterprise software suite.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 Market Insights

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Covid-19 on the Market

- 4.5 Market Dynamics

- 4.5.1 The surge in need for churn reduction

- 4.5.2 Increasing Vulnerability to Fraudulent Activities

- 4.6 Market Restraints

- 4.6.1 Lack of Awareness Among Telecom Operators

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Customer Analytics

- 5.1.2 Network Analytics

- 5.1.3 Market Analytics

- 5.1.4 Price Analytics

- 5.1.5 Service Analytics

- 5.1.6 Other Applications

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dell Inc.

- 6.1.2 Oracle Corporation

- 6.1.3 IBM Corporation

- 6.1.4 SAP SE

- 6.1.5 Microsoft Corporation

- 6.1.6 InfoFaces Inc.

- 6.1.7 Accenture PLC

- 6.1.8 Huawei Technologies Co. Ltd

- 6.1.9 Teradata Corporation

- 6.1.10 Wipro Limited

- 6.1.11 Nokia Corporation