|

市場調查報告書

商品編碼

1403975

穿戴式科技-市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Wearable Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

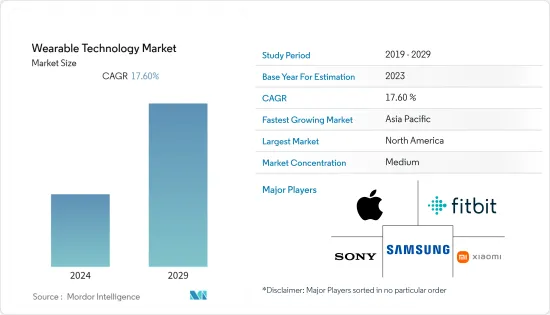

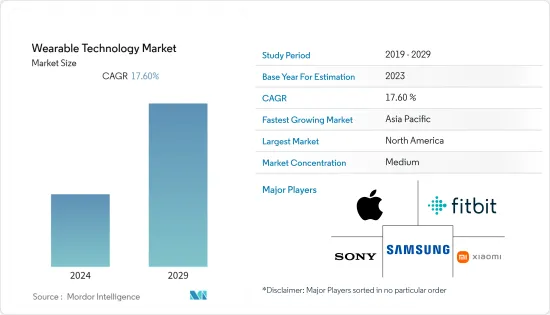

穿戴式科技市場規模預計將從2024年的1,864.8億美元成長到2029年的4,932.6億美元,預測期內複合年成長率為17.60%。

隨著 MEMS 感測器的出現,穿戴式技術不斷發展。智慧型手機的 GPS 和 IMU(包括加速計、陀螺儀和地磁計)的日常使用推動了這些感測器與專用穿戴裝置的整合。這些有助於健身追蹤穿戴裝置使用這些感測器監控身體活動。

主要亮點

- 消費者生活中的技術進步導致了可追蹤健康、運動和社交媒體通知的穿戴式技術的出現。過去幾年,智慧型手錶、健身追蹤器、VR/AR耳機等各種穿戴式裝置在社會中變得越來越普遍。因此,穿戴式裝置的受歡迎程度預計將繼續成長,因此公司正在尋找新的創新方法將穿戴式裝置應用到日常生活中是可以理解的。

- 多項研究表明,越來越多的人購買穿戴式裝置來促進健身和管理健康。最近的一項研究表明,全球消費者因健康自我效能感、健康和自主性以及技術創新而採用穿戴式醫療保健設備。此外,COVID-19大流行刺激了遠距醫療管理的快速大規模擴展,鞏固了遠端醫療作為一種便捷且有效的醫療保健模式的地位。

- 值得注意的是,智慧型手錶正在迅速獲得新用戶,包括老年人,因為蘋果和Fitbit 等穿戴式設備製造商不斷添加健康監測功能,吸引老年人並即時更新他們的健康狀況。這就是我正在做的事情。例如,2022 年 9 月,蘋果推出了 Apple Watch Series 8 和新款 Apple Watch SE,為其兩款最暢銷的智慧型手錶增添了重要的安全創新功能。 Apple Watch Series 8 配備大型常亮視網膜顯示器和堅固且不易損壞的正面水晶。此外,該新產品具有 18 小時全天電池續航時間,基於心電圖應用程式和跌倒偵測等一流的健康和安全功能,並引入了溫度感測、追溯排卵預測、碰撞偵測和國際檢測功能。漫遊。 。

- 此外,亞馬遜已經在進行試驗,並可能在未來幾年及以後面臨新的競爭。穿戴式裝置市場的現有企業可能會面臨來自亞馬遜的激烈競爭。據報道,亞馬遜耳機是亞馬遜硬體部門Lab126的產品,可以透過手勢控制接聽電話和改變音樂。然而,隨著智慧型穿戴裝置技術力的進步,複雜性和資料安全問題很可能成為產業擴張的障礙。儘管如此,智慧穿戴裝置領域的持續研究應該能夠在未來幾年內解決這些問題。

- 在COVID-19疫情下,擁有大量用於製造穿戴式產品的原料製造商的亞洲國家,如中國、印度、韓國、台灣和日本,都受到了封鎖,影響了生產計畫。由於全球大多數經濟體實施封鎖,銷售額下降,因為交貨僅限於必需品,而且公司修改了收益目標。

穿戴式科技市場趨勢

頭戴式顯示器預計將顯著成長

- 預計頭戴式顯示器在預測期內將顯著成長。此外,擴增實境(AR)和虛擬實境(VR)的發展在醫療保健產業越來越普及。為了協助外科手術培訓和手術,醫療專業人員正在使用 VR 技術和VR頭戴裝置。這可以減少手術失敗的機會。

- 擴增實境(AR)、虛擬實境 (VR) 和混合實境(MR) 將數位投影疊加到現實世界的物件上,提供上下文資訊並允許使用者與周圍環境進行視覺互動。儘管這些技術可以透過智慧型手機、平板電腦和許多其他媒介實現,但頭戴式顯示器 (HMD) 更普及。

- 身臨其境型HMD 主要用於體驗虛擬實境 (VR) 和擴增實境(AR)。由於成本、可得性、人體工學、不時尚的設計和其他因素,消費者的主流使用受到限制。 AR HMD 的主要驅動力是企業用途,它們在內部用作業務流程改進和培訓的免持工具。

- 任天堂和微軟等主要遊戲機製造商正在發揮主導,因為他們認知到 AR 的潛力。借助AR,玩家可以離開自己的“世界”,在現實世界中玩耍。例如,在「人類吃豆人」中,玩家可以戴上護目鏡並在現實世界中追逐其他吃豆人角色,同時看起來與吃豆人角色一模一樣。許多玩家認為,擁有行動裝置並不是 AR 遊戲所需的唯一條件。在某種程度上,主機設備可以彌補這一點。

- 愛立信消費者實驗室對巴西、中國、法國、日本、韓國、英國和美國7000 名 15 至 69 歲的人進行的一項調查發現,三分之二的參與者對身臨其境型AR 遊戲感興趣。我有。約32%的用戶認為,如果AR技術與身體活動和鍛鍊相結合,AR遊戲會更有趣。

北美預計將佔據很大佔有率

- 北美被譽為世界上所有重要技術進步的中心。智慧產品的出現推動了對更強大、更先進的穿戴式科技的需求。可支配收入的增加、增強型設備的快速採用和普及是該地區的一些關鍵促進因素。此外,蘋果、Fitbit 和 Garmin 等穿戴式裝置供應商在該地區擁有強大的影響力,為市場成長做出了貢獻。

- 眾多體育協會增加投資,以消除高薪職業運動員發生可預防傷害的可能性,預計將推動該地區穿戴式裝置的成長。例如,金州勇士隊正在與智慧服飾公司 Athos 合作,利用這些產品來預防傷害和提高球員表現。這項投資只是美國體育部門涉足智慧服飾產業形勢的一部分。

- 在美國以外,加拿大對穿戴式裝置的需求也在增加。預計該國將為軍事計劃(包括服飾)提供足夠的支出和資金。貝爾在美國和加拿大擁有多項專利,涵蓋了想要監測患病親人的個人和想要追蹤大量人群的機構如何使用其穿戴式技術。它展示了一個願景。

- 此外,美國穿戴式科技用戶的男女比例為 50:50,約 2,410 萬人。超過一半的使用者年齡在25歲至44歲之間,超過一半的使用者年齡在45歲以下。此外,50%的使用者來自高所得家庭,有全職工作。毫不奇怪,穿戴式科技的用戶大多是出於對運動和個人福祉的興趣。

穿戴式科技產業概況

穿戴式科技市場的競爭是溫和的,個體公司數量相當多。但從市場佔有率來看,三星、蘋果、小米等公司佔有相當大的市佔率。許多新興企業正在進入穿戴式科技產業,市場競爭正在加劇。因此,為了保持在這個市場的競爭力,公司不斷投資於新產品發布、業務擴張和策略併購。

2023 年 8 月,Gizmore 宣布與 Stanch Electronics India 建立策略合作夥伴關係,以擴大其在耳戴式裝置和穿戴式裝置類別的業務,並為其客戶提供創新產品。透過此次合作,Gizmore 計劃在 2023-24 年銷售 100 萬台音訊設備,主要專注於真正的無線耳塞類別。

2023年6月,義大利泳裝品牌Arena Italia宣布正在尋找針對運動市場的穿戴式裝置的收購機會。此外,在運動科學領域具有內部技術背景、生產各種技術感測器和穿戴式設備來追蹤游泳運動員表現的公司也可能會引起興趣。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 市場定義和範圍

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概覽(評估 COVID-19 對產業的影響)

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 客戶對健身和醫療保健中使用的小型設備的偏好不斷增加

- 下一代穿戴式裝置顯示器的成長前景日益廣闊

- 頭戴式顯示器使用的擴大預計將推動市場成長

- 市場抑制因素

- 電池壽命短

- COVID-19 對穿戴式科技市場的影響

第6章市場區隔

- 依設備類型

- 智慧型手錶

- 頭戴式顯示器

- 腕帶

- 耳戴式

- 其他設備類型(智慧服飾)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章競爭形勢

- 公司簡介

- Samsung Group

- Oculus VR LLC(Facebook)

- Alphabet Inc.

- Sony Corporation

- HTC Corporation

- Fitbit Inc.

- Xiaomi Inc.

- Apple Inc.

- Microsoft Corporation

- DAQRI Company

- AIQ Smart Clothing Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Wearable Technology Market size is expected to grow from USD 186.48 billion in 2024 to USD 493.26 billion by 2029, registering a CAGR of 17.60% during the forecast period.

Wearable technology has evolved owing to the emergence of MEMS sensors. Incorporating these sensors into a dedicated wearable device is driven by the impact of smartphones being used daily on the GPS or the IMU (consisting of an accelerometer, gyroscope, and magnetometer). These have helped the fitness-tracking wearable monitor body activities using these sensors.

Key Highlights

- Technological advancements in consumerism have given way to wearable technology that tracks health, movements, and social media notifications. Various wearable devices such as smartwatches, fitness trackers, and VR/AR headsets have become more and more prevalent in society over the past several years. Thus, it is expected that wearables will only continue to grow in popularity, so naturally, companies are finding new and innovative ways to apply them to everyday lives.

- Several studies have found that a rising number of individuals are purchasing wearable devices to promote fitness and manage their health. A recent study determined that consumers globally are motivated by health self-efficacy, health and autonomy, and technological innovativeness to adopt wearable healthcare devices. Furthermore, the COVID-19 pandemic encouraged a rapid, massive expansion of remote health management and firmly established telehealth as an accessible, validated model of healthcare.

- Notably, smartwatches are seeing a surge in new users, including the older population, because wearable makers, such as Apple and Fitbit, are adding health-monitoring features that appeal to older people and keep them updated about their health status in real time. For instance, in September 2022, Apple introduced the Apple Watch Series 8 and the new Apple Watch SE with important safety innovations to the two best-selling smartwatches. Apple Watch Series 8 features include a large, Always-On Retina display and a strong crack-resistant front crystal. Moreover, with an all-day 18-hour battery life, the new product builds on best-in-class health and safety features like the ECG app and fall detection by introducing temperature-sensing capabilities, retrospective ovulation estimates, Crash Detection, and international roaming.

- Furthermore, Amazon is already making attempts, and new competitors are anticipated in the upcoming years and beyond. The existing companies in the wearables market are likely to face intense rivalry due to Amazon's arrival. According to reports, the Amazon earphones, a product of Lab126, Amazon's hardware division, offer gesture controls for answering calls and changing the music. However, as the technological capabilities of smart wearables advance, the complexity and data security issues are likely to become more of a barrier to industry expansion. Still, ongoing research in the field of smart wearables should make it possible to solve these problems in the coming years.

- During the COVID-19 situation, Asian countries such as China, India, South Korea, Taiwan, and Japan, which had a significant presence of manufacturers of the raw materials used in wearable product manufacturing, experienced lockdowns and impacted production schedules. The sales were down as the lockdown in most global economies resulted in deliveries being limited to essentials and companies revising their revenue targets.

Wearable Technology Market Trends

Head-Mounted Display is Expected to Witness Significant Growth

- Over the forecast period, head-mounted display devices are expected to grow significantly. Additionally, developments in augmented reality (AR) and virtual reality (VR) are becoming increasingly popular in the healthcare industry. In order to aid surgical training and operations, medical professionals use VR technology and VR headsets. This aids them in lowering the possibility of surgical mishaps.

- Owing to augmented, virtual, and mixed reality, digital projections are overlaid with real-life objects, providing contextual information and allowing users to manipulate their surroundings visually. While these technologies are possible through smartphones, tablets, and a host of other mediums, head-mounted displays (HMDs) have become more popular.

- Immersive HMDs are primarily used to experience virtual reality (VR) and augmented reality (AR). Mainstream usage by consumers has been limited due to cost, availability, ergonomics, unfashionable design, and other factors. The primary driver for AR HMDs is enterprise usage, where they are used internally as hands-free tools for business process improvement and training.

- Major gaming console producers like Nintendo and Microsoft are leading the charge because they recognize the potential of AR. With the help of AR, players can leave "their world" and play in the actual world. For instance, Human Pac-Man lets players wear goggles and chase each other in real life while looking exactly like the Pac-Man characters. Many players believe that more than holding a mobile device is required for AR gaming. To some extent, console devices can make up for that.

- A survey conducted by Ericsson Consumer Lab on 7,000 people aged 15-69 in Brazil, China, France, Japan, South Korea, the UK, and the US indicated that two out of three participants were interested in immersive AR gaming. Around 32% of the users agreed that AR games would be more interesting if AR technology were combined with physical activity and exercise.

North America is Expected to Hold a Major Share

- North America is known as the hub for all significant technological improvements in the world. With the advent of smart gadgets, the demand is growing for more powerful and sophisticated wearable technologies. The growth in disposable income and the rapid adoption and popularity of enhanced devices are some of the primary drivers in this geographical region. Furthermore, the region has a strong presence of wearable vendors such as Apple, Fitbit, and Garmin, among others, which contributes to the market's growth.

- Numerous sports associations' increasing investments to eliminate the possibility of any preventable injuries to highly paid professional athletes are expected to fuel the region's wearables growth. The Golden State Warriors, for instance, are collaborating with smart clothing company Athos to use these products for injury prevention and player performance. This investment represents only a fraction of the involvement of the United States athletics sector in the smart clothing industry landscape.

- Apart from the United States, the demand for wearables is also increasing in Canada. The country is expected to provide sufficient expenditures and funding for its military programs (including clothing). Bell has various patents in the United States and Canada that lay out a comprehensive vision for how its wearable technology could be used both by individuals looking to monitor ill loved ones and by institutions wanting to track large populations.

- Further, the US wearable tech audience has a gender ratio of 50:50 and numbers around 24.1 million people. More than half of the audience is between the ages of 25 and 44, and more than half of the users are under 45. In addition, 50% of users are from high-income homes and work full-time jobs. Users of wearable technology are mostly motivated by interests in exercise and personal welfare, which is not surprising.

Wearable Technology Industry Overview

The wearable technology market is moderately competitive and consists of significant individual players. However, in terms of market share, companies such as Samsung, Apple, and Xiaomi occupy a considerable percentage. The wearable tech industry is also attracting a lot of startups, which, in turn, intensifies market competition. Thus, to maintain a competitive edge in this market, companies continuously invest in introducing new products, expanding their operations, or entering into strategic mergers and acquisitions.

In August 2023, Gizmore announced a strategic partnership with Staunch Electronics India to expand its presence in the hearable and wearable categories and bring innovative products to its customers. With this partnership, Gizmore plans to sell one million audio devices in 2023-24, with a major focus on the truly wireless earphones category.

In June 2023, Italian swimwear brand Arena Italia announced that it was looking for acquisition opportunities in the wearable devices for the sports market. Moreover, targets of interest could include companies with in-house technological backgrounds in sports science, producing a range of technological sensors and wearable devices to track swimmers' performances.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview (Assessment of Impact of COVID-19 on the Industry)

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing customer preference for svelte and small devices for use in fitness and healthcare

- 5.1.2 Rising Growth Prospects for Wearable Devices' Next-Generation Displays

- 5.1.3 Rising use of Head-Mounted display is expected to flourish the market growth

- 5.2 Market Restraints

- 5.2.1 Short battery life

- 5.3 Impact of COVID-19 on Wearable Technology Market

6 MARKET SEGMENTATION

- 6.1 By Type of Device

- 6.1.1 Smart Watches

- 6.1.2 Head-mounted Displays

- 6.1.3 Wristbands

- 6.1.4 Ear-wearables

- 6.1.5 Other Device Types (Smart Clothing)

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 India

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Group

- 7.1.2 Oculus VR LLC (Facebook)

- 7.1.3 Alphabet Inc.

- 7.1.4 Sony Corporation

- 7.1.5 HTC Corporation

- 7.1.6 Fitbit Inc.

- 7.1.7 Xiaomi Inc.

- 7.1.8 Apple Inc.

- 7.1.9 Microsoft Corporation

- 7.1.10 DAQRI Company

- 7.1.11 AIQ Smart Clothing Inc.