|

市場調查報告書

商品編碼

1431612

電力零售:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Electricity Retailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

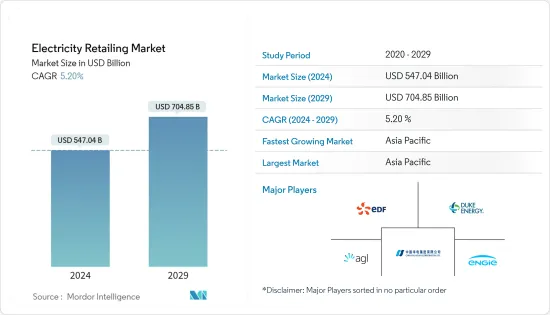

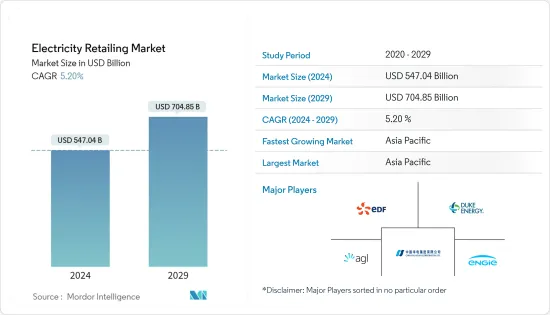

預計2024年全球電力零售市場規模將達5,470.4億美元,2024-2029年預測期間複合年成長率為5.20%,2029年將達到7,048.5億美元。

主要亮點

- 從中期來看,電力需求的增加和電動車的普及預計將在預測期內推動市場發展。

- 另一方面,新興的分散式發電資源預計將抑制市場成長。

- 然而,電力零售市場的技術進步(如先進電錶)和撒哈拉以南非洲地區的電力需求預計將在預測期內為市場創造機會。

- 預計亞太地區將在預測期內主導市場,因為該地區到 2022 年的電力消耗需求最高。

主要市場趨勢

住宅領域預計將佔據很大的市場佔有率

- 住宅用電包括照明、暖氣、冷氣、冷氣以及電器產品、電腦、電子設備、機械和大眾交通工具系統運作的用電。

- 美國佔世界發電量的很大一部分。 2022年,美國發電量佔全球的15.6%。

- 根據美國能源資訊署預測,2022年美國總電力消耗量量約4.5兆千瓦時,創有紀錄以來最高,是1950年用電量的14倍。最終電力消費量總量包括向消費者的零售售電量和直接用電量。

- 此外,2022年住宅領域的電力零售佔有率為38.9%,較2021年提高3.5個百分點。 2022年,美國住宅零售用電量消費量為1.42兆度。

- 智慧電錶是面向未來的技術的關鍵指標,其引入透過通用的打包無線服務技術實現配電公司和消費者之間的雙向即時通訊,為智慧電網鋪平了道路。由於政府對智慧電錶安裝的支援政策,零售電力需求預計將增加。在住宅領域,智慧電錶可用於提高客戶電力服務的可靠性和品質、追蹤用電情況,並就減少能源消費量和節省電費做出明智的決策。您可以做到。

- 例如,2022年4月,歐盟(EU)向清潔能源領域的五個計劃撥款約1.34億美元。塞爾維亞的計劃將支持在塞爾維亞配電系統中引入智慧電錶。這些資金將用於克拉列沃、恰克和尼什智慧電錶實施的第一階段。

- 基於以上幾點,預計住宅領域將佔據較大的市場佔有率。

亞太地區預計將主導市場

- 亞太地區擁有全球 50% 以上的人口和 60% 的最大城市。隨著人口的快速成長和工業化,隨著數百萬新客戶獲得電力,非洲大陸未來將面臨電力需求的增加。

- 根據世界能源數據統計,2022年亞太地區初級能源消費量為277.6艾焦耳,與前一年同期比較%。中國等國家電力需求最高,佔全球能源消費量總量的26.4%。

- 各地方政府也正在採取措施將現代技術應用於電力零售。亞太地區許多國家需要加強其輸配電(T&D)網路。為了向這些地區提供電力,該地區各國正大力投資建造電網和智慧電錶系統。

- 例如,2023 年 3 月,印度政府根據配電部門現代化計劃 (RDSS) 實施了全國範圍內的智慧電錶計劃。根據該計劃,印度政府的目標是在全國安裝超過2.5兆個智慧電錶。

- 基於上述情況,預計亞太地區將在預測期內主導市場。

競爭形勢

全球零售電力市場適度分散。主要企業(排名不分先後)包括 Engie SA、AGL Energy Ltd.、中國華電Group Limited (CHD)、Duke Energy Corporation. 和 Electricite de France SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 市場規模與需求預測,10 億美元(~2028 年)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電力需求增加

- 電動車的普及

- 抑制因素

- 分散式發電的新來源

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 法國

- 義大利

- 德國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Engie SA

- AGL Energy Ltd.

- China Huadian Corporation LTD.(CHD)

- Duke Energy Corporation

- Electricite de France SA.

- Enel SpA

- Keppel Electric Pte. Ltd.

- Tata Power Co. Ltd.

- E.ON SE

- Iberdrola SA

第7章 市場機會及未來趨勢

- 透過在電力零售中使用數位技術提高客戶參與

簡介目錄

Product Code: 50000761

The Electricity Retailing Market size is estimated at USD 547.04 billion in 2024, and is expected to reach USD 704.85 billion by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium period, the increase in the demand for electricity and the rising adoption of electric vehicles is expected to drive the market in the forecast period.

- On the other hand, new sources of distributed electricity generation are expected to restrain the market's growth.

- Nevertheless, advancements in the technology of the electricity retail market, like advanced meter and the requirement of power in the sub-Saharan Africa region, is expected to create opportunity for the market in the forecast period.

- Asia-Pacific is expected to dominate the market in the forecast period owing to the highest demand for electricity consumption in 2022.

Key Market Trends

Residential Segment is Expect to have a Significant Share in the Market

- Residential electricity use includes using electricity for lighting, heating, cooling, refrigeration, and operating appliances, computers, electronics, machinery, and public transportation systems.

- The United States has a significant share in World's electricity generation. In 2022, the country's share was 15.6% of the World's electricity generation.

- According to U.S. Energy Information Administration, total electricity consumption in the United States was about 4.05 trillion kWh in 2022, the highest amount recorded and 14 times greater than electricity use in 1950. Total electricity end-use consumption includes retail electricity sales to consumers and direct electricity use.

- Additionally, in 2022, the residential sector's retail electricity share was 38.9% of total electricity retail sales, 3.5% higher than in 2021. The total retail electricity consumption of the residential sector in the United States accounted for 1.42 trillion kWh in 2022.

- The adoption of smart meters, a significant measure of future-ready technologies, paves the way for the smart grid by enabling two-way real-time communication between distribution companies and consumers through general package radio services technologies. With supportive government policies for installing smart meters, the demand for retail electricity is expected to increase. In the residential sector, using smart meters can help improve the reliability and quality of electricity service for customers, track their electricity usage, and make informed decisions about reducing their energy consumption and saving money on their bills.

- For instance, in April 2022, European Union allocated around USD 134 million for five projects in the clean energy sector, including Advanced System for Remote Meter Reading Project. The project in Serbia will help the introduction of smart metering in the electricity distribution system in Serbia. The funds will be used for the first phase of smart meter deployment in Kraljevo, Cacak, and Nis.

- Thus, owing to the above points, the residential segment is expected to hold a significant market share.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is home to more than 50% of the global population and 60% of the large cities. The continent will face increasing demand for power in the future as millions of new customers are gaining access to electricity, with rapid population growth and industrialization.

- According to the Statistical Review of World Energy Data, in 2022, Asia-Pacific's total primary energy consumption accounted for 277.6 Exajoules, an annual growth rate of 2.1% compared to the previous year. A country like China has the highest electricity demand, accounting for 26.4 % of total world energy consumption.

- Various regional governments are also taking steps to apply modern technology in electricity retailing. Many countries in Asia-Pacific need more transmission and distribution (T&D) networks, and hence, electricity is not available in some of the remote and rural areas. To bring electricity to these areas, the countries in the region are investing heavily in building a transmission line network and smart metering system.

- For instance, in March 2023, the government of India implemented a nationwide Smart Meter program in the Revamped Distribution Sector Scheme (RDSS). Under this scheme, the government of India aims to install over 25 crore Smart Meters is envisaged across the country.

- Thus, owing to the above points, Asia-Pacific is expected to dominate the market in the forecast period.

Competitive Landscape

The global electricity retailing market is moderately fragmented. Some of the major companies (in no particular order) include Engie SA, AGL Energy Ltd., China Huadian Corporation LTD. (CHD), Duke Energy Corporation., and Electricite de France SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in the Demand for Electricity

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 New Sources of Distributed Electricity Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 Germany

- 5.2.2.5 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East & Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of the Middle-East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 AGL Energy Ltd.

- 6.3.3 China Huadian Corporation LTD. (CHD)

- 6.3.4 Duke Energy Corporation

- 6.3.5 Electricite de France SA.

- 6.3.6 Enel S.p.A.

- 6.3.7 Keppel Electric Pte. Ltd.

- 6.3.8 Tata Power Co. Ltd.

- 6.3.9 E.ON SE

- 6.3.10 Iberdrola SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Using Digital Technologies in Electricity Retailing to Improve Customer Engagement

02-2729-4219

+886-2-2729-4219