|

市場調查報告書

商品編碼

1403053

地理空間分析 -市場佔有率分析、產業趨勢/統計、2024 年至 2029 年成長預測Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

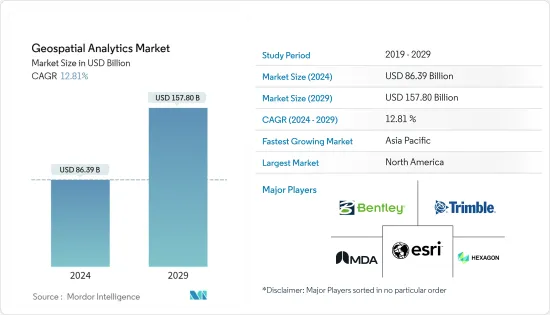

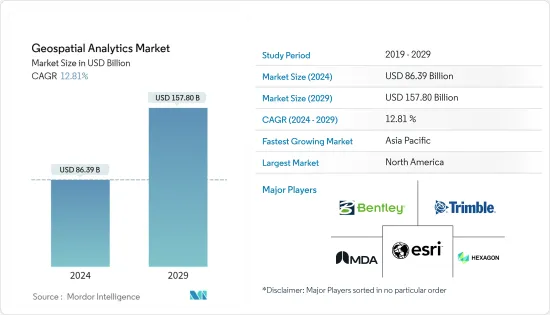

地理空間分析市場規模預計到 2024 年為 863.9 億美元,預計到 2029 年將達到 1578 億美元,在預測期內(2024-2029 年)複合年成長率為 12.81%。

主要亮點

- 區域分析操作、收集和顯示地理資訊系統 (GIS)資料和影像,例如衛星和 GPS 影像。區域分析基於地理座標和特定識別碼(例如街道和郵遞區號)。

- 在這個資料主導的工業時代,使用互聯技術(擴增實境、巨量資料、資訊、機器學習、物聯網、3D技術)的位置和空間資料正在改變傳統商業實踐的核心,透過資料視覺化驅動競爭優勢。消費者應用程式和企業層級對地理空間內容、即時資料和服務的需求持續成長。

- 5G還有望透過數位測繪和定位智慧技術幫助解決災害管理和氣候變遷等環境問題。 5G 和物聯網的連接性、速度和容量預計將減少溫室氣體排放、提高能源效率並更好地利用可再生資源。 5G 預計也將有助於改善有關天氣、植被和廢棄物管理的決策,並增加對地理空間分析的要求。

- 一個促進因素是人們對智慧城市發展的日益接受。地理空間分析解決方案已成為智慧城市發展的平台。地理資訊系統(GIS)已成為智慧城市日常生活的重要組成部分。 GIS 提供了IT基礎設施,整合了從規劃和設計到開發和維護的所有相關人員和所有智慧城市流程。

- 地理空間資料創建和分析廣泛應用於政府、商業和科學領域。然而,位置資料固有的敏感性特徵阻礙了地理空間研究及其社會應用。隨著GIS及相關地理空間技術的使用增加,社會對隱私的擔憂增加,政府法規限制資料收集、資訊共用、基於資訊的資訊使用和資料存儲,事實就是如此。預計這將阻礙市場成長。

- COVID-19 大流行對地理空間分析市場的影響可以忽略不計,包括醫療機構和政府在內的許多公司在大流行期間採用地理空間技術進行製藥和藥物輸送。使用地理空間分析對影響反應措施的因素進行分類。

- 然而,許多公司正在更新他們的解決方案,以自動化機器學習和人工智慧技術,以提供準確的見解。隨著5G技術的出現,這種趨勢在預測期內可能會持續增加。預計新的新興企業將在不久的將來增加對地理空間分析市場的需求。

地理空間分析市場趨勢

國防和情報將成為最大的最終用戶產業

- 地理空間系統允許軍隊透過GIS技術識別部隊和基地的位置以及重要的相關資訊。此技術用於國防土地管理,軍隊管理各級指揮的基地和分隊。您可以追蹤部隊動向、尋找資源並規劃任務。它也用於識別空對地轟炸任務的目標。它透過為指定的興趣區域提供不同程度的地形細節來幫助軍事目標識別。

- 國防和安全機構相關人員表示,地理空間資料在各種關鍵資料管理應用中發揮關鍵作用,包括災害、軍事行動、緊急管理、環境監測、土地和城市規劃等。

- 此外,地理空間技術的進步使得以前所未有的精度繪製行星和其他天體地圖成為可能,將來自衛星和探測器的資料和照片探勘為豐富的空間資訊。儘管太空人尚未踏上火星土壤,但科學家們正在藉助地理空間分析來熟悉火星地形的特殊性。

- 根據這些努力收集的空間資訊創建的行星地圖和馬賽克將提高我們對太空中遙遠天體的地質、地形和景觀的理解。美國地質調查局的天體地質科學中心提供了包括新視野號在內的各種任務收集的圖像和資料,並向研究人員和公眾開放。資料庫包括月球、火星、冥王星、土星、水星等的影像,可使用地理空間分析技術進行進一步分析。

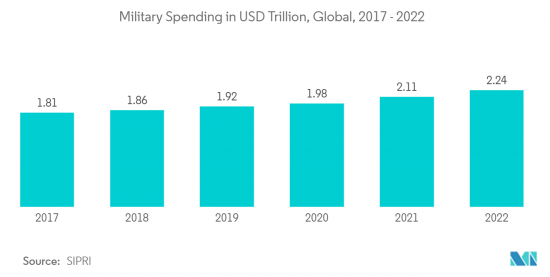

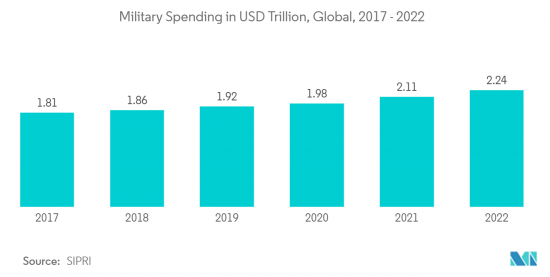

- 此外,政府在該領域的投資增加可能會在預測期內進一步推動研究市場需求。例如,根據SIPRI的數據,2022年全球軍費支出達到2.24兆美元,創該時期最高水準。

北美佔據主要市場佔有率

- 美國和加拿大建設產業的成長預計將增加對 3D 測繪和建模的需求,預計在預測期內也將成長。施工過程使用複雜的 3D 繪圖和地理空間分析來創建逼真的模型,這比使用滾動的藍圖更可取。這進一步推動了該地區的市場需求。

- 這就是為什麼公司正在採用位置追蹤解決方案來追蹤和監控其員工以及他們接觸的事物。此外,資訊分析有助於定義限制組織內團隊之間溝通的空間邊界。

- 2022 年 11 月,為物聯網設備提供 5G 連接的美國微型衛星電信業者Sateliot 將在SpaceX Falcon 9 火箭上部署一顆功能性微型衛星,以加速大規模物聯網部署。它已將物聯網產業轉向更便宜的全球連接,並帶來創新相當於GPS的引入。 Sateliot旨在透過部署一個由小型、強大的衛星組成的網路,為世界每個角落,包括災區、海洋和偏遠地區提供全面可靠的覆蓋來解決這些問題。此外,無論營運商如何,任何標準物聯網設備都可以使用該技術。

- 例如,2022 年 11 月,AWS IoT Core 這項託管雲端服務允許用戶連接數十億個 IoT 裝置並將數兆個訊息路由到 AWS 服務,將推出 AWS IoT Core Device Location。這項進階功能允許使用者使用緯度和經度座標等位置資訊來管理和追蹤物聯網設備。 Amazon Web Services IoT Core Device Location 讓客戶能夠最佳化業務流程、簡化維護並開拓新的使用案例。例如,您的現場服務團隊可以隨時資訊並輕鬆識別需要維護的設備。全球定位服務 (GPS) 是確定物聯網應用中物聯網設備位置的常用標準。

- 此外,雲端基礎的GIS 的快速採用以及 VR 和 AR 技術在地理資訊系統中的應用預計將對預測期內的市場成長產生重大影響。

地理空間分析產業概述

地理空間分析市場的特徵是整合不斷加強,多家主要企業在特定地區或國家佔據主導地位。這些主要企業包括 ESRI Inc.、通用電氣 (GE)、Hexagon AB、MDA Corporation、Bentley Systems, Inc.、Trimble Geospatial 等。這些產業巨頭採用各種策略來保持競爭。

2023 年 7 月,國際太空技術供應商 Locana 與致力於支援和擴展 OpenStreetMap (OSM)計劃的非營利組織 OpenStreetMap 美國聯手。 OSM 旨在增強對高品質地理資料的訪問,降低利用定位智慧的成本,並使更多組織能夠利用定位資料提供的見解。

2023年2月,GE再生能源的電網解決方案業務贏得了尼泊爾電力局(NEA)價值數百萬美元的合約。該合約包括尼泊爾各地 39 個不同額定功率的變電站的自動化。它還包括建造六個主控制中心(MCC),標誌著尼泊爾電力基礎設施的重大發展。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 智慧城市發展的採用率不斷提高

- 5G的引入推動市場成長

- 市場挑戰

- 高成本和營運問題

- 法律障礙

- 評估 COVID-19 對地理空間分析市場的影響

第6章市場區隔

- 按類型

- 表面分析

- 網路分析

- 地理空間視覺化分析

- 按行業分類

- 農業

- 公共產業和通訊

- 國防/資訊

- 政府機關

- 自然資源

- 按行業分類的其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- ESRI Inc.

- MDA LTD.

- Hexagon AB

- TRIMBLE INC.

- Bentley Systems, Inc.

- Fugro NV

- L3harris Technologies, Inc.

- ATKINS PLC(SNC LAVLIN GROUP)

- General Electric(GE)

- Critigen LLC(Locana Formerly CRITIGEN)

- Intermap Technologies Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Geospatial Analytics Market size is estimated at USD 86.39 billion in 2024, and is expected to reach USD 157.80 billion by 2029, growing at a CAGR of 12.81% during the forecast period (2024-2029).

Key Highlights

- Geospatial analysis manipulates, collects, and displays geographic information system (GIS) data and imagery, such as satellite and GPS imagery. Geospatial analysis is based on geographic coordinates and specific identifiers, including street or postal codes.

- In this data-driven industrial age, location information and spatial data using interconnected technologies (augmented reality, big data, artificial intelligence, machine learning, IoT, and 3D technology) are transforming the core of traditional business practices, driving the competitive advantage through data visualization. The need for geospatial content, real-time data, and services at the consumer application and enterprise level is constantly increasing.

- 5G is also expected to aid in addressing environmental challenges such as disaster management and climate change through digital mapping and location intelligence technologies. The connectivity, speed, and capacity of 5G and IoT are expected to reduce greenhouse gas emissions, improve energy efficiency, and enable better renewable resource use. 5G is also anticipated to help improve decision-making about weather, vegetation, and waste management, increasing the requirement for geospatial analytics.

- The driving factor is the increasing acceptance of smart city development. Geospatial analytics solutions have become the platform for smart city growth. Geographic information system (GIS) has become an integral part of everyday life in smart cities. GIS provides an IT infrastructure that integrates all stakeholders and all smart city processes, from planning and design to development and maintenance.

- Geospatial data creation and analysis are extensively utilized in governments, corporations, and scientific fields. Still, the inherent confidentiality features of location data create obstacles for geospatial research and its societal applications. The public concern over privacy was raised with the increasing usage of GIS and related geospatial technologies, and government rules and regulations restrict data gathering, location sharing, usage of location-based information, and data storage. This is expected to hinder the market's growth.

- The impact of the COVID-19 pandemic on the geospatial analytics market was negligible, with many companies, such as healthcare institutions and governments, adopting geospatial technologies for medicines and drug delivery during the pandemic. Influencing response efforts are categorized using geospatial analysis.

- However, many companies are updating their solutions to automate ML and AI technologies to offer accurate insights. With the advent of 5G technology, this trend will continue to increase during the forecast period. New start-ups are expected to boost the demand for the geospatial analytics market in the near future.

Geospatial Analytics Market Trends

Defense and Intelligence to be the Largest End-user Industry

- The geospatial systems allow the military to identify the locations of troops, bases, and important related information through GIS technology. The technology is used for defense site management for the military to manage bases and detachments across all levels of command. It can track troop movements, locate resources, and plan missions. It is also used in identifying targets for air-to-ground bombing missions. It has helped the military with target identification by providing various levels of topographical detail for a designated area of interest.

- According to the official sources in defense and security establishments, Geospatial data plays a vital role in a broad spectrum of critical data management applications, such as disaster, military operations and emergency management, environmental monitoring, and land and city planning.

- Furthermore, advancement in Geospatial technology enables more precise mapping of planets and additional celestial bodies than ever possible, turning the data and pictures that satellites and rovers send back into a wealth of spatial information. Although no astronaut has yet set foot on Martian soil, scientists have become highly familiar with the terrain's qualities with the help of Geospatial analytics.

- Planetary maps and mosaics generated from the spatial information gathered from these efforts build an understanding of the geology, topology, and landscape of distant objects in space. The US Geological Survey's Astrogeology Science Center delivers access to the images and data collected by various missions, including New Horizons, for use by researchers and the public. The database features visuals from the moon, Mars, Pluto, Saturn, Mercury, and more, with the compatibility to use geospatial analytics technology for further analysis.

- Moreover, increasing government investments in this sector may further propel the studied market demand in the projection period. For instance, According to SIPRI, in 2022, military spending worldwide amounted to USD 2.24 trillion, the highest during the period under consideration.

North America to Hold Significant Market Share

- The growth of the construction industry in the US and Canada is anticipated to increase the demand for 3D Mapping, and modeling is expected to grow during the forecast period, as the building process uses sophisticated 3D Mapping and geospatial analytics to create realistic modeling, which is preferable to using rolls of blueprints. This is further fueling the market's demand in the region.

- Therefore, companies are adopting location-tracking solutions to track and monitor their employees and what they come in contact with. Furthermore, location analytics can assist in defining the spatial boundaries to restrict inter-team communication within an organization.

- In November 2022, Sateliot, the United States-based nanosatellite telecommunications company to provide 5G connectivity for IoT devices, introduced its functional nanosatellite aboard a SpaceX Falcon 9 rocket to accelerate the massive IoT adoption and shift the IoT industry into cheap global connectivity, bringing a technological innovation on par with the introduction of GPS. Sateliot intends to resolve these problems by introducing a network of small, powerful satellites to offer total, reliable coverage to each corner of the world, including disaster zones, oceans, and remote regions. Moreover, this technology will work for anyone with any standard IoT device, regardless of operator.

- For instance, in November 2022, AWS IoT Core, a managed cloud service that allows users to connect billions of IoT devices and routes trillions of messages to AWS services, introduced AWS IoT Core Device Location. This advanced feature makes it possible for users to manage and track IoT devices leveraging their location data, such as longitude and latitude coordinates. Customers can optimize their business processes, streamline and simplify maintenance efforts, and unlock new use cases by using Amazon Web Services IoT Core Device Location. For instance, users' field service teams can stay informed and easily identify the location of devices that need maintenance action. Global Positioning Service (GPS) is a commonly applied standard to locate an IoT device in an IoT application.

- Moreover, adopting cloud-based GIS and the surge in the application of VR and AR technologies in geographic information systems are anticipated to have a significant impact on the market growth during the forecast period.

Geospatial Analytics Industry Overview

The geospatial analytics market is characterized by consolidation, with several prominent companies dominating specific regions and countries. These key players include ESRI Inc., General Electric (GE), Hexagon AB, MDA Corporation, Bentley Systems, Inc., Trimble Geospatial, and others. These industry giants employ various strategies to maintain a competitive edge.

In July 2023, Locana, an international spatial technology provider, joined forces with OpenStreetMap US, a nonprofit organization dedicated to supporting and expanding the OpenStreetMap (OSM) project. OSM aims to enhance access to high-quality geographic data, reduce the cost of utilizing location intelligence, and enable more organizations to leverage insights derived from location data.

In February 2023, GE Renewable Energy's Grid Solutions business secured a multi-million dollar contract from the Nepal Electricity Authority (NEA). This agreement involves the automation of 39 substations with varying ratings across Nepal. Additionally, it encompasses the construction of six Master Control Centers (MCCs), marking a significant development in Nepal's electrical infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Adoption of Smart City Development

- 5.1.2 Introduction of 5G to Boost Market Growth

- 5.2 Market Challenges

- 5.2.1 High Costs and Operational Concerns

- 5.2.2 Legal Hurdles

- 5.3 Assessment of Impact of COVID-19 on Geospatial Analytics Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Surface Analysis

- 6.1.2 Network Analysis

- 6.1.3 Geovisualization Analysis

- 6.2 By End-user Vertical

- 6.2.1 Agriculture

- 6.2.2 Utility and Communication

- 6.2.3 Defense and Intelligence

- 6.2.4 Government

- 6.2.5 Natural Resources

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 ESRI Inc.

- 7.1.2 MDA LTD.

- 7.1.3 Hexagon AB

- 7.1.4 TRIMBLE INC.

- 7.1.5 Bentley Systems, Inc.

- 7.1.6 Fugro NV

- 7.1.7 L3harris Technologies, Inc.

- 7.1.8 ATKINS PLC (SNC LAVLIN GROUP)

- 7.1.9 General Electric (GE)

- 7.1.10 Critigen LLC (Locana Formerly CRITIGEN)

- 7.1.11 Intermap Technologies Inc.