|

市場調查報告書

商品編碼

1403938

炭黑 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

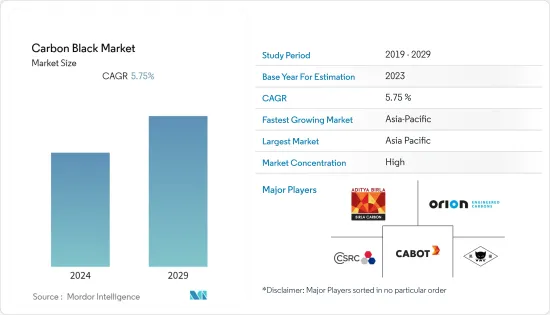

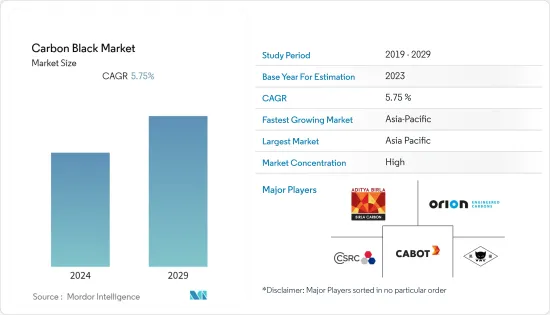

炭黑市場目前估計為227.9億美元,預計未來五年將達到301.5億美元,預測期內複合年成長率為5.75%。

2020 年市場受到 COVID-19 的負面影響。 2020年上半年,輪胎和橡膠產業受到新型冠狀病毒肺炎(COVID-19)疫情的影響較大。結果,對炭黑的消耗產生了不利影響。 2021年,汽車產量可望從疫情影響中恢復,市場可望穩定成長。 2022年,市場呈現顯著成長。

主要亮點

- 短期來看,專門食品炭黑市場滲透率的提高和電池領域應用的擴大是推動市場的主要因素。

- 另一方面,回收炭黑投資的增加和原料價格的波動正在阻礙市場成長。

- 電動車的日益普及預計將是未來的一個機會。

- 亞太地區主導全球市場,其中中國和印度是最大的消費國。

炭黑市場趨勢

擴大輪胎和工業橡膠製品的用途

- 炭黑是輪胎工業中常用的補強材料之一,因為它影響輪胎的機械性能和動態性能。炭黑與各種橡膠類型一起用於配方中,以客製化輪胎的性能特徵。

- 炭黑主要用在氣密層、胎側和汽車胎體。添加到橡膠化合物中後,炭黑具有散熱能力。它還可以改善操控性、胎面磨損和燃油經濟性。它還提供耐磨性。

- 炭黑在汽車輪胎和其他橡膠製品中用作填充物、增韌劑和補強劑。由於輪胎和橡膠產品具有重要的應用,這些行業趨勢預計將有利於市場成長。

- 據 WBCSD 稱,輪胎行業消耗了全球約 70% 的天然橡膠,並且對天然橡膠的需求不斷增加,與這種重要原料的生產相關的社會、經濟和環境機會正在多樣化。

- 全球新生產的小客車和輕型卡車領域對輪胎的需求正在穩步成長。米其林集團提供的月度統計數據顯示,2023年全球正品輪胎市場與2022年相比,前5個月成長了10%。

- 根據Modern Tire Dealer統計,2022年美國輪胎總出貨量約3.35億條。 2022年的大部分輪胎出貨是替換小客車輪胎,數量約2.22億條。

- 汽車產業(包括傳統汽車和電動車)的成長是推動輪胎和輪胎零件製造成長的關鍵因素。

- 根據 OICA 的數據,2022 年全球汽車銷售和註冊量較 2021 年下降約 0.8%。這一數字為 68,995,575 台,而 2021 年為 69,560,173 台。

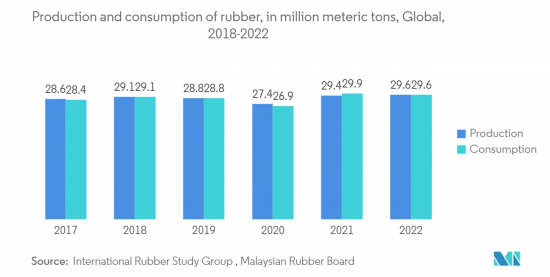

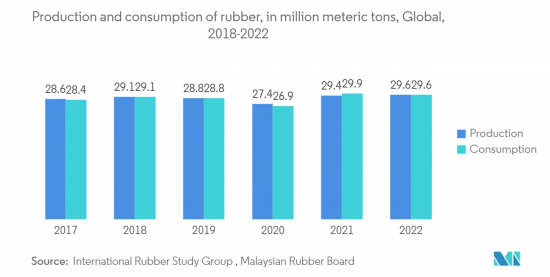

- 根據國際橡膠研究組織預測,2022年全球橡膠產量將與前一年同期比較小幅成長。這主要是由於下半年產量增加所致。 2022 年全球橡膠產量達 2,960 萬噸,而 2021 年為 2,940 萬噸。 2022年合成橡膠產量約1,490萬噸,僅比同年天然橡膠產量多30萬噸。

- 因此,所有上述因素預計將增加輪胎和工業橡膠製品對炭黑的需求。

中國在亞太市場佔主導地位

- 無論是產量或消費量,中國炭黑產能均在全球佔有較高佔有率。中國供需失衡會影響國內企業的市場佔有率和績效。

- 由於炭黑在輪胎等橡膠製品中的應用,以及近年來我國橡膠工業和汽車工業的積極發展,炭黑產業的快速發展引起了我國的關注,整個行業的生產金額正在增加。

- 國家統計局公佈的資料顯示,中國輪胎產業出現顯著成長,反映出國內外市場對輪胎的需求不斷增加。

- 2023年3月,中國輪胎產量年增11.3%至9,087萬條,顯示國內市場需求呈現成長趨勢。 2023年1月至3月,我國橡膠輪胎產量2,1998萬條,較去年同期成長6.4%。

- 橡膠輪胎產量的成長可以從該國多年來一直是世界上最重要的汽車生產國這一事實得到檢驗。根據中國工業協會統計,2023年上半年,中國汽車產量已超過1,325萬輛,較去年同期大幅成長9.3%。

- 除了在輪胎和橡膠製品中的應用外,炭黑作為油漆和塗料中的顏料以及紡織工業中的調色劑的應用在該國也佔有大量需求。因此,國內油漆塗料和紡織業的發展趨勢預計將進一步提振市場需求。

- 中國以工業化和製造業聞名,對油漆和被覆劑的需求廣泛。中國佔全球塗料市場四分之一以上。根據中國塗料工業協會統計,近年來該產業成長了7%。

- 根據世界塗料工業協會的數據,中國目前在該地區市場佔據主導地位,複合年成長率為 5.8%。預計2022年中國油漆塗料市場將成長5.7%。到2022年,中國油漆塗料總銷售額將超過450億美元,從而反映中國在東亞地區擁有最大市場佔有率(78%)的主導地位。

- 2022年,中國紡織品服裝出口成長2.53%,總額達3,230億美元。全年我國紡織品、服飾及服飾附件出口額3,233.44億美元,與前一年同期比較小幅成長2.53%。

- 中國紡織服裝委員會(CNTAC)是中國紡織服裝業的監管機構,監督到 2025 年,中國服飾年零售額將超過 4,150 億美元。

- 因此,預計所有上述因素都將在預測期內為炭黑市場的成長提供重大推動力。

炭黑產業概況

全球炭黑市場是一個綜合市場,前10名企業佔據了整個市場的主要佔有率。該市場的主要企業包括卡博特公司、Birla Carbon(Aditya Birla Group)、Orion Engineered Carbons SA、江西黑毛炭黑、國際證監會投資控股公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 提高專門食品炭黑的市場滲透率

- 擴大電池領域的應用

- 抑制因素

- 增加對回收炭黑的投資

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 貿易分析

- 技術形勢- 快速簡介

- 生產分析

- 價格走勢分析

第5章市場區隔(市場規模:數量/金額)

- 工藝類型

- 爐黑

- 氣黑

- 燈黑

- 熱感黑

- 目的

- 輪胎、工業橡膠製品

- 塑膠

- 碳粉/印刷油墨

- 塗層

- 纖維

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 合併、收購、合資、合夥和協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- ADNOC Group

- Asahi Carbon Co. Ltd

- Birla Carbon(Aditya Birla Group)

- BKT Carbon

- Cabot Corporation

- Epsilon Carbon Private Limited

- Himadri Speciality Chemical Ltd

- Imerys SA

- International CSRC Investment Holdings Co. Ltd

- Jiangxi Heimao Carbon Black Co. Ltd

- Longxing Chemical Stock Co. Ltd

- Mitsubishi Chemical Corporation

- NNPC Limited

- OCI Company Ltd

- Omsk Carbon Group

- Orion Engineered Carbons SA

- PCBL Limited

- Tokai Carbon Co. Ltd

第7章 市場機會及未來趨勢

- 電動車的普及

The carbon black market is currently estimated to be valued at USD 22.79 billion, and it is projected to reach USD 30.15 billion in the next five years, registering a CAGR of 5.75% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Due to the COVID-19 outbreak in the first half of 2020, the tire and rubber industry was significantly affected. This, in turn, had an unfavorable impact on the consumption of carbon black. The market was projected to grow steadily as automotive production recovered from the impact of the pandemic in 2021. The market witnessed a significant growth in 2022.

Key Highlights

- In the short term, the major factors driving the market are the increasing market penetration of specialty black and growing applications in the batteries segment.

- On the flip side, the increasing investments in recovered carbon black and volatility in the prices of raw materials are hindering the growth of the market studied.

- The growth in the adoption of electric cars is expectde to act as an opportunity in the future.

- Asia-Pacific dominated the market worldwide, with the largest consumption from China and India.

Carbon Black Market Trends

Increasing Application of Tires and Industrial Rubber Products

- Carbon black is one of the reinforcements that is frequently used in the tire industry, owing to its effect on the mechanical and dynamic properties of tires. It is used in various formulations with different rubber types to customize the performance properties of tires.

- Carbon black is mainly required in the inner liners, sidewalls, and carcasses. It has heat-dissipation capabilities when added to rubber compounds. It also improves handling, tread wear, and fuel mileage. It also provides abrasion resistance.

- Carbon black is used in vehicle tires and other rubber products as a filler, strengthening, and reinforcing agent. Owing to its vital applications in tires and rubber products, the trends in these industries are expected to favor the growth of the market studied.

- According to the WBCSD, the tire industry consumes approximately 70% of the world's natural rubber, and the demand for natural rubber is increasing, diversifying the social, economic, and environmental opportunities associated with the production of this important raw material.

- The demand for tires in the newly produced segments of passenger cars and light trucks has been witnessing stable growth worldwide. This is depicted through the monthly statistics provided by the Michelin Group, which state that the worldwide original equipment tire market has seen a 10% growth in the first five months of 2023 when compared with 2022.

- According to the Modern Tire Dealer, in 2022, overall shipments of tires in the United States amounted to around 335 million units. The majority of tire units shipped in 2022 were replacement passenger tires, with some 222 million units.

- The growth in the automotive industry, including both conventional and electric vehicles, is a significant factor driving the growth of tire and tire component manufacturing.

- According to the OICA, the global sales and registration of automobiles in 2022 observed a decline of around 0.8% as compared to 2021. It stood at 68,995,575 over 69,560,173 in 2021.

- According to the International Rubber Study Group, global rubber production saw a minimal increase in the production in 2022, when compared with the prior year. This was majorly due to the increased production in the second half of the year. The global production of rubber reached 29.6 million metric tons in 2022 as compared to 29.4 million metric tons in 2021. The synthetic rubber produced during 2022 amounted to approximately 14.9 million metric tons, just 0.3 million metric tons higher than the natural rubber produced during the year.

- Hence, all the above factors are expected to increase the demand for carbon black in the tires and industrial rubber products.

China to Dominate the Market in the Asia-Pacific Region

- China accounts for a higher share of the world's carbon black capacity in terms of both production and consumption. Any demand-supply imbalance in China can affect the market share and performance of domestic players.

- Owing to the application of carbon black in tires and other rubber-based products and the positive development of China's rubber and automobile industries in recent years, the carbon black industry's rapid development has taken the country's limelight, and the overall industry production is on the rise.

- As per the data released by the National Bureau of Statistics, the Chinese tire industry is experiencing substantial growth, reflecting the increasing demand for tires in the domestic and international markets.

- In March 2023, China's output of tires increased by 11.3% to 90.87 million compared to the same period last year, indicating a trend in the growing demand in the domestic market. China produced 219.98 million rubber tires from January to March 2023, a Y-o-Y increase of 6.4%.

- The growing rubber tire production can be validated by the fact that the country has been the most significant vehicle producer in the world for the past many years. According to the China Association of Automobile Manufacturers, China has already manufactured more than 13.25 million vehicles in the first half of 2023, witnessing a significant 9.3% growth Y-o-Y.

- Along with applications in tires and rubber products, the application of carbon black as a pigment in paints and coatings and as a toner in the textile industry also accounts to significant demand in the country. Hence growth trends in paints and coatings and textile industries in the country is further expected to drive the market demand.

- China is known for its industrialization and its manufacturing sector, where paints and coatings are widely required. China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has been registering a growth of 7% in recent years.

- According to the World Paint & Coatings Industry Association, China presently dominates the region market, which is growing at a CAGR of 5.8%. The Chinese paints and coatings market was expected to increase by 5.7 % in 2022. China's total paints and coatings sales exceeded USD 45 billion in 2022, thereby depicting the country's dominance in having the largest market share (78%) in East Asia.

- In 2022, China experienced a 2.53% increase in its exports of textiles and apparel, reaching a total value of USD 323 billion. Over the year, China's exports in textiles, apparel, and clothing accessories amounted to USD 323.344 billion, showing a modest growth of 2.53% when compared to the previous year.

- It is projected by the China National Textile and Apparel Council (CNTAC), the regulatory authority overseeing China's textile and apparel sector, that, by 2025, the annual retail sales of clothing in China could surpass USD 415 billion.

- Thus, all the abovementioned factors are expected to provide a huge impetus for the growth of the carbon black market over the forecast period.

Carbon Black Industry Overview

The global carbon black market is a consolidated market, where the top ten players contribute to a significant share of the overall market. Some of the major players in the market include Cabot Corporation, Birla Carbon (Aditya Birla Group), Orion Engineered Carbons SA, Jiangxi HEIMAO Carbon black Co. Ltd, and International CSRC Investment Holdings Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Market Penetration of Specialty Black

- 4.1.2 Growing Applications in the Batteries Segment

- 4.2 Restraints

- 4.2.1 Increasing Investments for Recovered Carbon Black

- 4.2.2 Volatility in Prices of Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Trade Analysis

- 4.6 Technology Landscape - Quick Snapshot

- 4.7 Production Analysis

- 4.8 Price Trend Analysis

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Process Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 Application

- 5.2.1 Tires and Industrial Rubber Products

- 5.2.2 Plastic

- 5.2.3 Toners and Printing Inks

- 5.2.4 Coatings

- 5.2.5 Textile Fiber

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADNOC Group

- 6.4.2 Asahi Carbon Co. Ltd

- 6.4.3 Birla Carbon (Aditya Birla Group)

- 6.4.4 BKT Carbon

- 6.4.5 Cabot Corporation

- 6.4.6 Epsilon Carbon Private Limited

- 6.4.7 Himadri Speciality Chemical Ltd

- 6.4.8 Imerys SA

- 6.4.9 International CSRC Investment Holdings Co. Ltd

- 6.4.10 Jiangxi Heimao Carbon Black Co. Ltd

- 6.4.11 Longxing Chemical Stock Co. Ltd

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 NNPC Limited

- 6.4.14 OCI Company Ltd

- 6.4.15 Omsk Carbon Group

- 6.4.16 Orion Engineered Carbons SA

- 6.4.17 PCBL Limited

- 6.4.18 Tokai Carbon Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Adoption of Electric Cars