|

市場調查報告書

商品編碼

1404545

MEMS -市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測MEMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

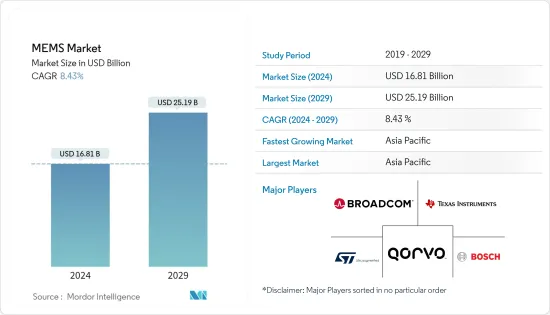

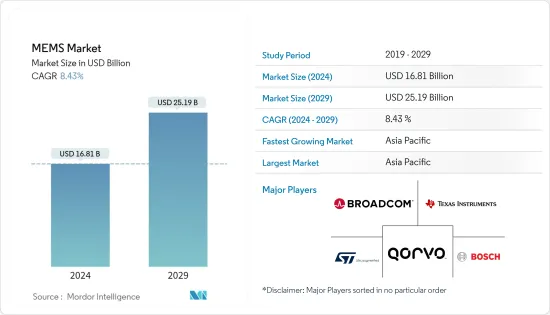

MEMS市場規模預計到2024年為168.1億美元,預計到2029年將達到251.9億美元,在預測期內(2024-2029年)複合年成長率為8.43%。

由於從汽車到家用電子電器等各種應用對 MEMS 的需求不斷增加,MEMS 領域正在經歷快速成長。

主要亮點

- 電子機械系統(MEMS)感測器由於其精確性、可靠性和電子設備小型化等優點,近年來受到廣泛歡迎。推動 MEMS 市場的關鍵因素是工業自動化以及對穿戴式裝置和物連網型設備等小型消費性設備的需求。

- 全球對物聯網設備不斷成長的需求正在引領 MEMS 在這些設備中的採用率。再加上小型化的趨勢,連網型設備也將從中受益。根據思科系統的預測,到 2022 年,連網型設備的數量預計將達到 11 億台,處於市場領先地位。

- 此外,未來幾年,工業對物聯網的需求預計將超過消費者連網型設備的需求,從而增加所需的連網型設備數量並提高工業採用率。據 GSMA 稱,到 2025 年,工業互聯設備的數量預計將超過消費者互聯設備的數量。 TDK Corp. 在 CES 2021 上宣布了一系列適用於工業應用的 MEMS 平台和感測器。

- 然而,市場面臨產品生產的挑戰以及缺乏標準化的製造流程。考慮到汽車產業中使用的感測器介面設計,MEMS 產生的電容變化很小。這必須以精確度和準確性來處理,從而增加產品製造的交貨時間並稍微抵消市場的成長。

- 消費和汽車應用中的持續感測器化、醫療和工業終端市場及相關應用的進步是推動市場成長的關鍵因素。由於對 MEMS 感測器的需求空前,許多 MEMS 製造商正在投資建造新的生產設施。例如,博世宣布計劃在 2022 年投資超過 4 億歐元(4.2607 億美元),擴建其位於德國德勒斯登和羅伊特林根的晶圓廠以及位於馬來西亞檳城的半導體業務。作為這項投資的一部分,羅伊特林根目前 35,000平方公尺的無塵室空間將階段增加總合超過 4,000平方公尺的無塵室空間。第一階段200毫米晶圓生產面積增加1000平方公尺,總合11500平方公尺,目前已完工。

- 除此之外,COVID-19 加快了更以患者為中心的方法的步伐,增加了對遠端患者監護的需求,包括遠端醫療、照護端設備和穿戴式裝置。對能夠追蹤患者體溫和血壓的穿戴式設備的需求不斷成長。這一趨勢為穿戴式裝置市場以及壓力、慣性、麥克風和熱電堆等整合式 MEMS 感測器創造了新的機會。

微電子機械系統市場趨勢

消費性電子應用領域預計將佔據主要市場佔有率

- MEMS 技術改進了多種重要的通訊和醫療生物技術應用,但其在家用電子電器中的應用為未來的進步帶來了巨大的希望。 MEMS 嵌入到從智慧型手機到其他消費品的各種產品中,並在人們的日常生活中無處不在。

- MEMS 由於其在高頻下改善的電氣性能而廣泛應用於智慧型手機、穿戴式設備和其他電子設備。在消費性電子領域,隨著注意力從傳統感測器轉向MEMS技術,市場預計將普及。在智慧型手機的推動下,消費性電子產品正逐漸取代汽車應用,成為MEMS的主要技術驅動力。

- 加速感應器和陀螺儀是智慧型手機中最受歡迎的兩種 MEMS(電子機械系統)應用。智慧型手機中各種感測器和致動器應用的多種晶片的普及是 MEMS 市場爆炸性成長的關鍵促進因素之一。在預測期內,由於智慧型手機銷售和商機的增加,行動裝置的 MEMS 預計將大幅擴張。

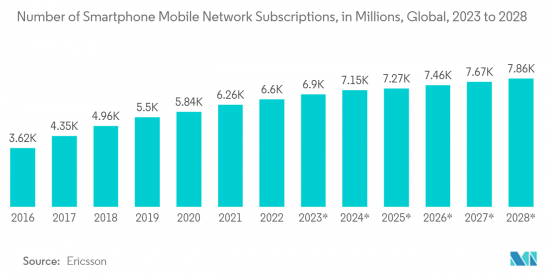

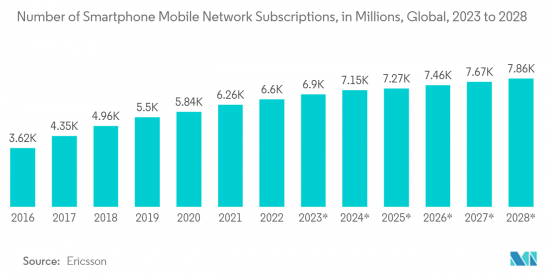

- 例如,根據愛立信移動2022年第四季報告,到2022年第四季度,全球行動訂閱普及達到106%。本季訂閱用戶淨增加 3,900 萬,2022 年第四季行動訂閱總數超過 84 億。此類新興市場的開拓預計將增加對MEMS裝置的需求,為廠商提供各種商機來擴大市場佔有率並滿足智慧型手機中對MEMS的需求。

- 這款智慧型手機採用光學影像穩定 (OIS) 和電子影像穩定 (EIS),由 MEMS 感測器實現。在預測期內,這些廣泛的功能和創新功能預計將增加對 MEMS 感測器的需求,尤其是智慧行動裝置中使用的感測器。

- 光學影像穩定、投影顯示和指紋認證技術等技術的進步和進步正在對MEMS感測器設計產生重大影響。技術趨勢、消費者偏好和其他因素對於塑造家用電子電器和智慧設備電子產業的發展非常重要。這些模式正在推動 MEMS 感測器小型化的需求。

亞太地區預計將佔據主要市場佔有率

- 亞太地區可能會主導 MEMS 市場。隨著主要家電製造商紛紛進軍電子機械系統(MEMS)市場,該市場正在不斷擴大。預計該市場將受到智慧型手機普及的提高、5G普及以及眾多最終用戶行業的進步的推動。

- 中國、韓國、日本、印度是亞太地區主要國家。亞太地區是 MEMS 感測器技術的龐大市場。該地區主導著其他最終用戶行業和全球半導體製造業的許多製造子部門行業。中國等國家向市場提供低成本產品。

- 例如,許多中國MEMS感測器公司,如美新半導體和深迪科技,都在物聯網(IoT)領域進行了大量投資。中國政府認為汽車工業,包括汽車零件產業,是最重要的產業之一。中央政府預計2025年中國汽車產量將達3,500萬輛。此舉旨在使汽車產業成為中國 MEMS 感測器最突出的應用領域之一。中國最近指示汽車製造商到 2030 年電動車(EV) 銷量比傳統汽車多 40%。由於汽車行業的這些進步,對 MEMS 技術的需求將持續成長。

- 隨著中國汽車市場朝著自動駕駛水準不斷提高的方向發展,壓力MEMS預計將繼續成長,這需要提高安全性和環保駕駛。中國的六項法規預計將促進各種應用,包括柴油微粒分子篩檢程式和顆粒汽油過濾器、蒸發排放控制系統、廢氣再循環和輪胎壓力監測系統。

- 此外,由於醫療領域的進步,預計亞太地區在預測期內將顯著成長。支持醫療器材與設備市場的政府計劃和政策,以及對研究和創新設施的投資增加,正在推動這一成長。

電子機械系統產業概況

MEMS 市場適度分散,主要企業包括 Broadcom Inc.、Robert Bosch GmBH、STMicroElectronics NV、Texas Instruments Inc. 和 Qorvo Inc.。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023年5月-SPEA與共進微電子將建立策略合作夥伴關係,預計將加強中國當地MEMS測試與校準業務的發展。該協議將GJM的先進製造服務和品管能力與SPEA世界一流的測試技術和專業知識相結合,預計將加速兩家公司在中國快速發展的MEMS領域的成長。

- 2023 年 6 月 - Rogue Valley Microdevices 宣布收購佛羅裡達州一棟 50,000 平方英尺的商業建築,作為其第二個微加工工廠。該空間將重新配置為無塵室和辦公空間,並計劃於 2025 年生產第一批 MEMS 設備。向棕櫚灣的擴張將使該公司能夠提高供應鏈的彈性並增加產量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 物聯網在半導體領域日益普及

- 智慧家電需求增加

- 工業和家庭自動化的採用率不斷提高

- 市場挑戰/抑制因素

- 高度複雜的製造流程和所需的週期時間

- MEMS缺乏標準化製造流程

第6章市場區隔

- 按類型

- RF MEMS

- 振盪器

- 微流控

- 環境微機電系統

- 光學微機電系統

- MEMS麥克風

- 慣性微機電系統

- 壓力微機電系統

- 嗜熱的

- 微測輻射熱計

- 噴墨頭

- 加速計

- 陀螺儀

- 其他類型

- 按用途

- 車

- 醫療保健

- 工業的

- 家用電器

- 電訊

- 航太/國防

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 相對定位

- 公司簡介

- Broadcom Inc.

- Robert Bosch GmBH

- STMicroelectronics NV

- Texas Instruments Inc.

- Qorvo Inc.

- Infineon Technologies AG

- Knowles Electronics LLC(Knowles Corporation)

- TDK Corporation

- NXP Semiconductors NV

- Panasonic Corporation

- GoerTek Inc.

第8章投資分析

第9章市場的未來

The MEMS Market size is estimated at USD 16.81 billion in 2024, and is expected to reach USD 25.19 billion by 2029, growing at a CAGR of 8.43% during the forecast period (2024-2029).

The MEMS sector is witnessing rapid growth due to the increasing demand for MEMS in multiple applications, from automotive to consumer electronics.

Key Highlights

- Microelectromechanical system (MEMS) sensors have gained significant traction over recent years due to advantages such as accuracy, reliability, and the scope for making smaller electronic devices. Among the significant factors driving the MEMS market are industrial automation and the demand for miniaturized consumer devices, such as wearables and IoT-connected devices.

- The increasing demand for IoT devices worldwide is spearheading the adoption rate of MEMS in these devices; when coupled with the miniaturization trend, the connected devices benefit as well. According to Cisco Systems, the number of connected is expected to reach 1,105 million by 2022, thus driving the market.

- Further, industrial demand for IoT is expected to eclipse the demand for consumer-connected devices over the coming years, with the sheer number of connected devices required and adoption in the industrial space on the rise. By 2025, industrial-connected devices are expected to be more in number than consumer-connected devices, according to GSMA. At CES 2021, TDK Corp. announced the availability of its range of MEMS platforms and sensors for industrial applications.

- However, the market faces challenges in product production and a lack of a standardized fabrication process. Considering the sensor interface design used in the automotive industry, the MEMS produces capacitance changes of tiny magnitudes. This must be addressed with precision and accuracy, increasing the lead time to manufacture the products and slightly offsetting the market's growth.

- Continuous sensorization of both consumer and automotive applications and advances in the medical and industrial end markets and associated applications are important factors contributing to the market growth. Owing to the unprecedented demand for MEMS sensors, many MEMS players are currently investing in new production fabs. For instance, Bosch announced plans to invest more than EUR 400 million (USD 426.07 million) in 2022 in expanding its wafer fabs in Dresden and Reutlingen, Germany, and its semiconductor operations in Penang, Malaysia. As part of the investment, a total of more than 4,000 square meters will be added to the current 35,000 square meters of clean-room space in Reutlingen, in two stages. The first stage, which involved adding 1,000 square meters of production area for 200-millimeter wafers to bring the total to 11,500 square meters, has already been completed.

- In additoin to this, COVID-19 has also accelerated the pace towards a more patient-centric approach and increased the need for remote patient monitoring, including telehealth, point-of-care devices, and wearables. There is a growing demand for wearables owing to their ability to track peoples' temperature and blood pressure. This trend has created new opportunities in the wearables market, as well as for integrated MEMS sensors, such as pressure, inertial, microphones, thermopiles, etc.

Micro-Electro-Mechanical System Market Trends

Consumer Electronics Application Segment is Expected to Hold Significant Market Share

- MEMS technology has improved several crucial communication and medical biotechnology applications, but its use in consumer electronics holds great promise for future advancements. MEMS has ingrained itself into people's daily lives by appearing in various products, from smartphones to other consumer goods.

- MEMS is widely used in smartphones, wearable devices, and other electronic devices due to its improved electrical performance at high frequencies. As the consumer electronics sector shifts its attention away from conventional sensors and toward MEMS technology, the market is anticipated to grow in popularity. As the main technology driver for MEMS, consumer electronics, driven by smartphones, gradually replaced automotive applications.

- Accelerometers and gyroscopes are two of the most well-known MEMS (micro-electro-mechanical systems) applications found in smartphones. The proliferation of multiple chips for various sensor and actuator applications in smartphones is one of the main drivers of the MEMS market's explosive growth. During the forecast period, MEMS for mobile devices is anticipated to expand significantly due to rising smartphone sales and business opportunities.

- For instance, global mobile subscription penetration was 106percent by Q4 2022, according to the Ericsson Mobility report for the fourth quarter of 2022. With a net addition of 39 million subscriptions during the quarter, the total number of mobile subscriptions surpassed 8.4 billion in Q4 2022. Such developments are anticipated to increase demand for MEMS devices and provide vendors with various business opportunities to increase their market share and meet the demand for MEMS in smartphones.

- Smartphones use optical image stabilization (OIS) and electronic image stabilization (EIS), enabled by MEMS sensors. During the forecast period, these broad features and innovative functions will likely augment the demand for MEMS sensors, especially for use in smart mobile devices.

- The advancement and evolution of technologies like optical image stabilization, projection displays, fingerprint technology, and others have significantly influenced the designs of MEMS sensors. Technology trends, consumer preferences, and other factors are significant in shaping developments in the electronics industry for consumer electronics and smart devices. These patterns are driving the demand for MEMS sensor miniaturization.

Asia Pacific is Expected to Hold Significant Market Share

- Asia Pacific is likely to dominate the MEMS market. The micro-electro-mechanical system (MEMS) market is expanding due to the presence of major consumer electronics manufacturers in this area. The market is anticipated to be driven by increasing smartphone penetration, 5G penetration, and advancements across numerous end-user industries.

- China, South Korea, Japan, and India, among others, are major Asian-Pacific countries. Asia-Pacific is a massive marketplace for MEMS sensor technologies. The area dominates many manufacturing subsectors of other end-user industries and the global semiconductor manufacturing sector. Nations like China are supplying low-cost goods to the market.

- For instance, many Chinese MEMS sensor firms, including MEMSIC Semiconductor, Senodia Technologies, and others, are investing heavily in the Internet of Things (IoT). The Chinese government views its automotive industry, including the auto parts sector, as one of its most prominent industries. The Central Government expects China's automobile output to reach 35 million units by 2025. This is intended to make the automotive sector one of the most prominent uses of MEMS sensors in China. China recently instructed automakers to sell 40percent more electric vehicles (EVs) than conventional vehicles by 2030. As a result of these advancements in the automotive industry, MEMS technology will become increasingly in demand.

- In the Chinese automotive market, pressure MEMS are expected to continue to grow due to the evolution towards increased autonomy levels that demand enhanced safety and greener driving. China 6 regulations are expected to boost various applications like diesel particulate filters and particulate gasoline filters, evaporative emissions control systems, exhaust gas recirculation, and tire pressure monitoring systems.

- Moreover, due to advancements in the healthcare sector, the Asia Pacific region is anticipated to grow significantly during the forecast period. Government programs and policies supporting the markets for healthcare equipment and devices, increasing investments in research and innovation facilities, and other factors contribute to this growth.

Micro-Electro-Mechanical System Industry Overview

The MEMS market is moderately fragmented with the presence of significant players like Broadcom Inc., Robert Bosch GmBH, STMicroelectronics NV, Texas Instruments Inc., and Qorvo Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - SPEA and GongJin Microelectronics have entered into a strategic partnership that is expected to strengthen the development of their MEMS testing and calibration business in the Mainland China territory. The agreement brings together GJM's leading manufacturing services and quality management capabilities with SPEA's world-class testing technologies and expertise and is expected to accelerate growth for both companies in the fast-growing MEMS field in China.

- June 2023 - Rogue Valley Microdevices announced its acquisition of a 50,000 sqft commercial building in Florida to serve as its second microfabrication facility. The space will be reconfigured for a cleanroom and office space, with initial production of its first MEMS devices slated for 2025. The company's expansion to Palm Bay will aid it in increasing supply-chain resilience and to boost production volume.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of IoT in Semiconductors

- 5.1.2 Increasing Demand for Smart Consumer Electronics

- 5.1.3 Increasing Adoption of Automation in Industries and Homes

- 5.2 Market Challenges/ Restraints

- 5.2.1 Highly Complex Manufacturing Process and Demanding Cycle Time

- 5.2.2 Lack of Standardized Fabrication Process for MEMS

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 RF MEMS

- 6.1.2 Oscillators

- 6.1.3 Microfluidics

- 6.1.4 Environmental MEMS

- 6.1.5 Optical MEMS

- 6.1.6 MEMS Microphones

- 6.1.7 Inertial MEMS

- 6.1.8 Pressure MEMS

- 6.1.9 Thermophiles

- 6.1.10 Microbolometers

- 6.1.11 Inkjet Heads

- 6.1.12 Accelerometers

- 6.1.13 Gyroscopes

- 6.1.14 Other Types

- 6.2 By Application

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Industrial

- 6.2.4 Consumer Electronics

- 6.2.5 Telecom

- 6.2.6 Aerospace and Defense

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Relative Positioning

- 7.1.1 Relative Positioning of MEMS Vendors

- 7.1.2 Relative Positioning of MEMS Foundries

- 7.2 Company Profiles*

- 7.2.1 Broadcom Inc.

- 7.2.2 Robert Bosch GmBH

- 7.2.3 STMicroelectronics NV

- 7.2.4 Texas Instruments Inc.

- 7.2.5 Qorvo Inc.

- 7.2.6 Infineon Technologies AG

- 7.2.7 Knowles Electronics LLC (Knowles Corporation)

- 7.2.8 TDK Corporation

- 7.2.9 NXP Semiconductors NV

- 7.2.10 Panasonic Corporation

- 7.2.11 GoerTek Inc.