|

市場調查報告書

商品編碼

1403906

資料中心冷卻 -市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

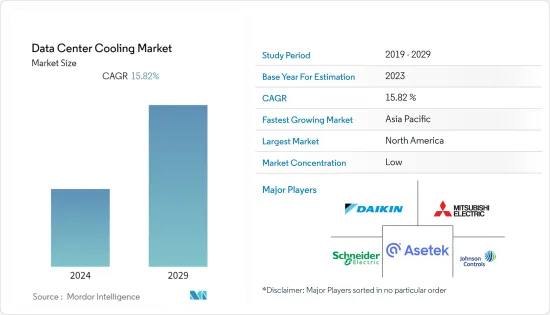

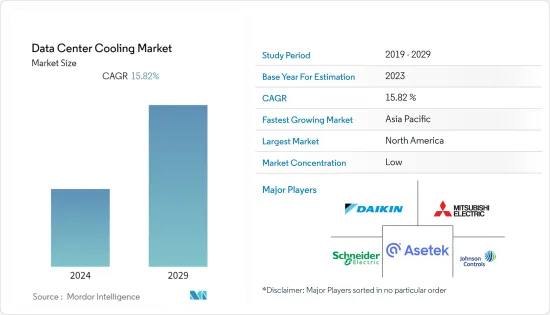

今年資料中心冷卻市場規模預計為165.6億美元,五年後將達345.1億美元,預測期內複合年成長率為15.82%。

由於人工智慧和媒體應用的高運算需求,資料中心的引入正在取得進展。此外,物聯網設備佔有率的不斷成長將推動邊緣運算的採用和成長。

主要亮點

- 由於數位化的進步將帶來更高性能的電腦,因此資料中心液體冷卻市場預計將顯著成長,這將需要整合大量的小型晶片。資料中心的設計和冷卻需求受到人工智慧 (AI) 工作負載的強大電腦硬體的影響。製造商正在引入大型矽晶片來最佳化人工智慧和高效能運算工作負載的效能。人工智慧和高效能運算環境中強大 GPU 的使用支援了資料中心冷卻技術的需求。

- OTT 和串流媒體服務的使用日益增加導致資料增加,從而推動市場開拓。 Disney+Hotstar、Hulu 和 Netflix 等線上串流服務帶來的資料成長將推動對具有有效冷卻效能的資料中心冷卻系統的需求。資料中心冷卻服務供應商越來越需要確保他們有能力在市場流量高峰期間提供高效率的產品。

- 生態資料中心是儲存、管理和分發資料的地方。該計劃旨在使機械、照明、電氣和電腦系統盡可能高效節能,同時最大限度地減少對環境的負面影響。採用創新方法和技術來建立和管理生態資料中心。由於網際網路的快速成長和使用,資料中心的能源消耗顯著增加。環境影響、公眾意識的提高、能源成本的上升以及政府的措施正在推動上市公司採取綠色政策。由於這些因素,永續資料中心的開拓對資料中心冷卻市場產生直接影響。

- 然而,適應的需要和電力短缺正在阻礙市場的成長。需要標準化和模組化的資料中心冷卻系統。希望削減成本且不願在高階定製冷卻系統上花費大量資金的公司需要可擴展性和彈性,以滿足當今最嚴苛的資料中心需求。

- COVID-19 的爆發對資料中心冷卻市場產生了負面影響。公司被迫暫時關閉,包括資料中心整合。強制性的社交距離規則使伺服器的實體變更、關閉建築物和開放新設施變得更加複雜。因此,世界各地的資料中心的需求比以往任何時候都更大。然而,疫情後,大量節省轉向了前期投資(CapEx)。此外,雲端服務的使用不斷增加,需要新的技術力和操作技能。因此,在這些因素的支持下,預計資料中心冷卻市場需求的成長在預測期內將呈現成長趨勢。

資料中心冷卻市場趨勢

資訊科技產業將經歷最高成長

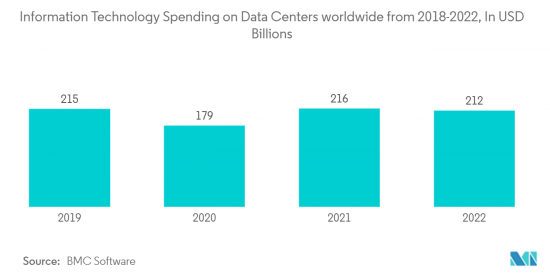

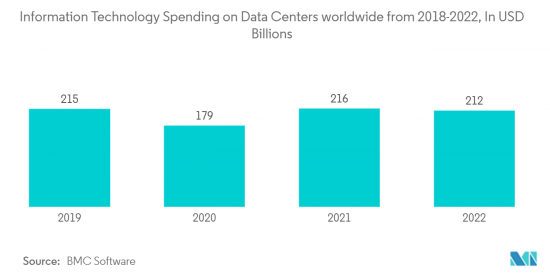

- 在資訊科技產業,企業需要個人資料的本地儲存和從小到大的超大規模資料中心。此外,雲端儲存的採用率逐年增加。因此,隨著軟體即服務 (SaaS) 供應商的成長使雲端儲存供應商能夠擴展其容量,對資料中心冷卻系統的需求預計將會成長。

- 為了提供更有效率的工作流程,Microsoft、AWS 和 Google 等雲端儲存供應商正在增加其在雲端中儲存的容量。這些公司正在投資超大規模交易。微軟和 Meta 將於 2022 年 6 月加入谷歌,利用人工智慧來管理資料中心,因為新的張量處理單元產生的熱量超出了資料中心先前冷卻解決方案的限制。

- IT 市場包括儲存電腦周邊設備並使用電腦通訊設備搜尋、傳輸和行動資料的組織、獨資企業和合夥企業銷售 IT 服務和相關產品。電腦網路、電視廣播、系統設計服務、電話等資訊分發技術以及此過程中涉及的其他設備也是IT市場的一部分。如此龐大的需求和設備帶動了資料中心空調市場的典型冷氣需求。

- 考慮到需要比傳統空氣冷卻解決方案更有效率的增強型、高品質和更有效的空氣冷卻解決方案,在 IT 和資料中心安裝冷卻系統至關重要。 IT基礎設施的進一步創新以及行動電話製造商對散熱系統管理熱量的需求增加也推動了該市場的成長。

- 儘管雲端服務快速發展,但當今的產業仍然嚴重依賴本地和混合資料中心。隨著這些公司尋求擴大資料儲存容量,其供應系統對其空調和暖氣設備的需求預計將會增加。此外,IT 領域敏捷和 DevOps 營運框架的趨勢正在增加對更有效率的資料儲存解決方案的需求。

亞太地區錄得強勁成長

- 預計亞太地區將成為未來幾年的主要市場驅動力。基於物聯網、機器學習和人工智慧等最新創新,中國對資料產生的需求不斷成長,加上政府政策促進更節能的基礎設施,使中國成為最重要的資料中心冷卻解決方案市場之一。在網路服務和大量資料的普及推動下,印度實現了第二高的成長。

- 中國是資料中心冷卻解決方案的主要市場之一,資料中心的數量正在迅速增加,部分原因是政府在全國範圍內推動綠色基礎設施的政策。

- 此外,中國也是全球成長最快的資料中心市場。隨著金融科技和數位轉型市場的不斷開拓,這種擴張為市場參與企業提供了獲得市場佔有率的絕佳機會。

- 由於亞太地區網路普及不斷提高,資料中心冷卻市場預計將大幅成長。隨著行動運算、物聯網和雲端處理發揮重要作用,該地區對資料中心的需求正在顯著成長。這也帶動了資料中心冷卻市場的蓬勃發展。

資料中心冷卻產業概述

資料中心冷卻市場分散,技術和政府對資料中心實施效率法規的支援帶來的好處預計將直接促進資料中心冷卻市場的成長。市場滲透率隨著現有市場中主要參與者的規模的擴大而增加。隨著對技術創新的日益關注,對新技術的需求不斷成長,從而推動了進一步發展的投資。主要參與企業包括 Vertiv Co、Schneider Electric SE 和 STULZ GMBH。

2023 年 4 月,Asetek, Inc. 宣布華碩推出第三代高階 ROG RYUJIN 一體式 CPU 散熱器。 RYUJIN III 240/360 和 RYUJIN III 240/360 ARGB CPU 散熱器結合了終極超頻性能、靜音運行和下一代美學,提供終極遊戲體驗和下一代性能。

2023 年 3 月,大金收購了 Alliance Air Products,這是一家總部位於聖地牙哥的自訂空氣處理設備設計和製造的領導者。大金和 Alliance Air 的綜合能力將滿足這些行業需求,包括減少資料中心對環境影響的冷卻器到電腦房空氣處理機 (CRAH) 系統。這些系統確保節能和節水之間的最佳平衡。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 數位資料量的增加

- 生態資料中心的出現

- 市場抑制因素

- 適應要求和停電

- COVID-19 對市場的影響

第6章市場區隔

- 按類型

- 風冷

- 液體冷卻

- 冷卻器

- 節熱器系統

- 立柱/機架/門/天花板冷卻系統

- 按服務

- 安裝部署

- 諮詢、支援及維護服務

- 按最終用戶產業

- 資訊科技

- BFSI

- 通訊

- 醫療保健

- 政府機關

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Major Vendors

- Daikin Industries Ltd

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Johnson Controls International PLC

- Asetek Inc.

- Liquid Cool Solutions Inc.

- STULZ GMBH

- Rittal GmbH & Co. KG

- Nortek Air Solutions

- Vertiv Co.

- Munters Group AB

- Major Vendors

第8章投資分析

第9章 市場機會及未來趨勢

The Data Center Cooling Market size was estimated at USD 16.56 billion in the current year to USD 34.51 billion in five years, registering a CAGR of 15.82% during the forecast period.

Due to the high computational needs of AI and media applications, data centers are being deployed increasingly. Moreover, the adoption of edge computing and this growth will be helped by a growing share of Internet of Things devices.

Key Highlights

- The market for liquid cooling of data centers is predicted to show substantial growth due to the increase in digitization leading to greater computer performance, and it requires a large number of small chips to be integrated. The design of data centers and the need to cool them are influenced by powerful computer hardware for Artificial Intelligence (AI) workloads. Manufacturers are introducing large silicon chips to optimize the performance of artificial intelligence and high-performance computing workloads. The use of powerful GPUs in artificial intelligence and high-performance computing environments supports the need for data center cooling technologies.

- The increasing use of OTT and streaming services has led to a growth in data, driving market development. Increased data from online streaming services such as Disney+ Hotstar, Hulu, and Netflix will drive the demand for data center cooling systems with effective cooling performance. There is a growing need to ensure that Data Center Cooling Service Providers have the capacity and ability to provide efficient products during peak traffic periods on the market.

- The Green Data Centre is the place where you store, manage, and distribute your data. It is planned that mechanical, lighting, electrical, and computer systems will be as energy efficient as possible while minimizing their adverse environmental impacts. Innovative methods and technologies are used to construct and manage green data centers. Data centers' energy consumption is increasing significantly due to the exponential growth and use of the Internet. Due to the environmental impact, increase in public awareness, higher energy costs, and governmental action, companies are under increased pressure to adopt green policies. The development of the sustainable data center has directly impacted the Data Centres Cooling Market due to these factors.

- However, the market's growth is hampered by the need to adapt and power shortages. A standard, standardized, modular data center air conditioning system is required. With companies looking to reduce costs and not willing to spend a lot of money on high-end customized cooling systems, they need to be scalable and flexible enough to meet data center needs that are very challenging today.

- The COVID-19 outbreak negatively influenced a cooling market for data centers. Temporary suspension of activities has been imposed on enterprises, such as the consolidation of data centers. Due to mandatory social distance rules, physical changes of servers, building closures, and opening new facilities were more complicated. This has led to an unprecedented demand for data centers across the world. However, tremendous savings have shifted to upfront CapEx investments in IT following the pandemic. In addition, the use of cloud services has increased, and there is a need for new technological and operating skills. Therefore, the growth in the need for a data center cooling market is expected to be supported by this factor and an upward trend over the forecast period.

Data Center Cooling Market Trends

Information Technology Industry to Witness Highest Growth

- For its business, the information technology industry requires on-premises storage of personal data and hyperscale data centers for operation in sizes ranging from small to large. Additionally, the adoption of cloud storage has been increasing over the years. As a result, the demand for data center cooling systems is expected to grow due to the growth of Software as a Service provider, enabling cloud storage providers to expand their capacity.

- To provide more efficient work processes, cloud storage providers such as Microsoft, AWS, and Google are expanding their capacity to store in the cloud. These companies make their investments in hyperscale transactions. As the heat generated by the new tensor processing units exceeds the limits of its previous cooling solutions in the data center, Microsoft and Meta joined Google in June 2022 to use artificial intelligence to help manage their data centers.

- The IT market consists of selling IT services and related products by organizations, sole traders, and partnerships that use computer telecommunications equipment to store computer peripherals and retrieve, transmit, and move data. Computer networks, television broadcasting, system design services, information distribution technologies such as telephony, and other devices involved in this process are part of the IT market. Such enormous requirements and equipment drive the demand of the data center air conditioning market to be cooled typically.

- Given the need for enhanced, high-quality, More Effective AirCooling Solutions, which are more efficient than conventional aircooled solutions, installing a Cooling System in IT and Data Centres is vital. This market growth is also stimulated by the increasing technological innovation of IT infrastructure and increased demand for cooling systems among mobile phone manufacturers to manage heat.

- Despite the rapid development of cloud services, there is considerable reliance on Onpromise and hybrid data centers in today's industry. These undertakings are trying to expand their data storage capacity, which is expected to increase demand for air conditioners or heating equipment in their supply systems. In addition, there is an increased need for more efficient data storage solutions due to the trend towards agile and DevOps operating frameworks in the IT sector.

Asia Pacific to Register a Significant Growth

- Asia Pacific will be a significant market driver in the future. Due to the increasing demand for data generation and government policies promoting more energy-efficient infrastructure in China, China is one of the most important Data Center Cooling Solutions markets based on recent innovations such as IoT, ML, and AI. The second-highest growth has been recorded in India, driven by the increased adoption of Internet services and a large volume of data.

- The rapidly growing number of data centers in China, along with the government policies to promote more environmentally sound infrastructure across the country, is one of the leading markets for Data Center Cooling Solutions.

- Moreover, China is the fastest-growing market for data centers worldwide. This expansion presents a tremendous opportunity for the participants in the study to gain market share, given the development of fintech and digital transformation in the country.

- Due to increasing internet penetration in Asia Pacific, the data center cooling market is expected to grow significantly. The demand for data centers in the region is growing considerably as mobile computing, the Internet of Things, and cloud computing play an essential role. This also gives rise to a thriving Data Center Cooling Market.

Data Center Cooling Industry Overview

The data center cooling market is fragmented as the benefits offered by the technology and support from the government by imposing efficiency regulations on data centers are expected to help the growth of the data center cooling market directly. Market penetration is growing with a strong presence of major players in established markets. With the increasing focus on innovation, the demand for new technologies is growing, which, in turn, is driving investments for further developments. Key players include Vertiv Co., Schneider Electric SE, and STULZ GMBH.

In April 2023, Asetek, Inc. announced that ASUS had introduced its third generation of ROG RYUJIN all-in-one CPU coolers for high-end builds, The RYUJIN III 240/360 and RYUJIN III 240/360 ARGB CPU coolers combine extreme overclocking capability, silent operation, and next-gen aesthetics to provide the ultimate in gameplay experiences and next-level performance.

In March 2023, Daikin acquired Alliance Air Products, a San Diego-based leader in custom air-handling equipment design and manufacturing. The combined capabilities of Daikin and Alliance Air address these industry requirements, including chiller-to-computer room air-handler (CRAH) systems that help mitigate a data center's environmental impact. These systems ensure an optimal balance between energy and water savings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Competitive Rivalry within the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of Digital Data

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Restraints

- 5.2.1 Adaptability Requirements and Power Outages

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Air cooled

- 6.1.2 Liquid cooled

- 6.1.3 Chillers

- 6.1.4 Economizer Systems

- 6.1.5 Row/Rack/Door/Overhead Cooling Systems

- 6.2 By Service

- 6.2.1 Installation and Deployment

- 6.2.2 Consulting, Support, and Maintenance Services

- 6.3 By End-user Vertical

- 6.3.1 Information Technology

- 6.3.2 BFSI

- 6.3.3 Telecommunication

- 6.3.4 Healthcare

- 6.3.5 Government

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Major Vendors

- 7.1.1.1 Daikin Industries Ltd

- 7.1.1.2 Schneider Electric SE

- 7.1.1.3 Mitsubishi Electric Corporation

- 7.1.1.4 Johnson Controls International PLC

- 7.1.1.5 Asetek Inc.

- 7.1.1.6 Liquid Cool Solutions Inc.

- 7.1.1.7 STULZ GMBH

- 7.1.1.8 Rittal GmbH & Co. KG

- 7.1.1.9 Nortek Air Solutions

- 7.1.1.10 Vertiv Co.

- 7.1.1.11 Munters Group AB

- 7.1.1 Major Vendors