|

市場調查報告書

商品編碼

1403947

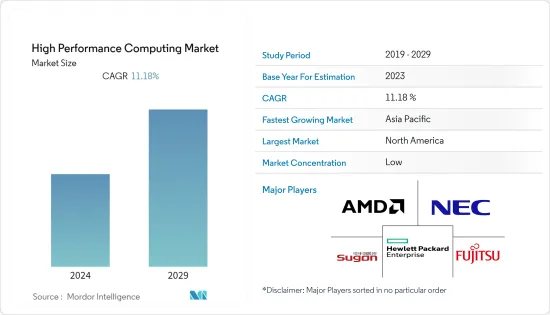

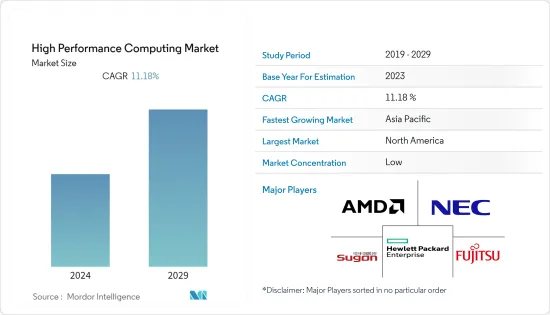

高效能運算:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測High Performance Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

高效能運算市場在基準年的價值為 543.2 億美元,預計在未來五年內將以 11.18% 的複合年成長率成長至 967.9 億美元。

雲端中高效能運算 (HPC) 的日益普及以及高效快速處理大量資料的新需求正在推動市場成長。

主要亮點

- 工業物聯網(IIoT)、人工智慧(AI)和需要電子設計自動化(EDA)的工程投資增加等因素預計將在預測期內推動市場發展。硬體供應商持續投資開發支援這些功能的解決方案,從而擴大了市場。此外,美國、德國、英國、日本和中國等國家已認知到這些技術是經濟成長的重要驅動力。這些國家是 HPC 解決方案的潛在市場,這些解決方案支持這些舉措,同時保持成本和效能舉措。

- 此外,如果沒有合適的工具和技術,就很難滿足日益成長的縮短產品開發週期 (PLC) 的需求以及即時維持品質的要求。配備用於高保真建模和模擬的 CAE(電腦輔助工程)軟體的高效能運算 (HPC) 系統廣泛應用於離散製造、醫療機器人和汽車行業等各個領域。更受歡迎,正在支援市場的成長。

- 金融建模和生命科學模擬等各種工業應用中的物理模擬、最佳化和機器學習 (ML) 是 HPC 如何在及時解決複雜問題方面發揮關鍵作用的例子。隨著電動車、自動駕駛汽車和聯網汽車進入市場,汽車產業不斷應對發展挑戰,將邊緣運算功能融入這些解決方案正在推動高效能運算軟體市場的發展。

- 然而,HPC 解決方案需要必要的企業資料才能發揮作用,這使最終用戶面臨資料外洩的風險,並且需要國防、BFSI 和醫療保健領域等高安全協議,這對許多最終用戶來說是採用解決方案的障礙。

- 對 HPC 的需求大幅成長,尤其是在生物科學領域,因為 HPC 用於疫苗開發和應對 COVID-19 大流行的影響。自大流行以來,資料消耗和雲端需求增加。這是因為企業已經推廣遠距工作並將工作負載轉移到雲端。這支持了 COVID-19 大流行後的市場成長。

高效能運算市場趨勢

本地部署模型預計將顯著成長

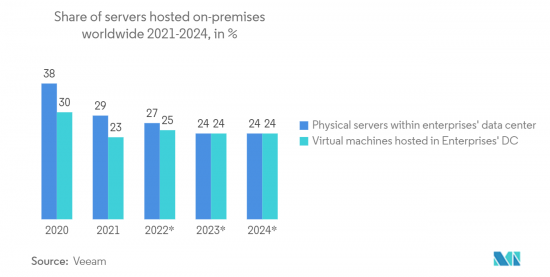

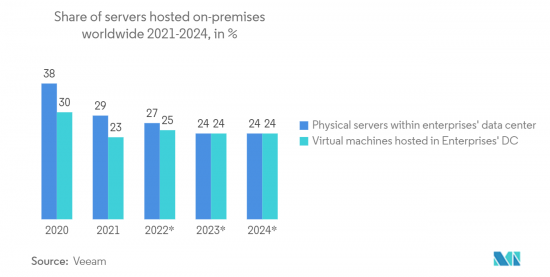

- 本地系統利用了整個HPC系統的全部功能,並且不受連接問題的影響,並且擁有很大的市場佔有率。此外,已經建立儲存和舊有系統的企業通常是大型企業,更喜歡在本地部署 HPC 解決方案,從而在預測期內推動市場發展。

- 本地系統擴大用於大規模研究、分析和建模應用程式,並且及時存取資料是一項關鍵需求。此外,隨著業務複雜性的增加和這些系統功能的增加,高效能運算系統的輸出和輸入能力的增加,也強化了這個趨勢。

- 該模型的另一個關鍵促進因素是個人資料的安全性。這種防止資料庫攻擊的方法被企業和政府機構使用,特別是在國防部門。物理存在要求對系統、應用程式和資料的安全性和完整性有很大影響。

- 此外,隨著網路威脅的增加以及臉部辨識和全球安全資料庫等更先進技術的出現,這些系統預計將被引入國防部門。由於國防部門對隱私和安全的需求日益成長,HPC 的本地部署在世界各地的國防應用中越來越受歡迎。

- 雲端基礎方案正在成為各種應用程式最容易存取的選項之一,因為它們以相對較低的成本提供用戶所需的儲存和運算,但它們不能保護雲端用戶的資料和應用程式。適當的安全措施應包括在內,以確保

北美預計將佔據很大佔有率

- 由於美國和加拿大的技術進步,北美地區以較早採用先進技術而聞名。新技術的發展和安全需求正在推動高效能運算系統的使用。這種擴展可能會影響這兩種類型的大資料量。在此預測期內,北美預計仍將是高效能運算的全球市場領導。支持這項需求的主要因素之一是政府在研發活動上的支出增加。

- 此外,美國政府將提高高效能運算處理能力,以應對製造業挑戰,並支持該國為所有美國創造清潔能源未來的舉措。推出了「製造業」計畫。

- 例如,2023年1月,美國能源局宣布與美國國家實驗室高效能運算(HPC)部門合作,協助製造商簡化流程、提高生產力、減少碳排放6,並宣布投資180萬美元團隊。

- 該產業雲集了 HPE、IBM、微軟、NVIDIA 和 AMD 等大公司,因此該地區的高效能運算需求預計將大幅成長。此外,北美國家擴大採用高效能運算,讓各行業的公司透過虛擬環境將模擬、高階建模和資料分析應用到製造流程中,從而創造了北美市場的需求。

- 市場上的供應商正在與其他公司建立新的合作夥伴關係,以擴大其地理範圍和覆蓋範圍。例如,Graphcore的合作夥伴計畫已擴大,以涵蓋更多潛在客戶並推廣其智慧處理單元IPU解決方案的使用。為了擴大其區域影響力,該公司在其全球合作夥伴計畫中增加了幾個北美合作夥伴,其中包括 Applied Data Systems 和 Images et Technologie,它們正在支持北美市場的成長。

高效能運算產業概覽

高效能運算 (HPC) 市場高度分散。惠普、超微、中科曙光、NEC、富士通等大公司的進駐對整體市場影響重大。高效能運算供應商越來越注重透過產品創新、聯盟和研發投資來提供增強的解決方案,以在預測期內擴大市場佔有率。

- 2022 年 11 月 - 印度和歐盟簽署高效能運算和量子技術合作意向協議,包括在生物分子醫學領域使用印度和歐洲超級電腦進行 HPC 應用方面的合作。

- 2022 年 5 月-慧與建立歐洲首個高效能運算和人工智慧系統生產設施,以加速客戶交付並加強該地區的供應生態系統,並宣布業務擴張。為了支援高效能運算需求,Apollo HPE 系統和 Cray EX超級電腦的製造和出貨證明了全球 HPC 解決方案的市場成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對高效能運算市場的影響

第5章市場動態

- 市場促進因素

- 以高效率的速度處理大量資料的新需求

- 雲端 HPC 採用率的提高

- 市場抑制因素

- 資料安全問題

第6章市場區隔

- 按成分

- 硬體

- 伺服器

- 儲存設備

- 系統

- 網路裝置

- 軟體和服務

- 硬體

- 依部署類型

- 本地

- 雲

- 按工業用途

- 航太/國防

- 能源/公用事業

- BFSI

- 媒體娛樂

- 製造業

- 生命科學與醫療保健

- 其他工業應用

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Advanced Micro Devices Inc.

- NEC Corporation

- Hewlett Packard Enterprise

- Sugon Information Industry Co. Ltd

- Fujistu Ltd

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Dell EMC(Dell Technologies Inc.)

- Dassault Systemes SE

- Lenovo Group Ltd

- Amazon Web Series

- NVIDIA Corporation

- Atos SE

第8章投資分析

第9章市場的未來

The High Performance Computing Market is valued at USD 54.32 billion in the base year and is expected to grow at a CAGR of 11.18% during the forecast period to become USD 96.79 billion by the next five years. Increasing adoption of High Performance Computing (HPC) in the cloud and the emerging need to process large amounts of data efficiently and quickly drive market growth.

Key Highlights

- Factors such as the increasing investments in the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and engineering, which demand Electronic Design Automation (EDA), are likely to drive the market over the forecast period. The market has been augmented by the continued investment from hardware providers to develop solutions that support these capabilities. In addition, countries like the United States, Germany, the United Kingdom, Japan, and China, among others, have acknowledged the significance of such technologies as an essential driver for economic growth. These countries are potential markets for HPC solutions, which support these initiatives while preserving cost and performance efficiencies.

- Moreover, without the appropriate tools and technology, it becomes practically difficult to handle the growing need for short product development cycles (PLCs) and the requirement to maintain quality in real time. High-performance Computing (HPC) systems with Computer-aided Engineering (CAE) software for high-fidelity modeling simulation are becoming more widely used in various sectors, including discrete manufacturing, robotics in healthcare, and the automotive industry, fueling the market growth.

- Physical simulation, optimization, and Machine Learning (ML) in varied industrial applications, including financial modeling and life science simulation, are some examples where HPC plays a critical role in solving complex problems within time. In the automotive industry, EVs, autonomous vehicles, and connected vehicles are continuously taking development challenges to enter the market and require edge computing capabilities to be incorporated into these solutions driving the HPC software market.

- However, the HPC solutions need essential enterprise data for their functioning, which exposes the market to data breaching risk for the end users, creating obstacles for the adoption of the solutions across many end users due to their high-security protocols, such as Defence, BFSIs, and Healthcare sectors.

- The demand for HPC saw significant growth, especially in bioscience, as HPC was used to develop a vaccine and tackle the effects of the COVID-19 pandemic. Data consumption and cloud demand have increased since the pandemic, owing to enterprises moving toward remote working and shifting their workloads onto the cloud. This has supported the market growth after the Covid-19 pandemic.

High Performance Computing Market Trends

On Premise Deployment Model is Expected to Witness Significant Growth

- With its ability to take advantage of all the overall HPC system's capabilities and not be hindered by connection problems, an on premise model has a significant market share. Aditionally, the companies that have already established storage and legacy systems are generally large-scale enterprises which prefer the on-premise deployment of HPC solutions, fueling the market during the forecast period.

- There is an increasing use of onpremise systems in large research, analytical and modelling applications as well as a key need for access to timely data. In addition, this trend is reinforced by the increasing complexity of operations and the increasing capabilities of these systems, which increase the output and input capacity of high performance computing systems.

- Another main driver for this model is the security of private data. This way of preventing database attacks is used by businesses and government agencies, particularly in the defence sector. The physical presence requirement has a strong impact on the security and integrity of the system, application and data.

- Moreover, due to the increasing cyber threat and the emergence of more advanced technologies such as facial recognition and global security databases, it is anticipated that these systems will be introduced into the defence sector. Due to the increasing need of privacy, and security in the defence sector, the on premise deployment of HPC is gaining traction in the defence application worldwide.

- Although cloud-based solutions are becoming one of the most depedable options for various applications as they provide the storage and computation needs for users at a relatively very low cost, the area still needs to include appropriate security measures to protect the data and applications for cloud users.

North America is Expected to Hold Major Share

- The North American region is recognized for its early adoption of advanced technologies because of the Technical advancement in the United States and Canada. The development of new technologies and the need for security are encouraging the use of high performance computing systems. The expansion will affect both types of large data. North America will remain the world's market leader in high performance computing during this projection period. One key factor underpinning this demand is the increased government expenditure on research and development activities.

- Aditionally, the US government has introduced the High-Performance Computing for Manufacturing program to increase the country's capabilities in high computing processing to address the manufacturing challenges and support the country's initiatives for a clean energy future for all Americans.

- For instance, in January 2023, the Department of Energy of the USA announced an investment amount of USD 1.8 million for six teams who would work with the U.S. National Laboratories' high-performance computing (HPC) department to help manufacturers streamline their processes, increase productivity, and lower their carbon footprint in the country, would support the market growth in the North American region.

- The industry has significant companies, including, HPE, IBM, Microsoft, NVIDIA and AMD, and as a result, the need for high-performance computing in the area is anticipated to develop significantly. Additionally, North American countries have been adopting High-performance computing, enabling companies in various sectors to apply simulation, advanced modeling, and data analysis to manufacturing processes through a virtualized environment, creating a demand for the market in North America.

- The market's vendors have forged new alliances with other businesses to increase their geographic reach and coverage. Graphcore's partner programme has been expanded, for example, to reach more potential customers and help them accelerate their use of its Intelligence Processing UnitIPU solutions. To broaden its regional reach, the company added several partners in the North American region to its global partner program, including Applied Data Systems and Images et Technologie, among others, supports the market growth in North America.

High Performance Computing Industry Overview

High Performance Computing (HPC) Market is highly fragmented. The presence of major players, such as Hewlett Packard Enterprise, Advanced Micro Devices Inc., Sugon Information Industry Co. Ltd, NEC Corporation, and Fujitsu Ltd, has considerable influence on the overall market. High-performance computing vendors increasingly focus on delivering enhanced solutions through product innovations, collaborations, and investment in R&D to increase their market share during the forecast period.

- November 2022 - India and the EU signed an Intent for Cooperation agreement in high-performance computing and quantum technologies, including collaboration on HPC applications using Indian and European Supercomputers in Bio molecular medicines, which would create an oppertunity for the market vendors during the forecast period.

- May 2022 - Hewlett Packard Enterprise has announced An expansion to accelerate customer delivery and strengthen the region's supply ecosystem by building its first European production facility for high performance computing and artificial intelligence systems. In order to support the need for high performance computing, a market growth in HPC solutions throughout the world is shown by building and shipping Apollo HPE systems and Cray EX supercomputers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the High-performance Computing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Emerging Need to Process Enormous Amount of Data with Efficiency Speed

- 5.1.2 Increasing Adoption of HPC in the Cloud

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Security of the Data

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Servers

- 6.1.1.2 Storage Devices

- 6.1.1.3 Systems

- 6.1.1.4 Networking Devices

- 6.1.2 Software and Services

- 6.1.1 Hardware

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Industrial Application

- 6.3.1 Aerospace and Defense

- 6.3.2 Energy and Utilities

- 6.3.3 BFSI

- 6.3.4 Media and Entertainment

- 6.3.5 Manufacturing

- 6.3.6 Life Science and Healthcare

- 6.3.7 Other Industrial Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advanced Micro Devices Inc.

- 7.1.2 NEC Corporation

- 7.1.3 Hewlett Packard Enterprise

- 7.1.4 Sugon Information Industry Co. Ltd

- 7.1.5 Fujistu Ltd

- 7.1.6 Intel Corporation

- 7.1.7 International Business Machines Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Dell EMC (Dell Technologies Inc.)

- 7.1.10 Dassault Systemes SE

- 7.1.11 Lenovo Group Ltd

- 7.1.12 Amazon Web Series

- 7.1.13 NVIDIA Corporation

- 7.1.14 Atos SE