|

市場調查報告書

商品編碼

1408397

視訊串流:市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Video Streaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

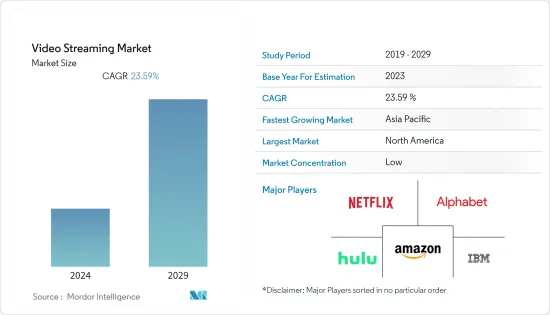

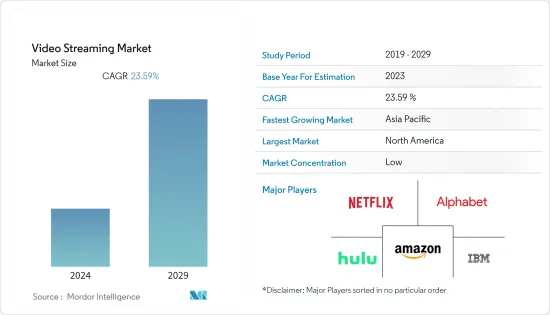

今年視訊串流媒體市場規模預計為1050.9億美元。

預計五年內將達3,030.5億美元,預測期內複合年成長率為23.59%。 OTT 平台無需傳統有線或衛星訂閱即可提供隨選視訊內容,人們對 OTT 平台的認知不斷增強,這可能會促進市場的顯著成長。此外,OTT 平台預計將透過獲得用戶(尤其是尋求靈活和個人化內容消費的年輕觀眾)來推動未來的市場成長。

主要亮點

- 視訊串流市場發展迅猛,改變了人們使用娛樂和資料的方式。視訊串流是透過網路即時傳送數位視訊內容,讓使用者可以在各種連接網路的小工具上觀看電影、錄音、現場活動和電視節目,而無需使用傳統的實體媒體和其他影像內容。

- 高速網路的普及是串流影音市場背後的驅動力。寬頻和行動網路的普及意味著消費者可以在智慧型手機、個人電腦、智慧型電視和平板電腦上快速存取和串流影片內容。觀眾可以隨時透過任何工具觀看自己喜歡的節目和電影。

- 此外,隨著這些網路連線的增加,特別是在城鎮中,串流影音變得越來越重要,其優勢在於發達的網路基礎設施和方便的串流影音體育目標受眾以及充足的存取權限隨著獲取難度降低,市場持續成長。此外,智慧型手機、平板電腦、智慧型電視和其他支援資料的裝置的大規模採用正在推動視訊串流的成長。

- 然而,視訊串流平台可能面臨非法複製內容和未經授權分發受版權保護材料的課題。盜版影響串流媒體服務的收益、內容創作者的收益,並限制市場成長。

- 此外,COVID-19 對視訊串流媒體市場產生了積極影響。封鎖使人們能夠探索和消費在串流媒體平台上提供的各種內容。在此期間,用戶發現了新的節目、電影和類型。此外,根據 IBEF 的數據,從 2020 年 1 月到 7 月, Over-The-Top產業的付費訂閱數量增加了 30%,從 2,100 萬增加到超過 2,900 萬。此外,都市區在OTT視訊平台用戶中所佔比例最大。

視訊串流市場趨勢

高速網路連線的普及

- 寬頻網路的全球普及不斷提高是視訊串流激增的主要原因之一。寬頻基礎設施顯著增加,為更多人口提供了更多的網路連線。隨著越來越多的家庭和地區連接可靠、高速的網際網路,視訊串流服務的潛在受眾不斷擴大,串流媒體平台擁有更廣泛的基本客群。

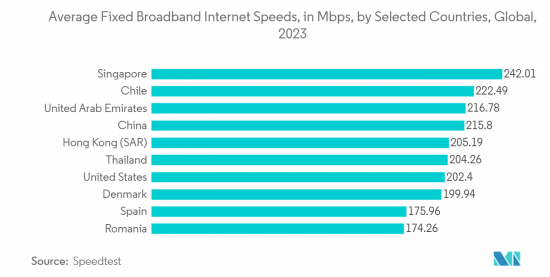

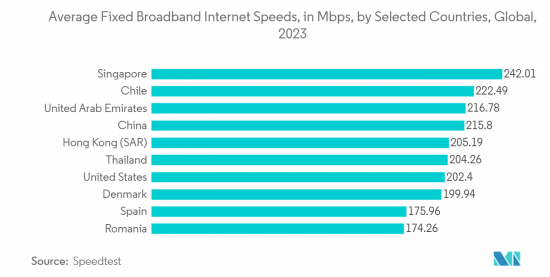

- 此外,根據 Speedtest 最近的一項研究,截至 2023 年 4 月,新加坡的平均固定寬頻網路速度為 242Mbps,是世界上最快的。阿拉伯聯合大公國以約 217 Mbps 排名第三,智利以超過 222 Mbps 排名第二。這些高速網路連線極大地促進了視訊串流平台的普及。

- 透過高速網路連接,使用者可以在各種裝置上觀看串流媒體影片,包括智慧型手機、平板電腦、電腦和智慧型電視。透過行動裝置提供的高速網路簡化了行動電話的使用,使用戶可以隨時隨地觀看自己喜歡的內容,從而增加了便利性和協作性。

- 此外,高速網路連線使得無縫分發高畫質影像內容成為可能。視訊串流平台現在可以提供高畫質 (HD) 和 4K 內容,讓觀眾體驗更身臨其境的娛樂。更快的網路速度可以減少緩衝問題,讓使用者享受不間斷的播放,從而提高串流媒體服務的整體滿意度。

- 高速網路連線的採用也催生了直播,您可以即時觀看活動、體育賽事、音樂會和遊戲比賽。由於網路基礎設施的改進,直播串流媒體獲得了極大的普及,為用戶提供了獨特的互動體驗,並培養了觀眾的社群意識。

- 此外,高速網路促進了Over-The-Top平台的發展,這些平台可以直接向用戶提供視訊內容,而無需訂閱傳統的有線或衛星電視。高速網路連線的可用性使觀眾更容易利用無線優勢並選擇 OTT 服務,從而使消費者行為和偏好發生重大轉變。

預計北美將佔據較大市場佔有率

- 北美是一些世界上最大的串流媒體平台的所在地。 Netflix、Amazon Prime Video、Hulu、Disney+、HBO Max 和 YouTube 等公司已在該地區立足,為用戶提供豐富多樣的內容庫。這些平台正在大力投資製作原創內容,以吸引和留住觀眾,從而形成競爭激烈且蓬勃發展的串流媒體市場。

- 該地區精通技術的人口和擁抱數位創新的文化進一步推動了視訊串流服務的普及。北美人很容易接受新的數位趨勢,消費點播內容的便利性促使人們從傳統電視轉向視訊串流平台。

- 此外,COVID-19 大流行加速了北美視訊串流的成長。鎖門和就地避難令促使家庭娛樂需求激增,推動觀眾成長和串流媒體服務新訂閱。這次疫情凸顯了數位娛樂的重要性,並鞏固了視訊串流作為北美許多人一級資訊來源的地位。

- 北美市場佔有率較高的另一個因素是該地區豐富多樣的內容。北美串流媒體平台迎合不同的受眾,並提供多種語言和流派的內容。提供在地化內容在吸引和留住不同人群的用戶方面發揮著重要作用。

- 此外,該地區的串流媒體平台預計將繼續適應不斷變化的消費者偏好和不斷變化的市場動態,以保持其主導地位並在競爭激烈的視訊串流行業中發展。

視訊串流媒體產業概述

隨著全球公司競相提供各種解決方案和服務,視訊串流市場預計將變得競爭激烈。此外,這些公司積極參與合作夥伴關係和創新,以保持市場競爭力。市場上的知名參與者包括 IBM、亞馬遜、Netflix、Hulu 等。

2023 年 6 月,亞馬遜計劃推出廣告支援的 Prime 視訊串流服務層級。這家線上零售和串流媒體公司希望擴大其廣告業務並增加娛樂收入。此外,亞馬遜已開始與華納兄弟探索頻道和派拉蒙環球公司討論透過 Prime Video Channels 為其串流服務提供廣告支援層。透過 Prime Video Channels,用戶可以訂閱 Max 等串流服務和 Paramount+ 無廣告版本,並透過應用程式觀看。

2023 年 5 月,著名影片共用公司 Rumble 宣布收購了由科技投資者兼企業家 David Sacks 和 Axel Ericsson 創立的舊金山播客和直播服務 Callin。作為 Rumble 的一部分,Erickson 和 Callin 團隊將繼續開發直播功能。

2023 年 4 月,為線上生活提供支援和保護的雲端服務供應商 Akamai Technologies 在 2023 NAB Show 上宣布了用於串流媒體影片的新雲端處理功能。該工具旨在幫助 OTT 提供者為觀眾提供更高品質、更個人化的視訊體驗。它還可以幫助營運商實現更可預測的營運成本節約,並加強內容收益的努力。此外,Akamai 還介紹了其認證運算合作夥伴計畫的最新參與者,並推出了通用媒體用戶端資料 (CMCD)協定的改進通訊協定。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 高速網路連線的普及

- 體育賽事、音樂會和比賽等直播活動越來越受歡迎

- 市場抑制因素

- 非法複製內容和未經授權散佈受版權保護的作品

- 內容許可和製作高成本

第6章市場區隔

- 依串流媒體類型

- 即時視訊串流

- 非線性視訊串流

- 依成分

- 軟體

- 依服務

- 依解決方案

- 網際網路通訊協定電視

- Over-The-Top(OTT)

- 有線電視

- 付費電視

- 依平台

- 遊戲機

- 筆記型電腦和桌上型電腦

- 智慧型手機和平板電腦

- 智慧型電視

- 依收益模式

- 廣告

- 出租

- 訂閱

- 依部署類型

- 雲

- 本地

- 依最終用戶

- 企業

- 消費者

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Amazon.com, Inc.

- Alphabet Inc.

- Netflix, Inc.

- Hulu LLC(The Walt Disney Company)

- Brightcove Inc.

- Apple Inc.

- Roku, Inc.

- Haivision Systems Inc.

- Tencent Holdings Limited

- Akamai Technologies, Inc.

- Warner Bros. Discovery, Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Video Streaming Market size is estimated at USD 105.09 billion in the current year. It is expected to reach USD 303.05 billion in five years, registering a CAGR of 23.59% during the forecast period. The increasing recognition of OTT platforms, providing on-demand video content without the necessity for conventional cable or satellite subscriptions, might account for significant market growth. Moreover, OTT platforms were expected to draw more subscribers, especially among younger audiences pursuing flexible and personalized content consumption in the coming years to drive future market growth.

Key Highlights

- The video streaming market has grown significantly, transforming people's entertainment and data utilization. Video streaming is a real-time delivery of digital video content over the web, authorizing users to watch movies, watch recordings, live events, TV shows, and other visual content on different internet-connected gadgets without conventional physical media.

- The large availability of high-speed internet can be a driving force for the streaming video marketplace. Consumers can quickly get the right of entry to and stream video content to their smartphones, PCs, smart TVs, and tablets due to the vast use of broadband and mobile internet. This availability will increase demand for content material, while viewers can see shows and films favored on any tool at any time.

- Furthermore, the increase of these internet connections, particularly in cities and towns, has made streaming video less challenging to get suitable access to as more significant conditions' advantage of the substantial net infrastructure and a convenient target audience for streaming video sports keeps making bigger the marketplace growth. In addition, the huge adoption of smartphones, tablets, smart TVs, and other data-enabled gadgets has fueled the increase of video streaming.

- However, video streaming platforms might face challenges related to content piracy and unauthorized distribution of copyrighted material. Piracy affects the revenues of streaming services and content creators' earnings, thereby restraining market growth.

- Further, COVID-19 positively impacted the video streaming market. The lockdowns allowed people to explore and engage with a broader range of content available on streaming platforms. Users discovered new shows, movies, and genres during this period. Moreover, according to the IBEF, between January and July 2020, the number of paid subscriptions in the over-the-top industry increased by 30%, from over 21-29 million. Furthermore, urban areas had the most significant percentage of OTT video platform users.

Video Streaming Market Trends

Growing Availability of High-speed Internet Connections

- The rise in global penetration of broadband internet is one of the primary reasons for the surge in video streaming. Broadband infrastructure has increased substantially, increasing internet connections to a more significant population. As more households and regions access stable and fast internet, the potential audience for video streaming services has expanded, leading to a more extensive customer base for streaming platforms.

- Moreover, according to a recent survey by Speedtest, Singapore was recorded to be the fastest average fixed broadband internet speed as of April 2023, at 242 Mbps. The United Arab Emirates came in third with an average fixed broadband internet speed of about 217 Mbps, whereas Chile ranked second with more than 222 Mbps. Such significant internet speeds would have considerably contributed to the increased adoption of video streaming platforms.

- A high-speed Internet connection can allow users to watch streaming videos on various devices, including smartphones, tablets, computers, and smart TVs. The availability of high-speed Internet through mobile devices has simplified the use of mobile phones and allowed users to watch their favorite content anytime, anywhere, increasing convenience and collaboration.

- Additionally, high-speed Internet connections have enabled seamless delivery of high-quality video content. Video streaming platforms can now offer high definition (HD) and 4K content, giving viewers a more immersive and entertaining experience. Due to faster internet speeds, buffering issues are reduced, and users can enjoy uninterrupted playback, increasing their overall satisfaction with the streaming service.

- Adopting high-speed Internet connections has also led to live streaming, where users can watch events, sports, concerts, and gaming competitions in real-time. Live streaming has gained immense popularity due to the improved internet infrastructure that gives users a unique and interactive experience and fosters a sense of community among viewers.

- Further, high-speed Internet has enabled the growth of over-the-top (OTT) platforms that deliver video content directly to users without subscribing to traditional cable or satellite television. The availability of high-speed Internet connections has made it easier for viewers to leverage the cordless benefits and opt for OTT services, leading to a significant shift in consumer behavior and preferences.

North America is Expected to Hold a Significant Market Share

- North America has some of the largest streaming platforms globally. Companies like Netflix, Amazon Prime Video, Hulu, Disney+, HBO Max, and YouTube have established a strong presence in the region, offering subscribers a diverse and extensive library of content. These platforms have invested heavily in original content production to attract and retain viewers, leading to a competitive and thriving streaming market.

- The region's tech-savvy population and cultural acceptance of digital innovations have further fueled the adoption of video streaming services. North Americans readily embrace new digital trends, and the convenience of on-demand content consumption has driven a significant shift from traditional television to video streaming platforms.

- Moreover, the COVID-19 pandemic accelerated the growth of video streaming in North America. Lockdowns and stay-at-home orders led to a surge in demand for at-home entertainment, driving increased viewership and new subscriptions to streaming services. The pandemic highlighted the importance of digital entertainment and solidified the position of video streaming as a primary source of entertainment for many North Americans.

- Another factor contributing to North America's significant market share is the region's extensive and varied content offerings. Streaming platforms in North America cater to diverse audiences, providing content in multiple languages and genres. The availability of localized content has played a crucial role in attracting and retaining subscribers across different demographics.

- Further, streaming platforms in the region are anticipated to continue adapting to changing consumer preferences and evolving market dynamics to maintain their prominent position and grow in the highly competitive video streaming landscape.

Video Streaming Industry Overview

The Video Streaming Market is expected to be highly competitive due to global firms competing in various solutions and service offerings. In addition, these firms are actively engaging in partnerships and innovations to stay competitive in the market. A few prominent players in the market include IBM, Amazon, Netflix, Hulu, etc.

In June 2023, Amazon plans to introduce an advertising-supported Prime Video streaming service tier. The online retail and streaming firm wants to expand its ad business and boost entertainment income. Additionally, Amazon has initiated discussions with Warner Bros. Discovery and Paramount Global to include the ad-based tiers of their streaming services through Prime Video Channels. Users may subscribe to streaming services like Max and Paramount+'s ad-free editions through Prime Video Channels and watch through the app.

In May 2023, Rumble, a prominent video-sharing company, revealed that the business acquired Callin, the podcasting and live-streaming service in San Francisco created by tech investor and entrepreneur David Sacks and Axel Ericsson. As part of Rumble, Ericsson and the Callin team will keep developing live-streaming capabilities.

In April 2023, Akamai Technologies, a cloud services provider that power and secure online lives unveiled new cloud computing features for streaming video at the 2023 NAB Show. The tools are designed to assist OTT providers in providing viewers with video experiences of greater quality and more tailored to their individual needs. They can also assist operators in realizing reduced, more predictable operating expenses and enhancing attempts to monetize content. Furthermore, Akamai highlighted the most recent participants in its Qualified Computing Partner program and revealed improvements to its support for the Common Media Client Data (CMCD) protocol.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Availability of High-speed Internet Connections

- 5.1.2 Rising Popularity of Live Streaming Events, such as Sports, Concerts, and Gaming

- 5.2 Market Restraints

- 5.2.1 Content Piracy and Unauthorized Distribution of Copyrighted Material

- 5.2.2 High Costs of Content Licensing and Production

6 MARKET SEGMENTATION

- 6.1 By Streaming Type

- 6.1.1 Live Video Streaming

- 6.1.2 Non-Linear Video Streaming

- 6.2 By Component

- 6.2.1 Software

- 6.2.2 Services

- 6.3 By Solutions

- 6.3.1 Internet Protocol TV

- 6.3.2 Over-the-Top (OTT)

- 6.3.3 Cable TV

- 6.3.4 Pay-TV

- 6.4 By Platform

- 6.4.1 Gaming Consoles

- 6.4.2 Laptops & Desktops

- 6.4.3 Smartphones & Tablets

- 6.4.4 Smart TV

- 6.5 By Revenue Model

- 6.5.1 Advertising

- 6.5.2 Rental

- 6.5.3 Subscription

- 6.6 By Deployment Type

- 6.6.1 Cloud

- 6.6.2 On-Premises

- 6.7 By End User

- 6.7.1 Enterprise

- 6.7.2 Consumer

- 6.8 By Geography

- 6.8.1 North America

- 6.8.2 Europe

- 6.8.3 Asia Pacific

- 6.8.4 Latin America

- 6.8.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Amazon.com, Inc.

- 7.1.3 Alphabet Inc.

- 7.1.4 Netflix, Inc.

- 7.1.5 Hulu LLC (The Walt Disney Company)

- 7.1.6 Brightcove Inc.

- 7.1.7 Apple Inc.

- 7.1.8 Roku, Inc.

- 7.1.9 Haivision Systems Inc.

- 7.1.10 Tencent Holdings Limited

- 7.1.11 Akamai Technologies, Inc.

- 7.1.12 Warner Bros. Discovery, Inc.