|

市場調查報告書

商品編碼

1408754

日本資料中心網路:市場佔有率分析、產業趨勢與統計、2024 年至 2030 年成長預測Japan Data Center Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

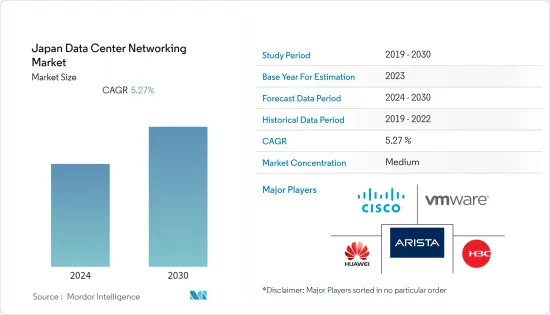

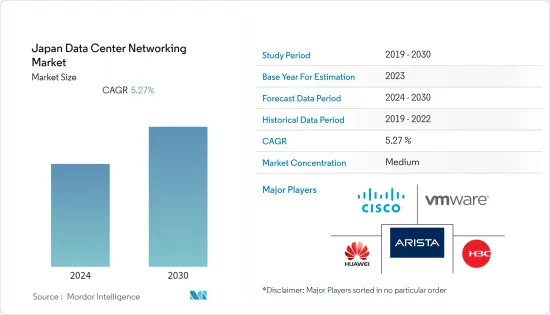

上年度日本資料中心網路市場規模達到 7.096 億美元,預計在預測期內複合年成長率為 5.27%。

主要亮點

- 中小企業對雲端運算的需求不斷成長、政府有關資料安全的法規以及國內企業投資的增加是推動日本資料中心需求的主要因素。

- 日本資料中心網路市場未來IT負載能力預計到2029年將達到2000MW。到 2029 年,日本的占地面積預計將增加到 1,000 萬平方英尺。

- 預計到2029年,安裝的機架總數將達到50萬個。到 2029 年,東京將安裝最多數量的機架。連接日本的海底電纜系統有近30個,其中許多正在建造中。

- 其中一條海底電纜計劃於 2023 年開通,即東南亞-日本 2 號電纜 (SJC2),該電纜全長超過 10,500 公里,登陸點位於千倉和志摩。

- 由於資料儲存需求不斷成長,全國資料中心的數量正在迅速增加。此外,能源約佔資料中心營運成本的40%,這使得資料中心強調能源效率變得越來越重要。為了將提高能源效率作為削減成本的措施,主要企業正在專注於制定日本資料中心的綠色標準,從而增加了對基礎設施管理的需求。因此,預計這些因素將在預測期內推動市場成長。

日本資料中心網路市場趨勢

IT/通訊領域佔有很大佔有率。

- 基於雲端基礎的服務的日益普及促使日本零售和超大規模主機代管服務的擴張,從而促使對資料中心空間的需求增加以及對資料中心內網路設備和服務的需求增加。

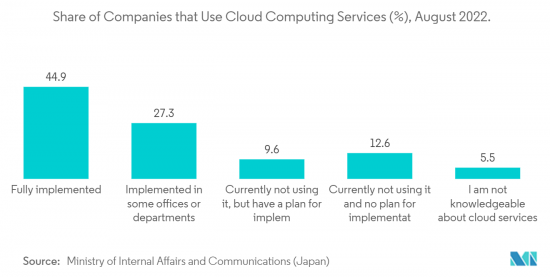

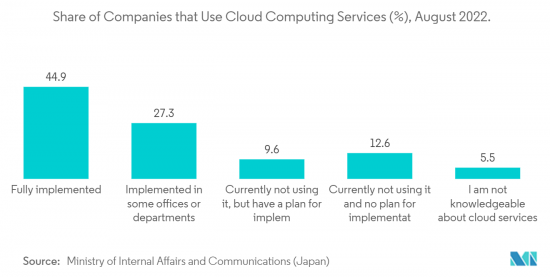

- 雲端服務在日本越來越受歡迎。巨量資料整合的需求、更多遠端工作的需求以及資料遷移到雲端的需求正在推動國內雲端資料中心的使用。

- 預計雲端運算在所有最終用戶中將顯著成長。日本政府數位機構正在中央和地方政府辦公室推廣雲端服務的使用。在日本,企業轉向雲端基礎設施的商業案例得到了多個因素的支持。雲端基礎設施不需要大量的資本投資,雲端處理可以輕鬆地隨著每個公司的IT系統進行擴展。整體而言,雲端成長率為13.51%。

- 此外,在電訊領域,隨著LTE的長期演進,政府繼續推動5G和其他能夠比目前技術資料傳輸的最尖端科技的部署。 NTT Docomo、KDDI、Softbank Corporation和樂天移動均已獲得內務部分配的 5G 頻段。

- 此外,預測期內日本的行動資訊服務收入將以6.8%的速度成長,主要是由於行動網路訂閱數量的增加和5G服務的採用增加,從而帶來更高的ARPU(每位用戶平均收入)。預計會增加。這些發展方面預計將進一步補充該地區資料中心的成長,並促進市場上網路設備和服務的成長。

乙太網路切換器市場佔有率最大

- 資料中心乙太網路切換器是運作在資料中心環境中的網路設備。它在資料中心伺服器、儲存設備和其他網路設備之間建立互連以促進高效、快速的資料傳輸方面發揮著至關重要的作用。交換器旨在支援Gigabit和多Gigabit以太網,包括 10GbE、25GbE、40GbE 和 100GbE,以實現高速資料傳輸。

- 日本各地的資料中心使用廣泛的乙太網路交換器網路。日本擁有許多資料中心,為金融、科技和醫療保健等眾多產業提供支援。為了確保基礎設施的效率和可靠性,這些資料中心依賴乙太網路交換器等高效能網路設備。

- 在日本,5G服務已被大量部署和採用,數據中心的增長正在擴大。 總務省旨在繼續推進日本的5G體驗。 我們設定了到 2024 年 3 月底實現 98% 5G 人口覆蓋的目標。 數據中心運營商正在增加對先進技術的投資,以保持在全球市場上的競爭力。 為了滿足網路的需求,我們有時會依賴來自各個製造商的乙太網交換機,包括國內和國外品牌。

- 市場的主要參與者正專注於更新他們的網路設備以滿足市場需求。 2023 年 6 月,思科的 Nexus 9800 系列模組化交換機將擴展 Cisco Nexus 9000 系列產品群組,採用新的機箱架構,該架構包括多個第一代線卡和交換矩陣模組的組合,使其能夠從 57 Tbps 擴展到 115 Tbps。 機箱中的每個線卡插槽對應一個線卡,該線卡提供 400GE 或 100GE 埠和更高的速度。

- 與企業數據中心相比,超大規模數據中心具有優勢,例如規模經濟和定製工程。 在日本,此類設施的數量正在增加。 以前,日本的公司依賴當地的系統集成商。 然而,今天,他們正在採取更保守的方法來實現全雲。 Hyperscaler繼續在日本投資,並看到了私營部門和政府數位化帶來的重大未開發增長。 隨著互聯網用戶數量的增加和全國的數位化,對數據中心的需求不斷增加,預計該市場區隔在預測期內將出現可觀的增長。

日本資料中心網路產業概況

日本計劃未來建置資料中心計劃,預計未來幾年日本資料中心網路產業的需求將會增加。該市場適度整合,主要參與者包括思科系統公司、Arista Networks Inc.、H3C Technologies、VMware Inc.和華為技術有限公司。這些主要參與者擁有重要的市場佔有率,並正在積極努力擴大基本客群。

2023年8月,H3C發布了下一代資料中心交換器S9827系列。此創新產品採用CPO矽光電技術打造,以其卓越的性能成為產業里程碑。單晶片提供高達51.2T的頻寬,支援64個800G端口,吞吐量較400G產品提升8倍。該設計融合了液體冷卻和智慧型無損操作等先進技術,將有助於創建高度普及、低延遲、節能的智慧網路。Masu。

2022 年 11 月,Equinix 和VMware發布了重要公告,以滿足對新型數位基礎設施和多重雲端服務不斷成長的需求。兩家公司已宣布計劃在全球擴大合作夥伴關係。此外,兩家公司還宣布推出VMware Cloud on Equinix Metal,這是一項新的分散式雲端服務,旨在支援企業應用程式,提高效能、安全性和成本效率。該服務將 VMware 管理和支援的雲端基礎設施與 Equinix 互連的全球即服務相結合,為企業提供增強的雲端解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 更多採用雲端基礎的服務

- 5G網路的出現推動市場成長

- 市場抑制因素

- 網路安全威脅與勒索軟體攻擊

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 依成分

- 依產品

- 乙太網路切換器

- 路由器

- 儲存區域網路 (SAN)

- 應用傳遞控制器 (ADC)

- 其他網路設備

- 網路安全設備、廣域網路最佳化家電和軟體,包括:

- 依服務

- 安裝與整合

- 培訓與諮詢

- 支援與維護

- 依產品

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府機關

- 媒體與娛樂

- 其他最終用戶

第6章 競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Arista Networks Inc.

- H3C Technologies Co., Ltd.

- VMware Inc

- Huawei Technologies Co. Ltd.

- Extreme Networks Inc.

- NVIDIA Corporation(Cumulus Networks Inc.)

- Dell EMC

- NEC Corporation

- IBM Corporation

- HP Development Company, LP

- Intel Corporation

- Broadcom Corp

- Schneider Electric

第7章 投資分析

第8章 市場機會及未來趨勢

The Japan data center networking market reached a value of USD 709.6 million in the previous year, and it is further projected to register a CAGR of 5.27% during the forecast period.

Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

- The upcoming IT load capacity of the Japan data center market is expected to reach 2000 MW by 2029. The country's construction of raised floor area is expected to increase to 10 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 500 K units by 2029. Tokyo is expected to house the maximum number of racks by 2029. There are close to 30 submarine cable systems connecting Japan, and many are under construction.

- One such submarine cable that is estimated to start service in 2023 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 Kilometers with landing points from Chikura and Shima, Japan.

- An increasing need for data storage has resulted in an upsurge in the number of data centers nationwide. Additionally, energy represents around 40% of the operational costs of a data center; it is also becoming increasingly important for data centers to focus on energy efficiency. To improve energy efficiency as a cost-saving measure, key players focus on developing a green standard for data centers in Japan, which results in increasing the demand for Infrastructure management. Hence, such factors are expected to drive market growth during the forecast period.

Japan Data Center Networking Market Trends

IT & Telecommunication Segment Holds the Major Share.

- The increasing adoption of cloud-based services is driving the expansion of retail and hyperscale colocation services in Japan, resulting in increased demand for space in data centers and, consequently, the need for more network devices and services within data centers.

- Cloud services are growing in popularity in Japan. The need for big data integration and the demand for more remote work and data migration to the cloud are driving the use of domestic cloud data centers.

- Cloud is expected to showcase major growth among all the end users. The Government of Japan's Digital Agency promotes the utilization of cloud services for both central government and local government offices. In Japan, the business case for enterprises moving to cloud infrastructure is supported by several factors. Cloud infrastructure does not require a large capital investment, and cloud computing can easily be scaled to each company's IT system. Overall, the growth rate for the cloud is 13.51%.

- Further, in the Telecom sector, the Government is continuing its push to deploy 5G and other cutting-edge technologies that could transfer data faster than currently available with the long-term evolution of LTE. NTT DOCOMO, KDDI, Softbank, and Rakuten Mobile were each allocated a 5G spectrum by the Ministry of Internal Affairs and Communication (MIC).

- Additionally, Mobile data service revenue in Japan is expected to increase at a growth rate of 6.8% during the forecast period, primarily driven by growing mobile internet subscriptions and the increasing adoption of higher average revenue per user (ARPU)-yielding 5G services. Such developmental aspects are expected to further complement the growth of the data centers in the region and substantiate the growth of network devices and services in the market.

Ethernet Switches Holds Largest Market Share

- Data center ethernet switches are network devices that operate in a data center environment. In order to facilitate the efficiency and rapid transfer of data, they play an essential role in establishing interconnection between servers, storage devices, or other network equipment at a data center. Switches are designed for high-speed data transmission with support for gigabit and multigigabit Ethernet, including 10GbE, 25GbE, 40GbE, 100GbE, and beyond.

- Data centers throughout Japan use an extensive network of ethernet switches. Japan has many data centers to support a broad range of industries, including finance, technology, healthcare, and so on. To ensure efficiency and reliability in their infrastructure, these data centers rely on High-Performance Networking Equipment such as ethernet switches.

- Significant deployment and adoption of 5G services in Japan, resulting in increasing the growth of the data centers. The Ministry of International Affairs and Communications aims to continue moving the Japanese 5G experience forward. It set a target of 98% 5G population coverage by the end of March 2024. Data center operators are increasingly investing in advanced technology to maintain their competitiveness in a global market. To meet the network needs, they may rely on Ethernet switches from various manufacturers, including domestic and international brands.

- The key players in the market focus on updating the network devices to meet the market demand. In June 2023, Cisco's Nexus 9800 Series modular switches expand the Cisco Nexus 9000 Series portfolio with a new chassis architecture to include a combination of several first-generation line cards and fabrics modules, allowing it to scale from 57 Tbps up to 115 Tbps. Each line card slot on the chassis can support line cards that now offer 400GE or 100GE ports and higher speeds.

- Hyperscale data centers offer advantages such as economies of scale and custom engineering over enterprise data centers. These facilities are increasing in Japan. Previously, Japanese businesses relied on local systems integrators. However, now, they have a more conservative approach to going full cloud. Hyperscalers continue to invest in Japan and see a large, untapped growth coming from digitization in the private sector and the government. The demand for data centers is continuously rising along with a growing number of internet users and digitalization across the country, which is expected to experience decent growth in the segment during the forecast period.

Japan Data Center Networking Industry Overview

The upcoming DC construction projects in Japan are expected to drive increased demand in the Japan Data Center Networking Market over the coming years. This market is moderately consolidated, featuring key players such as Cisco Systems Inc., Arista Networks Inc., H3C Technologies Co., Ltd., VMware Inc., and Huawei Technologies Co. Ltd. These major players, holding significant market shares, are actively engaged in expanding their customer base in the region.

In August 2023, H3C introduced the S9827 series, a next-generation data center switch. This innovative product, built on CPO silicon photonics technology, marks a milestone in the industry with its remarkable capabilities. It offers a single-chip bandwidth of up to 51.2T and supports 64 800G ports, resulting in an eightfold increase in throughput compared to 400G products. The design incorporates advanced technologies such as liquid cooling and intelligent lossless operations, which collectively contribute to the creation of a highly widespread, low-latency, and energy-efficient smart network.

In November 2022, Equinix, Inc. and VMware, Inc. made a significant announcement in response to the growing demand for new digital infrastructure and Multicloud services. The two companies revealed their plans for a worldwide expansion of their partnership. Additionally, they introduced VMware Cloud on Equinix Metal as a new distributed cloud service aimed at supporting enterprise applications with improved performance, security, and cost-effectiveness. This service is set to combine VMware's managed and supported cloud infrastructure with Equinix's interconnected global bare-metal-as-a-service offering, providing an enhanced cloud solution for businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Cloud-Based Services

- 4.2.2 Advent of 5G Networks Drives Market Growth

- 4.3 Market Restraints

- 4.3.1 Cybersecurity Threats and Ransomware Attacks

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 By Product

- 5.1.1.1 Ethernet Switches

- 5.1.1.2 Router

- 5.1.1.3 Storage Area Network (SAN)

- 5.1.1.4 Application Delivery Controller (ADC)

- 5.1.1.5 Other Networking Equipment

- 5.1.1.5.1 Including: Network security equipment, WAN optimization appliance, Softwares)

- 5.1.2 By Services

- 5.1.2.1 Installation & Integration

- 5.1.2.2 Training & Consulting

- 5.1.2.3 Support & Maintenance

- 5.1.1 By Product

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Arista Networks Inc.

- 6.1.3 H3C Technologies Co., Ltd.

- 6.1.4 VMware Inc

- 6.1.5 Huawei Technologies Co. Ltd.

- 6.1.6 Extreme Networks Inc.

- 6.1.7 NVIDIA Corporation (Cumulus Networks Inc.)

- 6.1.8 Dell EMC

- 6.1.9 NEC Corporation

- 6.1.10 IBM Corporation

- 6.1.11 HP Development Company, L.P.

- 6.1.12 Intel Corporation

- 6.1.13 Broadcom Corp

- 6.1.14 Schneider Electric