|

市場調查報告書

商品編碼

1408442

6G -市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測6G - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

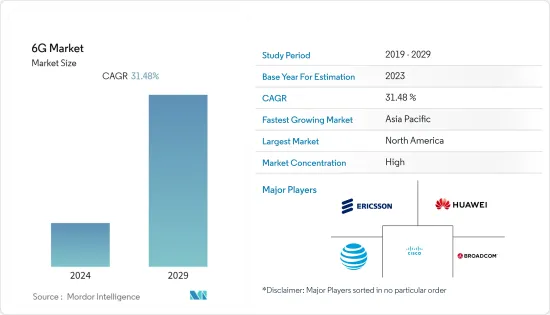

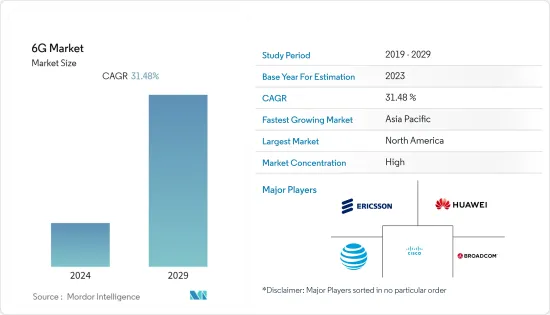

預計6G市場在預測期內的複合年成長率將達到31.48%。

主要亮點

- 6G 預計將在 2030 年代推出,其基礎是 5G 高階功能在社交、消費者和工業用例中實現行動連接的突破。透過整合數位世界和物理世界,6G 將透過多感官擴增實境、精準醫療、智慧農業協作機器人和智慧型自主系統等新應用,打造一個更創新、永續和高效的社會,預計將做出貢獻。

- 物聯網和加密貨幣等新興技術對連接的重視以及對 6G通訊的需求不斷增加,是促進該行業成長的關鍵因素。高速網際網路和遠端連接是6G技術的基本特徵,其採用將促進這些通訊技術的商業化。

- 快速都市化和通訊現已成為人類營養的基本權利,並可能在塑造市場方面發揮重要作用。大量人口已經遷移到大城市,以尋求更多機會和更好的生活。通訊和連接將在這一轉變中發揮關鍵作用。此外,6G技術的採用也將受到智慧城市擴張和支持都市區人口成長的努力的嚴重影響。

- 6G 可能會建立在 5G 初步成功的基礎上,以確保物聯網設備和網路的可靠性。此外,6G的到來將伴隨著自動化和智慧型設備水準的顯著提高,例如生產現場的倉庫機器人,因為與5G相比,6G具有更低的延遲和更高的資料負載。

- 此外,為了促進 5G 生態系統的發展並支持歐洲的 6G 研究,智慧網路服務營業單位選擇了 35 個研發和試點計劃的初始組合。其目標是在先進5G系統領域打造一流的歐洲供應鏈,並建立歐洲6G技術能力。這些投資顯著提高了市場成長率。

6G市場趨勢

對資料的需求增加

- 分析了由於多種數位技術和行動裝置的引入而產生大量資料而導致的資料需求的增加,從而為6G市場創造了巨大的需求。

- 此外,隨著行動資料消耗的增加,6G基礎設施的部署和擴展對於支援不斷成長的資料流量和提供增強的行動連線變得至關重要。例如,根據愛立信的報告,截至年終,不包括固定無線存取(FWA)流量的全球行動資料總流量達到每月93EB。到 2028 年,該流量預計將成長 3.5 倍,達到每月 329EB。預期的流量大幅成長凸顯了對強大且先進的基礎設施(例如 6G 網路)的需求,以滿足對行動資料服務不斷成長的需求。

- 預測期內流量成長的預測是基於 AR、VR 和混合實境(MR) 等 XR 類服務將在預測期結束時首先推出的假設。此外,雲端處理服務的採用正在各行業中迅速擴大。雲端基礎的應用程式需要高速連接來存取和處理儲存在遠端位置的資料。

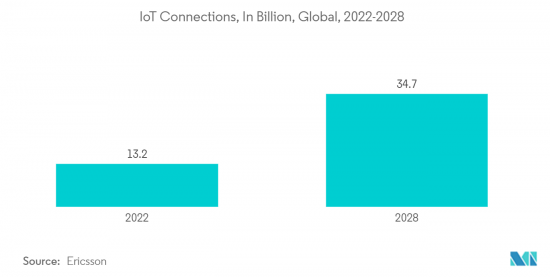

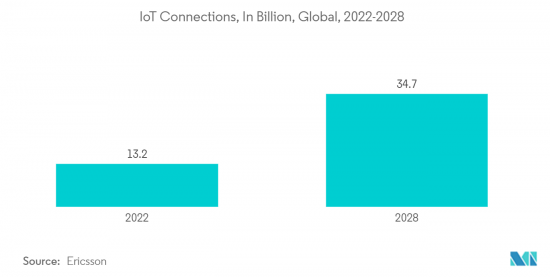

- 此外,物聯網領域的成長是資料需求的關鍵促進因素之一。例如,增加網路容量將加速MassiveIoT技術的成長,使其能夠透過頻譜共享與4G和5G共用,以及頻譜分割頻寬duplexFDD,甚至與6G一起實現更快的速度成為可能。

- 此外,愛立信預計,到 2030 年,連網裝置數量將超過 500 億台。透過解決所有連接問題,6G 有望釋放物聯網的潛力並為智慧城市提供動力。

分析顯示北美佔最大市場佔有率

- 在北美,美國是5G和6G市場的主要創新者和投資者之一。該國的通訊業佔全球5G技術消耗的大部分。

- 美國在地區5G市場的投資、部署和應用方面也佔據主導地位。包括AT&T、Verizon和T-Mobile在內的美國通訊業者已與愛立信、三星、諾基亞、華為和中興通訊等網路設備供應商簽署了10億美元的協議,建設美國的5G和6G網路基礎設施。

- 此外,2023年4月,美國商務部長正式推出了15億美元的公共無線供應鏈創新基金,用於建立開放和互通性的網路。透過展示新的無線網路開放架構方法的可行性,第一輪資金籌措確保 5G 和下一代無線技術的未來將由美國及其全球盟友和合作夥伴共同建造。我認為這將有助於確保那。創新基金是日本和美國立法努力的成果,旨在開發開放、可互通的無線網路,以加強安全、競爭和永續的全球供應鏈。

- 2023 年 4 月,白宮與商界領袖、技術代表和學術專家進行了磋商,制定了未來 6G 網路的策略。儘管 6G 技術仍處於起步階段,距離廣泛普及可能還需要數年時間,但預計其速度將明顯快於目前的 5G 網路,並大幅提高全球的高速網際網路接入。

- 此外,投資的增加也拉動了市場的成長速度。例如,2022 年 12 月,高級無線研究平台 (PAWR)計劃辦公室宣布獲得美國國家科學基金會(NSF) 的 280 萬美元投資,用於加速 5G、6G 及更高技術的無線創新。 。這項新資源反映了世界各地的研究人員對無線研究設施日益成長的興趣,並強調了增加對先進和動態測試環境的訪問的計劃的需求。

6G產業概況

6G 技術市場預計將顯著成長,迫使企業合作並制定有凝聚力的策略,以在這個競爭激烈的領域保持競爭力。這些公司經常建立合資企業(稱為合資計劃),以共用產品系列併尋求額外資源來實現其目標。這些努力將促進資源共用並加速進展。值得注意的是,6G 市場由大公司主導,這些公司正在大力投資開發,並著眼於未來的商業部署。

2022 年 11 月,NTT DoCoMo 與韓國 SK Telecom (SKT) 宣佈建立戰略合作夥伴關係,旨在推進 5G 和 6G 蜂窩技術。兩家公司之間的合作也擴展到開放和虛擬無線接取網路(RAN)技術的開發。此舉符合不斷變化的全球形勢,因為各個地區都在為部署下一代蜂窩技術做好準備。

2022年11月,愛立信承諾在該國建立一個新的研究團隊,作為數百萬英鎊投資的一部分,共同努力加強英國的無線通訊能力。未來 10 年,愛立信將向英國的一項致力於 6G 研究和突破性創新的計畫投入 1000 萬英鎊。這項舉措凸顯了 6G 技術在全球範圍內日益成長的重要性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 影響市場的宏觀經濟因素

第5章市場動態

- 市場促進因素

- 對資料的需求增加

- 邊緣運算

- 市場抑制因素

- 由於網路架構模型部署和頻譜挑戰,初始資本投資較高

第6章市場區隔

- 按設備

- 行動裝置

- 物聯網和邊緣運算設備

- 其他設備

- 按行業分類

- 農業

- 車

- 醫療保健

- 政府機關

- 製造業

- 按行業分類的其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭形勢

- 公司簡介

- AT&T

- Broadcom

- Cisco

- Ericsson

- Huawei

- Nokia

- NTT Docomo

- Orange

- NEC Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The 6G market is expected to register a CAGR of 31.48% during the forecast period.

Key Highlights

- 6G is anticipated to become available in the 2030s, building on societal, consumer, and industry use-case mobile connectivity breakthroughs enabled by the high-end capabilities of 5G. It is expected that 6G will contribute to a more innovative, more sustainable, and more efficient society with new uses for multisensory extended realities, precision health care, smart agricultural cobot, and intelligent autonomous systems by merging the digital and physical worlds.

- The increasing emphasis on connectivity and demand for 6G communication in newly developing technologies, e.g., the Internet of Things or cryptocurrencies, are significant factors contributing to the industry's growth. The introduction of high-speed Internet and remote connectivity, which are fundamental to the characteristics of 6G technologies, will be conducive to commercializing such communication technologies.

- Rapid urbanization and communication, now a fundamental right for human nutrition, will also play an essential role in shaping the market. A large population has already moved to the big cities for increased opportunities and better living. The critical role of communication and connectivity in this transition has been played. Moreover, the adoption of 6G technology will be significantly influenced by growing efforts toward supporting smarter cities and population growth in urban areas.

- In order to ensure the reliability of Internet of Things devices and networks, 6G will likely draw on the original success of 5G. Moreover, the emergence of 6G will coincide with a much larger level of automation and intelligent devices, such as warehouse robots at production sites, in view of its lower latency and higher data load compared to 5G.

- Further, to enable the development of 5G ecosystems and to support 6G research in Europe, the Smart Networks and Services Joint Undertaking selected its first portfolio of 35 R&I and trial projects. The objective is to create a first-class European supply chain in the field of advanced 5G systems as well as build Europe's capacity for 6G technology. These investments are significantly driving the market growth rate.

6G Market Trends

Increasing Data Demand

- The increasing data demand with the growing generation of high-volume data with the adoption of several digital technologies and mobile devices is analyzed to create significant demand for the 6G market.

- Further, as mobile data consumption grows, the deployment and expansion of 6G infrastructure become essential to support the increasing data traffic and deliver enhanced mobile connectivity. For instance, according to the Ericsson report, at the end of 2022, total global mobile data traffic, excluding traffic from fixed wireless access (FWA), reached 93 EB per month. By 2028, it is anticipated that this traffic will have increased by a factor of 3.5 to reach 329 EB per month. The anticipation of such significant traffic growth emphasizes the need for robust and advanced infrastructure, like 6G networks, to accommodate the rising demand for mobile data services.

- The estimation of the expected growth in traffic over the period is accompanied by an assumption that, at the end of the forecast period, there will be a first uptake of XR-type services such as AR, VR, and Mixed RealityMR. In addition, the adoption of cloud computing services is expanding rapidly across industries. Cloud-based applications require high-speed connectivity to access and process data stored remotely.

- Further, the growing IoT sector is one of the major contributors to the data demand. For instance, Adding network capacity will enhance the growth of MassiveIoT technologies and enable it to coexist with 4G and 5G in a spectrum division band duplexFDD as well as by sharing spectrum, and 6G could further enhance the speed.

- Furthermore, according to an Ericsson estimate, by 2030, there will be more than 50 billion linked devices. By addressing and resolving all connectivity concerns, 6G is anticipated to liberate the IoT's potential and serve as the driving force for the smart city.

North America is Analyzed to Hold Largest Share in the Market

- In North America, the US is one of the major innovators and investors in the 5G and 6G markets, owing to a high investment rate for advanced technological deployments. The telecom industry in the country accounts for a significant portion of the global consumption of 5G technology.

- Also, the US dominates the regional 5G market regarding investment, adoption, and applications. Telecom operators in the country, such as AT&T, Verizon, and T-Mobile, have made billion-dollar deals with network equipment vendors, such as Ericsson, Samsung, Nokia, Huawei, and ZTE, to build up their US 5G and 6G network infrastructure.

- Moreover, In April 2023, The US Secretary of Commerce officially launched a USD 1.5 billion public wireless supply chain innovation fund, which will be used to build Open and Interoperability networks. By demonstrating the viability of new, open-architecture approaches to wireless networks, this initial round of funding will help to ensure that the future of 5G and next-gen wireless technology is built by the US and its global allies and partners. The Innovation Fund is a result of the legislative efforts undertaken by both sides to develop Open and Interoperable Wireless Networks, which aim to enhance security, competitiveness, and sustainable worldwide supply chains.

- In April 2023, The White House consulted with business leaders, technology representatives, and experts in academia about developing strategies for the future 6G networks. Although 6G technologies are still in the early phases and likely years away from widespread use by the public, they are expected to become significantly faster than current 5G networks, as well as exponentially increasing high-speed internet access throughout the world.

- Moreover, the growing investments are also bolstering the market growth rate. For instance, in December 2022, The Platforms for Advanced Wireless Research (PAWR) Project Office announced an investment of USD 2.8 million from the US National Science Foundation (NSF) to accelerate wireless innovation in 5G, 6G, and beyond. The new resources reflect the growing interest of researchers around the world in wireless research facilities and highlight the need for programs to increase their access to advanced and dynamic testing environments.

6G Industry Overview

The 6G technology market is poised for significant growth, prompting companies to collaborate and devise cohesive strategies to stay competitive in this fiercely contested arena. Such enterprises, sharing a product portfolio and seeking additional resources to meet their goals, often engage in collaborative ventures, known as Joint Venture Programmes. These initiatives facilitate resource sharing and accelerate progress. Notably, the 6G market is dominated by major players making substantial investments in development, with an eye on future commercial deployment.

In November 2022, NTT DoCoMo and South Korea's SK Telecom (SKT) announced a strategic partnership aimed at advancing both 5G and 6G cellular technologies. Their collaborative efforts extend to the development of open and virtualized radio access network (RAN) technology. This move aligns with the evolving global landscape as various regions position themselves for the rollout of next-generation cellular technologies.

In November 2022, in a concerted effort to bolster the United Kingdom's wireless communications capabilities, Ericsson committed to establishing a new research team in the country as part of a multi-million-pound investment. Over the next decade, Ericsson plans to inject GBP 10 million into a UK-based program dedicated to 6G research and groundbreaking innovations. This initiative underscores the growing importance of 6G technology on a global scale.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Macro Economic Factors Impacting the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Data Demand

- 5.1.2 Edge Computing

- 5.2 Market Restraints

- 5.2.1 High Initial Capital Expenditure due to Deployment of Network Architecture Model and Spectrum Challenges

6 MARKET SEGMENTATION

- 6.1 By Devices

- 6.1.1 Mobile Devices

- 6.1.2 IoT and Edge Computing Devices

- 6.1.3 Other Devices

- 6.2 By End-user Vertical

- 6.2.1 Agriculture

- 6.2.2 Automotive

- 6.2.3 Healthcare

- 6.2.4 Government

- 6.2.5 Manufacturing

- 6.2.6 Other End-user Verticals

- 6.3 By Region

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T

- 7.1.2 Broadcom

- 7.1.3 Cisco

- 7.1.4 Ericsson

- 7.1.5 Google

- 7.1.6 Huawei

- 7.1.7 Nokia

- 7.1.8 NTT Docomo

- 7.1.9 Orange

- 7.1.10 NEC Corporation