|

市場調查報告書

商品編碼

1404385

軍事生物辨識市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Military Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2024 年,軍事生物辨識市場價值為 528.3 億美元,預計到 2029 年將達到 745.5 億美元,預測期內(2024-2029 年)複合年成長率為 7.13%。

由於 COVID-19 大流行,軍事生物辨識市場面臨前所未有的挑戰。隨著疫情的出現,世界各國政府啟動了封鎖和邊境關閉。這影響了物流以及生產軍事生物辨識系統所需的各種原料的供應。此外,國防預算下降以及各國防公司裁員導致武裝部隊訂單減少,最終影響了軍隊先進生物識別技術的生產和開發。新冠疫情過後,隨著邊境開放封鎖解除,關鍵原料得以運抵製造商,市場出現強勁復甦。此外,各種國防相關企業已開始增加對新技術研究的投資,預計這也將在不久的將來帶來市場成長。

全球反恐戰爭導致人們越來越關注生物辨識技術作為識別和追蹤恐怖分子嫌疑人的安全解決方案。這可能會推動未來幾年生物辨識市場的成長。技術進步,例如用於虹膜辨識的雙眼生物辨識相機的開發,可以為軍方提供快速個人識別的機會。電腦和相關技術的進步使生物辨識成為高度自動化的過程,推動未來市場的成長。

軍事生物辨識市場趨勢

預計指紋認證領域在預測期內將以最高複合年成長率成長

預計指紋辨識領域在預測期內將呈現顯著成長。這一成長是由世界各地國防預算的增加以及世界各地國防軍採用新生物識別技術的需求不斷增加所推動的。這是為了在複雜的戰場任務中準確地驗證一個人的身分。

世界各地的軍隊都使用生物辨識技術來安全地控制對設施、設備和 IT 系統的存取。它也用於識別戰場上的敵人。此外,先進的生物辨識技術最常用於國防和資訊部門。這主要是為了識別一個人的身份並限制未經授權的個人進入軍事限制區域內的物理空間。

指紋是目前國防軍中最常使用的生物辨識指標。目前的技術以幾種不同的方式捕捉指紋。最常見的方法是光學掃描,它使用棱鏡來測量形成指紋影像的微小脊和谷之間的距離。另一種方法是使用薄膜電晶體(TFT)技術,該技術使用微小的電流來測量相同的脊和谷。第三種方法使用聲波捕捉皮膚表面下的指紋。指紋掃描器將這些影像數位化為獨特的數位模板。然後它可以用來匹配現有記錄,以確保只有授權人員才能存取任何軍事設施,並防止敏感資料洩露給敵人。

此外,泰雷茲目前正在開發的與指紋相關的一項不斷發展的技術,即自動指紋辨識系統(AFIS),是一種生物辨識系統。它使用數位成像技術來捕獲、儲存和分析指紋資料,使其成為執法和國防相關人員的重要工具。它有助於根據獨特的指紋模式快速準確地識別個人。

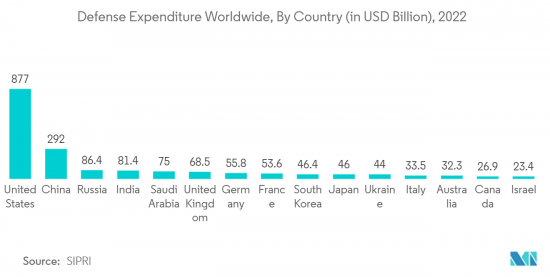

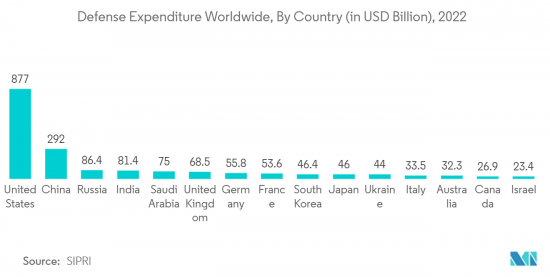

因此,全球國防支出的成長,加上技術進步帶來的先進指紋感測器市場的不斷開拓,將導致指紋辨識領域在預測期內呈現出積極的前景和顯著的市場成長。

北美地區將在預測期內顯著成長

預計北美在預測期內將呈現最高成長。北美各市場參與者的研究投資支出不斷增加,北美地區國防相關人員對採用先進生物識別技術的需求不斷增加,以及升級安全能力的需求正在推動北美地區對軍事生物識別技術的需求。在不久的將來,這些都是導致顯著成長的關鍵因素。

生物辨識技術可以在軍事行動中以多種方式使用。它還可用於控制對軍事設施的訪問,確保僅允許授權的個人訪問。您也可以識別似乎對友軍構成威脅的人。美國在阿富汗和伊拉克的軍事行動中就以這種方式使用了生物辨識技術。除其他用途外,生物辨識設備還用於掃描部隊在檢查站和巡邏時遇到的人員。

臉部認證系統等生物辨識技術新興市場的開拓預計將推動北美軍事生物辨識市場的成長。此外,一些美國機構也在尋求開發先進的生物辨識技術來保護和禁止未經識別的存取。例如,2022年10月,美國部長簽署了美國生物辨識計劃,這是第一個與生物辨識相關的陸軍指令。

因此,擴大國防和安全能力的需求不斷成長,加上技術的不斷發展,預計將推動軍事生物識別技術在預測期內在北美地區取得積極的前景和巨大的市場佔有率,並將呈現成長。

軍事生物辨識產業概述

軍事生物辨識市場高度分散,不同的參與企業佔據了很大的市場佔有率。著名的市場參與企業包括 Aware, Inc.、Leidos, Inc.、Fulcrum Biometrics, Inc.、M2SYS 和 IDEMIA。市場上的主要參與企業專注於開發先進的生物辨識系統,世界各地的各種國防人員使用這些系統來執行複雜的戰場任務。用於生產先進軍事生物識別系統的研發支出的成長可能會在不久的將來帶來更好的機會。

此外,各製造商目前正在將虹膜辨識和臉部認證等技術整合到其生物辨識系統中,以供軍方有效識別有興趣的人員,預計這將在預測期內增加軍事生物辨識技術,從而支持市場成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 擴大生物辨識系統在軍事領域的採用

- 市場抑制因素

- 從長遠來看,全球網路攻擊的增加將阻礙市場

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 識別類型

- 指紋辨識

- 臉部認證

- 虹膜辨識

- 其他

- DNA識別

- 手指形狀識別

- 擊鍵識別

- 簽名辨識

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 中東和非洲其他地區

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Cross Match Technologies, Inc.(HID Global Corporation)

- M2SYS Technology

- IDEMIA

- Aware, Inc.

- Fulcrum Biometrics

- ZKTECO CO., LTD.

- Leidos Holdings, Inc.

- Corvus Integration, Inc.

- HID Global Corporation

- NEC Corporation

- BIO-key International

- THALES

第7章 市場機會及未來趨勢

- 擴大虹膜辨識生物辨識系統在軍事應用的採用

The military biometrics market is valued at USD 52.83 billion in 2024 and is anticipated to reach USD 74.55 billion by 2029, registering a CAGR of 7.13% during the forecast period (2024-2029).

The military biometrics market witnessed unprecedented challenges due to the COVID-19 pandemic. The advent of the pandemic led to various governments worldwide initiating lockdowns as well as closing down of borders. It led to an effect on the logistics as well as the supply of various raw materials that are required for the production of biometric systems for the military. In addition, the decline in the orders from defense forces owing to a fall in the defense budget coupled with layoffs by various defense companies ultimately affected the production and development of advanced biometric technologies for the military. The market showcased a strong recovery post-COVID due to the opening up of borders and removing lockdowns, thereby enabling key raw materials to reach the manufacturers. Also, various defense companies started increasing their investments in researching new technologies, and this is expected to lead to market growth in the near future.

The global war on terrorism brought an increased focus on biometric technology as a security solution for identifying and tracking suspected terrorists. It may drive the growth of the biometrics market in the coming years. Technological advancements, such as the development of binocular-shaped biometric cameras for iris recognition, may prove to be opportunities for the military for quick individual identification. Advancements in computer and related technologies led to biometric recognition being a highly automated process that drives market growth in coming years.

Military Biometrics Market Trends

Fingerprint Recognition Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period

The fingerprint recognition segment is expected to show significant growth during the forecast period. The growth is attributed to the increased defense budget of various countries around the world and the increasing need for the adoption of new biometric technologies by the worldwide defense forces. It is in order to precisely authenticate the identity of the person during complex battlefield missions.

Militaries around the world use biometrics for secure access control to facilities, equipment, and IT systems. It is also to identify adversaries in the field. Moreover, advanced biometric technology is utilized most frequently in defense & intelligence. It is mainly for recognizing the identity of a person and restricting the access of an unauthorized individual to the physical spaces within the confined area of military forces.

Currently, fingerprints are the most used biometric indicator, which is being used by the defense forces. Current technologies capture fingerprints in several different ways. The most common method is optical scanning, which makes use of prisms to measure the distance between the tiny ridges and valleys that form a fingerprint image. Another method uses thin film transistor (TFT) technology, which employs a small electrical current to measure those same ridges and valleys. A third method uses sound waves to capture fingerprints below the surface of the skin. Fingerprint scanners digitize these images into unique digital templates. It can then be used to match against existing records, thereby only allowing authorized personnel to gain access to any military facility and also to protect confidential data from leaking to the enemy.

Furthermore, growth in technologies regarding fingerprints known as Automated Fingerprint Identification System (AFIS), which Thales is currently developing, is a biometric identification system. It uses digital imaging technology to obtain, store, and analyze fingerprint data, thereby making it an essential tool for law enforcement agencies and defense personnel. It helps in the rapid and accurate identification of individuals based on their unique fingerprint patterns.

Thus, the growth in terms of defense expenditure of various countries globally, coupled with the increase in the development of advanced fingerprint sensors due to advancement in technology, will lead to the fingerprint recognition segment witnessing a positive outlook and significant market growth during the forecast period.

North America Will Showcase Remarkable Growth During the Forecast Period

North America is projected to show the highest growth during the forecast period. The increasing expenditure by various market players in North America in terms of investments in research, the growing need for the adoption of advanced biometrics by the defense personnel in the North American region, and the need for upgrading security capabilities are the major factors that will lead to military biometrics witnessing significant growth in North America in the near future.

Biometrics can be used in a variety of ways during military operations. It can also be employed to control access to a military installation by verifying that only authorized individuals are granted such access. Another use includes identifying individuals considered to pose a threat to friendly forces. Biometric technology was used in this manner by the US Army during the military operations which were conducted in Afghanistan and Iraq. Among other uses, devices that were capable of biometrically identifying persons were employed at checkpoints and by units on patrol to scan persons whom they encountered.

Advanced developments of biometric technologies, such as face authentication systems, among others, are expected to lead the market growth for biometrics for the military in North America. In addition, some of the agencies in the US are also looking forward to developing advanced biometric technologies in order to safeguard and prohibit unrecognized access. For instance, in October 2022, the Secretary of the Army signed the US Army Biometric Program, the first Army directive related to biometrics.

Thus, the growing need for expanding defense and security capabilities coupled with increasing technological developments will lead to military biometrics witnessing a positive outlook and significant growth in market share in the North American region during the forecast period.

Military Biometrics Industry Overview

The military biometrics market is fragmented in nature, with various players holding significant shares in the market. Some prominent market players are Aware, Inc., Leidos, Inc., Fulcrum Biometrics, Inc., M2SYS, and IDEMIA, amongst others. The key players in the market are focusing on the development of advanced biometric systems, which will be used by various defense personnel worldwide in order to carry out complex battlefield missions. The growth in terms of expenditure on research and development towards manufacturing advanced biometric systems for the military will lead to creating better opportunities in the near future.

Moreover, various manufacturers are now integrating technologies such as iris and facial recognition in the biometric systems in order for the military to effectively identify persons of interest, and this is expected to support the growth of the military biometrics market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of biometric system in the military

- 4.3 Market Restraints

- 4.3.1 Growth in cyber attacks worldwide will hamper the market in the long run

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Recognition Type

- 5.1.1 Fingerprint Recognition

- 5.1.2 Facial Recognition

- 5.1.3 Iris Recognition

- 5.1.4 Others

- 5.1.4.1 DNA Recognition

- 5.1.4.2 Finger Geometry Recognition

- 5.1.4.3 Keystroke Recognition

- 5.1.4.4 Signature Recognition

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Qatar

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Cross Match Technologies, Inc. (HID Global Corporation)

- 6.2.2 M2SYS Technology

- 6.2.3 IDEMIA

- 6.2.4 Aware, Inc.

- 6.2.5 Fulcrum Biometrics

- 6.2.6 ZKTECO CO., LTD.

- 6.2.7 Leidos Holdings, Inc.

- 6.2.8 Corvus Integration, Inc.

- 6.2.9 HID Global Corporation

- 6.2.10 NEC Corporation

- 6.2.11 BIO-key International

- 6.2.12 THALES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The growing adoption of iris recognition biometric systems for military applications