|

市場調查報告書

商品編碼

1406233

數位音訊工作站 (DAW):市場佔有率分析、產業趨勢/統計、成長預測,2024-2029 年Digital Audio Workstation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

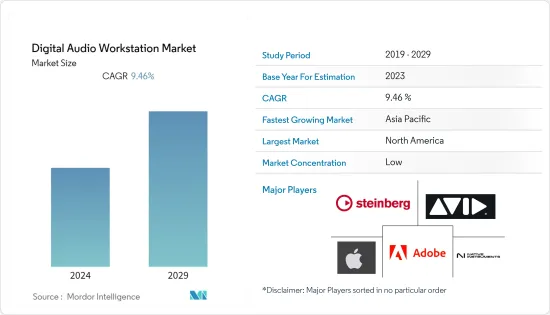

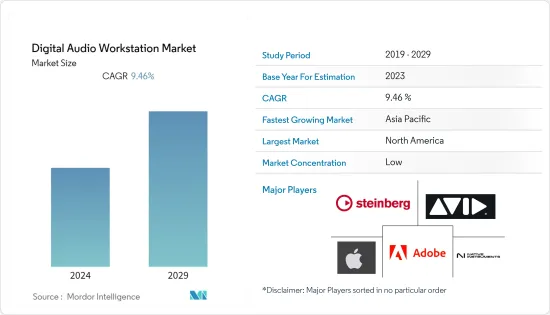

數位音訊工作站(DAW)市場上年度價值27.6億美元,預計五年後將達到47.9億美元,複合年成長率為9.46%。

在過去的幾十年裡,數位音訊工作站 (DAW) 取得了長足的進步。在當今的娛樂產業中,數位音訊工作站(DAW)主要用於音訊和視訊處理系統。數位音訊工作站 (DAW) 網路由用於錄製、編輯、混合和生成音訊檔案的軟體和硬體組件組成。

主要亮點

- 為了改善客戶體驗,市場製造商以及娛樂和媒體產業在研發領域的技術增強正在增加各種數位音訊工作站 (DAW) 的採用。此外,各種重要的播放器都使用音樂製作軟體(通常稱為數位音訊工作站(DAW))來進行作曲、音樂應用、數位錄音和電子音樂。

- 數位音訊工作站 (DAW) 市場是由樂器數位化、對高畫質視訊和音訊的需求不斷成長以及音訊製作技術的進步推動的。雲端基礎的數位音訊工作站(DAW)採用率的不斷上升以及音樂製作人的顯著增加可能會推動數位音訊工作站(DAW)市場的成長率。此外,Android作業系統數位音訊工作站(DAW)的開發和消費性電子產品價格的下降預計將對數位音訊工作站(DAW)市場的成長率產生正面影響。

- 人工智慧和機器學習等技術的使用增加可能會推動對 DAW 的需求。音樂產業的人工智慧使音訊專業人士能夠增強數位音訊檔案。使用人工智慧技術,音樂製作人可以從數位檔案中刪除鼓、人聲和貝斯,以創作高品質的表演音樂。在音樂產業使用人工智慧的主要目的是將音樂扁平化為樂器和功能聲音。根據麥肯錫的報告,預計到 2030 年,大約 70% 的公司將採用人工智慧技術。隨著人工智慧驅動的音樂的日益普及,公司已經開始投資於機器創作或輔助音樂的未來。

- 此外,由於現場表演的持續增加以及世界各地多名 DJ 專業人士的出現,預計該市場將會擴大。此外,高技能人員專注於升級現有設備和技術創新,將新產品推向市場,以支持市場成長。

- 購買軟體和設備的成本可能會阻礙 DAW 市場的成長。為了設定技術設備,使用者需要一台功能強大的電腦、音樂錄製和處理軟體、一個介面以及一個用支架或麥克風電纜設置的良好麥克風系統。入門級錄音室現在便宜得多,從 500 美元到專業錄音室約 20,000 美元,具體取決於錄音室的技術先進程度。

- 市場上的主要企業透過訂閱或永久授權提供 DAW 軟體。然而,一些公司免費提供解決方案。因此,一些用戶傾向於選擇開放原始碼解決方案,而不是企業提供的訂閱,這是阻礙 DAW 市場成長的抑制因素。

- COVID-19 大流行造成的破壞急劇增加了對數位媒體的需求。串流內容以及音訊、播客和新聞消費的增加表明聽眾人數顯著增加。這已成為音訊專業人士使用 DAW 提高音質並向數位音訊檔案添加音效的機會。此外,對高等級音訊和視訊的需求不斷成長、對人工智慧主導的音樂的需求不斷成長以及雲端基礎的DAW 的採用預計將推動市場發展。

數位音訊工作站 (DAW) 市場趨勢

Mac作業系統預計將佔據主要市場佔有率

- 由於各種最終使用領域的使用量不斷增加,Mac 作業系統預計在預測期內也會成長。據推測,Mac 區隔市場也將實現健康成長和擴張。預計在預測期內,將越來越多的 Mac 服務用於錄製和編輯數位音訊檔案將推動對該作業系統的需求。

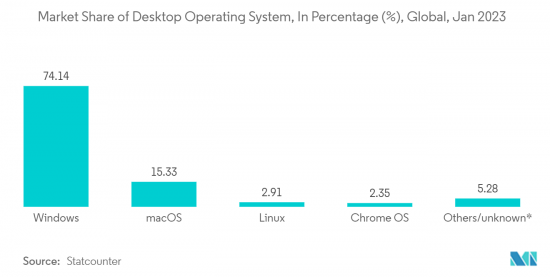

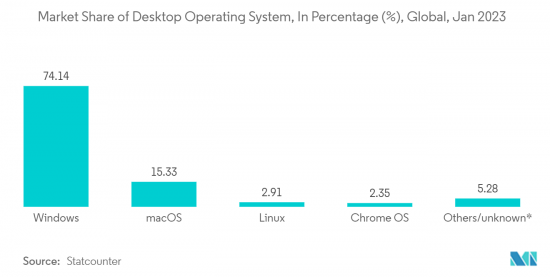

- 鑑於其建造品質和穩定性,Mac 為許多用戶提供了更好的集體解決方案。由於其設計結構,Mac 預計還將為各種消費者提供增強的解決方案,並推動 Mac 市場的成長。據 Statcounter 稱,蘋果的 Mac 作業系統在桌面作業系統市場中只佔次要地位,但多年來一直在擴大市場佔有率。最新版本 macOS Ventura 是 macOS 第 19 版。截至2023年1月,Mac OS桌面作業系統全球市佔率超過15.33%。

- Mac 電腦提供直覺、使用者友善的介面,有助於簡化創新工作流程。 macOS 的設計理念,包括 Dock、任務控制和多手勢等功能,可提高工作效率並促進音訊製作任務之間的無縫導航。

- Mac 作業系統以其與音訊硬體和軟體的兼容性而聞名,但這種相容性也擴展到跨平台工作流程。許多 DAW 和音訊插件與 Mac 相容,允許用戶與不同作業系統上的藝術家、工程師和製作人無縫協作。

- 2022 年 9 月,PreSonus Audio Electronics, Inc. 宣佈推出 Studio One 6,這是該公司適用於 macOS 和 Windows 的最新版本的音樂製作軟體。 Studio One 6 是全球最暢銷的數位音訊工作站 (DAW) 發展的最新篇章,具有行業領先的創新、改進的混音和最先進的使用者介面定製選項。

- 此外,2022 年 9 月,英國軟體公司 Audiomovers 宣佈了 Omnibus,這是專為 Mac 使用者開發的專業音訊工具的最新開發。 Omnibus 支援應用程式之間的音訊路由,並將多個音訊源組合到虛擬輸入中,從而使您能夠克服複雜的軟體和硬體設置問題作為解決方法。 Omnibus 與 Mac OS X 10.15.7 或更高版本相容,並允許無限的物理設備和最多兩個虛擬設備。 Omnibus 具有兩個強大的虛擬驅動器,每個驅動器有16個通道,可讓使用者快速將音訊從 A 點連接到 B 點,並使用 Audiomovers 進行錄製、混合、比較或輔助。

- Mac OS 在專業音訊產業擁有強大的影響力。許多著名的錄音室、音樂製作公司和現場音響工程師都使用基於 Mac 的系統作為他們的主要工作站。這種廣泛的採用進一步鞏固了 Mac OS 在 DAW 市場中的地位。

預計北美將佔據較大市場佔有率

- 北美地區對數位音訊工作站(DAW)市場做出了巨大貢獻。由於該地區音樂數位化程度不斷提高,預計該市場將快速成長。

- 由於供應商普及儘早向最終用戶採用和普及先進技術解決方案,美國和加拿大等國家對包括 Android 和 Linux 作業系統在內的先進技術的採用正在增加。

- 2022 年 9 月,Avid 將與 Addixtech 的銷售協議擴大到美國音訊和影像內容製作技術市場。 Avid 受惠於 Adistech 加速其分銷合作夥伴的物流、財務和其他業務流程的能力。該協議將使 Avid 能夠滿足電視、電影、音樂和教育領域對內容創作和管理產品的需求。

- 北美強調音樂教育和培訓,培養熟練的音訊專業人員團隊。許多教育機構,包括大學、學院和音訊工程學校,都提供包含 DAW 培訓的課程和計劃。

- 北美擁有許多知名錄音室,從大型設施到小型獨立錄音室。許多工作室都依賴 DAW 作為音訊錄製、編輯、混音和母帶製作的重要工具。此外,該地區的許多音響工程師、音樂製作人和藝術家都依賴 DAW 軟體來創作、製作和發行他們的音樂。

數位音訊工作站 (DAW) 產業概述

數位音訊工作站 (DAW) 市場較為分散,主要參與者包括 Apple Inc.、Adobe Inc.、Steinberg Media Technologies GmbH、Avid Technology Inc. 和 Native Instruments GmbH。市場參與者正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

- 2023 年 6 月,BandLab Technologies 宣布對 Cakewalk 進行企業品牌重塑,並計劃讓世界各地的創作者更容易使用其著名的音樂製作軟體。在新的架構下,Cakewalk by BandLab將過渡到Cakewalk,而Cakewalk Sonar和Cakewalk Next這兩個產品將成為獨立產品。除了新的公司名稱外,網站也更新為cakewalk.com,標誌也更新了。

- 2022 年 9 月,Avid 將與 Addixtech 的分銷協議擴展到美國音訊和視訊內容製作技術市場。 Avid 受惠於 Addistec 加速其分銷合作夥伴的物流、財務和其他業務流程的能力。該協議將使 Avid 能夠滿足電視、電影、音樂和教育領域對內容創作和管理產品的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對高畫質視訊和音訊的需求增加

- 在音訊和視訊製作中增加技術的使用

- 市場課題

- 低度開發國家網路普及放緩

- 軟體購置成本與宏觀經濟經濟狀況

第6章市場區隔

- 依作業系統

- Mac

- Windows

- 其他

- 依最終用戶

- 專業/音訊工程師/混音師

- 電子音樂家

- 音樂工作室

- 音樂學校

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Apple Inc.

- Adobe Inc.

- Steinberg Media Technologies GmbH

- Avid Technology Inc.

- Native Instruments GmbH

- MAGIX Software GmbH

- PreSonus Audio Electronics Inc.

- Harrison Consoles Inc.

- Cakewalk Inc.(bandLab Technologies)

第8章投資分析

第9章 市場機會及未來趨勢

The Digital Audio Workstation Market was valued at USD 2.76 billion in the previous year and is expected to register a CAGR of 9.46%, reaching USD 4.79 billion in five years. Over the past few decades, digital audio workstations have made tremendous progress. In today's entertainment industry, digital audio workstations are used in almost both audio and video processing systems. Digital audio workstation meshwork comprises software and hardware components for recording, editing, mixing, and producing audio files. These are exclusively crafted from silicon carbide or gallium nitride to maintain sound integrity and avoid resonance effects.

Key Highlights

- There is a higher adoption of various digital audio workstations due to the technological enhancements in the field of R&D by manufacturers in the market and the entertainment and media sectors to enhance the customer experience. In addition, various vital players use music production software widely known as digital audio workstations for musical composition, musical applications, digital recording, and electronic music.

- The digital audio workstation (DAWs) market is driven by the rising digitalization of instruments, rising demand for high-definition video and audio, and the development of technology in audio-making. The upsurge in the adoption rate of cloud-based digital audio workstations and the significant increase in music producers will cushion the growth rate of the digital audio workstation (DAWs) market. Furthermore, developing digital audio workstations (DWA) for the Android operating system and deteriorating consumer electronics prices will positively impact the growth rate of the digital audio workstation (DAWs) market.

- Increased use of technology such as Artificial Intelligence and Machine learning could drive the need for DAW. Artificial intelligence in the music industry allows audio professionals to enhance their digital audio files. Using AI technology, music creators remove drums, vocals, and bass from any of their digital files to create high-quality performance music. The primary intent behind using AI in the music industry is to flatten music into instrumental and functional sounds. According to the McKinsey report, it is anticipated that around 70% of companies will opt for AI technology by 2030. Owing to the increasing adoption of AI-driven music, companies have already been investing in the future of machine-created or assisted music.

- Moreover, the market is expected to grow due to the growing number of ongoing live performances and several DJ professionals worldwide. In addition, highly skilled personnel are focusing on upgrading and innovating existing devices to release new products in the market to support market growth.

- Costs involved in buying the software or equipment could hamper the growth of the DAW Market because technological equipment is what most people worry about. To set up technical equipment, the user will need a powerful computer, music recording and processing software, an interface, and a good microphone system set up with a stand or microphone cable. The entry-level recording studio has become far less expensive, ranging from USD 500 to a professional recording studio that costs around USD 20,000, depending on how technologically advanced the studio is.

- The market's key players offer their DAW software through subscription and perpetual license offerings. However, certain enterprises provide their solutions free of cost. Owing to this, a few users tend to opt for open-source solutions instead of availing of the subscriptions provided by the companies, which is a restraining factor that could hamper the growth of the DAW Market.

- The disruption due to the COVID-19 pandemic surged the demand for digital media. The increasing streaming content and consumption of audiobooks, podcasts, and news showcased a significant rise among listeners. This created an opportunity for audio professionals who used DAWs to improve sound quality and add sound effects to digital audio files. Additionally, growing demand for high-definition audio and videos, rising demand for AI-driven music, and adopting cloud-based DAW are expected to drive the market.

Digital Audio Workstation Market Trends

MAC Operating System is Expected to Hold Significant Market Share

- MAC operating system is also expected to grow over the projected time frame due to its increasing application in different end-use sectors. The MAC segment is also speculated to register healthy growth and expansion. Increasing the adoption of Mac services in recording and editing digital audio files is expected to propel the demand for the OS over the forecast period.

- Given its build quality and stability, Mac provides a better collective solution for numerous users. Mac also offers enhanced solutions to various consumers owing to its design structure, which is expected to drive the growth of the MAC segment in the market. According to Statcounter, Apple's Mac operating system has gained market share over the years, albeit remaining a minor player in the desktop OS market. The most recent version, macOS Ventura, is the nineteenth release of macOS. As of January 2023, the Mac OS desktop operating system (OS) has a share of over 15.33 percent globally.

- Mac computers offer intuitive and user-friendly interfaces, contributing to a streamlined creative workflow. The macOS design philosophy, including features like Dock, Mission Control, and multi gestures, enhances productivity and facilitates seamless navigation between audio production tasks.

- While the Mac operating system is renowned for its compatibility with audio hardware and software, the compatibility also extends to cross-platform workflows. Many DAWs and Audio plugins are available for Mac, allowing users to collaborate seamlessly with artists, engineers, and producers on different operating systems.

- In September 2022, PreSonus Audio Electronics, Inc. announced the launch of Studio One 6, the latest version of the company's music production software for macOS and Windows. Studio One 6 is the most recent chapter in the evolution of one of the global bestselling digital audio workstations, featuring industry-leading innovations, mixing improvements, and the most advanced user interface customization options.

- In addition, in September 2022, UK-based software company Audiomovers launched Omnibus, the latest development in pro audio tools exclusively for Mac users. Omnibus allows audio routing between applications and can combine multiple audio sources into a virtual input to overcome the problem of complicated software and hardware setups as a workaround. Omnibus is supported on Mac OS X 10.15.7 or higher, with unlimited physical devices and up to two virtual devices. Omnibus has two powerful virtual drivers with 16 channels each that allow users to connect audio from point A to B quickly and then record, mix, compare, or facilitated by Audiomovers.

- Mac OS has a strong presence in the professional audio industry. Many renowned recording studios, music production houses, and live sound engineers rely on Mac-based systems as their primary workstations. This widespread adoption further strengthens the position of Mac OS in the DAW market.

North America is Expected to Hold Significant Market Share

- The North American region significantly contributes to the digital audio workstation market. The Market is poised to grow at a blistering pace in this region due to increased digitization in music.

- Owing to the early adoption of advanced technology solutions and initiatives by vendors to reach the end-user base, countries such as the United States and Canada are witnessing increased adoption of advanced technologies, including Android and Linux operating systems.

- In September 2022, Avid expanded its distribution agreement with Adicstec Inc. into the United States market for audio and video content production technologies. Avid has benefitted from Adistec's ability to accelerate distribution partner logistics, finance, and other business processes. This agreement enables Avid to keep pace with demand for its content creation and management products across television, film, music, and education.

- North America strongly emphasizes music education and training, fostering a skilled talent pool of audio professionals. Many educational institutions, such as universities, colleges, and specialized audio engineering schools, offer courses and programs that incorporate DAW training.

- North America has numerous renowned recording studios, ranging from large-scale facilities to smaller independent studios. Many studios rely on DAW as an essential audio recording, editing, mixing, and mastering tool. Additionally, many sound engineers, music producers, and artists across the region utilize DAW software to create, produce, and distribute their music.

Digital Audio Workstation Industry Overview

The Digital Audio Workstation Market is fragmented, with major players like Apple Inc., Adobe Inc., Steinberg Media Technologies GmbH, Avid Technology Inc., and Native Instruments GmbH. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In June 2023, BandLab Technologies announced a corporate rebranding of Cakewalk with plans to make its renowned music production software even more accessible to global creators. Under the new structure, Cakewalk by BandLab will transition into Cakewalk, with two distinct products underneath Cakewalk Sonar and Cakewalk Next. In addition to the new name, the company has launched an updated website at cakewalk.com and a new logo.

- In September 2022, Avid expanded its distribution agreement with Adicstec Inc. into the United States market for audio and video content production technologies. Avid has benefitted from Adistec's ability to accelerate distribution partner logistics, finance, and other business processes. This agreement enables Avid to keep pace with demand for its content creation and management products across television, film, music, and education.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for High Definition Video and Audio

- 5.1.2 Increased Use of Technology in Audio and Video Making

- 5.2 Market Challenges

- 5.2.1 Slowdown in Internet Penetration Rates in Underdeveloped or Emerging Economies

- 5.2.2 Costs Involved in Acquiring the Software and Macroeconomic Situations

6 MARKET SEGMENTATION

- 6.1 By Operating System

- 6.1.1 Mac

- 6.1.2 Windows

- 6.1.3 Other Operating Systems

- 6.2 By End User

- 6.2.1 Professional/Audio Engineers and Mixers

- 6.2.2 Electronic Musicians

- 6.2.3 Music Studios

- 6.2.4 Music Schools

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Adobe Inc.

- 7.1.3 Steinberg Media Technologies GmbH

- 7.1.4 Avid Technology Inc.

- 7.1.5 Native Instruments GmbH

- 7.1.6 MAGIX Software GmbH

- 7.1.7 PreSonus Audio Electronics Inc.

- 7.1.8 Harrison Consoles Inc.

- 7.1.9 Cakewalk Inc. (bandLab Technologies)