|

市場調查報告書

商品編碼

1440296

生物識別卡:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Biometric Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

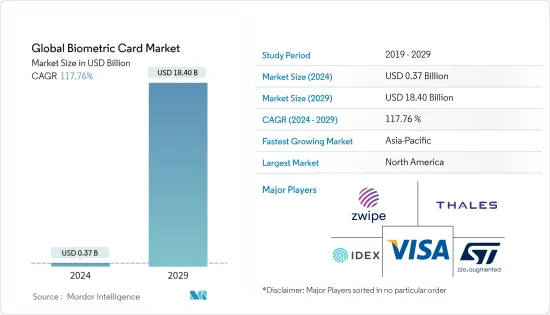

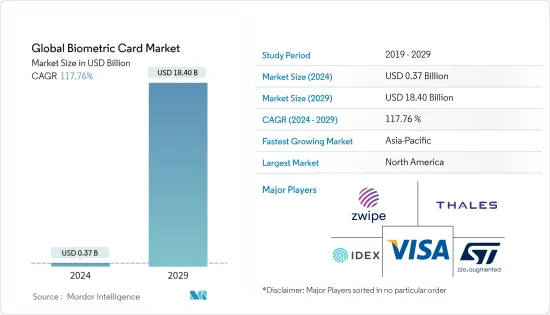

預計2024年全球生物識別卡市場規模為3.7億美元,預計2029年將達到184億美元,在預測期內(2024-2029年)成長117.76%,以年複合成長率成長。

銀行、零售、遊戲、安全等各種最終用戶對生物識別系統的需求不斷增加,預計將支持預測期內所研究市場的成長。

主要亮點

- 生物識別卡將嵌入式晶片技術與指紋、眼視網膜和虹膜掃描、臉部模式和語音辨識等生物識別技術結合,以在店內購物時驗證持卡人的身份。生物辨識卡還包括具有各種安全功能的智慧卡,例如光學條或條碼、全像安全影像和嵌入式晶片。

- 生物識別證明文件,可根據個人的身體和行為特徵來分析和識別個人。其中包括指紋、眼睛視網膜和虹膜掃描、臉部模式、語音辨識和身體動作。生物辨識卡還包括具有各種安全功能的智慧卡,例如光學條或條碼、全像安全影像和嵌入式晶片。

- 智慧卡是一種使用生物識別分析來識別個人身分的ID卡。智慧卡有多種形式,但最常見和流行的是具有內部記憶體的處理器或與儲存晶片配合使用的智慧卡。該卡透過與掃描器或遠端電磁介面的直接物理接觸進行連接。卡可以儲存大量資料,執行加密和數位簽章,並將這些資訊連接到遠端非接觸式系統,例如電磁讀卡機。透過使用這項技術,生物識別卡比傳統的非接觸式付款方式提供了更高的安全性。在交易處理過程中,卡片會在核准付款之前將掃描器上的使用者指紋與儲存在卡片的安全晶片上的資料進行比較。您的個人資料永遠不會保存在銀行的伺服器上或發送到中央資料庫。因此,即使在被盜的情況下,客戶也不必擔心其帳戶遭到詐欺活動。這增加了額外的保護層並確保您的帳戶詳細資訊的安全。生物識別卡的這種額外保護沒有付款標準,允許消費者進行高額或低額交易。

- 生物識別ID卡應用於多種解決方案,特別是對於安全性要求較高的公司和個人。此外,競爭行業的公司可能會選擇生物識別卡作為防止非法複製和盜竊的額外安全措施。高級ID卡供給政府部門、研究機構以及一些大學和學校。

- 對卡片生物識別所需的技術比目前使用的付款卡中使用的技術更昂貴。雖然消費者可能願意為更安全的支付卡支付少量費用,但目前生物識別卡的成本預計為每張卡 20 美元左右,這使得它們更受用戶歡迎,但招募受到限制。

- COVID-19感染疾病一直是非接觸式付款的催化劑。疫情過後,科技業開發了非接觸式解決方案,間接提高了無需第二個身分驗證因素的交易處理水準。無支付限制的生物識別付款卡可滿足您所有的非接觸式交易需求,同時解決安全問題。

生物識別卡市場趨勢

付款產業呈現顯著成長

生物識別技術作為密碼和 PIN 碼的安全且便捷的替代方案,在金融服務領域普及。這項技術被認為有潛力讓消費者的生活變得更容易管理,並為他們提供更有意義的選擇來驗證自己的身分。

據 Fingerprint Cards AB 稱,預計到 2026 年,付款設備的年出貨將達到約 60 億台。預計幾乎所有這些設備都將是非接觸式的。此外,該公司估計付款領域生物識別感測器模組和軟體的潛在總可尋址市場 (TAM) 每年約為 30 億個。

鑑於付款行業對所研究市場的成長潛力,供應商越來越關注新產品的發布並合作加速生物識別卡的商業化。Masu。例如,2022 年 4 月,IDEX Biometrics ASA 宣布與歐洲著名卡片製造商之一 E-Kart 建立合作夥伴關係,在東歐將生物識別付款解決方案商業化。

同樣,2022 年 4 月,全球生物識別公司 Fingerprint Cards AB 宣布,其技術將用於在摩洛哥推出至少兩張新的商業生物識別付款卡。預計這些趨勢將在預測期內支持所研究市場的成長。

亞太地區成長率最高

生物識別付款卡是該地區的未來之路,儘管智慧型手機的使用量有所增加,但在快節奏的亞太地區,付款卡市場仍然強勁。根據中國人民銀行預計,我國銀行卡總數預計將從2020年的89.54億張增加到2021年的92.47億張。

同樣,根據日本信用協會的數據,截至2021年3月,日本發行的信用卡數量為2.9531億張,與前一年同期比較成長約0.8%。

目前,各種市場供應商正在致力於整合生物識別技術。他們將提供真正顛覆性的服務,顯著擴大該地區的銀行客戶群,並將其與各種最終用戶整合。例如,先進指紋識別和身份驗證解決方案的知名供應商之一IDEX Biometrics ASA 於2021 年6 月宣布,中國建設銀行(CCB) 將擴大某些「數位人民幣」考試,並宣布將發行由中國建設銀行擔保的智慧卡。原本的。 IDEX Biometrics 指紋感應器和生物識別軟體。

同樣,2021 年 7 月,生物識別金融科技公司 Zwipe 宣布與國際卡片付款處理商和卡片個人化機構 ICPS 合作,將支援 Zwipe Pay ONE 的生物識別付款卡引入亞洲和非洲。並宣布將向銀行提供這項服務。

生物識別卡產業概況

全球生物識別卡市場正在見證著日益擴大業務能力的知名供應商之間的激烈競爭。結果,市場出現了巨大的投資和激烈的競爭。該市場的特點是多家大公司正在積極致力於擴大客戶群並隨後增加市場佔有率。因此,市場競爭程度被認為較高。市場上營運的一些主要企業包括 Zwipe AS、Thales Group、IDEX Biometrics、STMicroElectronics 等。

2022 年 6 月 - Zwipe 和 Fidor 銀行宣布計劃於 2022 年下半年在德國試點生物識別付款卡。 Zwipe Pay 技術平台為此提供支援。生物識別卡的推出符合 Fidor 的策略,即以最安全的方式為消費者提供數位銀行業務和支付服務。

2022 年 5 月 - Fingerprint Cards AB 和獨立行動 POS 商家收購方和網路供應商 Mswipe 宣佈建立合作夥伴關係,將生物識別簽帳金融卡和信用卡引入印度。該公司表示,此次合作將採用 Fingerprints 的 T-Shape 模組和軟體平台。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對的強度

- 評估 COVID-19感染疾病對市場的影響

- 產業生態系統分析

- 生物識別卡的演變

第5章市場動態

- 市場促進因素

- 透過新興國家的金融包容性措施擴大需求

- 向多因素身份驗證的過渡預示著市場的成長

- 市場挑戰

- 來自非卡片式生物識別設備的激烈競爭

- 實施成本增加

第6章市場區隔

- 按用途

- 付款

- 存取控制

- 政府身分證件和普惠金融

- 其他用途

- 按最終用戶產業

- BFSI

- 零售

- 政府

- 衛生保健

- 商業組織

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介*

- Zwipe AS

- Thales Group

- IDEX Biometrics ASA

- Goldpac Fintech

- Fingerprint Cards AB

- Seshaasai Business Forms(P)Ltd

- IDEMIA Group

- ST Microelectronics NV

- Mastercard Incorporated

- Visa Inc.

- Ethernom Inc.

- Samsung's System LSI Business

- Shanghai Fudan Microelectronics Group Co. Ltd

第8章投資分析

第9章 未來展望

第10章市場機會分析

The Global Biometric Card Market size is estimated at USD 0.37 billion in 2024, and is expected to reach USD 18.40 billion by 2029, growing at a CAGR of 117.76% during the forecast period (2024-2029).

Increasing demand for biometric authentication systems across various end-users, including banking, retail, gaming, and security, is expected to support the growth of the studied market during the forecast period.

Key Highlights

- Biometric cards combine the embedded chip technology with biometric authentication technologies such as fingerprints, eye retina, iris scanning, facial patterns, voice recognition, etc., to verify the cardholder's identity for in-store purchases. Biometric cards also comprise smart cards with various security features, such as an optical strip or barcode, a holographic security image, and an embedded chip.

- Biometric cards are forms of identification that analyze and recognize individuals based on their physical and behavioral traits. These include fingerprints, eye retina, iris scanning, facial patterns, voice recognition, and body movement. Biometric cards also comprise smart cards with various security features, such as an optical strip or barcode, a holographic security image, and an embedded chip.

- A smart card is an identity card that uses biometric analysis to identify an individual. Smart cards are available in several forms, but the most common and popular are those with a processor with internal memory or those that function with a memory chip. The cards are connected via direct physical contact with a scanner or a remote electromagnetic interface. The cards can store large amounts of data, carry out their encryption and digital signatures, and connect this information to a remote, a contactless system like an electromagnetic card reader. By using this technology, biometric cards offer more security than conventional contactless payment methods. During the transaction processing, the card compares the user's fingerprint on the scanner with the reference data stored in the card's secure chip before authorizing the payment. No personal data is held on a bank's servers or sent to the centralized database. Hence, in case of theft, the customers will not have to worry about fraudulent activity on their accounts. It adds an extra layer of protection and ensures that the user's account details are kept secure. This added protection by the biometric cards does not have a payment threshold, allowing its consumers to make high or low-value transactions.

- Biometric ID cards apply to several solutions, especially for companies and individuals requiring greater security. Moreover, companies in highly competitive fields may choose biometric cards as an added security against illegal duplication and theft. Advanced ID cards serve government sectors, research institutions, and some universities and schools.

- The technology required for biometric authentication in cards involves a higher expense than the technology used in the payment cards that are being used currently. Although consumers may be willing to pay a small fee for a more secure payment card, the current cost of the biometric card, which is expected to be around USD 20 per card, restricts its adoption among users.

- The COVID-19 pandemic has been a catalyst when it comes to contactless payments. Following the pandemic, the tech sector has developed contactless solutions, indirectly resulting in higher transaction levels being processed without a second authentication factor. With no payment limits, biometric payment cards meet the need for all contactless transactions while addressing security concerns.

Biometric Card Market Trends

Payments Segment to Show Significant Growth

Biometric technology is gaining ground in financial services as a secure and convenient alternative to passwords and PINs. This technology is increasingly being considered to have the potential to make the consumers' lives more manageable and provide them with more significant choices to confirm their identity.

According to Fingerprint Cards AB, around 6 billion payment devices are expected to be shipped annually by 2026. Also, almost all these devices are anticipated to be contactless. Moreover, the company depicts the potential Total Addressable Market (TAM) to be around 3 billion units per year for biometric sensor modules and software in the payment domain.

Considering the potential the payment sector holds for the growth of the studied market, vendors are increasingly focusing on new product launches and collaborating to facilitate the commercialization of biometric cards. For instance, in April 2022, IDEX Biometrics ASA announced its collaboration with E-Kart, one of the prominent card manufacturers in Europe, to commercialize biometric payment solutions in Eastern Europe.

Similarly, in April 2022, Fingerprint Cards AB, a global biometrics company, announced that its technology would be used as part of at least two new commercial biometric payment card launches in Morocco. Such trends are expected to support the growth of the studied market during the forecast period.

Asia Pacific to Exhibit the Highest Growth Rate

Biometric payment cards are a way to the future in the region, and there is a robust market for payment cards in the fast-paced Asia-Pacific region, even in the face of rising smartphone use. According to the People's Bank of China, the total number of bank cards in China will increase to 9,247 million in 2021, from 8,954 million in 2020.

Similarly, according to Japan Consumer Credit Association, the number of credit cards issued in Japan amounted to 295.31 million as of March 2021. It was an increase of about 0.8 percent compared to the previous year.

Various market vendors are currently working to integrate biometric technology. They will have a truly disruptive offering that will significantly expand the banking customer base in the region and integrate it with various end-users. For instance, in June 2021, IDEX Biometrics ASA, one of the prominent providers of advanced fingerprint identification and authentication solutions, announced that China Construction Bank (CCB) expanded certain "digital renminbi" trials to include the issuance of smart cards that are secured by IDEX Biometrics fingerprint sensors and biometric software.

Similarly, in July 2021, Zwipe, a biometric fintech company, announced its collaboration with the international card payment processor and card personalization bureau ICPS to bring Zwipe Pay ONE-enabled biometric payment cards to banks across Asia and Africa.

Biometric Card Industry Overview

The Global Biometric Card Market is seeing intense competition among prominent vendors, who are increasingly expanding their business capabilities. As such, huge investments are being witnessed in the market, increasing competition. The market is marked by several large-scale players actively working to increase their customer base and subsequently increase their market share. Therefore, the degree of competition is considered high in the market. Some of the major players operating in the market include Zwipe AS, Thales Group, IDEX Biometrics, and STMicroelectronics, among others.

June 2022 - Zwipe and Fidor Bank announced plans to pilot biometric payment cards in Germany during the second half of 2022. The Zwipe Pay technology platform will power this. The launch of biometric cards is in line with Fidor's strategy to provide its consumers with access to digital banking and pay services in the most secure way possible.

May 2022 - Fingerprint Cards AB and Mswipe, an independent mobile POS merchant acquirer & network provider, announced their collaboration to bring biometric debit and credit cards to India. According to the company, the partnership will feature Fingerprints' T-Shape module and software platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Industry Ecosystem Analysis

- 4.5 Evolution of Biometric Cards

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Financial Inclusion-based Initiatives in Emerging Countries

- 5.1.2 Move Toward Multi-factor Authentication Bodes Well for Market Growth

- 5.2 Market Challenges

- 5.2.1 Strong Competition from Non-card Biometric Devices

- 5.2.2 Higher Implementation Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Payments

- 6.1.2 Access Control

- 6.1.3 Government ID and Financial Inclusion

- 6.1.4 Other Applications

- 6.2 By End-User Vertical

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Government

- 6.2.4 Healthcare

- 6.2.5 Commercial Entities

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles *

- 7.1.1 Zwipe AS

- 7.1.2 Thales Group

- 7.1.3 IDEX Biometrics ASA

- 7.1.4 Goldpac Fintech

- 7.1.5 Fingerprint Cards AB

- 7.1.6 Seshaasai Business Forms (P) Ltd

- 7.1.7 IDEMIA Group

- 7.1.8 ST Microelectronics NV

- 7.1.9 Mastercard Incorporated

- 7.1.10 Visa Inc.

- 7.1.11 Ethernom Inc.

- 7.1.12 Samsung's System LSI Business

- 7.1.13 Shanghai Fudan Microelectronics Group Co. Ltd