|

市場調查報告書

商品編碼

1408389

公共雲端-市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Public Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

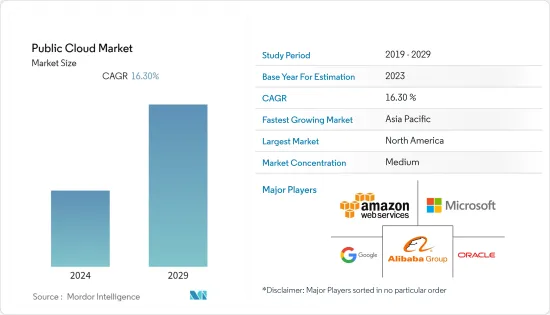

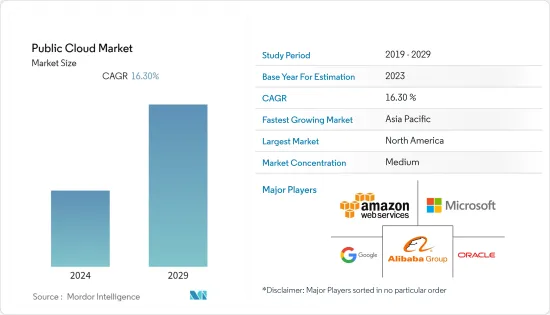

全球公共雲端市場目前市場規模為5,186.9億美元,預計五年後將達1,1036億美元,預測期內複合年成長率為16.3%。

採用公共雲端的關鍵市場促進因素之一是它為各種規模的企業提供無與倫比的可擴展性和彈性。傳統的本地基礎設施通常需要協助來應對需求的突然激增,從而導致成本高昂的過度配置或資源利用不足。許多提供者允許您快速增加或減少資源以回應不斷變化的需求。

主要亮點

- 公共雲端服務徹底改變了公司管理 IT 預算的方式。計量收費模式允許企業存取廣泛的服務,而無需支付初期成本。傳統上,採購和營運硬體意味著大量投資,但雲端的營運支出方法改變了財務遊戲規則。與此結合,計量收費定價模式有利於新興企業和資本有限的小型企業,並允許大型企業最佳化其 IT 支出。除此之外,公司可以在不花費大量資金的情況下嘗試新想法,這鼓勵了實驗並為市場提供了動力。

- 根據泰雷茲集團預測,截至2022年,超過60%的業務資料將儲存在雲端。這一比例在 2015 年達到了 30%,隨著企業擴大將資源轉移到雲端環境以提高安全性、可靠性和業務敏捷性,這一比例還在繼續增加。這些因素為經過市場研究的供應商在未來幾年擴大其服務範圍創造了巨大的成長機會。企業擴大採用雲端運算也擴大了所涵蓋的市場範圍。例如,總部位於印度的市場供應商 Druva Inc. 報告稱,由於存在大量非結構化資料,許多公司將企業資料作為主要目標。該公司還報告稱,這些資料佔企業儲存系統儲存資料的 80% 以上。

- Flexera Cloud Report 2022 對 753 名受訪者進行了調查。該公司發現,受訪者對 SaaS 和 IaaS/PaaS 決策有重大影響,78% 的受訪者參與 SaaS 決策,而更積極參與公有雲決策的受訪者佔 77%。這類似於受訪者主動管理公共雲端IaaS、PaaS 和 SaaS 的持續使用和成本的方式 (69%)。此外,根據 Fortinet 2022 年雲端安全報告,雲端用戶認為雲端承諾提供自適應容量和可擴展性 (53%)、提高敏捷性 (50%) 以及提高可用性和業務永續營運(45%)。我們保證這正在發生。

- 此外,安全風險可能是市場成長的一個問題。到目前為止,第三方經營團隊一直謹慎對待這項服務。此外,資料外洩的威脅始終存在,這也對市場發展提出了挑戰。企業IT管理的關鍵目標是流程標準化。傳統上,管治的需要源自於提供監督和指導。無論您現有的系統是私有雲端雲還是公共雲端,管理整合多個系統的混合雲端都變得更加複雜。根據 RightScale 的雲端狀況報告,雲端管治是企業和小型企業面臨的最大挑戰。企業受訪者表示這是一個擔憂,主要是因為他們擁有多重雲端策略。

- COVID-19 改變了企業的運作方式。隨著 COVID-19 大流行導致需求增加,企業開始尋求全球超大規模資料中心業者,以協助他們實施雲端服務,以提高業務的生產力和可擴展性。雲端處理可以透過降低成本、提高彈性和彈性以及最大限度地提高資源利用率來幫助您競爭。疫情期間,組織被迫採用遠距工作場景,導致資料外洩事件和閘道器增加。根據 Hosting Tribunal 的數據,到 2020 年,大約 94% 的企業已經在使用雲端服務,預計約 83% 的企業工作負載將位於雲端。

公共雲端市場趨勢

SaaS(軟體即服務)預計將佔很大佔有率

- SaaS(軟體即服務)是一種雲端基礎的模型,雲端供應商透過網際網路開發應用程式並將其交付給最終用戶。獨立軟體供應商 (ISV) 可以與第三方雲端供應商簽訂契約,以在此模型中託管其應用程式。 SaaS 應用程式包括申請系統、客戶關係管理 (CRM)、服務台、人力資源解決方案等。組織正在採用 SaaS 模型來降低商業軟體的初期成本、在單一電腦上安裝軟體的需求、隨著公司發展而服務的可擴展性、與其他軟體應用程式的整合以及對所有使用者的即時可用性。多種好處,包括更新。例如,Dropbox 就是 SaaS 的一個例子。雲端儲存允許企業儲存、共用和協作處理文件和資料。使用者可以同步和備份檔案並從任何裝置存取它們。

- 各行業的參與企業正在收購市場進入者,以擴大其影響力並進入新參與企業。例如,2022年9月,總部位於阿布達比的B2B物流SaaS平台Lyve Global宣布收購跨境電商物流和解決方案供應商Shopini World,將業務拓展全部區域。該市場的參與企業正在尋求透過策略性收購和合併來擴大其服務範圍,以滿足該國對 SaaS 不斷成長的需求。

- 同樣在 2022 年 6 月,純雲端原生安全供應商 Aqua Security 今天宣布其雲端原生安全 SaaS 在新加坡全面上市 (GA),為更廣泛的 APJ 地區提供服務。客戶可以立即受益於 SaaS 服務提供的資料主權、平台安全性和彈性,並可以在雲端原生攻擊發生之前進行預防。新加坡的軟體即服務允許政府、銀行、金融服務和其他受監管部門的 Aqua 客戶利用治理和合規性來實現全面的雲端原生安全、風險管理和合管治。您可以透過本地方式利用我們的服務滿足資料主權要求的服務。

- 2023年5月,全球雲端基礎資料管理軟體供應商Stibo Systems收購了微軟的I參與合作夥伴計畫。 Stibo Systems 在 Microsoft 的支援和指導下改進了其雲端服務。這種整合使客戶能夠提高其雲端投資和資源的短期和長期績效。

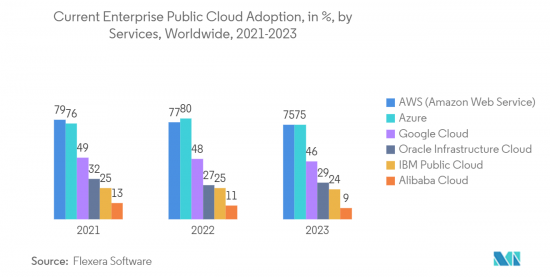

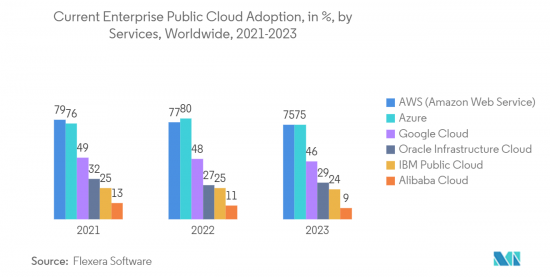

- Flexera Software 表示,在 2023 年對 627 家公司進行的雲端調查中,75% 的企業受訪者表示他們正在採用 Microsoft Azure 進行公共雲端使用。 AWS、Microsoft Azure、Google Cloud 或超大規模供應商是全球領先的雲端運算平台供應商。公共雲端服務提供了地理上分佈的資料中心網路,使企業能夠在更靠近最終用戶的位置部署應用程式和服務,無論其位置如何。這種全球部署可確保低延遲訪問,從而提高效能和使用者體驗。

預計北美將佔據很大的市場佔有率

- 北美是公共雲端採用的主要創新者和先驅。該地區為雲端微服務供應商奠定了堅實的基礎,刺激了市場成長。其中包括 Amazon Web Services Inc.、Oracle Corporation、IBM Corporation、Microsoft Corporation 等。由於先進技術的日益採用,該地區在雲端微服務市場中越來越受歡迎。此外,北美企業正在採用金融、電子商務和旅遊服務的公共雲端架構,這些架構的需求量很大,因為它們可以經濟高效地儲存資訊和資料,並提高敏捷性、效率和可擴展性。雲端運算、人工智慧、巨量資料、分析、行動社交媒體、網路安全和物聯網等成熟技術的使用正在推動創新和轉型,並推動北美商業生態系統的成長。

- 根據 Stormforge 發布的一份報告,18% 的北美受訪者表示,他們的組織每月在雲端使用上的支出在 10 萬美元到 25 萬美元之間。此外,44% 的受訪者預計他們的雲端支出將在未來12 個月內增加,另外32% 的受訪者預計他們組織的雲端支出將在未來12 個月內大幅增加。我確實如此。美國是北美主要國家之一,如此巨大的雲端支出可能會為所研究的市場創造成長機會。

- 根據美國小型企業發展管理局預測,2022年,美國小型企業數量將達3,320萬家,約佔全國企業的99.9%。 2022年美國小型企業數量的擴張反映持續成長,比上一年(2021年)成長2.2%,比2017年至2022年成長12.2%。如此龐大的中小企業數量很可能為市場參與企業提供開發新的公有公共雲端解決方案以佔領市場市場佔有率的機會。

- 市場參與企業正在合作更好地服務客戶。例如,2022年6月,企業雲端資料管理供應商Informatica宣布擴大與資料雲端新興企業Snowflake的合作,並進行新產品改進,以增加共同用戶的價值。使用者可以利用智慧資料管理雲端 (IDMC) 平台的強大功能,使用新的 Informatica Enterprise Data Integrator(目前正在開發的 Snowflake Marketplace 的本機應用程式)來整合來自 Snowflake Data Cloud 的各種企業應用資料。

- 同樣,2023 年 7 月,房地產解決方案領域的全球參與企業MRI Software 宣布,透過在加拿大推出首個雲端實例,將其產品擴展到加拿大市場。加拿大的 MRI 客戶現在可以輕鬆存取 MRI 的最新解決方案,並透過在國內託管資料來確保遵守隱私和安全法規。加拿大客戶現在可以透過新的雲端實例利用該公司的下一代房地產平台 MRI Agora。 MRI Agora 以人工智慧為先的基礎為基礎,透過連網資料和共用服務幫助企業自動執行日常任務。 MRI Agora Insights 揭示了可操作的投資組合趨勢並推動更好的業務決策。

公共雲端產業概況

全球公共雲端市場由多個參與者主導,包括亞馬遜網路服務公司(AMAZON.COM, Inc.)、阿里雲(阿里巴巴集團控股有限公司)、Google 有限公司(Alphabet Inc.)、微軟公司、甲骨文公司和SAP SE.參與企業存在並且適度整合。公司持續投資於策略合作夥伴關係和產品開拓,以大幅提高市場佔有率。以下是一些最近的市場開拓:

2023 年 4 月,VMware, Inc. 宣布推出 VMware 跨雲端託管服務。這是一組監管建議,旨在提高合作夥伴和消費者的利益,並使高技能成員能夠發展其託管服務實踐。 VMware 的跨雲端託管服務建立在 VMware 所征服的基礎之上,即建立一個由 4,000 多家雲端服務參與企業組成的生態系統,為全球數以萬計的客戶提供服務,使合作夥伴能夠更輕鬆地使用設施管理服務。這提高了我們合作夥伴的盈利,並為成長和擴張開闢了新的可能性。

2022年10月,Google雲端宣布全球領先的線上消費零售商Wayfair已完成其資料中心服務和應用程式向雲端的遷移,Google雲端作為其整體雲端策略的基礎做到了。此舉將使 Wayfair 能夠提高企業敏捷性和創新能力,管理突發容量,並擴展機器學習 (ML) 和人工智慧 (AI) 的新用途,從詐騙偵測到個人化客戶協助。現在可以處理各種問題場景。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 5G、人工智慧、機器學習和物聯網等新技術發展的興起

- 與雲端採用相關的經濟影響

- 市場抑制因素

- 資料隱私和資料安全

第6章 市場細分

- 按發展

- SaaS(Software-as-a-Service)

- PaaS(Platform-as-a-Service)

- IaaS(Infrastructure-as-a-Service)

- 按組織規模

- 中小企業

- 大型組織

- 按最終用戶產業

- BFSI

- 醫療保健

- 政府機關

- 製造業

- 資訊科技/通訊

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭環境

- 公司簡介

- Amazon Web Services Inc. (AMAZON.COM, Inc.)

- Alibaba Cloud (Alibaba Group Holding Limited)

- Google LLC (Alphabet Inc.)

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- IBM Corporation

- Salesforce Inc.

- Vmware Inc.

- Adobe Inc.

第8章投資分析

第9章 市場未來展望

The Global Public Cloud market is valued at USD 518.69 billion in the current year and is expected to register a CAGR of 16.3% during the forecast period to reach USD 1,103.60 billion in five years. One of the primary market drivers for public cloud adoption is the unmatched scalability and elasticity it offers to businesses of all sizes. Traditional on-premises infrastructures often need help to handle sudden spikes in demand, leading to costly overprovisioning or underutilization of resources. Numerous providers allow businesses to scale their resources up or down rapidly in response to changing requirements.

Key Highlights

- Public cloud services have transformed the way companies operate their IT budgets. The pay-as-you-go model lets organizations access diverse services without incurring upfront costs for Software and hardware. Traditionally, procuring and operating hardware meant substantial investments, but the cloud's operational expenditure approach changes the financial landscape. In confluence with this, the pay-as-you-go pricing model benefits startups and small businesses with limited capital and allows larger enterprises to optimize their IT spending. Apart from this, it encourages experimentation, as companies try out new ideas without committing to significant expenses, which provides an impetus to the market.

- According to Thales Group, As of 2022, over 60 percent of all business data is stored in the cloud. As businesses progressively move their resources into cloud environments to enhance security, dependability, and business agility, this balance hit 30% in 2015 and has since increased. These factors create a massive growth opportunity for the market-studied vendors to expand their offerings in the coming years. The growing adoption of cloud computing among enterprises also broadens the scope of the studied market. For instance, India-based market vendor Druva Inc. reported that many companies primarily target enterprise data due to a large amount of unstructured data. The company also reported that this data claim accounts for over 80% of the data stored in enterprise storage systems.

- Flexera Cloud Report 2022 surveyed 753 respondents; the company stated that respondents heavily influence SaaS and IaaS/PaaS decisions; 78% are involved in SaaS decisions, compared to 77% of respondents active in public cloud decisions. This is similar to how respondents actively manage continuing usage and costs for public cloud IaaS, PaaS, and SaaS (69 %). Further, according to the Fortinet Cloud Security Report 2022, Cloud users guarantee that the cloud is delivering on the promise of adaptable capacity and scalability (53%), increased agility (50 percent), and improved availability and business continuity (45%) Such massive adoption of cloud solutions would drive the market.

- Moreover, security risks are likely to concern market growth. To date, the third-party executives have handled services with care. Further, the threat of data breaches is always on, which also challenges market progress. The primary purpose of IT governance in the enterprise is process standardization. Traditionally, the need for governance originated to provide supervision and direction. Whether the existing systems are private or public clouds, managing a hybrid cloud incorporating multiple systems will be more complex. According to the RightScale State of the Cloud report, cloud governance was the top challenge for enterprises and SMBs. Enterprise respondents cited it as a concern, mainly because they have a multi-cloud strategy.

- The COVID-19 altered how companies function. Due to a rise in demand driven by the COVID-19 pandemic, businesses have turned to global hyper scalers for help implementing cloud services to increase the productivity and scalability of their operations. Cloud computing can increase competitiveness by lowering costs, improving flexibility and elasticity, and maximizing resource use. During the pandemic, organizations were pushed toward adopting remote working scenarios, leading to increased incidents and gateways for data breaches. According to the Hosting Tribunal, in 2020, about 94% of enterprises were estimated to be already using cloud services, and about 83% of enterprise workloads were on the cloud.

Public Cloud Market Trends

Software-as-a-Service (SaaS) is Expected to Hold Significant share

- Software as a service (SaaS) is a cloud-based model in which a cloud provider develops applications and makes them available to end users over the internet. An independent software vendor (ISV) may contract a third-party cloud provider to host the application in this model. SaaS applications include a billing invoicing system, Customer Relationship Management (CRM), help desk, and Human Resource solutions. Organizations are deploying the SaaS model to utilize multiple advantages, including the reduced upfront costs of commercial software, the need to establish software on individual machines, service scalability with a firm's growth, integrations with other software applications, and instant updates to all users. For instance, Dropbox is a real example of SaaS. Cloud storage allows firms to store, share, and collaborate on files and data. The users can sync and back up files to access them from any device.

- The players from various industries are acquiring the market players to expand their presence and enter new markets. For instance, in September 2022, Lyve Global, an Abu Dhabi-based B2B logistics SaaS platform, announced the acquisition of Shopini World, a cross-border e-commerce logistics and solutions provider, to expand its business across the Middle East and North Africa region. The players in the market are looking for strategic acquisitions and mergers to expand their offerings and cater to the rising demand for SaaS in the country.

- Further, in June 2022, Aqua Security, the pure-play cloud-native security provider, today announced the general availability (GA) of cloud-native security SaaS in Singapore, serving the broader APJ region. Customers can immediately take benefit of the data sovereignty, platform security, and flexibility delivered by the SaaS service to prevent cloud-native attacks before they happen. With SaaS (Software as a Service) in Singapore, Aqua customers in government, banking, financial services, and other regulated sectors can leverage the service for comprehensive cloud-native security, risk management, and compliance through an in-region service that addresses their governance and data sovereignty requirements.

- In May 2023, Stibo Systems, a global provider of master data management software, joined Microsoft's Partner Program as an independent software exporter to create and host cloud-based Software as a Service on Microsoft Azure. Stibo Systems improved its cloud services with support and guidance from Microsoft. This integration will enable clients to improve the short and long-term performance of their cloud investments and resources.

- According to Flexera Software, a state of cloud report surveyed 627 in 2023 states that 75 percent of enterprise respondents indicated adopting Microsoft Azure for public cloud usage. AWS, Microsoft Azure, and Google Cloud, or hyperscalers, are among the leading cloud computing platform providers worldwide. Public cloud services offer a geographically distributed network of data centers, allowing businesses to deploy applications and services close to their end users regardless of location. This global reach ensures low-latency access, improving performance and user experience.

North America is Expected to Hold Significant Share of the Market

- North America is among the leading innovators and pioneers in adopting public cloud. The region has a strong foothold of cloud microservice vendors, which adds to the market's growth. Some include Amazon Web Services Inc., Oracle Corporation, IBM Corporation, and Microsoft Corporation. Due to the growing adoption of advanced technologies, this region is gaining traction in the cloud microservices market. Moreover, there is an increasing demand from North American firms, as they have adopted public cloud architecture in financial, e-commerce, and travel services, which helps store information and data cost-effectively and boosts agility, efficiency, and scalability. The use of developed technologies, such as cloud computing, AI, big data and analytics, mobility/social media, cybersecurity, and IoT, among others, has led to innovation and transformation, thereby stimulating growth in the business ecosystem of North America.

- According to a report published by Stormforge, 18% of respondents from North America state that their organization has a monthly cloud spend that ranges between USD 100,000 and USD 250,000. Further, 44% of respondents expect cloud spending to increase somewhat over the next 12 months, while another 32% indicate that they expect their organization's cloud spending to increase significantly over the next 12 months. The United States is one of the major countries in North America, and such huge spending on the cloud would create an opportunity for the studied market to grow.

- According to the United States Small Business Administration Office of Advocacy, in 2022, the digit of small enterprises in the United States reached 33.2 million, accounting for approximately (99.9 percent) of firms in the country. The expansion in the number of small firms in the United States in 2022 reflects constant growth, with a 2.2 percent rise from the previous year(2021) and a 12.2% increase from 2017 to 2022. Such a huge number of SMEs would create an opportunity for the market players to develop new public cloud solutions to capture the market share

- The players in the market are collaborating to provide better services to their customers. For instance, in June 2022, Informatica, an enterprise cloud data management supplier, announced an expanded collaboration with Snowflake, the Data Cloud startup, and new product improvements to boost value for joint users. Users could use the power of the Intelligent Data Management Cloud (IDMC) Platform to integrate a wide range of enterprise application data in the Snowflake Data Cloud with the new Informatica Enterprise Data Integrator, a native application in Snowflake Marketplace that is currently in development.

- Similarly, in July 2023, MRI Software, a global player in real estate solutions, announced that it had expanded its offerings to the Canadian market by launching its first cloud instance in Canada. MRI clients in Canada can now easily access the latest solutions from MRI and host their data in the country, ensuring compliance with privacy and security regulations. Canadian clients can use MRI Agora, the company's next-generation real estate platform, through the new cloud instance. Based on an AI-first foundation, MRI Agora empowers businesses to automate mundane tasks through connected data and shared services. MRI Agora Insights unearths actionable portfolio trends to drive better business decisions.

Public Cloud Industry Overview

The Global Public Cloud market is moderately consolidated with the presence of several players like Amazon Web Services Inc.(AMAZON.COM, Inc.), Alibaba Cloud (Alibaba Group Holding Limited), Google LLC (Alphabet Inc.), Microsoft Corporation, Oracle Corporation, SAP SE, etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In April 2023, VMware, Inc. announced VMware Cross-Cloud managed services, a set of prescriptive recommendations with improved partner and consumer benefits that will enable highly skilled members to grow their managed services practices. Building on VMware's conquest in creating an ecosystem of more than 4,000 cloud service players that serve tens of thousands of clients worldwide, VMware Cross-Cloud managed services will make facility-managed services faster for partners and easier to consume by clients. This will enhance partner profitability while opening new possibilities for growth and expansion.

In October 2022, Google Cloud announced that Wayfair, one of the world's most prominent online destinations for the home, has completed migrating its data center services and applications to the cloud, with Google Cloud as the basis of its overall cloud strategy. The move enables the retailer to increase enterprise agility and technical innovation, manage burst capacity, and scale new uses of machine learning (ML) and artificial intelligence (AI) for scenarios ranging from fraud detection to personalized customer outreach.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in development of new technologies such as 5G, Artifical Intelligence, Machine Learning and Internet of Things

- 5.1.2 Economic benefits leading to cloud adoption

- 5.2 Market Restrains

- 5.2.1 Data Privacy and Data Security

6 MARKET SEGEMENTATION

- 6.1 By Deployment

- 6.1.1 Software-as-a-Service (SaaS)

- 6.1.2 Platform-as-a-Service (PaaS)

- 6.1.3 Infrastructure-as-a-Service (IaaS)

- 6.2 By Organization Size

- 6.2.1 SME's Organization

- 6.2.2 Large Organizations

- 6.3 By End User Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 IT and Telecom

- 6.3.6 Others End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc. (AMAZON.COM, Inc.)

- 7.1.2 Alibaba Cloud (Alibaba Group Holding Limited)

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Microsoft Corporation

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 IBM Corporation

- 7.1.8 Salesforce Inc.

- 7.1.9 Vmware Inc.

- 7.1.10 Adobe Inc.