|

市場調查報告書

商品編碼

1404504

電子鼻(E-Nose):市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Electronic Nose (E-Nose) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

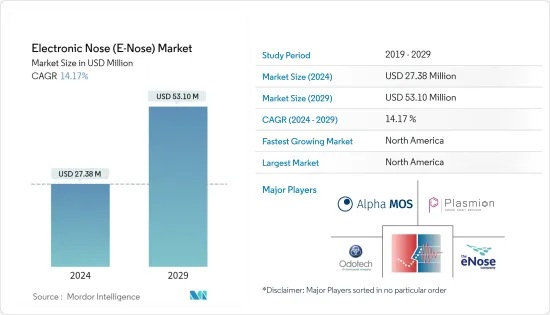

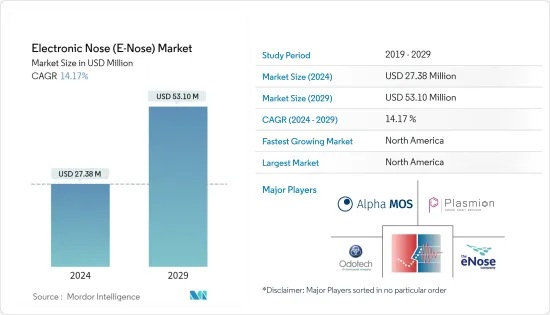

電子鼻(E-Nose)市場規模預計到2024年為2738萬美元,預計到2029年將達到5310萬美元,在預測期內(2024-2029年)複合年成長率為14.17%。

主要亮點

- 人工智慧 (AI)、雲端和物聯網 (IoT) 等技術進步正在對電子鼻 (E-Nose) 技術的需求產生積極影響。這些進步為計算系統提供動力,而計算系統是電子鼻 (E-Nose) 行業產品的關鍵組件之一。

- 電子鼻(E-Nose)在辨識酒、蔬菜、菸草等物品的氣味方面具有重要的應用價值。廣泛應用於氣味檢測、原料檢驗、品質顯示、澆水過程控制等。它也是品質保證和品管的重要工具之一。在水果和蔬菜測試中,它主要用於檢測成熟度和識別種子。

- 肺癌、結核病和糖尿病等疾病的盛行率不斷上升,以及對這些疾病早期檢測的需求不斷增加,在所研究市場的成長中發揮重要作用。根據美國癌症協會估計,2023年美國將有約59,910名女性死於肺癌和支氣管癌。據估計,2023 年美國將有 88,900 名男性死於肺癌和支氣管癌。

- 電子鼻(E-Nose)市場也見證了犯罪和安全領域的需求。隨著國際恐怖主義的擴散和恐怖攻擊中爆炸物使用的增加,世界各地的執法機構面臨著檢測隱藏在行李、郵件、車輛和飛機中的炸彈的挑戰。在軍事和國防部門,電子鼻用於檢測爆炸物、化學製劑和其他危險材料。它也用於軍事設施和訓練場的監視、偵察和環境監測。

- 由於電子鼻(E-Nose)中整合的感測器成本較高,因此電子鼻(E-Nose)的成本明顯較高。這是阻礙市場成長的主要因素,因為電子鼻(E-Nose)的初始成本較高,中小企業無法負擔。使用者缺乏意識和技術專業知識,加上不同地區不同的監管要求,是阻礙所研究市場成長的另一個因素。

- 隨著 COVID-19 大流行,各種宏觀經濟趨勢正在影響國防部門,包括全球經濟狀況、政府國防支出、地緣政治緊張局勢和技術進步。目前影響國防部門的全球宏觀經濟趨勢包括脫碳、高強度戰爭 (HIW)、環境、社會和管治(ESG) 考慮以及全球對國防部門投資的增加。根據SIPRI的數據,2022年軍費開支為8,770億美元,美國位居軍事開支最高國家之首。這約佔同年世界軍費總額(總計2.2兆美元)的40%。中國以估計 2,920 億美元的軍事開支位居第二,俄羅斯緊隨其後,位居第三。

- 據美國預算辦公室稱,美國國防支出預計每年都會增加,直到 2033 年。 2023年美國國防支出將達7,460億美元。該預測也預測,到 2033 年,國防支出將增加至 1.1 兆美元。這些舉措可能會支持軍事和國防部門採用電子鼻(E-Nose)等先進技術。

電子鼻(E-Nose)市場趨勢

廢棄物管理(環境監測)成為最大的最終使用者領域

- 垃圾掩埋垃圾掩埋場散發的甲烷氣體和其他異味不僅導致全球暖化,也因異味造成滋擾,成為各地最大的滋擾源之一。因此,廢棄物管理和環境影響監測應用為電子鼻 (E-Nose) 技術提供了巨大的潛力。

- 電子鼻用於氣味暴露評估的機會極為重要,特別是在擴散模型不適用的情況下。使用受體的電子鼻技術在垃圾掩埋場中具有巨大的潛力,例如,由於來源的性質和其他原因,每個模擬時域中氣味排放的詳細表徵和量化是困難的。隨著該地區各國政府考慮透過循環經濟(回收和再利用)來更好地管理垃圾掩埋場,對實現此類即時監控的技術的需求正在增加。

- 污水處理廠(WWTP)工業氣體排放造成的氣味滋擾是一個反覆出現的問題,難以妥善管理,部分原因是缺乏適當的測量儀器來即時準確量化現場氣味濃度。此類測量對於定期檢驗氣味緩解系統的效率、識別工廠內的主要氣味源以及根據大氣擴散模型預測場外影響至關重要。

- 當僅透過檢測法(人體面板)測量氣味時,該技術的高成本和不連續性不可避免地導致測量數量不足,無法提供氣味排放的代表性特徵。電子鼻(E-Nose)目前被認為是最有前景的環境氣味監測工具之一。

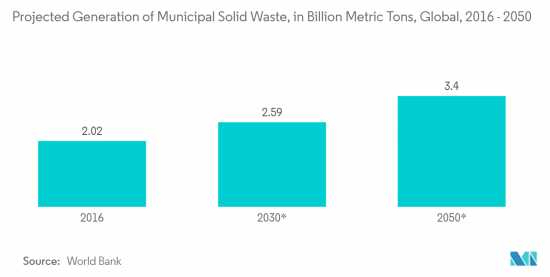

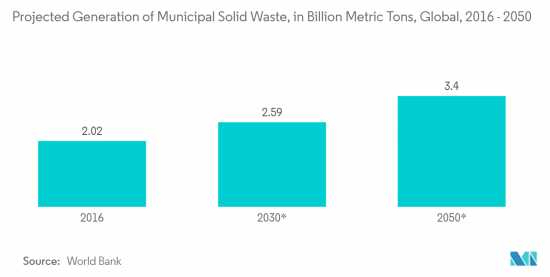

- 世界各地的廢棄物產生率正在增加。根據世界銀行的數據,2020年全球產生了22.4億噸固態廢棄物,相當於每人每天0.79公斤的足跡。由於都市化帶來的人口快速成長,預計每年產生的廢棄物量將比2020年增加73%,到2050年將達到38.8億噸。隨著廢棄物量的增加,廢棄物管理新技術的投資和採用預計將在預測期內積極推動和影響電子鼻的採用。

北美主導電子鼻市場

- 北美地區由於基礎設施發達、資源容易取得等因素佔據了很大的市場佔有率,導致電子鼻技術在國防、醫藥、食品和飲料等領域的採用正在取得進展。

- 該地區也是受嚴格監管的大型食品和飲料行業的所在地。因此,電子鼻技術看到了巨大的發展機會。例如,根據美國人口普查局的數據,2022 年 12 月美國食品和飲料店月度零售額為 884.3 億美元,而 2022 年 11 月為 821.4 億美元。

- 根據 StatCan 的數據,2022 年 6 月加拿大食品和飲料零售總額為 120.6 億加元(89 億美元),而 2021 年 6 月為 118.1 億加元(87.3 億美元)。食品和飲料銷售的這種成長可能會在預測期內推動電子鼻(E-Nose)設備的需求。

- 電子鼻(E-Nose)技術在食品和飲料行業的需求量很大,因為它可以比人的鼻子更有效地檢測肉類和家禽產品等食品的新鮮度。這有助於準確確定食品的保存期限並減少食品浪費。

- 同樣,美國的醫療機構正在使用電子鼻技術來診斷兒童氣喘。光是在美國,就有約 620 萬名兒童被診斷出患有氣喘,佔 18 歲以下人口的 8.4%。根據小兒肺科雜誌發表的報告顯示,國內使用電子鼻技術診斷氣喘的成功率為80-100%。該研究指出,該技術幾乎沒有什麼缺點,預計在未來幾年內可以克服,為該技術的普及鋪平了道路。

- 該地區的城市和州也對其公民和企業的氣味污染進行監管,這可能會促進電子鼻解決方案的發展。例如,德克薩斯州布達市就因惡臭而對居民處以罰款。這包括宣布煙霧、化學物質和動物屍體等氣味的法令。各個最終用戶產業正在進行的類似技術創新和研究預計將成為該地區市場成長的催化劑。

電子鼻(E-Nose)產業概況

電子鼻 (E-Nose) 市場正在變得半固體,多家公司包括 Alpha MOS、Plasmion GmbH、The eNose Company、Airsense Analytics GmbH 和 Envirosuite。市場上的公司致力於開發先進的產品和工藝,並加強供應鏈,以滿足消費者複雜且不斷變化的需求。

- 2023年5月,Alpha MOS宣布其牛奶品質管理解決方案獲得全球第七大乳製品集團、中國第一大酪農集團中國蒙牛集團的正式檢驗。該認證是在與分銷公司 Lan Chou Instruments 簽署為期兩年的框架協議,為蒙牛配備 Heracles NEO 電子鼻(E-Nose)後六個月獲得的。我們是第一家安裝三個 Heracles NEO 裝置的製造商,使我們能夠監測產品氣味在操作條件下隨時間的變化。

- 2023年4月,eNose公司在芝加哥舉行的HIMSS全球健康會議暨展覽會上展示了aeoNose用於肺癌治療的用途。 aeoNose 使用該公司的平台 IRIS4health Intersystems 與您的 EHR 進行通訊。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19對電子鼻(E-Nose)市場的影響

第5章市場動態

- 市場促進因素

- 在電子鼻(E-Nose)技術中引入人工智慧和神經形態計算

- 市場挑戰

- 電子鼻(E-Nose)初始成本較高

第6章市場區隔

- 按最終用戶產業

- 軍事/國防

- 醫療保健

- 食品和飲料

- 廢棄物管理(環境監測)

- 按行業分類的其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章競爭形勢

- 公司簡介

- Alpha MOS

- Electronic Sensor Technology

- Plasmion GmbH

- Envirosuite

- The eNose Company

- Airsense Analytics GmbH

- Sensigent LLC

- Aryballe Technologies SAS

- Stratuscent Inc.

- Common Invent BV

- E-Nose Pty Ltd

第8章投資分析

第9章市場的未來

The Electronic Nose Market size is estimated at USD 27.38 million in 2024, and is expected to reach USD 53.10 million by 2029, growing at a CAGR of 14.17% during the forecast period (2024-2029).

Key Highlights

- Technological advances, such as artificial intelligence (AI), the cloud, and the Internet of Things (IoT), have positively impacted the demand for electronic nose technology. These advancements have enhanced computing systems, which are one of the key components of products in the electronic nose industry.

- The electronic nose has significant application value in identifying odors of items like wine, vegetables, or cigarettes. It is widely employed in odor detection, raw material inspection, quality signing, and sprinkling process management. It is also one of the indispensable tools for quality assurance and quality control. It is primarily used for maturity detection and species identification in fruit and vegetable testing.

- The increasing prevalence of diseases like lung cancer, tuberculosis, and diabetes and the increasing necessity for early detection of these diseases play a significant role in the growth of the market studied. According to the American Cancer Society, in 2023, it was estimated that around 59,910 women in the United States would die of lung and bronchial cancer. 88,900 men are estimated to die of lung and bronchial cancer in the United States in 2023.

- The e-nose market is also witnessing demand from the crime and security sector. With the surge of international terrorism and the increased use of explosives in terrorist attacks, law enforcement agencies globally face the problem of detecting hidden bombs in luggage, mail, vehicles, and aircraft. In the military and defense sector, e-nose devices can be used to detect explosives, chemical agents, and other hazardous materials. They are also employed for surveillance, reconnaissance purposes, and environmental monitoring at military installations and training areas.

- The cost of an electronic nose is significantly high due to the high costs of sensors that are incorporated into it. This is a major factor hampering the market's growth as the initial cost of the electronic nose is high, making it unaffordable for small- and medium-sized enterprises. Lack of awareness and technical expertise among users, coupled with varying regulatory requirements across various regions, is another factor that is likely to hinder the growth of the market studied.

- Along with the COVID-19 pandemic, various macroeconomic trends, such as global economic conditions, government spending on defense, geopolitical tensions, and technological advancements, influence the defense sector. Critical macroeconomic trends currently shaping the defense sector include decarbonization, high-intensity warfare (HIW), environmental, social, and governance (ESG) considerations, and increasing investments in the defense sector globally. According to SIPRI, with USD 877 billion allocated to the military in 2022, the United States leads the ranking of countries with the largest military spending. That equated to approximately 40% of overall global military spending that year, which totaled USD 2.2 trillion. With an estimated USD 292 billion spent, China was the second-highest military spender, with Russia coming in third.

- According to the US Congressional Budget Office, defense spending in the United States is predicted to increase every year until 2033. Defense outlays in the United States amount to USD 746 billion in 2023. The forecast predicts an increase in defense outlays up to USD 1.1 trillion in 2033. Such developments are likely to boost the adoption of advanced technologies like electronic nose in the military and defense sector.

Electronic Nose Market Trends

Waste Management (Environmental Monitoring) to be the Largest End-user Vertical

- Methane gas and other odors produced at landfills not only contribute to global warming but also create an odor nuisance, which is considered one of the largest sources of nuisance in various regions. As a result, waste management or environmental impact monitoring applications provide significant scope for electronic nose technology.

- The opportunities for e-nose for odor exposure assessment purposes are critical, especially in cases where dispersion modeling is not applicable. For instance, in landfills, where a detailed characterization and quantification of odor emissions for every hour of the simulation time domain is difficult due to the nature of the source, among other reasons, e-nose technology that uses receptors can be of strong potential. As governments across regions are considering a circular economy (reuse by recycling) to manage their landfills better, the need for such technology that enables real-time monitoring is increasing.

- Odor annoyance due to industrial gas emissions from wastewater treatment plants (WWTPs) is a recurring problem that is difficult to manage properly, partly due to the lack of appropriate instrumentation to accurately quantify odor concentrations in situ and in real-time. Such measurements are key to regularly verifying the efficiency of odor abatement systems, identifying the main odor sources within the plant, and predicting off-site impacts based on atmospheric dispersion models.

- When odors are exclusively measured by olfactometry (human panels), the high cost and discontinuous nature of this technique inevitably lead to an insufficient number of measurements to provide a representative characterization of the odor emissions. Electronic noses are currently considered one of the most promising tools for environmental odor monitoring.

- Waste generation rates are rising around the world. As per the World Bank, in 2020, the world generated 2.24 billion tons of solid waste, which amounted to a footprint of 0.79 kg per person per day. With rapid population growth along with urbanization, annual waste generation is estimated to increase by 73% from 2020 levels to reach 3.88 billion tons in 2050. With the growing amount of waste, the investment and adoption of new technologies in managing waste are expected to positively boost and influence e-nose's adoption during the forecast period.

North America to Dominate the E-Nose Market

- North America holds a significant share of the market studied due to factors such as developed infrastructure and the availability of resources, which have enabled the adoption of e-nose technology in sectors such as defense, healthcare, and food and beverages, among others.

- The region is also home to a major food and beverage industry, which is highly regulated. This is where e-nose technology finds a prime opportunity for growth. For instance, according to the US Census Bureau, in December 2022, the monthly retail sales of food and beverage stores in the United States were USD 88.43 billion, compared to USD 82.14 billion in November 2022.

- According to StatCan, retail sales of food and beverage stores in Canada amounted to CAD 12.06 billion (USD 8.91 billion) in June 2022, compared to CAD 11.81 billion (USD 8.73 billion) in June 2021. Such an increase in food and beverage sales may facilitate the demand for electronic nose devices during the forecast period.

- The demand for e-nose technology is high in the food and beverage industry, as it can detect the freshness of food items, such as meat and poultry products, more effectively than a human nose. This helps in accurately determining the longevity of food items and reducing the amount of food waste.

- Similarly, healthcare agencies in the United States are trying to diagnose asthma in children using e-nose technology. In the United States alone, about 6.2 million children are diagnosed with asthma, comprising 8.4% of the population younger than 18 years. According to the report published by Pediatric Pulmonology, the country achieved an 80-100% success rate in asthma diagnosis using the e-nose technology. The study stated that this technology has fewer drawbacks, which are expected to be combated in the coming years, paving the way for the widespread adoption of this technology.

- Also, cities and states in the region regulate citizens and enterprises for odor pollution, which allows e-nose solutions to grow. For example, Buda, Texas, is fining residents for offensive odors. This includes an ordinance declaring offensive odors, including smoke, chemicals, and dead animals. Similar ongoing innovations and research across various end-user industries are expected to act as a catalyst for the market's growth in the region.

Electronic Nose Industry Overview

The Electronic Nose Market is semi-consolidated with the presence of several players like Alpha MOS, Plasmion GmbH, The eNose Company, Airsense Analytics GmbH, Envirosuite, etc. The companies in the market aim to develop advanced products and processes and strengthen their supply chains to cater to consumers' complex and evolving needs.

- In May 2023, Alpha MOS declared the formal validation of its milk quality control solution by the Chinese conglomerate Mengniu, which is the seventh-largest dairy group globally and the foremost in China. This validation was granted six months after the execution of a two-year framework agreement with the distribution enterprise Lan Chou Instruments, which aimed at equipping Mengniu with Heracles NEO electronic noses. The manufacturer has become the first to be equipped with three Heracles NEO instruments to monitor, under operational conditions, the alterations in the aroma of its products over time.

- In April 2023, The eNose Company demonstrated the use of the aeoNose to treat lung cancer at the HIMSS Global Health Conference and Exhibition in Chicago. The aeoNose communicates with the EHR using the company's platform, IRIS4health Intersystems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Electronic Nose Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Introduction of AI and Neuromorphic Computing in E-Noses Technology

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of E-Noses

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Military and Defense

- 6.1.2 Healthcare

- 6.1.3 Food and Beverage

- 6.1.4 Waste Management (Environmental Monitoring)

- 6.1.5 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Alpha MOS

- 7.1.2 Electronic Sensor Technology

- 7.1.3 Plasmion GmbH

- 7.1.4 Envirosuite

- 7.1.5 The eNose Company

- 7.1.6 Airsense Analytics GmbH

- 7.1.7 Sensigent LLC

- 7.1.8 Aryballe Technologies SAS

- 7.1.9 Stratuscent Inc.

- 7.1.10 Common Invent B.V.

- 7.1.11 E-Nose Pty Ltd