|

市場調查報告書

商品編碼

1402967

農業螯合化合物市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測Agricultural Chelates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

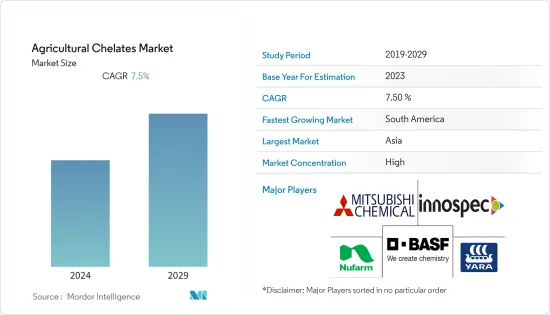

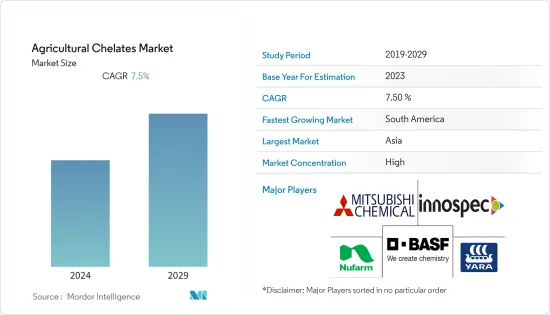

預計到 2024 年,農業螯合物市值將達到 11 億美元,預測期內複合年成長率為 7.5%。

主要亮點

- 不斷變化的氣候條件、減少的耕地和不斷增加的全球人口正在增加人們對糧食安全的擔憂。因此,螯合物在農業領域的使用顯著增加,以提高作物產量並滿足全球糧食需求。螯合透過提供某些營養物質來幫助改善植物的營養吸收。這個過程改善了植物的生長和發育,並提高了作物的產量和品質。

- 由於土壤的異質性和複雜性,傳統的微量營養素很容易被氧化或沉澱。螯合可防止微量營養素在溶液和土壤中發生不良反應。螯合肥料可提高鐵、銅、錳和鋅等微量營養素的生物利用度,有助於提高經濟作物生產的生產力和盈利。當作物生長在微量營養素壓力較低或 pH 值高於 6.5 的土壤中時,螯合肥料可以比常規微量營養素提高商業性產量。

- 隨著永續農業的興起以及人們日益認知到合成螯合物對環境的負面影響,對生物分解性螯合物的需求不斷增加。因此,每家公司都充分利用客戶需求並保持市場主導地位。

- 例如,美國特殊化學品製造商 Innospec 於 2022 年推出了生物分解性螯合物 ENVIOMET® C。 ENVIOMET(R) C生物分解釋放到環境中後會迅速生物分解,進而降低與鉛(Pb) 等重金屬形成持久性有機螯合物的可能性。因此,土壤堆積和地下水污染的風險較小。

- 因此,上述因素預計將在研究期間刺激市場成長。

農業螯合物市場趨勢

農業領域越來越青睞 EDTA

- 乙二胺四乙酸 (EDTA) 是農業中使用最廣泛的合成螯合物之一,應用於土壤和葉面噴布營養劑。 EDTA 也可用於 pH 值為 6.0 的土壤中進行露地施肥。 EDTA由於其廣泛的應用而擁有最大的市場佔有率。

- EDTA 螯合物比其他無機來源更受青睞,因為它能有效地將微量元素(如鐵(Fe)、錳(Mn)、銅(Cu) 和鋅(Zn))從土壤吸收到植物根部。這種情況很少見。

- 鋅是一種微量營養素,對於植物激素平衡和生長素活性很重要,對於植物生長至關重要。有機螯合鋅源如 Zn-EDTA (12% Zn) 通常被認為優於無機鋅源。對於玉米和豆類,使用 Zn-EDTA 螯合肥料代替硫酸鋅 (ZnSO4) 需要總量的一半。 EDTA 螯合物比其他市售農業螯合物相對便宜且更容易取得。

- 市場領先公司擁有用於農業投入品的全面的 EDTA產品系列。例如,Corteva 提供各種 EDTA 螯合物,例如 Versenol 和 Crop Max,這些產品在農業領域的需求量很大。與其他市售農業螯合物相比,EDTA 螯合物相對便宜且容易取得。處理土壤中汞、鎘和鉛毒素的能力將在預測期內促進 EDTA 螯合物的成長。

亞太地區主導市場

- 亞太地區擁有最大的農業螯合物市場規模,主要由中國、印度和日本推動。中國是人口最多的國家,擁有世界上一些最大的農業設施。人口的快速成長和對糧食需求的增加迫使農民種植產量作物。因此,國內需要農業螯合物。

- 據澳洲政府稱,鹼性土壤約佔澳洲國土面積的23.8%,西澳土壤pH值在4至8.5之間。因此,由於微量元素效率限制了農業生產力的成長,澳洲對 EDTA 螯合物的需求正在增加。

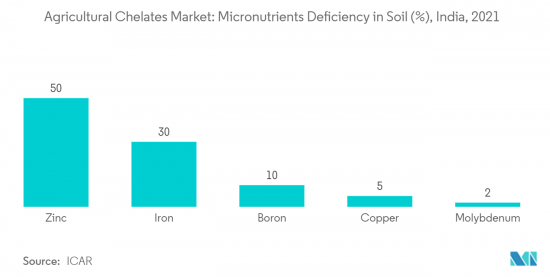

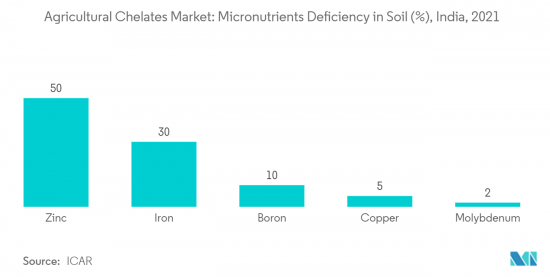

- 印度存在微量營養素缺乏:鋅 36.5%、溴 24.2%、鐵 12.8%、錳 7.1%、銅 4.2%。結果是,農產品的產量和營養品質顯著降低。由於土壤養分缺乏以及螯合物的有效性,該國對螯合物的需求正在增加。印度市場的成長速度預期溫和。

農業螯合物產業概況

全球農業螯合物市場集中。該市場的主要企業包括 Yara International ASA、 BASF SE、Nufarm、Mitsubishi Chemical Corporation 和 Innospec Inc.。這些參與企業的巨大市場佔有率歸因於其高度多元化的產品系列以及回顧期間的收購和合作夥伴關係。這些公司也專注於研發和產品創新,以擴大其地理影響力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對農作物產量的需求

- 螯合劑在微量營養素中毒的應用

- 土壤微量營養素缺乏

- 市場抑制因素

- 螯合物的非生物分解

- 有機農業的興起與合成螯合物使用的限制

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 合成

- EDTA

- EDDHA

- DTPA

- IDHA

- 其他組合類型

- 有機的

- 蘋果硫酸鹽

- 胺基酸

- 七葡萄糖酸鹽

- 其他有機類型

- 合成

- 目的

- 土壤

- 葉面噴布

- 施肥

- 其他用途

- 作物類型

- 糧食

- 豆類和油籽

- 經濟作物

- 水果和蔬菜

- 草坪/觀葉植物

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Yara International ASA

- Nouryon

- BASF SE

- Shandong Iro Chelating Chemical Co. Ltd

- Haifa Negev technologies Ltd

- Ava Chemicals Private Limited

- Protex International

- Mitsubishi Chemical Corporation

- Deretil Agronutritional

- Innospec Inc.

第7章 市場機會及未來趨勢

The agricultural chelates market is valued at USD 1.1 billion in 2024 and is projected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- Changing climatic conditions, decreasing availability of arable land, and increasing global population are raising food security concerns. As a result, there has been a significant rise in the use of chelating agents in the agriculture sector to improve crop yield and meet global food demand. Chelating agents help improve plant nutrient uptake by making certain nutrients available. This process can improve plant growth and development and increase crop yield and quality.

- Since soil is heterogeneous and complex, traditional micronutrients are readily oxidized or precipitated. Chelation keeps a micronutrient from undesirable reactions in solution and soil. Chelated fertilizers improve the bioavailability of micronutrients, such as Fe, Cu, Mn, and Zn, and, in turn, contribute to the productivity and profitability of commercial crop production. Chelated fertilizers have more potential to increase commercial yield than regular micronutrients when the crop is grown in low-micronutrient stress or soils with a pH greater than 6.5.

- With the rise of sustainable farming and the increasing awareness of the adverse environmental impact of synthetic chelating agents, there has been a rise in the demand for biodegradable chelating agents. Therefore, companies are capitalizing on customers' needs to uphold a leading position in the market.

- For instance, in 2022, Innospec, a US-based specialty chemical company, launched ENVIOMET® C biodegradable chelating agents. When released into the environment, ENVIOMET® C chelating agents rapidly biodegrade, reducing the possibility of forming persistent organic chelates with heavy metals, such as lead (Pb). This results in less risk of soil accumulation and underground water pollution.

- Therefore, the abovementioned factors are anticipated to stimulate market growth during the study period.

Agricultural Chelates Market Trends

Increasing Preference for EDTA in Agriculture

- Ethylenediaminetetraacetic acid (EDTA) is one of the most extensively used synthetic chelating agents in agriculture and finds applications in soil and foliar-applied nutrients. EDTA can also be used for open-field fertigation in the case of soil with a pH range of 6.0. Its wide application is a significant reason behind its holding the largest market share.

- EDTA chelates are widely preferred over other inorganic sources, as they are effective in the uptake of trace elements, such as iron (Fe), manganese (Mn), copper (Cu), and zinc (Zn), from the soil to the roots of the plant.

- As a micronutrient, zinc is crucial for plant hormone balance and auxin activity and is vital for the growth of plants. Organic chelated zinc sources, such as Zn-EDTA (12% of Zn), are generally considered superior to inorganic zinc sources. In the case of corn and bean crops, only half the total is required if Zn-EDTA chelate fertilizer is the source rather than zinc sulfate (ZnSO4). EDTA chelates are comparatively less expensive and readily available than other commercial agriculture chelates available in the market.

- The major players in the market have a comprehensive product portfolio for EDTA being used in agriculture inputs. For instance, Corteva has a wide range of EDTA chelating agents under Versenol and Crop Max, which are highly demanded in agriculture. EDTA chelates are comparatively less expensive and readily available than other commercial agriculture chelates available in the market. Its ability to treat toxins such as mercury, cadmium, and lead in the soil drives the growth of EDTA chelates during the forecast period.

Asia-Pacific Dominates the Market

- The Asia-Pacific region has the highest market value for agricultural chelates, majorly led by China, India, and Japan. As the country with the largest population, China has one of the most extensive agricultural facilities globally. With a rapid increase in population and the increasing demand for food, farmers are compelled to grow crops with high yields. This creates the need for agricultural chelates in the country.

- According to the Government of Australia, alkaline soils occupy about 23.8% of the total land area in Australia, and soils in western Australia have a pH range between 4 and 8.5. Therefore, the demand for EDTA chelating agents is increasing in Australia due to trace element efficiencies, which limit agricultural productivity growth.

- India is witnessing an incidence of micronutrient deficiencies, such as Zn 36.5%, Boron 24.2%, Fe 12.8%, Mn 7.1%, and Cu 4.2%. This has led to severe losses in produce yield and nutritional quality. In line with the nutrient deficiency in the soil and the effectiveness of chelates in combatting it, the demand for chelates is increasing in the country. The Indian market is estimated to grow at a moderate rate.

Agricultural Chelates Industry Overview

The global agricultural chelates market is concentrated. The major players in the market are Yara International ASA, BASF SE, Nufarm, Mitsubishi Chemical Corporation, and Innospec Inc, among others. The significant market share of these players can be attributed to a highly diversified product portfolio and acquisitions and partnerships during the review period. These players also focus on R&D and product innovations to widen their geographical presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand For Higher Crop Yields

- 4.2.2 Application of Chelates in Micronutrient Intoxication

- 4.2.3 Micronutrient Deficiency In Soil

- 4.3 Market Restraints

- 4.3.1 Non-biodegradable Nature of Chelates

- 4.3.2 Rise of Organic Farming and Restriction on the Use of Synthetic Chelating Agents

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Synthetic

- 5.1.1.1 EDTA

- 5.1.1.2 EDDHA

- 5.1.1.3 DTPA

- 5.1.1.4 IDHA

- 5.1.1.5 Other Synthetic Types

- 5.1.2 Organic

- 5.1.2.1 LingoSulphates

- 5.1.2.2 Aminoacids

- 5.1.2.3 Heptagluconates

- 5.1.2.4 Other Organic Types

- 5.1.1 Synthetic

- 5.2 Application

- 5.2.1 Soil

- 5.2.2 Foliar

- 5.2.3 Fertigation

- 5.2.4 Other Applications

- 5.3 Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Pulses and Oilseeds

- 5.3.3 Commercial Crops

- 5.3.4 Fruits and Vegetables

- 5.3.5 Turf and Ornamentals

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yara International ASA

- 6.3.2 Nouryon

- 6.3.3 BASF SE

- 6.3.4 Shandong Iro Chelating Chemical Co. Ltd

- 6.3.5 Haifa Negev technologies Ltd

- 6.3.6 Ava Chemicals Private Limited

- 6.3.7 Protex International

- 6.3.8 Mitsubishi Chemical Corporation

- 6.3.9 Deretil Agronutritional

- 6.3.10 Innospec Inc.