|

市場調查報告書

商品編碼

1438458

半導體設備:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Semiconductor Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

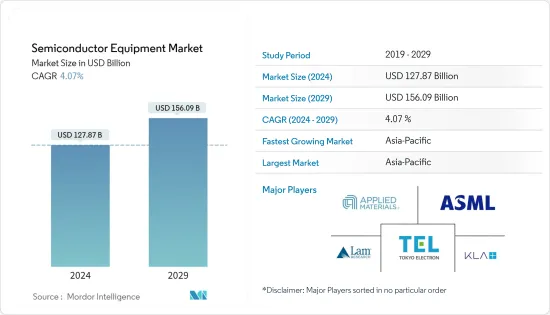

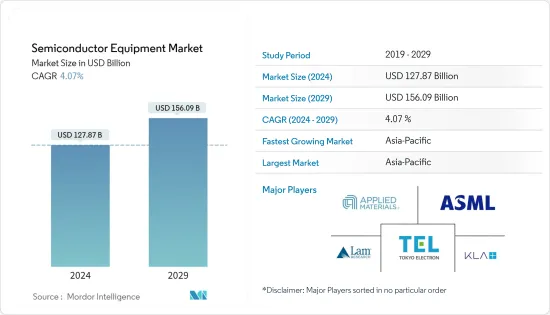

2024年半導體設備市場規模預估為1,278.7億美元,預估至2029年將達到1,560.9億美元,在預測期間(2024-2029年)年複合成長率為4.07%成長。

全球半導體產業受到智慧型手機和先進消費性電器產品等其他設備的同步成長以及汽車產業的成長所推動。

主要亮點

- 這些產業受到無線技術(5G)和人工智慧等技術轉型的推動。推動市場發展的因素有很多,包括對高性能、低成本半導體的需求穩定成長,這些因素在短期、中期和長期內產生不同的影響。

- 5G的推出預計將成為推動市場的關鍵因素之一。 5G 的擴展將導致無線產業的擴展,從而實現擴增實境、關鍵任務服務、固定無線存取和物聯網等創新。

- 此外,隨著半導體產業的逐步變化,如節點和晶圓尺寸的小型化,超大規模整合技術對更大晶圓尺寸的需求帶動了半導體設備的成長。此外,與晶圓小型化相關的成本上升和檢測挑戰正促使晶圓廠製造商將製程監視器從裸晶圓轉移到大批量晶圓。

- 全球300毫米矽晶圓需求強勁,近年來200毫米矽晶圓需求也快速成長。據SEMI稱,200毫米晶圓廠正準備從2017年到2022年在全球每月新增超過60萬片晶圓。預計此類趨勢將進一步成為所研究市場成長的催化劑。

- 2020 年上半年,冠狀病毒感染疾病(COVID-19) 大流行擾亂了全球(尤其是中國)的半導體供應鏈和生產流程。主要原因是勞動力短缺,導致多家半導體公司停止營運。這給依賴半導體的最終產品公司帶來了危機。

半導體設備市場趨勢

消費性電子產品需求不斷成長

- 消費性電器產品是成長最快的領域,對市場擴張做出了重大貢獻。智慧型手機的成長預計將隨著人口的成長而繼續成長,使其成為該市場的關鍵驅動力。由於平板電腦、智慧型手機、筆記型電腦和穿戴式裝置等產品的需求增加,消費性電器產品產品正在推動該產業的發展。隨著半導體技術的進步,機器學習等新的市場領域正迅速鞏固。

- 由於汽車、醫療設備、智慧型裝置、智慧家庭和穿戴式裝置等產品的不斷改進,半導體整合已成為一種普遍現象。此外,消費者對小型設備的需求正在推動將半導體整合到單一晶片上的趨勢不斷成長。由於半導體可以組裝到單一晶片上,因此用於半導體製造的機械正在獲得發展勢頭。

- 年終,行動用戶數約為82億人。預計到年終,這一數字將達到近 91 億。同時,行動寬頻用戶佔有率可能從 84% 上升至 93%。到預測期結束時,獨立行動客戶數量預計將從年終的61 億增加到 67 億。

- 智慧型手機相關合約數量仍在增加。截至年終,合約數量為63億份,佔所有行動電話合約的近77%。到 2027 年,這一數字預計將增至 78 億,即所有行動用戶的 87%。

- 半導體設備市場是由對更快、更有效的記憶體解決方案的需求所推動的。這些半導體變得越來越複雜並且能夠處理密集的記憶體操作。總體而言,由於對 IP解決方案供應商的依賴增加,市場上出現了大量投資。

預計亞太地區將佔據主要市場佔有率

- 半導體設備集中在少數國家,這些設備的銷售在幾個主要國家之外非常有限或根本不存在。作為成熟半導體技術的重要生產國,中國已取得顯著成長。同時,中國政府繼續將半導體產業視為經濟成長和技術領先的驅動力。預計到 2030 年,全球新增產能將增加 40% 左右。

- 此外,領先的自動化測試設備供應商泰瑞達 (Teradyne) 將於 2022 年 4 月向領先的微控制器單元 (MCU) 和安全積體電路 (IC) 供應商 Nations Technologies 交付第 7,000 個 J750出貨測試平台。 。中國晶片製造商。

- 擴大採用智慧電子設備來改善製造機會,以及電子產品更大程度地整合到各種應用中,是推動日本半導體設備成長的關鍵因素。此外,物聯網、人工智慧和連接連網型設備融入各種最終用戶產業預計將推動該國的半導體設備市場。

- 國際貿易組織 SEMI 表示,汽車和高效能運算設備中使用的晶片的強勁需求預計將使台灣今年成為全球前端晶片製造設備上最大的支出國。台灣晶圓廠設備支出預計每年成長 52%,達到 340 億美元。

- 韓國和其他地方的主要晶圓代工廠廠正在增加投資和鼓勵,以擴大其在各自國家行業的影響力。此外,產業通商資源部宣布,到2030年,晶片出口額預計將翻倍,達到2,000億美元。此外,政府還計劃建造一條延伸至首爾以南數十公里的「K半導體帶」。將晶片設計師、製造商和供應商聚集在一起。這些工廠將增強韓國在全球半導體行業的競爭力,將主要半導體公司及其供應商叢集,在全球晶片短缺的情況下實現關鍵半導體材料和設備的本地化供應。

半導體設備產業概況

半導體設備市場競爭對手之間的競爭強度適中。企業專業化是由在小型企業產業競爭所需的大量研發和資本投資所推動的。主要參與者包括應用材料公司、ASML 控股半導體公司和 KLA 公司。該市場的最新發展包括:

- 2022 年 5 月:SCREEN Holdings 加大力度減少半導體產業對環境的影響。然而,隨著對半導體裝置的依賴增加,製造過程造成的環境影響已成為半導體產業通用關注的問題。考慮到這項挑戰,SCREEN SPE 同意參與由世界主導的創新者 IMEC 領導的永續半導體技術和系統調查計畫。該計劃旨在幫助半導體產業減少其整體環境影響。

- 2022 年 2 月:台灣全球半導體代晶圓代工廠聯電 (UMC) 宣布計劃在新加坡建造一座新的先進製造工廠。新工廠將建在位於白沙 (Pasir Ris) 的現有 Fab12i 工廠旁。規劃計劃總投資50億美元。新晶圓製造廠的月產能將達到30,000片晶圓,預計2024年終開始生產。聯華電子表示,該工廠將成為新加坡最先進的半導體晶圓代工廠之一,將生產 22 奈米和 28 奈米晶片。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 消費性電子產品需求不斷成長

- 人工智慧、物聯網和連網型設備在各行業中激增

- 市場限制因素

- 技術的動態本質要求製造設備發生一些變化

第6章市場區隔

- 依設備類型

- 前端裝置

- 微影製程設備

- 蝕刻設備

- 沉澱設備

- 測量/檢測設備

- 材料去除/清洗設備

- 光阻劑加工設備

- 其他設備類型

- 後端設備

- 測驗設備

- 組裝/包裝設備

- 前端裝置

- 按供應鏈進入

- IDM

- OSAT

- 鑄造廠

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 日本

- 台灣

- 韓國

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Applied Materials Inc.

- ASML Holding Semiconductor Company

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

- Veeco Instruments Inc.

- Screen Holdings Co. Ltd

- Teradyne Inc.

- Hitachi High-Technologies Corporation

第8章投資分析

第9章市場機會與未來趨勢

The Semiconductor Equipment Market size is estimated at USD 127.87 billion in 2024, and is expected to reach USD 156.09 billion by 2029, growing at a CAGR of 4.07% during the forecast period (2024-2029).

The global semiconductor industry is driven by the simultaneous growth of smartphones and other devices, such as advanced consumer electronics, and the growth of the automotive industry.

Key Highlights

- These industries are driven by technology transitions such as wireless technologies (5G) and artificial intelligence. Several factors, including a steady rise in the demand for high-performance and low-cost semiconductors, drive the market with varying impacts over the short, medium, and long term.

- The deployment of 5G is expected to be one of the key factors driving the market. This is because the expansion of 5G would lead to the expansion of the wireless industry and enable innovations like augmented reality, mission-critical services, fixed wireless access, and the Internet of Things.

- Furthermore, with the gradual transitions in the semiconductor industry, such as the miniaturization of nodes and wafer sizes, the demand for increasing the wafer sizes for ultra-large-scale integration technologies has fostered the growth of semiconductor equipment. Moreover, fab manufacturers are shifting process monitors from bare wafers to production wafers due to the higher cost and inspection challenges faced by wafer miniaturization.

- The global demand for 300 mm silicon wafers is strong, and the demand for 200 mm has also seen a surge in recent years. According to SEMI, 200 mm fabs are gearing up to add over 600,000 wafers per month across the world during 2017-2022. Such trends are further expected to act as catalysts for the growth of the market studied.

- The COVID-19 pandemic disrupted the supply chains and production processes of semiconductors worldwide, especially in China, during the first half of 2020. The primary reason was a labor shortage, during which several semiconductor companies suspended operations. This created a crunch for end-product companies that depend on semiconductors.

Semiconductor Equipment Market Trends

Increasing Demand for Consumer Electronic Devices

- Consumer electronics is the fastest-growing segment and contributes significantly to market expansion. The growth of smartphones, which is predicted to increase with population growth, is the key driving force for this market. Consumer electronics drive the industry due to the increased demand for products such as tablets, smartphones, laptop computers, and wearable gadgets. As semiconductor technology advances, new market areas, such as machine learning, are rapidly being integrated.

- Due to ongoing improvements in items, including cars, medical equipment, smart devices, smart homes, and wearables, semiconductor integration has become a widespread phenomenon. Additionally, the trend of combining semiconductors into a single chip is expanding due to the consumers' desire for small-sized devices. The machinery used to manufacture semiconductors is gaining momentum since it makes it possible to assemble semiconductors on a single chip.

- There were approximately 8.2 billion mobile subscriptions by the end of 2021. This is anticipated to reach nearly 9.1 billion by the end of 2027. The percentage of mobile broadband subscriptions may rise from 84% to 93% at the same time. By the end of the forecast period, there are expected to be 6.7 billion unique mobile customers, up from 6.1 billion at the end of 2021.

- Smartphone-related subscriptions are still increasing. There were 6.3 billion at the end of 2021, making up nearly 77% of all mobile phone subscriptions. By 2027, this is anticipated to increase to 7.8 billion, or 87% of all mobile subscribers.

- The semiconductor equipment market is driven by the demand for quicker and more effective memory solutions. These semiconductors are becoming more complicated and can handle intensive memory operations. Overall, the market is seeing significant investments due to the increased reliance on IP solution providers.

Asia-Pacific Expected to Hold Significant Market Share

- The semiconductor equipment is highly concentrated in a few countries, and sales of this equipment are very limited or non-existent outside some major countries. China has grown significantly as an essential producer of mature semiconductor technologies. On the other hand, the Chinese government continues to prioritize the semiconductor industry as a driver of economic growth and technological leadership. It is expected to add roughly 40% of the new global capacity by 2030.

- Further, in April 2022, Teradyne Inc., a leading supplier of automated test equipment, announced the shipment of the 7,000th unit of its J750 semiconductor test platform to Nations Technologies, a leading microcontroller unit (MCU) and security integrated circuit (IC) chip maker in China.

- The growing adoption of smart electronic devices that improve manufacturing opportunities and the significant integration of electronics into various applications are the key factors driving the growth of semiconductor equipment in Japan. Moreover, the incorporation of IoT, artificial intelligence, and connected devices into various end-user industries are expected to drive the semiconductor equipment market in the Country.

- Due to the robust demand for chips used in vehicles and high-performance computing devices, Taiwan is expected to become the world's largest spender on front-end chip manufacturing equipment this year, according to the international trade group SEMI. Taiwanese fab equipment spending is expected to rise by 52% yearly to USD 34 billion.

- South Korea and other major hubs for foundries are increasingly investing and incentivizing to expand the industry presence of their respective countries. In addition, the Ministry of Trade, Industry, and Energy announced that chip exports are expected to double to USD 200 billion by 2030. Furthermore, the government seeks to build a "K-Semiconductor belt" that stretches dozens of kilometers south of Seoul and brings together chip designers, manufacturers, and suppliers. These plants aim to sharpen South Korea's competitive edge in the global semiconductor industry and localize major semiconductor materials and equipment supplies with key semiconductor companies and their suppliers working in clusters amid a global chip shortage.

Semiconductor Equipment Industry Overview

The intensity of competitive rivalry is moderately high in the semiconductor equipment market. Firm specialization is driven by the high R&D investments and capital expenditures required to compete in the SME industry. Some key players are Applied Materials Inc., ASML Holding Semiconductor Company, and KLA Corporation. A few recent developments in this market are:

- May 2022: SCREEN Holdings increased its efforts to reduce the environmental impact of the semiconductor industry. However, as reliance on semiconductor devices has grown, the environmental impact created by the manufacturing processes has become a shared concern for the semiconductor industry. With this challenge in mind, SCREEN SPE agreed to join the Sustainable Semiconductor Technologies and Systems research program led by IMEC, a world-leading innovator. The program is designed to help the semiconductor industry reduce its overall environmental impact.

- February 2022: United Microelectronics Corporation (UMC), a Taiwanese global semiconductor foundry, announced its plans to build a new advanced manufacturing facility in Singapore. The new facility would be built next to its existing plant, known as Fab12i, in Pasir Ris. The total investment for the planned project was USD 5 billion. The new wafer fab facility would have a monthly capacity of 30,000 wafers, with production expected to start in late 2024. According to UMC, it would also be one of the most advanced semiconductor foundries in Singapore and will produce 22 nm and 28 nm chips.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Consumer Electronic Devices

- 5.1.2 Proliferation of AI, IoT, And Connected Devices Across Industry Verticals

- 5.2 Market Restraints

- 5.2.1 Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Front-end Equipment

- 6.1.1.1 Lithography Equipment

- 6.1.1.2 Etch Equipment

- 6.1.1.3 Deposition Equipment

- 6.1.1.4 Metrology/Inspection Equipment

- 6.1.1.5 Material Removal/Cleaning Equipment

- 6.1.1.6 Photoresist Processing Equipment

- 6.1.1.7 Other Equipment Types

- 6.1.2 Back-end Equipment

- 6.1.2.1 Test Equipment

- 6.1.2.2 Assembly and Packaging Equipment

- 6.1.1 Front-end Equipment

- 6.2 By Supply Chain Participants

- 6.2.1 IDM

- 6.2.2 OSAT

- 6.2.3 Foundry

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Taiwan

- 6.3.3.4 Korea

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials Inc.

- 7.1.2 ASML Holding Semiconductor Company

- 7.1.3 Tokyo Electron Limited

- 7.1.4 Lam Research Corporation

- 7.1.5 KLA Corporation

- 7.1.6 Veeco Instruments Inc.

- 7.1.7 Screen Holdings Co. Ltd

- 7.1.8 Teradyne Inc.

- 7.1.9 Hitachi High -Technologies Corporation