|

市場調查報告書

商品編碼

1406916

半導體後端設備:市場佔有率分析、產業趨勢與統計、成長預測,2024-2029Semiconductor Back-End Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

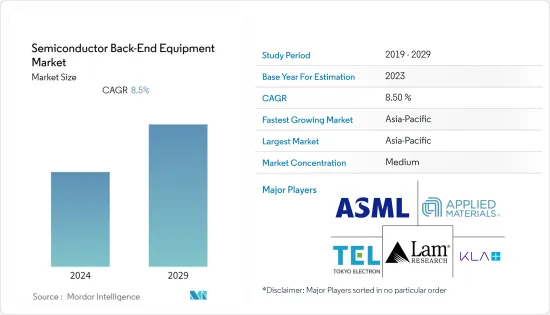

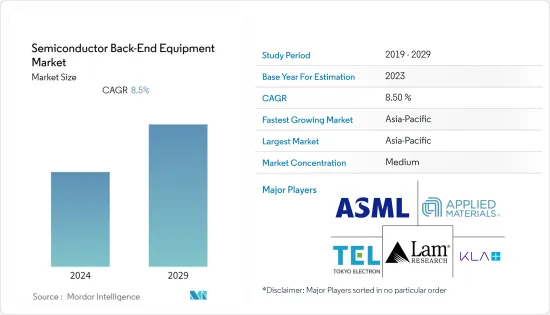

上年度全球半導體後端設備市場價值為846億美元,預計未來五年將達1,380.2億美元,預測期內複合年成長率為8.5%。

主要受家用電子電器應用推動的半導體產業大幅擴張,是推動全球半導體後端設備市場成長的關鍵因素之一。

主要亮點

- 設計、前端和後端是半導體製造流程的三個主要組成部分。後端半導體製造是指在晶圓上創建所有功能/電路之後的步驟,包括用於封裝、測試和組裝積體電路的工具。極高的精度、精度和高吞吐量使這項令人興奮的技術成為可能。

- 智慧型手機和先進家用電子電器和汽車開發等其他設備的成長正在推動全球半導體產業的發展。無線技術(5G)和人工智慧等技術進步正在推動這些產業的發展。因此,包括對高性能和經濟實惠的半導體晶片的需求持續成長在內的多種因素,在短期、中期和長期範圍內以不同的方式影響著市場。例如,根據愛立信的行動報告,到年終年底,全球5G用戶數將達到46億,約佔所有行動用戶數的一半。

- 這些趨勢的影響也反映在半導體銷售上。例如,2023年2月,半導體產業協會(SIA)宣布,2022年全球半導體產業銷售額為5,741億美元,比上年的5,559億美元成長3.3%。半導體產業的顯著成長也可能推動後端設備市場,在預測期內提供大量機會。

- 此外,增加對半導體設備價值鏈的投資也為所研究市場的成長提供了良好的前景。例如,根據SEMI的預測,全球半導體製造設備銷售額將從2021年的1,026億美元成長到2022年的1,076億美元,成長5%。

- 不過,市場也看到了一些與成本相關的抑制因素。例如,混合連接最困難的課題之一是成本。這種類型的處理被認為是晶片製造商、晶圓代工廠和 IDM 晶圓廠後端的延伸。與其他類型的包裝相比,所需的設備更加昂貴且自動化,且製程清潔度標準也更加嚴格。

- 此外,持續不斷的地緣政治衝突,例如美國貿易爭端和俄羅斯-烏克蘭衝突,對半導體產業的價值鏈產生了重大影響。例如,這些衝突已經影響產業一段時間,加劇了晶片短缺和半導體供應鏈問題。這種干擾可能導致鎳、鈀、銅、鈦、鋁和鐵礦石等關鍵原料的價格波動,進而擾亂半導體製造。

半導體後端設備市場趨勢

黏合設備預計將推動市場發展。

- 由於對具有更高效率、處理能力和更小占地面積的半導體晶片的需求不斷成長,半導體鍵合設備將得到應用,從而推動預測期內的市場需求。此外,隨著前端製程的顯著發展,對半導體鍵合設備的需求不斷增加。

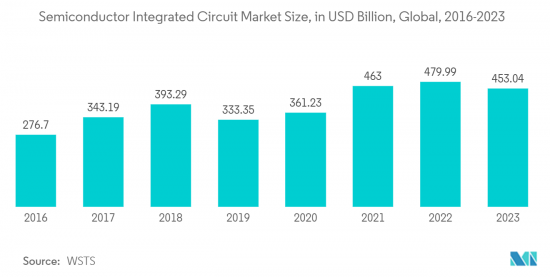

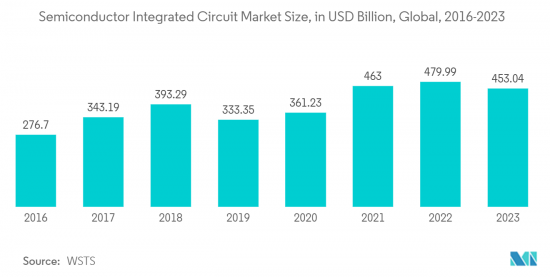

- 支援黏合設備需求的主要因素之一是智慧型手機、穿戴式裝置、個人電腦和智慧家居設備等家用電子電器和運算設備產品的成長。半導體晶片/IC 消耗的增加為所研究市場的成長創造了良好的前景,因為這些設備使用多個積體電路或半導體晶片。例如,根據 WSTS 的數據,2023 年半導體整合市場預計將達到 4,530.4 億美元,而 2016 年為 2,767 億美元。

- 此外,對尖端封裝技術和其他應用的投資也推動了對黏合設備解決方案的需求。例如,2022 年 3 月,英特爾公司在歐盟半導體價值鏈上投資了 800 億歐元,其中包括尖端封裝技術。此外,製造商正致力於改進製造後端機械和半導體製造設備(SME)所需的半導體。例如,全球重要的連接和電源解決方案提供商 Qorvo 於 2023 年 2 月透露,它已獲得 Adeia Inc. 的 Adeia混合鍵合技術許可。

- 對半導體設備製造設備的投資不斷增加也為所研究市場的成長創造了良好的前景。例如,晶片設備製造商ASML於2022年11月宣布將在韓國開設新廠生產半導體設備。該公司宣布將投資 2,400 億韓元(1.81 億美元)建設佔地 16,000平方公尺的設施。預計於 2024 年下半年開始營運。由於鍵結是半導體晶片製造過程中的重要步驟,這些新興市場的開拓預計將帶來未來的市場機會。

- 此外,不同行業各種應用對鍵合設備的需求預計將在未來幾年推動市場。汽車製造商也在多種乘客安全應用中使用 MEMS 和光電子技術,這主要是由於人們對乘客和駕駛員安全的擔憂日益增加。黏合設備可以提供這些汽車組件所需的精密封裝。

亞太地區實現顯著成長

- 亞太半導體後端設備市場預計在預測期內將迅速擴大。預計該市場將受到國內主要供應商的策略性投資和成熟半導體產業擴張的推動。隨著未來四年晶片消費量的增加,亞太地區的半導體市場規模預計將是美洲的三倍以上。

- 此外,該地區還是一些世界上最大的半導體製造商的所在地。據SIA稱,包括台灣、中國、韓國和日本在內的東亞地區佔全球半導體產能的75%。隨著全球晶片短缺的持續,亞太地區的其他幾個國家正在建立新的代工設施,以滿足對後端設備的需求。

- 根據半導體設備與材料國際公司的數據,2022年中國大陸在半導體設備上的支出為282.7億美元,而台灣則為268.2億美元。支出逐年增加,很可能成為受訪市場的驅動力。此外,台灣正迅速成為半導體生產的市場參與者,對製造和後端機械產生了很高的需求。據SIA稱,台灣(92%)和韓國(8%)擁有全球最先進(<10奈米厚)的半導體製造能力。

- 此外,由於國內晶片需求的增加,預計中國將取代美國成為全球領先的半導體產業強國。根據半導體產業協會預測,到2030年,半導體市場規模將加倍,達到1兆美元以上,其中中國貢獻了60%以上的成長。如此快速的成長預計將增加對半導體鍵合設備的需求。

- 此外,隨著5G技術的引入,該地區用於半導體製造的設備市場正在擴大,預計這將為世界數位基礎設施提供主要推動力,從而帶動對半導體晶片的需求。例如,GSM協會的《2022年亞太移動經濟》報告預測,到2025年,5G連線數將達到4億,佔所有行動連線數的14%以上。這些發展可能會在未來幾年推動亞太市場的發展。

半導體後端設備產業概況

半導體後端設備市場競爭溫和。各種服務供應商定期要求後端設備來滿足其不斷成長的半導體需求。由於設定和研發成本非常高,因此最好利用知名品牌的專業知識來管理這種需求和訂單的湧入。然而,政府監管支持和企業合作以提高產量已成為該行業的常態。主要市場參與者包括 ASML Holding NV、Applied Materials, Inc.、Tokyo Electron Ltd. 和 Lam Research Corporation。

2023年8月,領先的半導體代工廠台積電開始向多家先進封裝設備供應商新訂單。本公司與固登精工、Apic Yamada、Disco、Scientech等供應商合作。與設備供應商的合作突顯了該公司為加強其先進封裝能力所做的持續努力。

2023年6月,美國晶圓製造設備製造商Lam Research宣布,將能夠一步在晶圓邊緣兩側形成專有的保護膜,以防止先進半導體製造過程中出現的缺陷和損壞。隆重推出Coronaus DX,它能夠採用以前無法實現的先進邏輯、封裝和晶片製造製程。預計此類發展也將影響先進後端設備的發展。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 電動和混合動力汽車對半導體的需求增加

- 建立新代晶圓代工廠的需求(國際晶片短缺)

- 市場抑制因素

- 設定成本高

- 產品的不斷發展影響著需求

第6章市場區隔

- 依類型

- 晶圓測試

- 切塊

- 黏合

- 測量

- 組裝和包裝

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 台灣

- 韓國

- 日本

- 其他亞太地區

第7章 競爭形勢

- 公司簡介

- ASML Holding

- Applied Materials

- Lam Research

- Tokyo Electron Limited

- KLA Corporation

- Advantest Corporation

- Onto Innovation Inc.

- SCREEN Holdings Co. Ltd.

- Teradyne Inc.

- Toshiba Corporation

第8章投資分析

第9章市場的未來

The Global Semiconductor Back-End Equipment Market was valued at USD 84.6 billion in the previous year and is expected to register a CAGR of 8.5 percent during the forecast period to become USD 138.02 billion by the next five years. The significant expansion of the semiconductor industry, primarily fueled by consumer electronics applications, is one of the primary elements augmenting the growth of the Global Market for semiconductor back-end equipment.

Key Highlights

- The design, front-end, and back-end processes are the three main components of the semiconductor manufacturing process. Back-end semiconductor manufacturing refers to the processes after all features/circuits have been created on the wafer and includes tools for packaging, testing, and assembling integrated circuits. Extreme accuracy, precision, and high throughput make for this exciting technology.

- The growth of smartphones and other devices, such as advanced consumer electronics and automotive development, drives the global semiconductor industry. Technology advancements like wireless technologies (5G) and artificial intelligence drive these industries. As a result, several factors, including the consistent increase in demand for high-performance and affordable semiconductor chips, influence the Market in different ways over the short-, medium-, and long-term horizons. For instance, according to Ericsson Mobility Report, by the end of 2028, there will be 4.6 billion 5G subscriptions globally, accounting for about half of all mobile subscriptions.

- The impact of such trends is evident on the semiconductor sales. For instance, in February 2023, the Semiconductor Industry Association (SIA) announced global semiconductor industry sales totaled USD 574.1 billion in 2022, reporting an increase of 3.3% compared to the previous year's total of USD 555.9 billion. The semiconductor industry's significant growth will also drive the Market for back-end equipment, opening up numerous opportunities during the forecast period.

- Furthermore, the growing investment in the semiconductor equipment value chain also creates a favorable outlook for the growth of the studied Market. For instance, according to SEMI, the global sales of semiconductor manufacturing equipment increased 5% from USD 102.6 billion in 2021 to a record of USD 107.6 billion in 2022.

- However, the Market is also witnessing several restraints associated with cost. For instance, one of the most challenging issues with hybrid bonding is cost. This type of processing is seen by chip makers, foundries, and IDMs as an extension of the wafer fab back end of the line. The equipment required is more expensive and automated than other types of packaging, and the standards for process cleanliness are much stricter.

- Further, the ongoing geo-political conflicts such as the US-China trade dispute and the conflict between Russia and Ukraine significantly impact the value chain of the semiconductor industry as these conflicts have resulted in the implementation of various types of sanctions of several countries which in turn impacts the growth of the studied Market. For example, these conflicts have already exacerbated the chip shortages and semiconductor supply chain issues that have affected the industry for some time. The disruption may also result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, which may obstruct the manufacturing of Semiconductors.

Semiconductor Back-End Equipment Market Trends

Bonding Equipment is Expected to Drive the Market.

- Semiconductor Bonding Equipment finds application due to rising demand for semiconductor chips with higher efficiency, processing power, and smaller footprint, driving demand for the market during the forecast period. The need for semiconductor bonding equipment has also increased due to significant developments in front-end processes.

- One of the main factors assisting the demand for bonding equipment is the growth of consumer electronic and computing device products such as smartphones, wearables, PCs, smart home devices, etc. As these devices use multiple integrated circuits and semiconductor chips, the growing consumption of semiconductor chips/ICs creates a favorable outlook for the studied market's growth. For instance, according to WSTS, the semiconductor-integrated market is anticipated to reach a value of USD 453.04 billion in 2023, compared to USD 276.7 billion in 2016.

- Furthermore, investments in cutting-edge packaging technologies and other applications also drive the demand for bonding equipment solutions. For instance, in March 2022, Intel Corp. invested EUR 80 billion across the entire semiconductor value chain in the European Union, including cutting-edge packaging technologies. Moreover, the manufacturers are also concentrating on improving the semiconductors needed to make the back-end machinery and semiconductor manufacturing equipment (SME). For instance, Qorvo, a significant global provider of connectivity and power solutions, was revealed to have licensed Adeia's hybrid bonding technology in February 2023 by Adeia Inc.

- The growing investments in semiconductor equipment manufacturing facilities also create a favorable outlook for the growth of the studied market. For instance, the chip equipment manufacturer ASML announced in November 2022 that it was to open a new facility in South Korea to produce semiconductor equipment. The company announced that it would spend WON 240 billion (USD 181 million) to build a facility that would be 16,000 square meters. The expected start of operations is in the second half of 2024. These futuristic industry developments are expected to lead to future market opportunities, as bonding is a crucial process in the semiconductor chip manufacturing process.

- Moreover, in the upcoming years, the market is expected to be driven by the demand for bonding equipment for various applications across industries. Primarily due to the rising concerns about the safety of passengers and drivers, automobile manufacturers are also using MEMS and optoelectronics in several passenger safety applications. Bonding equipment can provide the high-precision packaging that these automobile assemblies require.

Asia-Pacific to Witness a Significant Growth

- The Asia-Pacific Semiconductor Back-End Equipment Market is expected to expand rapidly during the forecast period. The Market is anticipated to be driven by strategic investments made by important domestic suppliers and the expansion of the well-established semiconductor industry. As chip consumption increases in the next four years, the Asia-Pacific semiconductor market is expected to more than triple in size from that of the Americas.

- Furthermore, the region is home to one of the biggest semiconductor manufacturers in the world. According to SIA, East Asia, which includes Taiwan, China, South Korea, and Japan, has 75 percent of the world's capacity for producing semiconductors. Several other countries in the Asia Pacific intend to establish new foundry facilities and draw demand for back-end equipment because of the ongoing global chip shortage.

- According to Semiconductor Equipment and Materials International, in 2022, spending on semiconductor equipment in China amounted to USD 28.27 billion, while in Taiwan, it stood at USD 26.82 billion. The expenditure has increased yearly, which will drive the studied Market. Further, Taiwan is quickly becoming a market player in the production of semiconductors, creating a high demand for manufacturing and back-end machinery. Taiwan (92%) and South Korea (8%), according to SIA, are responsible for all of the world's most sophisticated (below 10nm thickness) semiconductor manufacturing capacities.

- In addition, it is anticipated that China will surpass the United States as the world's significant semiconductor industry powerhouse due to its growing domestic chip demand. According to the Semiconductor Industry Association, the semiconductor market will double in size to reach more than USD 1 trillion by 2030, with China accounting for more than 60% of that growth. Such exponential growth is anticipated to increase demand for semiconductor bonding equipment.

- Furthermore, the Market for equipment used in semiconductor manufacturing in the region is expanding due to the introduction of 5G technology, which is anticipated to provide a significant boost to the digital infrastructure globally, driving the demand for semiconductor chips. For instance, the Mobile Economy Asia-Pacific 2022 report from the GSM Association projects that by 2025, there will be 400 million 5G connections, equivalent to over 14% of all mobile links. In the upcoming years, such developments will fuel the Market in the Asia Pacific region.

Semiconductor Back-End Equipment Industry Overview

The semiconductor back-end equipment market is moderately competitive. Various service providers regularly demand back-end equipment to cope with the ever-increasing semiconductor need. This influx of demand and orders is best managed with the expertise of well-established brands due to extensively high setup and R&D costs. However, government regulation support and company partnerships to boost production are standard in the industry. Some key market players include ASML Holding N.V., Applied Materials, Inc., Tokyo Electron Limited, and Lam Research Corporation, among others.

In August 2023, TSMC, a leading semiconductor foundry, began placing new orders with several advanced packaging equipment suppliers. The company has been working with suppliers such as Gudeng Precision Industrial, Apic Yamada, Disco, and Scientech. The decision to engage with equipment suppliers highlights the company's ongoing efforts to enhance its advanced packaging capabilities.

In June 2023, Lam Research, an American wafer fabrication equipment manufacturer, unveiled Coronus DX, which can, in a single step, deposit a proprietary layer of protective film on both sides of the wafer edge to help prevent damage and defects and damage that occur during advanced semiconductor manufacturing, paving the way for adoption of advanced logic, packaging and chip production processes that weren't feasible before. Such developments are also anticipated to influence the development of advanced back-end equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Trends on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Semiconductors in Electric and Hybrid Vehicles

- 5.1.2 Demand for Setting Up New Foundries (International Chip Shortage)

- 5.2 Market Restraints

- 5.2.1 High Setup Costs

- 5.2.2 Constant Evolution of Products Influencing Demand

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wafer Testing

- 6.1.2 Dicing

- 6.1.3 Bonding

- 6.1.4 Metrology

- 6.1.5 Assembly and Packaging

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Taiwan

- 6.2.3.3 South Korea

- 6.2.3.4 Japan

- 6.2.3.5 Rest of the Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASML Holding

- 7.1.2 Applied Materials

- 7.1.3 Lam Research

- 7.1.4 Tokyo Electron Limited

- 7.1.5 KLA Corporation

- 7.1.6 Advantest Corporation

- 7.1.7 Onto Innovation Inc.

- 7.1.8 SCREEN Holdings Co. Ltd.

- 7.1.9 Teradyne Inc.

- 7.1.10 Toshiba Corporation