|

市場調查報告書

商品編碼

1408746

資料中心網路:市場佔有率分析、產業趨勢/統計、成長預測,2024-2030 年Data Center Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

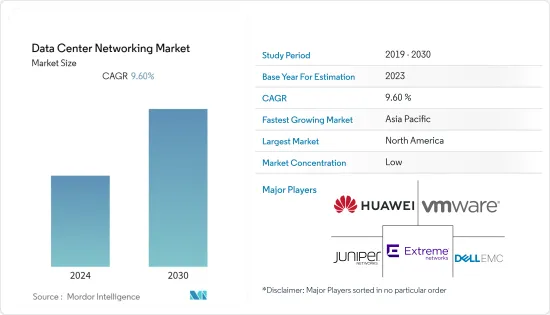

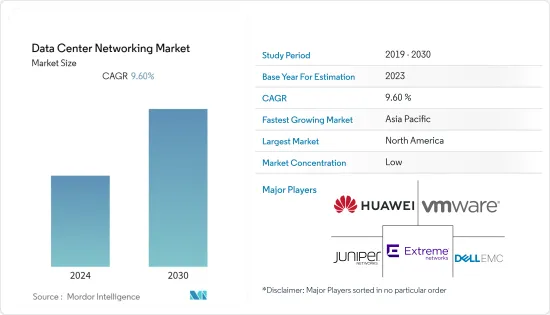

上年度全球資料中心網路市場規模達到 245 億美元,預計在預測期內複合年成長率為 9.6%。

主要亮點

- 網路解決方案在過去幾年中獲得了廣泛的歡迎,這主要是由於對負載平衡、效能改進以及對更高級需求的支援的需求不斷增加。頻寬需求的成長速度遠遠超過企業預算,分散式阻斷服務 (DDoS) 等網路攻擊不斷增加。企業面臨的課題是以用戶期望的速度安全、有效率地交付應用程式。這促使了巨大的市場需求。

- 數位化的進步預計將增加對資料中心的需求,並相應地推動網路市場的發展。全產業對邊緣運算的投資將在未來四年內顯著改變資料中心生態系統的面貌,到 2026 年,邊緣元件在總運算中的佔有率將增加 29%,從 21% 增加到 27%。 Vertiv 對資料中心行業專家進行的新的全球調查的主要發現之一是該行業正在向邊緣轉移的程度。

資料中心網路市場趨勢

應用程式交付控制器佔很大佔有率

- 應用程式交付控制器主要在尖峰時段提供安全性和對應用程式的存取。隨著運算轉移到雲端,軟體應用程式交付控制器 (ADC) 正在承擔傳統上由自訂硬體執行的任務。 ADC 也為應用程式部署提供附加功能和彈性。

- 在當今的數位商業環境中,公司專注於保持敏捷性和創新性,以實現競爭、成長和繁榮。因此,隨著企業尋求簡單、精簡的方法來開發、部署、修改和管理應用程式,DevOps 處於數位商務策略的前沿和中心。 ADC 對於實現 DevOps 所實現的全速和敏捷性至關重要。

- 隨著企業專注於從不斷成長的資料中獲得更多價值,市場供應商正在推出可擴展、安全且經濟高效的最新 ADC 解決方案。例如,2021年5月,Array Networks發布了其APV系列應用效能控制器的軟體版本(版本10.2.x)和創新硬體平台(x800系列)。 APV x800 系列實體家電(APV1800、2800、5800 等)提供多種指標、40 個 Gig-E 介面和改進的 SSL 效能。

- 與產生大量資料的筆記型電腦和桌上型電腦相比,越來越多的用戶使用智慧型手機和平板電腦等行動裝置上網。根據 GSM 協會的數據,預計到 2025 年,美國將成為全球智慧型手機普及最高的國家。

- 該供應商不斷投資於研發活動並提供創新產品,以擴大其市場佔有率和基本客群。例如,2022 年 8 月,F5 宣布推出新的流量管理和安全解決方案,旨在讓客戶更好地控制其 NGINX 實例佇列。新發布的 F5 NGINX 管理套件 1.0 具有集中式儀表板,可提供對 NGINX 實例、應用程式介面 (API) 管理工作流程、應用傳輸服務和安全解決方案的更大可見性和控制。

亞太地區將推動市場顯著成長

- 在亞太地區,超互聯環境正在提高通訊業者的重要性,營運商在支援消費者和企業的連接和協作需求方面發揮基礎性作用。在整個亞太地區,75% 的通訊業者收益實現正成長。在通訊市場成熟度排名中,韓國排名全球第二,僅次於香港。

- 資料中心的需求顯著增加,並且注重效率和低延遲。中國和印度在資料中心建置上著力追趕全球競爭對手,大型企業紛紛擴大資料中心規模,以確保資訊服務的穩定性和可靠性,對處理能力的需求快速成長。

- 韓國政府採用雲端運算技術來增強該國的超高速網路連線、電子政府服務和穩定的長期演進 (LTE) 可用性。預計這將對預測期內的市場成長產生積極影響。

- 由於技術進步,受訪市場中連網設備的數量正在增加。此外,中國雲端運算產業的成長得到了政府的大力支持和私營部門的大量投資的支持。此外,5G和支援5G的設備將顯著提高設備的互連性。其結果是連接設備的增加,這直接增加了控制資料流量和雲端基礎的應用程式的安全性的需求。

- 此外,中國、印度和印尼等國家的網路用戶和資料流量正在增加,進一步推動了該地區 ADC 解決方案的成長。隨著數位時代的進步,市場供應商透過為最終用戶提供更多創新的網路解決方案和產品並確保最佳的技術體驗來引領區隔市場。

- 例如,2022年6月,網路安全和應用交付解決方案供應商Radware和託管安全服務提供者OneSecure宣佈了一項擴大的合作協定。 為了增強OneSecure為東盟企業提供的Webyith篡改和域名網路釣魚監控服務,MSSP宣佈將擴展其網路安全套件,以包括Radware的應用保護即服務服務和雲分散式拒絕服務(DDoS)保護服務。

資料中心網路產業概述

全球資料中心網路市場呈現明顯的分散化,近年來競爭形勢日益激烈。 Extreme Networks、Dell EMC 和 VMware 等行業主要企業已經鞏固了自己的地位並佔領了重要的市場佔有率。這些主要企業正積極致力於擴大各地區的基本客群。為了實現這一目標,我們正在採取策略合作舉措,旨在加強市場佔有率並提高整體盈利。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對雲端儲存的需求不斷成長以及對可靠應用程式效能的需求不斷成長

- 公司網路攻擊增加

- 市場抑制因素

- 網路複雜度

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 依成分

- 依產品

- 乙太網路交換器

- 路由器

- 儲存區域網路(SAN)

- 應用傳遞控制器 (ADC)

- 其他

- 依服務

- 安裝/整合

- 培訓/諮詢

- 支援/維護

- 依產品

- 依最終用戶

- 資訊科技/通訊

- BFSI

- 政府

- 媒體娛樂

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東

- 非洲

第6章 競爭形勢

- 公司簡介

- Extreme Networks Inc.

- Dell EMC

- Vmware, Inc.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Arista Networks Inc.

- NEC Corporation

- HP Development Company, LP

- Fortinet, Inc.

- Array Networks, Inc.

- Radware Corporation

- A10 Networks, Inc.

- Moxa Inc.

- Lenovo Group Limited

- Broadcom Corporation

- H3C Holding Limited

- NVIDIA(Cumulus Networks Inc.)

- Cisco Systems Inc.

- F5 Networks Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The global data center networking market reached a value of USD 24.5 billion in the previous year, and it is further projected to register a CAGR of 9.6% during the forecast period.

Key Highlights

- Networking solutions have gained significant traction in the past few years, primarily owing to the rising need for load balancing, improving performance, as well as to handle much more advanced requirements. Bandwidth demand is growing much faster than the company budgets, and cyber attacks such as distributed denial-of-service (DDoS) are constantly on the rise. It has become a challenge for companies to securely and efficiently deliver their applications at the speed the users expect. This factor leads to major market demand.

- The rise in digitalization will likely increase the demand for data centers, proportionately driving the networking market. Significantly, industry-wide investment in edge computing will transform the profile of the data center ecosystem over the next four years, raising the edge component of total computing by 29%, from 21% of total computing to 27% in 2026. The extent of the industry's ongoing shift to the edge is among the significant findings from a new global survey of data center industry specialists from Vertiv.

- The upcoming IT load capacity of the global data center server market is expected to reach 71K MW by 2029. The region's construction of raised floor area is expected to increase 273.9 million sq. ft by 2029. The region's total number of racks to be installed is expected to reach 14.2 million units by 2029. North America is expected to house the maximum number of racks by 2029.

- There are close to 500 submarine cable systems connecting the regions globally, and many are under construction. One such submarine cable that is estimated to start service in 2025 is CAP-1, which stretches over 12,000 km with a landing point in Grover Beach, United States.

Data Center Networking Market Trends

Application Delivery Controller to Hold Significant Share

- The application delivery controllers primarily provide security and access to the applications at peak times. As computing is moving toward the cloud, software application delivery controllers (ADCs) have been performing tasks that have been traditionally performed by custom-built hardware. They also offer additional functionalities and flexibility for application deployment.

- In today's digital business environment, businesses focus on staying agile and innovative to compete, grow, and thrive. That puts DevOps front and center in digital business strategy as companies seek simple, streamlined ways to develop, deploy, change, and manage applications. The ADC is critical in enabling the full speed and agility that DevOps makes possible.

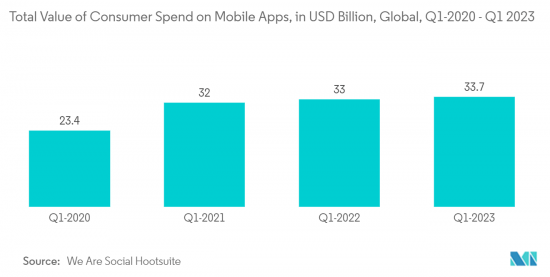

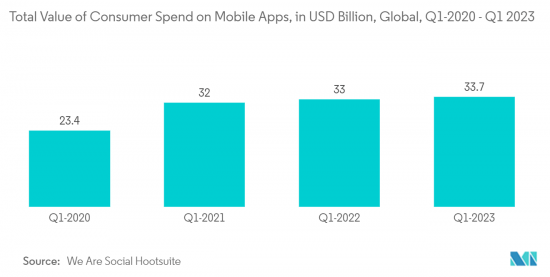

- Moreover, We Are Social and Hootsuite data indicates that consumer spending on mobile applications grew over the past few years, starting at USD 3.7 billion till quarter-one 2023, which is accelerating the demand for the ADC with features that enhance the performance of applications.

- With organizations focusing on extracting greater value from their growing data volumes, market vendors are introducing scalable, secure, and cost-effective modern ADC solutions. For instance, in May 2021, Array Network announced a software version (version 10.2.x) and innovative hardware platforms (the x800 Series) for its APV Series application performance controllers. APV x800 Series physical appliances (APV1800, 2800, 5800, etc.) offer production across multiple metrics, 40 Gig-E interfaces, and improved SSL performance.

- More users are surfing the web on smartphones, tablets, and other mobile devices compared to a laptop or desktops, resulting in the generation of large amounts of data. According to the GSM Association, by 2025, the United States is expected to have the highest smartphone adoption globally.

- Market vendors continuously invest in R&D activities to introduce innovative product offerings to gain more market presence and customer base. For instance, in August 2022, F5 announced the launch of a new traffic management and security solution designed to offer better control over its customers' fleets of NGINX instances. The newly launched F5 NGINX Management Suite 1.0 comes with a centralized dashboard to provide high visibility and control of NGINX instances, application programming interface (API) management workflows, application delivery services, and security solutions.

Asia-Pacific To Hold Significant Market Growth

- In Asia-Pacific, the hyper-connectivity environment has reinforced the importance of telcos, which play a foundational role in supporting consumers' and enterprises' connectivity and collaboration needs. Across Asia-Pacific, 75% of the operators registered positive revenue growth. South Korea is second only to Hong Kong in the world rankings of telecom market maturity.

- The need for data centers is increasing significantly and placing a greater emphasis on effectiveness and low latency. China and India are putting much effort into overtaking their competitors globally in constructing data centers, which is generating a booming demand for processing capacity as larger organizations attempt to scale up their data centers to assure the stability and reliability of data services.

- The South Korean government employed cloud computing technologies to enhance its banking on the country's super-fast internet connectivity, e-government services, and stable long-term evolution (LTE) availability. This is expected to contribute to the market's growth positively over the forecast period.

- Owing to technological advancements, there is an increase in the number of connected devices in the studied market. Moreover, strong government backing and substantial private sector investment are behind the growth of China's cloud computing industry. Furthermore, 5G and 5 G-enabled devices will exponentially increase the devices' interconnectivity. As a result, it increases connected devices, thereby directly augmenting the need for controlling the data traffic and security of the cloud-based applications.

- As financial organizations are increasingly adopting hybrid cloud, public cloud, and multi-cloud strategies to meet the need for compliance, competition, and modernization, the demand for networking solutions is anticipated to grow in the coming years. According to F5's State of Application Strategy Report- Financial Services Edition for 2022, 69% of financial services organizations in the Asia Pacific region have deployed multi-cloud strategies.

- In addition, the increasing internet users and data traffic in countries like China, India, and Indonesia are further augmenting the growth of ADC solutions in the region. With the evolving digital era, market vendors are offering more innovative network solutions and products for end-users, ensuring they have the best technology experience driving the market segment.

- For instance, in June 2022, Cyber security and application delivery solutions provider Radware and managed security service provider OneSecure announced the expansion of their collaboration agreement. In order to enhance OneSecure's Webyith defacement and domain phishing monitoring service for the ASEAN enterprises, the MSSP announced to expand of the cyber security suite to include Radware's Application Protection-as-a-service offering and cloud-distributed denial-of-service (DDoS) protection service.

Data Center Networking Industry Overview

The global data center networking market exhibits a notable degree of fragmentation, characterized by a competitive landscape that has intensified in recent years. Key industry players, including Extreme Networks Inc., Dell EMC, and VMware, Inc., among others, have solidified their positions and demonstrated substantial market shares. These major players are actively concentrating on expanding their customer base across various regions. To achieve this goal, they employ strategic collaborative initiatives designed to bolster their market share and enhance overall profitability.

In November 2022, VMware, Inc. introduced its cutting-edge SD-WAN solution, which encompasses a novel SD-WAN Client. This innovation aims to assist enterprises in delivering applications, data, and services securely, reliably, and efficiently across diverse networks to any device.

In September 2022, AppViewX, a prominent player specializing in automated machine identity management (MIM) and application infrastructure security, made a significant announcement. The company joined F5's Technology Alliance Program (TAP), ushering in a partnership that is expected to jointly promote enterprise application security and delivery solutions. This collaboration focuses on the management of applications and the enhancement of cybersecurity measures across on-premises, cloud, and edge locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need of Cloud Storage and Rsing Demand for Reliable Application Performance

- 4.2.2 Increasing Cyberattacks Among Enterprises

- 4.3 Market Restraints

- 4.3.1 Increasing Network Complexity

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 By Product

- 5.1.1.1 Ethernet Switches

- 5.1.1.2 Router

- 5.1.1.3 Storage Area Network (SAN)

- 5.1.1.4 Application Delivery Controller (ADC)

- 5.1.1.5 Other Networking Equipment

- 5.1.2 By Services

- 5.1.2.1 Installation & Integration

- 5.1.2.2 Training & Consulting

- 5.1.2.3 Support & Maintenance

- 5.1.1 By Product

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

- 5.3 Region

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East

- 5.3.6 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Extreme Networks Inc.

- 6.1.2 Dell EMC

- 6.1.3 Vmware, Inc.

- 6.1.4 Huawei Technologies Co. Ltd.

- 6.1.5 Juniper Networks Inc.

- 6.1.6 Arista Networks Inc.

- 6.1.7 NEC Corporation

- 6.1.8 HP Development Company, L.P.

- 6.1.9 Fortinet, Inc.

- 6.1.10 Array Networks, Inc.

- 6.1.11 Radware Corporation

- 6.1.12 A10 Networks, Inc.

- 6.1.13 Moxa Inc.

- 6.1.14 Lenovo Group Limited

- 6.1.15 Broadcom Corporation

- 6.1.16 H3C Holding Limited

- 6.1.17 NVIDIA (Cumulus Networks Inc.)

- 6.1.18 Cisco Systems Inc.

- 6.1.19 F5 Networks Inc.