|

市場調查報告書

商品編碼

1408216

澳洲與紐西蘭地理空間分析:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測ANZ Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

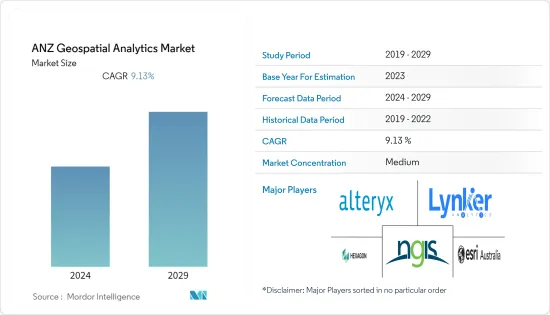

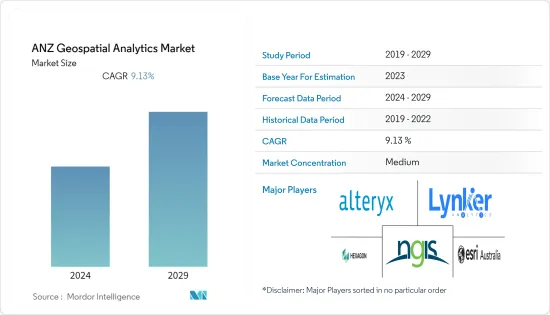

澳洲和紐西蘭地理空間分析市場規模預計未來五年將從目前的 6.2 億美元成長到 9.5 億美元,預測期內複合年成長率為 9.13%。

澳洲和紐西蘭地理空間分析市場的推動因素包括各種公共和私人最終用戶行業不斷成長的需求、大型市場參與企業的存在以及城市規劃中對地理空間分析的需求不斷成長。

主要亮點

- 澳洲和紐西蘭的地理空間分析生態系統持續發展,市場參與企業看到創新地理空間分析解決方案的成長,包括人工智慧 (AI) 和機器學習 (ML),可從地理空間資料中獲得有意義的見解。近年來,由於地理空間分析解決方案的出現,澳洲和紐西蘭的地理空間分析生態系統經歷了顯著成長。以增加先進技術的使用。此外,擴大使用資訊資訊做出明智的決策,進一步推動了該地區對地理空間功能和地理空間分析解決方案的需求。

- 該地區的市場供應商正在利用先進技術在地理空間領域提供創新的分析功能,並對其進行進一步分析,以推動該地區最終用戶行業對地理空間分析解決方案的需求。例如,總部位於澳洲的地理空間情報公司在地理空間分析、巨量資料和連結分析、機器學習、人工智慧以及有效使用者介面的開發方面擁有豐富的專業知識。這些技能使該公司能夠開發複雜且創新的地理空間分析工具,這些工具可以自動從大型資料集集中提取資料和資訊,並以支持資訊決策的格式呈現這些資訊。

- 衛星和感測器等地理空間資料的可用性和可訪問性的提高正在推動市場成長。因為地理空間資料可以透過利用地理空間分析解決方案為全部區域的組織提供資訊、明智的決策和有價值的見解。例如,紐西蘭土地資訊(LINZ) 專注於發布紐西蘭建築和自然環境的詳細地理空間資料模型。 LINZ 在 data.linz.govt.nz 上共用其資料集,從道路和河流資料到航空影像和雷射雷達。

- 此外,2023 年 5 月,Vexcel 資料計畫宣布透過其基於網路的平台 Viewer 免費存取紐西蘭和澳洲的航空圖像。此免費存取為商業和政府用戶提供主要大都市區的高解析度、高精度圖像,包括珀斯、奧克蘭、雪梨、墨爾本、布里斯班、惠靈頓和基督城。澳洲和紐西蘭的組織可以參與這項免費服務。預計這些因素將在預測期內為該地區的地理空間分析市場提供成長機會。這些因素推動了組織對地理空間分析解決方案的需求,以從影像、衛星和感測器的空間資料中實現利潤最大化和競爭優勢。

- 在 COVID-19 大流行期間,該地區對地理空間分析解決方案表現出了巨大的需求,以提供對抗 COVID-19 大流行的關鍵資訊。 EMSINA(澳洲緊急管理空間資訊網路)等地區政府機構已與 Esri Australia 等市場供應商合作,使用地理空間資料集來對抗疫情。大流行後,由於該地區領先供應商開發的創新和複雜的地理空間分析解決方案的增加,市場出現了顯著成長。

澳洲和紐西蘭地理空間分析市場趨勢

農業部門預計將佔據較大市場佔有率

- 近年來,在智慧和精密農業實踐的推動下,澳洲和紐西蘭地區的農業部門取得了顯著成長。該地區生產和出口多種農產品,包括牛和小麥,使農業成為該地區的重要經濟部門。地理空間分析解決方案具有多種優勢,包括現場資料映射、組織和分析以及遠端作物監測。

- 該地區的農業部門正在大量採用地理空間分析解決方案,透過整合高解析度影像、實地觀察和即時資料饋送來了解如何充分利用有限的資源。 Esri Australia 等供應商正積極致力於農業領域的創新地理空間分析解決方案,進而影響市場成長。

- 此外,該地區還有許多精密農業提供者在推廣精密農業實踐。精密農業涉及多種技術的使用,包括 GPS、無人機、感測器和高級分析。精密農業實踐預計將要求使用地理空間分析來改善農場決策和規劃,並積極推動澳洲-紐西蘭地區農業部門對地理空間分析的需求。

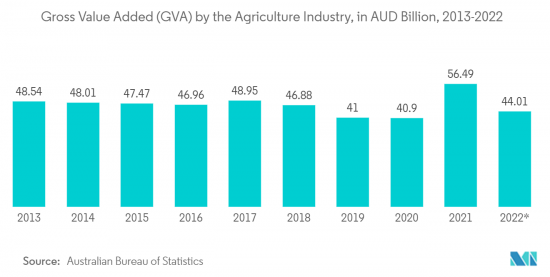

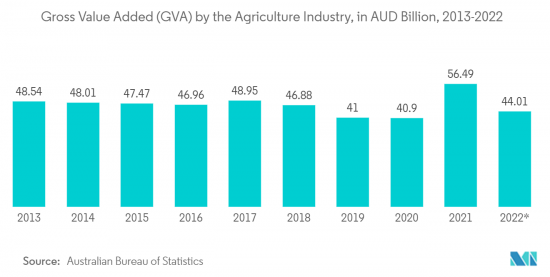

- 此外,農業對澳洲-紐西蘭地區至關重要,該產業積極推動了該地區的國內生產總值。市場供應商開發的農業專用地理空間解決方案為農業產業提供了成長前景,因為該地區的農業產業採用地理空間分析解決方案,這將對市場成長產生積極影響。例如,根據澳洲統計局的資料,截至2022年9月,澳洲農業附加價值毛額(GVA)達440.1億澳元(約289.2億美元)。

澳洲預計將出現顯著成長

- 由於從農業到城市規劃等終端用戶行業的需求不斷成長,預計澳洲在未來幾年將大量採用地理空間分析解決方案。此外,該國擁有著名的市場供應商,他們不斷為不同行業創新地理空間分析產品,對該國的市場成長產生了積極影響。

- 例如,Experian Australia 為國內零售業提供地理空間分析解決方案。透過地理空間分析和解決方案,該公司幫助零售商更有效地選擇位置,確定收益促進因素,更好地協調零售/分店服務、產品和消費者,以及更準確地衡量商店周轉率額。好處包括更準確的估計和更好地了解競爭影響。

- 此外,中國日益成長的都市化進一步增加了對地理空間分析解決方案的需求,以實現正確有效的城市規劃。例如,根據世界銀行的資料,澳洲的都市化將從2005年的84.22%上升到2022年的86.49%。此外,澳洲地理資訊系統、數位分析和遙感 (GDARS) 實踐領域委員會認知到地理資訊系統、數位分析和遙感在城市規劃和自然資源管理、災害應變和公共衛生等應用中發揮的重要作用。意識到我的角色。

- 此外,該國的公共產業正在與地理空間分析公司合作,解決圍繞網路協調的核心資料問題,並實施預測性維護策略,以減少網路故障和損壞。例如,2022年11月,Horizon Power的地理空間情報計畫將推出地理空間情報解決方案,利用遙感、影像和高級分析技術來轉變公用事業公司快速了解其網路健康狀況的能力。透過跨越數千公里的網路,地理資訊程序可以最佳化資產性能並保持網路的可靠和安全。該公用事業公司求助於地理空間專家 Altavec 來提供該程式。

澳洲和紐西蘭地理空間分析產業概述

澳洲-紐西蘭地理空間分析市場適度整合,少數大型供應商佔了重要的市場佔有率。該地區的市場參與企業正在熱衷於合作和收購活動,並推出整合先進技術的新型創新地理空間分析解決方案。澳洲-紐西蘭地理空間分析市場的主要市場供應商包括 NGIS Australia Pty Ltd (NGIS)、Alteryx、Hexagon AB、Esri Australia 和 Lynker Analytics Ltd。

2022 年 12 月,地理空間資料、分析和分析的專業供應商澳洲 Geospatial Intelligence Pty Ltd 宣布與全球領先的高解析度衛星影像供應商之一 Satellogic 建立新的合作夥伴關係。 Satellogic 設計、製造和營運地球觀測 (EO) 衛星,以實惠的價格收集高解析度影像。該公司的四個頻譜波段(藍色、紅色、綠色和近紅外線)經過正射校正、GIS 就緒,並以最低 70 公分解析度提供。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 智慧城市發展和城市規劃對地理空間分析的需求不斷成長

- 將人工智慧和機器學習等先進技術整合到地理空間分析解決方案中

- 市場抑制因素

- 與地理空間分析解決方案相關的成本上升

第6章市場區隔

- 按類型

- 表面分析

- 網路分析

- 地理視覺化

- 按行業分類

- 農業

- 公共產業和通訊

- 國防/資訊

- 政府機關

- 採礦/自然資源

- 汽車與運輸

- 醫療保健

- 房地產/建築業

- 按行業分類的其他最終用戶

- 按國家/地區

- 澳洲

- 紐西蘭

第7章 競爭形勢

- 公司簡介

- NGIS Australia Pty Ltd(NGIS)

- Alteryx

- Hexagon AB

- Esri Australia

- Lynker Analytics Ltd

- Intermap Technologies

- Mapizy Pty Ltd.

- New Zealand Geoanalytics Ltd.

- CoreLogic NZ Limited

- Abley Ltd

- Geospatial Intelligence Pty Ltd.

第8章投資分析

第9章 市場機會及未來趨勢

The ANZ geospatial analytics market size is expected to grow from USD 0.62 billion in the current year to USD 0.95 billion in the next five years at a CAGR of 9.13% during the forecast period. The ANZ geospatial analytics market is driven by the increasing demand from various public and private end-user industries, the presence of major market players, and the increasing demand for geospatial analytics in urban planning.

Key Highlights

- The ANZ geospatial analytics ecosystem has witnessed substantial growth in the past couple of years owing to the growth in innovative geospatial analytics solutions by the market players and the increasing use of advanced technologies such as artificial intelligence(AI) and machine learning(ML) for meaningful insights from the geospatial data. Moreover, the increasing use of location information to make informed decisions further drives the demand for geospatial capabilities and geospatial analytics solutions in the region.

- Market vendors in the region are using advanced technologies to offer innovative analytics capabilities in the geospatial domain, which is further analyzed to boost the demand for geospatial analytics solutions in the end-user industries across the region. For instance, Australia-based geospatial intelligence has considerable expertise in geospatial analysis, big data & link analytics, machine learning, artificial intelligence, and the development of effective user interfaces. These skills allow the company to develop sophisticated and innovative geospatial analytical tools that automate the extraction of data and information from large data sets and display this information in a format that supports informed decision-making.

- The increasing availability and accessibility of geospatial data from satellites, sensors, etc., aided the market's growth, as the geospatial data can provide substantial informed decisions and valuable insights by leveraging geospatial analytics solutions in organizations across the region. For instance, the National mapping agency Land Information New Zealand (LINZ) focused on publishing detailed geospatial data that models New Zealand's built and natural environments. LINZ shares its datasets-from road and river data to aerial imagery and LiDAR-on data.linz.govt.nz.

- Further, in May 2023, Vexcel Data Program announced free access to aerial imagery in New Zealand and Australia through its web-based platform, Viewer. This no-cost access provides commercial and government users with high-resolution, highly accurate imagery of major metro areas such as Perth, Auckland, Sydney, Melbourne, Brisbane, Wellington, and Christchurch. Australian and New Zealand organizations are eligible to participate in this free offering. Such factors are further expected to offer growth opportunities for the geospatial analytics market in the region over the forecast period. Such factors have driven organizations' demand for geospatial analytics solutions to maximize benefits and competitive edge from the spatial data from imagery, satellites, and sensors.

- During the COVID-19 pandemic, Geospatial Analytics Solutions witnessed substantial demand to offer Vital Information for Combating COVID-19 Pandemic in the region. Government organizations in the region, such as Emergency Management Spatial Information Network Australia (EMSINA), partnered with market vendors such as Esri Australia to combat the pandemic using geospatial datasets. Post-pandemic, the market is witnessing substantial growth owing to the increase in innovative and sophisticated geospatial analytics solutions developed by the major market vendors in the region.

ANZ Geospatial Analytics Market Trends

Agriculture Segment is Anticipated to Hold Significant Market Share

- The ANZ region's agriculture sector has grown substantially in the past few years, led by smart farming and precision agriculture practices. The region produces and exports a diverse range of agricultural products, including cattle, and wheat, making agriculture an important economic sector of the region. Various benefits are associated with geospatial analytics solutions, such as mapping field data, organizing and analyzing it, and monitoring their crops remotely.

- The agriculture sector in the region is witnessing substantial adoption of geospatial analytics solutions by integrating high-resolution imagery, field observations, and real-time data feeds to understand how to make the most of limited resources. Market vendors such as Esri Australia are actively innovating geospatial analytics solutions in the agriculture domain, thus impacting the growth of the market.

- Further, the region is promoting precision agriculture practices with the presence of many precision agriculture providers. Precision agriculture involves the use of various technologies, such as GPS, drones, sensors, and advanced analytics. Precision agriculture practices are expected to seek the use of geospatial analytics to improve farm decision-making and planning, thus positively driving the demand for geospatial analytics in the agriculture sector of the ANZ region.

- Additionally, agriculture is becoming vital in the ANZ region, with the industry actively driving the region's GDP. The agriculture industry's adoption of geospatial analytics solutions in the region owing to the agriculture sector-specific geospatial solutions developed by market vendors are further analyzed to offer growth prospects to the agriculture industry, thus positively impacting the growth of the market. For instance, according to the Australian Bureau of Statistics data, as of September 2022, the gross value added (GVA) of the agriculture industry in Australia reached AUD 44.01 billion (~USD 28.92 billion).

Australia is Expected to Witness Substantial Growth

- Australia is expected to witness substantial adoption of geospatial analytics solutions in the coming years owing to the growing demand from various end-user industries ranging from agriculture to urban planning. Moreover, the country is home to some of the prominent market vendors who are continuously innovating their geospatial analytics offerings for a diverse range of industries, thus positively impacting the market growth in the country.

- For instance, Experian Australia offers geospatial analytics solutions for the retail sector in the country. The company provides benefits for retail organizations through its geospatial analytics solutions, such as more effective site selection, identification of profitability drivers, better alignment between retail/branch services, products, and consumers, more accurate estimates of store turnover, and improved understanding of competitor impact.

- Moreover, the high degree of urbanization in the country is further driving the demand for geospatial analytics solutions for proper and effective urban planning. For instance, according to the data from the World Bank, urbanization in Australia increased from 84.22% in 2005 to 86.49% in 2022. Further, the GIS, Digital Analytics, and Remote Sensing (GDARS) Area of Practice Committee in Australia recognizes the critical role that GIS, digital analytics, and remote sensing play in various applications, from urban planning and natural resource management to disaster response and public health.

- Further, utility companies in the country are partnering with geospatial analytics companies to deal with core data issues with network alignment and implement predictive maintenance strategies to reduce network failures and damages. For instance, in November 2022, Horizon Power's Geospatial Intelligence Program leveraged remote sensing, imagery, and advanced analytic technologies to deliver a geospatial intelligence solution that transforms the utility's ability to understand the state of the network quickly. With a network spanning thousands of kilometers, the geospatial intelligence program will optimize asset performance and keep the network reliable and safe. The utility company has selected geospatial specialist Altavec to deliver the program.

ANZ Geospatial Analytics Industry Overview

The ANZ geospatial analytics market is moderately consolidated owing to a few major market vendors holding significant market share. The market players in the region are indulging in partnership and acquisition activities and launching new innovative geospatial analytics solutions with the integration of advanced technologies. A few major market vendors in the ANZ geospatial analytics market include NGIS Australia Pty Ltd (NGIS), Alteryx, Hexagon AB, Esri Australia, and Lynker Analytics Ltd, among others.

In December 2022, Australia-based Geospatial Intelligence Pty Ltd, a specialist geospatial data, analysis, and analytics provider, announced a new partnership with Satellogic, one of the leading global providers of high-resolution satellite imagery. Satellogic designs, builds, and operates its fleet of earth observation (EO) satellites to collect affordable, high-resolution imagery. Its four multispectral bands (blue, red, green, near-IR) are delivered ortho-rectified and GIS-ready, available at 70 cm resolution on nadir.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Geospatial Analytics in Smart City Development and Urban Planning

- 5.1.2 Integration of Advanced Technologies such as AI and ML in Geospatial Analytics Solutions

- 5.2 Market Restraints

- 5.2.1 Higher Costs Associated With Geospatial Analytics Solutions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Surface Analysis

- 6.1.2 Network Analysis

- 6.1.3 Geovisualization

- 6.2 By End-user Vertical

- 6.2.1 Agriculture

- 6.2.2 Utility and Communication

- 6.2.3 Defense and Intelligence

- 6.2.4 Government

- 6.2.5 Mining and Natural Resources

- 6.2.6 Automotive and Transportation

- 6.2.7 Healthcare

- 6.2.8 Real Estate and Construction

- 6.2.9 Other End-user Verticals

- 6.3 By Country

- 6.3.1 Australia

- 6.3.2 New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NGIS Australia Pty Ltd (NGIS)

- 7.1.2 Alteryx

- 7.1.3 Hexagon AB

- 7.1.4 Esri Australia

- 7.1.5 Lynker Analytics Ltd

- 7.1.6 Intermap Technologies

- 7.1.7 Mapizy Pty Ltd.

- 7.1.8 New Zealand Geoanalytics Ltd.

- 7.1.9 CoreLogic NZ Limited

- 7.1.10 Abley Ltd

- 7.1.11 Geospatial Intelligence Pty Ltd.