|

市場調查報告書

商品編碼

1408491

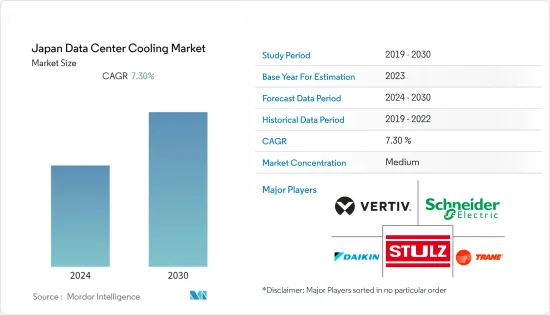

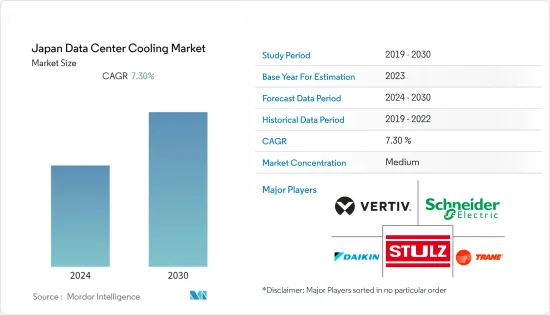

日本資料中心冷卻:市場佔有率分析、產業趨勢與統計、2024-2030 年成長預測Japan Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

上年度,日本資料中心冷卻市場的市場規模達到 6.702 億美元,預計在預測期內複合年成長率為 7.3%。

主要亮點

- 中小企業對雲端運算的需求不斷成長、政府有關資料安全的法規以及國內企業投資的增加是推動該國和地區資料中心需求的關鍵因素。

- 日本資料中心市場未來IT負載容量預計到2029年將達到2,100MW。到 2029 年,日本的占地面積預計將增加到 10,000 平方英尺。

- 預計到 2029 年,日本已安裝的機架總數將達到 51.2 萬個。到 2029 年,預計機架數量最多的地區將是大阪和東京。全年氣溫通常在 2°C 至 30°C 之間波動,很少低於 -1°C 或超過 0.5°C。

- 有近32條海底電纜系統連接日本,其中許多正在建設中。

日本資料中心冷卻市場趨勢

液基冷卻正在蓬勃發展

- 技術進步使得液體冷卻更易於維護、更具可擴展性且更經濟實惠,在熱帶氣候地區減少了 15% 以上的資料冷卻消費量,在綠色地區減少了 80% 以上。用於液體冷卻的能量可以重新用於加熱建築物和水,先進的人造冷媒可以有效減少空調的碳排放。

- 一些日本公司一年中至少有幾個月使用雪作為冷媒。 資料 Dock Co., Ltd. 總部位於日本北部海岸的新潟縣,利用融雪劑和室外冷空氣冷卻其位於長岡市的伺服器。

- 日本資料中心供應商 KDDI 和 NTT DATA 正在探索浸入式技術,以顯著減少冷卻伺服器硬體的能源浪費。 KDDI 的現場測試表明,與傳統風冷系統相比,溫度控制期間的功耗驚人地降低了 94%。 KDDI 表示,雖然 IT 設備通常被認為是耗電最多的,但據說資料中心總耗電量的大約一半用於冷卻。

- 直接液體冷卻 (DLC) 解決方案可達到 1.02 至 1.03 的部分電源使用效率 (PUE) 值,甚至比最先進的空氣冷卻系統的效率也高出一個位數的差異。然而,值得注意的是,PUE 並不佔 DLC 能源效率效益的大部分。在傳統伺服器設定中,風扇負責伺服器機架內的電力消耗,且此功耗會計入 PUE 運算的 IT 功耗部分。這些風扇被認為是整個資料中心能耗的一個組成部分。

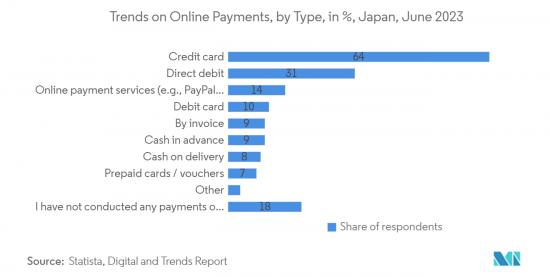

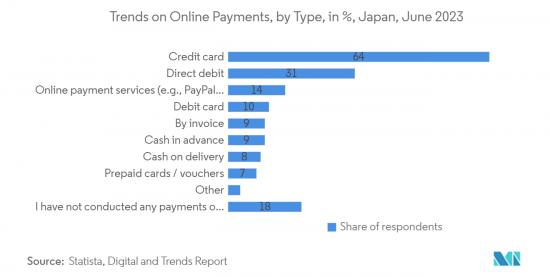

- 日本是三大電子商務市場之一。日本是三大電子商務市場之一,超過英國但落後美國。日本的電子商務市場主要是由高科技網路基礎設施支援的高網路普及所推動的。行動商務正在經歷顯著擴張。預計到 2022 年,行動銷售額將超過整個 B2C 電子商務市場。截至2021年,日本行動商務市場規模約4.9兆日圓。過去 10 年成長了一倍多。此類案例解決了對主機代管的主要需求,以及對改善冷卻服務不斷成長的需求。

IT/通訊是最大的部分

- 日本是索尼、松下、富士通、NEC 和東芝等主要 ICT 公司的所在地,並且在日本作為主要 ICT 中心的擴張中繼續發揮著重要作用。此外,該國眾多現代化和擴建計劃的有序開拓以及政府為維持品質和先進基礎設施而增加的支出也支持了市場成長。

- E-Japan策略的快速發展,重點是開拓地方電子政府計劃,包括公民參與、自我評估和線上政府服務回饋,可能會推動日本ICT市場的未來成長。

- 日本政府正在推動加速私營部門數位轉型並支持新興中小企業的措施。 2021年,由日本經濟產業省和內務部主導的日本政府發布了促進組織內部數位轉型的指導方針,特別是針對中小企業。同樣,同年發布了部署人工智慧、網路安全和安全雲端服務的指南。

- 2022 年 11 月,數位基礎設施供應商 Equinix 宣布將投資 1.15 億美元建造新資料中心,以擴大其在日本的數位基礎設施足跡。這個新資料中心將增強該公司與全球網路和雲端服務供應商的連接,從而擴大和加強日本的數位經濟。

- 2022年6月,日本政府宣布將在年終前為99%的人口部署無線網路。促進數位化的基本政策和海底電纜計劃於年終在日本全國完成。

日本資料中心冷卻產業概況

日本資料中心冷卻市場競爭適中,並且最近取得了進展。目前,少數大公司在市場上佔據主導地位,包括Stulz GmbH、施耐德電氣、Vertiv Group Corp.、Daikin Industries Ltd.和Trane Inc.。

2023 年 3 月,總部位於漢堡的空調公司 STULZ 發布了關於其行業領先的 Cyberair 3PRO DX 系列的重要公告。據透露,同系列的某些機組可與全球暖化潛勢 (GWP) 較低的冷媒 R513A 相容。這項突破性的發展凸顯了該公司對為資料中心提供最永續的空調系統的持續承諾。此外,世圖茲正在擴大產品系列,涵蓋 R513A 冷媒的使用。

2022年2月,技嘉發表了一款基於AMD EPYC和Nvidia A100技術的開創性高效能運算伺服器。這些伺服器配備了 CoolIT 的直接液體冷卻系統。新機器配備一或兩個 AMD EPYC 7003 系列「Milan」處理器,擁有多達 128 個核心和四個或八個 Nvidia A100 80GB SXM4 模組。 CoolIT 以其獨特的直接液冷系統而聞名,可分別冷卻 CPU 和 GPU 以最佳化效能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 區域內IT基礎設施的發展

- 生態資料中心的出現

- 市場抑制因素

- 成本、調適要求、停電

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 冷卻技術

- 風冷

- 液體冷卻

- 蒸發冷卻

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府機關

- 媒體與娛樂

- 其他最終用戶

第6章 競爭形勢

- 公司簡介

- Vertiv Co.

- Schneider Electric SE

- STULZ GMBH

- Daikin Industries Ltd

- Trane Inc.

- Johnson Controls International PLC

- Mitsubishi Electric Corporation

- RITTAL Electro-Mechanical Technology Co. Ltd(RITTAL GMBH & CO. KG)

- Nortek Air Solutions

- Munters Air Treatment Equipment(Beijing)Co. Ltd

- CoolIT Systems Inc.

- Asetek AS

- Wakefield-Vette Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Japan data center rack market reached a value of USD 670.2 million in the previous year, and it is further projected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country/region.

- The upcoming IT load capacity of the Japan data center market is expected to reach 2100 MW by 2029. The country's construction of raised floor area is expected to increase to 10K sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 512K units by 2029. Osaka and Tokyo are expected to house the maximum number of racks by 2029. Throughout the year, temperatures typically fluctuate between 2°C and 30°C, rarely dropping below -1°C or above 0.5°C.

- There are close to 32 submarine cable systems connecting Japan, and many are under construction.

Japan Data Center Cooling Market Trends

Liquid-based Cooling is The Fastest Growing Segment

- Technological advances have made liquid cooling easier to maintain, more scalable, and more affordable, reducing data center liquid consumption by more than 15% in tropical climates and by 80% in greener areas. The energy used for liquid cooling can be recycled to heat buildings and water, and advanced artificial refrigerants can effectively reduce the carbon footprint of air conditioners.

- Some Japanese companies already use snow as a coolant for at least several months of the year. Based in Niigata prefecture on Japan's north coast, DataDock Inc. cools its servers in Nagaoka City with snowmelt and cold outside air.

- Japanese data center providers KDDI and NTT DATA are researching immersion technology to significantly reduce energy waste in cooling server hardware. In KDDI's field test, we achieved an astounding result of reducing power consumption during temperature control by 94% compared to conventional air cooling systems. KDDI said IT equipment is often thought of as the biggest consumer of power, but about half of the total power consumption in data centers is used for cooling.

- Direct liquid cooling (DLC) solutions can achieve partial power usage effectiveness (PUE) values ranging from 1.02 to 1.03, surpassing the efficiency of even the most advanced air cooling systems by a low single-digit margin. It is important to note, however, that PUE does not account for a significant portion of the energy efficiency improvements attributed to DLC. In traditional server setups, fans are responsible for power consumption within the server rack, and this power usage is factored into the IT power section of the PUE calculation. These fans are considered an integral part of the data center's overall energy consumption.

- Japan is one of the three largest markets for e-commerce. It is placed ahead of the United Kingdom but behind the United States. The e-commerce market in Japan is primarily driven by high internet penetration, secured by the Hi-tech network infrastructure. M-commerce is experiencing significant expansions. Mobile sales were projected to outpace the overall B2C e-commerce market until 2022. The mobile commerce market size in Japan stood at around JPY 4.9 trillion as of 2021. It has more than doubled over the last decade. Such instances cater to the major demand for colocation with the increasing demand for improved cooling services.

IT & Telecommunication is the Largest Segment

- Japan is home to major ICT organizations such as Sony, Panasonic, Fujitsu, NEC, and Toshiba, which continue to play a key role in the country's expansion as a major center for ICT. In addition, the orderly development of numerous modernization and expansion projects in the country, along with increasing government spending on maintaining high-quality and advanced infrastructure, are also driving the growth of the market.

- The rapid growth of the E-Japan strategy, which focuses on the development of local e-government projects involving citizen participation, self-evaluation, and feedback on online government services, will drive future growth of the Japanese ICT market.

- The Japanese government is making efforts to accelerate the digital transformation of the private sector and support emerging SMEs. In 2021, the Japanese government, led by the Ministry of Economy, Trade and Industry and the Ministry of Internal Affairs and Communications, published guidelines for promoting digital transformation within organizations, especially targeting small and medium-sized enterprises. Similarly, guidelines on implementing AI, cybersecurity, and secure cloud services were also published in the same year.

- In November 2022, digital infrastructure provider Equinix announced it would expand its digital infrastructure footprint in Japan with a USD 115 million investment in new data centers. The new data center will enhance corporate connectivity with global networks and cloud service providers, enabling them to scale and strengthen Japan's growing digital economy.

- In June 2022, the Japanese government announced that it would deploy wireless networks to 99% of the population by the end of 2030. Its basic policy to promote digitalization and submarine cables is scheduled to be completed throughout Japan by the end of 2025.

Japan Data Center Cooling Industry Overview

The Japan data center cooling market is moderately competitive and has recently gained a competitive edge. Currently, a few major players, including Stulz GmbH, Schneider Electric SE, Vertiv Group Corp., Daikin Industries Ltd, and Trane Inc., hold a dominant position in the market.

In March 2023, STULZ, a Hamburg-based mission-critical air conditioning company, made a significant announcement regarding its industry-leading CyberAir 3PRO DX series. They revealed that some units within this series are now compatible with the low global warming potential (GWP) refrigerant R513A. This groundbreaking development underscores the company's ongoing commitment to delivering the most sustainable air conditioning systems for data centers. Additionally, STULZ has expanded its product portfolio to incorporate the use of R513A refrigerant.

In February 2022, Gigabyte introduced pioneering high-performance computing servers based on AMD EPYC and Nvidia A100 technology. These servers are equipped with CoolIT's direct liquid cooling system. The new machines feature 1 or 2 AMD EPYC 7003 series 'Milan' processors, boasting up to 128 cores, as well as 4 or 8 Nvidia A100 80GB SXM4 modules. CoolIT, known for its unique direct liquid cooling system, ensures separate cooling for the CPU and GPU, optimizing performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of IT Infrastructure in the Region

- 4.2.2 Emergence of Green Data Centers

- 4.3 Market Restraints

- 4.3.1 Costs, Adaptability Requirements, and Power Outages

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Cooling Technology

- 5.1.1 Air-based Cooling

- 5.1.2 Liquid-based Cooling

- 5.1.3 Evaporative Cooling

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vertiv Co.

- 6.1.2 Schneider Electric SE

- 6.1.3 STULZ GMBH

- 6.1.4 Daikin Industries Ltd

- 6.1.5 Trane Inc.

- 6.1.6 Johnson Controls International PLC

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 RITTAL Electro-Mechanical Technology Co. Ltd (RITTAL GMBH & CO. KG)

- 6.1.9 Nortek Air Solutions

- 6.1.10 Munters Air Treatment Equipment (Beijing) Co. Ltd

- 6.1.11 CoolIT Systems Inc.

- 6.1.12 Asetek AS

- 6.1.13 Wakefield-Vette Inc.