|

市場調查報告書

商品編碼

1407082

螯合劑:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Chelating Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

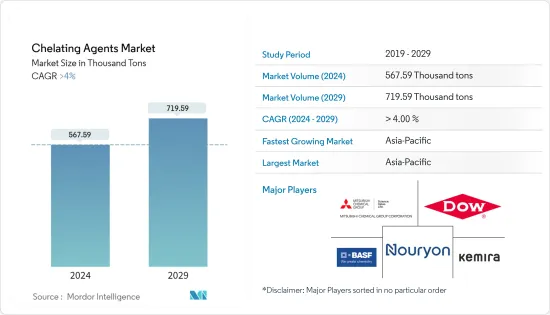

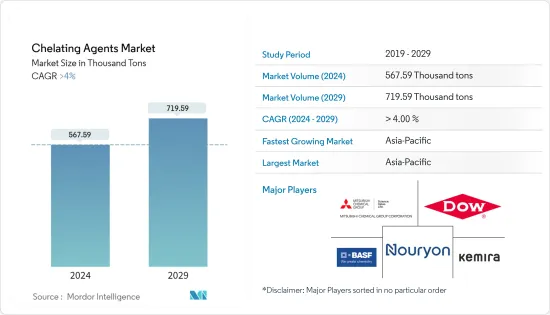

螯合劑市場規模預計到2024年為567,590噸,預計到2029年將達到719,590噸,在預測期內(2024-2029年)複合年成長率超過4%。

2020 年,市場受到 COVID-19 大流行的負面影響。 2020年上半年,受新冠肺炎(COVID-19)疫情影響,製漿造紙產業成長大幅下滑。結果,螯合劑的消耗受到不利影響。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

居家清洗應用對螯合劑的需求不斷增加預計將推動市場成長。

另一方面,非生物分解分解的螯合劑對環境的負面影響預計將在預測期內抑制市場成長。

此外,一些最終用戶產業對綠色螯合劑的需求不斷成長,可能會在未來為全球市場提供利潤豐厚的成長機會。

亞太地區主導全球市場,中國、印度和日本等國家是最大的消費國。

螯合劑市場趨勢

清洗應用中螯合劑的消耗量增加

- 螯合劑主要用於清洗應用。螯合劑用於各種清洗產品,因為它們在防止硬水中的礦物質干擾清洗過程方面發揮著重要作用。

- 除了清洗之外,螯合劑還具有許多好處,包括延長清洗產品的保存期限、保持顏色、提供抗菌作用以及防止鎳和鉻引起的過敏。

- 當用於肥皂和清潔劑時,螯合劑有助於防止金屬污漬並加速漂白劑的分解。另一方面,用於生產工業清洗液的螯合劑可透過鬆動、分解和溶解附著在設備表面的不溶鹽來幫助去除水垢和鐵鏽。

- 人們對保持個人和周圍環境衛生的意識不斷增強,刺激了許多全球清潔劑製造公司的發展,並開拓了家庭清洗配方需求的不斷成長。

- 例如,2022年5月,生產Aerial和Tide等品牌的寶潔公司(P&G)投資20億印度盧比(約2,652萬美元)在海德拉巴建造了一家液體清潔劑製造工廠。

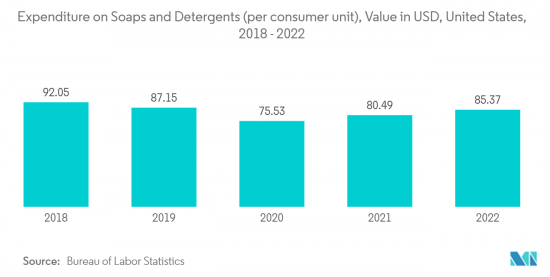

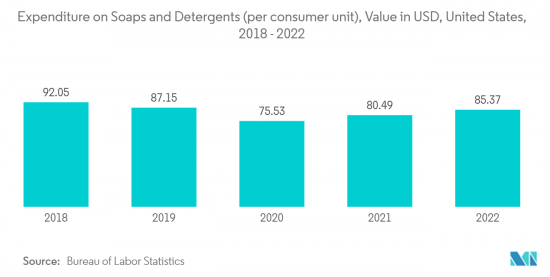

- 根據美國勞工統計局預測,2022年美國每位消費者在肥皂和清潔劑的平均年支出約為85.37美元,與前一年同期比較增加6%。

- 因此,綜合考慮以上因素,預計近期清洗應用領域對螯合劑的需求將大幅成長。

亞太地區主導市場

- 由於中國、印度等主要國家造紙和紙漿行業、清洗劑、污水處理、農業化學品、製藥行業應用等的擴張,預計亞太地區將在預測期內佔據螯合劑市場的最大市場和日本。將會完成。

- 亞太地區對家用和工業清潔劑的需求成長最快。由於快速工業化,方便易用的清潔劑在這些國家很普及。

- 螯合劑廣泛用於紙漿和紙張漂白,該行業的成長得益於電子商務活動的活性化。紙質軟包裝解決方案已成為傳統塑膠包裝的耐用且環保的替代品。紙質包裝的普及正在加強紙漿和造紙業對螯合劑的需求基本面。

- 中國造紙協會公佈的資料顯示,2022年,全球最大的造紙國中國製漿、造紙及紙製品產業總產量達28,391萬噸。這比 2021 年小幅成長了 1.32%,對所研究的市場產生了正面影響。

- 此外,隨著環境法規的收緊以及日常生活中對優質安全水的日益偏好,亞太地區的污水處理量正在迅速增加。中國、印度和日本食品和飲料、製藥、化學和個人護理行業的快速成長,以及人口規模的擴大和消費者消費能力的增強,正在迅速增加對螯合劑的需求並推動市場成長。我認為它將進一步增加。

- 上述因素預計將在預測期內推動亞太地區螯合劑市場的成長。

螯合劑產業概況

螯合劑市場因其性質而部分整合。主要企業(排名不分先後)包括陶氏化學、BASF股份公司、諾力昂、凱米拉和三菱化學集團。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 居家清潔劑使用量增加

- 製漿造紙工業中螯合劑的消耗量增加

- 水處理應用需求不斷成長

- 抑制因素

- 與非生物分解的螯合劑相關的環境風險

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 非生物分解

- 生物分解性

- 目的

- 清潔工

- 紙漿/紙

- 水處理

- 農藥

- 化學品

- 食品和飲料

- 藥品

- 個人護理

- 其他用途(攝影、紡織加工等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- ADM

- Ascend Performance Materials

- Ava Chemicals Pvt. Ltd.

- BASF SE

- Bozzetto Group

- Chemtex Specialty Limited

- Dow

- Hexion

- Kemira

- Lanxess

- Macrocyclics

- Merck KGaA

- Mitsubishi Chemical Holdings Corporation

- Nagase & Co., Ltd.

- Nippon Shokubai Co., Ltd.

- Nouryon

- Shandong IRO Chelating Chemical Co. Ltd.

- Tate & Lyle PLC

- Tosoh Corporation

- Zhonglan Industry Co., Ltd.

第7章 市場機會及未來趨勢

- 對綠色螯合劑的認知和需求不斷成長

- 擴大醫藥產業

The Chelating Agents Market size is estimated at 567.59 Thousand tons in 2024, and is expected to reach 719.59 Thousand tons by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic in 2020. Due to the COVID-19 outbreak in the first half of 2020, the pulp and paper industry experienced a substantial clog in its growth rate. This, in turn, unfavorably impacted the consumption of chelating agents. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Increasing demand for chelating agents from household cleaning applications is expected to fuel market growth.

On the flip side, the adverse effects of non-biodegradable chelating agents on the environment are anticipated to restrain the growth of the market over the forecast period.

Further, the growing demand for green chelating agents in several end-user industries is likely to create lucrative growth opportunities for the global market in the future.

The Asia-Pacific region dominated the market around the world, with countries like China, India, and Japan being the biggest consumers.

Chelating Agents Market Trends

Increasing Consumption of Chelating Agents in Cleaning Applications

- Chelating agents are used majorly in cleaning applications. A variety of cleaning formulations are derived using chelating agents owing to their vital role in preventing interference in the cleaning process from the minerals present in hard water.

- Apart from cleaning, the chelating agents demonstrate many other advantages, such as improving the shelf life of the products being cleaned, maintaining color, imparting antimicrobial effects, preventing allergies from nickel or chromium, etc.

- When used in soaps and detergents, the chelating agents facilitate the prevention of metal staining as well as the premature decomposition of bleaching agents. On the other hand, the chelating agents used in making industrial cleaning solutions aid in scale and rust removal by loosening, breaking up, and dissolving insoluble salt deposits on the equipment's surface.

- The growing consciousness for hygiene maintenance in personal and surrounding spaces has stimulated many global detergent manufacturing companies to tap into the surging demand for domestic cleaning formulations.

- For instance, In May 2022, Proctor & Gamble (P&G), the manufacturer of brands like Aerial and Tide, invested INR 2 billion (~ USD 26.52 million) in the construction of a liquid detergent manufacturing plant in Hyderabad.

- According to the Bureau of Labor Statistics, the average annual expenditures for soaps and detergents in the United States amounted to roughly USD 85.37 per consumer unit in 2022, reflecting an increase of 6% compared to the previous year.

- Therefore, considering the factors mentioned above, the demand for chelating agents is expected to rise in the cleaners application segment significantly in the near future.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for chelating agents market during the forecast period owing to the expanding paper and pulp sector, cleaners, wastewater treatment, agrochemicals, and pharmaceutical industry applications etc. in major countries such as China, India, Japan, etc.

- The Asia-Pacific is witnessing the fastest growth in the demand for both household and industrial detergents. The fast-paced industrialization has made way for the penetration of convenient and easy-to-apply cleaners in these countries.

- Chelating agents find wide usage in the bleaching of pulp and paper, an industry whose growth is being propelled by the rise in e-commerce activities. The paper-based flexible packaging solutions have emerged as durable and environment-friendly alternatives to conventionally used plastic packaging. The popularity of paper-based packaging has fortified the demand fundamentals for chelating agents in the pulp and paper industry.

- China, the world's largest paper manufacturing country, according to the data published by the China Paper Association, the total output of the pulp, paper, and paper products industry reached 283.91 million tons in 2022. This is a slight increase of 1.32 percent from 2021, thus positively impacting the studied market.

- In addition, the wastewater treatment in the Asia-Pacific region has rapid increase with tightening environmental regulations and a growing preference for high-quality and safe water in day-to-day life. Rapidly growing food and beverage, pharmaceutical, chemical, and personal care sectors in China, India, and Japan, with growing population size and strengthening consumer spending power, are spiraling the demand for chelating agents, which will further enhance the growth of the market studied.

- In June 2022, an environmental protection company that focuses on water environment management, named China Everbright Water, secured the expansion and upgrading project of the Zhangdian East Chemical Industry Park Industrial Wastewater Treatment in Zibo City, Shandong Province. This project will be operated on a BOT (Build-Operate-Transfer) model, with a designed daily industrial wastewater treatment capacity of around 5,000 m3.

- All the factors mentioned above are likely to fuel the growth of the Asia-Pacific chelating agents market over the forecast period.

Chelating Agents Industry Overview

The chelating agents market is partially consolidated in nature. The major players (not in any particular order) include Dow, BASF SE, Nouryon, Kemira, and Mitsubishi Chemical Group Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Cleaners in Households

- 4.1.2 Escalating Chelating Agents Consumption in the Pulp and Paper Industry

- 4.1.3 Growing Demand in Water Treatment Applications

- 4.2 Restraints

- 4.2.1 Environmental Risks Associated With Non-Biodegradable Chelating Agents

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Non-biodegradable

- 5.1.2 Biodegradable

- 5.2 Application

- 5.2.1 Cleaners

- 5.2.2 Pulp and Paper

- 5.2.3 Water Treament

- 5.2.4 Agrochemicals

- 5.2.5 Chemical

- 5.2.6 Food and Beverages

- 5.2.7 Pharmaceuticals

- 5.2.8 Personal Care

- 5.2.9 Other Applications (Photography, Textile Processing, Etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Ascend Performance Materials

- 6.4.3 Ava Chemicals Pvt. Ltd.

- 6.4.4 BASF SE

- 6.4.5 Bozzetto Group

- 6.4.6 Chemtex Specialty Limited

- 6.4.7 Dow

- 6.4.8 Hexion

- 6.4.9 Kemira

- 6.4.10 Lanxess

- 6.4.11 Macrocyclics

- 6.4.12 Merck KGaA

- 6.4.13 Mitsubishi Chemical Holdings Corporation

- 6.4.14 Nagase & Co., Ltd.

- 6.4.15 Nippon Shokubai Co., Ltd.

- 6.4.16 Nouryon

- 6.4.17 Shandong IRO Chelating Chemical Co. Ltd.

- 6.4.18 Tate & Lyle PLC

- 6.4.19 Tosoh Corporation

- 6.4.20 Zhonglan Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Awareness and Demand for Green Chelating Agents

- 7.2 Expanding Pharmaceutical Industry