|

市場調查報告書

商品編碼

1403845

藍牙揚聲器:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Bluetooth Speaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

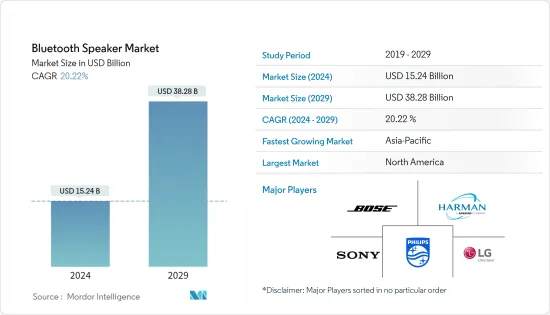

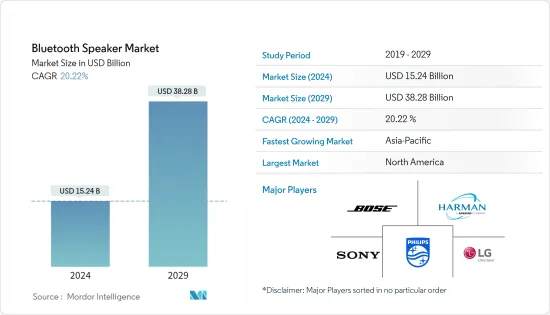

藍牙揚聲器市場規模預計到2024年為152.4億美元,預計到2029年將達到382.8億美元,在預測期內(2024-2029年)複合年成長率為20.22%。

隨著消費者的偏好從有線揚聲器轉向無線和攜帶式揚聲器,對無線揚聲器的需求不斷增加。此外,戶外應用對易於維護的電池供電設備的需求不斷成長,以及音訊行業中藍牙的使用不斷增加,繼續推動產品需求。

主要亮點

- 藍牙揚聲器是一種使用與汽車收音機相同技術的音訊設備。這些設備無需接線即可直接連接到您的音訊來源,因此您可以移動揚聲器並仍然播放音訊。近年來,藍牙連接領域出現了各種創新,以進一步提高隱私性和品質。例如,2023年5月,Promate推出了印度首款藍牙音箱Glitz-L。這款攜帶式戶外揚聲器採用 LumiSound 技術增強您的聆聽體驗,提供 360 度環繞音響以及與音樂節拍同步的燈光秀。

- 此外,鋰離子電池的發展也極大地幫助了攜帶式藍牙揚聲器市場,因為它不需要頻繁充電並提供更多的播放時間。快速充電技術和行動電源還可以透過減輕揚聲器的重量和解決充電問題來推動需求。

- 隨著市場對藍牙音箱的需求不斷增加,各家公司都在向市場推出新產品。例如,2022年6月,藍牙揚聲器領先供應商Bose宣布推出一款配備專用感測器的新型藍牙揚聲器「Soundlink Flex」。該公司表示,Bose SoundLink Flex 最大限度地提高了清晰度並產生強勁的低音,以便客戶可以感知任何樂器或人聲。該公司的此類舉措預計將在預測期內推動市場對藍牙揚聲器的需求。

- 推動藍牙揚聲器市場成長的另一個主要因素是錄製音樂產業的成長。根據國際唱片業聯合會 (IFPI) 的數據,在付費訂閱串流媒體成長的推動下,全球錄製音樂市場在 2022 年成長了 9%。此外,根據 IFPI 的全球音樂報告,2022 年將有 5.89 億付費訂閱音樂帳戶用戶,這將對訂閱音樂訂閱收益做出重大貢獻,該收入將成長 10.3% 至 127 億美元。隨著藍牙揚聲器作為家庭娛樂設備變得普及,這些趨勢預計將繼續支持市場成長。

- 家庭自動化現已準備好透過藍牙驅動的完整家庭自動化系統進行擴展。藍牙網狀網路將繼續提供可靠的無線連接平台,實現燈光、恆溫器、煙霧探測、攝影機、門鈴和鎖的自動控制。然而,智慧音箱有潛力成為智慧家庭的中央控制設備。預計未來幾年智慧音箱的銷量將成長許多倍,這可能對市場成長構成挑戰。

- 此外,藍牙揚聲器的技術限制(例如範圍限制)也限制了所研究市場的成長,因為即使是最好的攜帶式藍牙揚聲器也不能保證提供像 Wi-Fi 那樣的廣泛範圍。因此,使用者會注意到當遠離揚聲器時訊號會下降。

藍牙音箱市場趨勢

手提式藍牙音箱成長迅速

- 攜帶式藍牙音箱相對較小且重量輕,可以移動到任何地方。攜帶式揚聲器有多種形狀和尺寸。條形音箱、電子管和夾子是市場上使用最廣泛的型號。市場中不斷變化的消費者動態以及消費者對攜帶式設備的偏好不斷增加正在支持市場的成長。

- 隨著客戶聽音音訊方式的選擇發生變化,對攜帶式揚聲器的需求也不斷增加。數位化和 Hi-Fi 系統之間音樂風格的變化將推動製造商創新、開發和提高音訊效能。

- 攜帶式音訊設備領域的音訊和語音使用者介面技術也取得了巨大進步,具有更高的整合度、沉浸式音質、無線連接和設備上人工智慧,可實現更多創新設備。對攜帶式藍牙揚聲器的需求並促進市場成長。

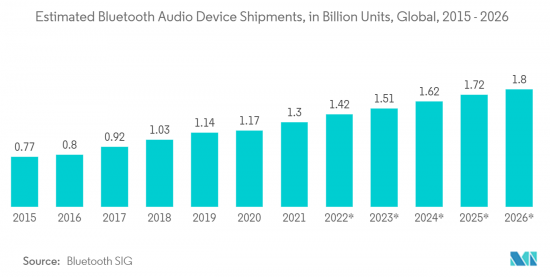

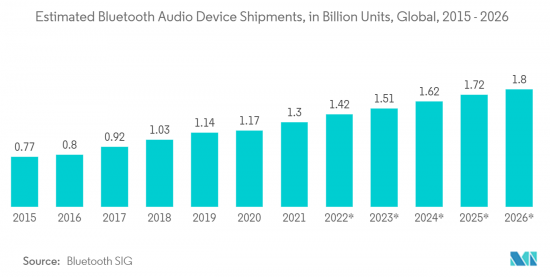

- 此外,攜帶式藍牙揚聲器往往更節能,這就是為什麼它們變得越來越普及的原因。這些揚聲器不需要插入電源插座,並由一次性電池或可充電電池供電。因此,它不會消耗太多電力。例如,根據藍牙技術聯盟 (Bluetooth SIG) 的數據,藍牙音訊設備的全球出貨預計將從 2015 年的 7.7 億台成長到 2026 年的 18 億台。類似的趨勢預計也會反映在攜帶式藍牙設備領域,該設備特別受年輕消費者歡迎。

北美佔據主要市場佔有率

- 由於北美在採用新技術和先進技術方面處於世界領先地位,預計將佔據藍牙揚聲器市場的很大佔有率。此外,龐大的音樂產業的存在也為該地區研究市場的成長創造了良好的前景。例如,根據 RIAA 的數據,美國錄製音樂產業成長了約 6%,預計 2022 年零售額將達到 159 億美元。

- 由於其可靠和高品質的產品和服務,美國電子公司在該地區的全球電子產業中佔據主導地位。美國一些最大、最著名的電子公司包括 KEF、JBL、Klipsch 和 Bose。

- 此外,音訊串流服務的日益普及正在推動北美無線揚聲器行業的擴張。例如,Spotify等音樂串流平台近年來在美國經歷了快速成長。根據 RIAA 的數據,2022 年美國音樂串流訂閱用戶數量將達到 9,200 萬,與前一年同期比較(與 2021 年相比)增加 800 萬。

- 此外,預計音訊播客聽眾數量的增加將對預測期內的北美藍牙揚聲器市場產生重大影響。例如,根據 Buzzsprout 的數據,截至 2023 年 7 月,美國擁有 49.9% 的播客聽眾,其次是英國(6.1%)以及加拿大和澳洲(4.3%)。從上圖可以看出,北美有許多播客聽眾,因此藍牙音箱的需求預計會增加。

藍牙音箱產業概況

藍牙音箱市場分散,不斷變化的消費者需求正在推動企業創新以吸引更多消費者。這個市場的競爭逐年加劇,企業紛紛推出許多產品來吸引消費者。該市場的主要企業包括索尼公司、皇家飛利浦公司、三星電子(哈曼國際工業)和 Bose 公司。

2023 年 5 月,索尼電子推出了兩款新型無線揚聲器:SRS-XV800 和 SRS-XB100。根據該公司介紹,新型揚聲器「SRS-XV800」可為家庭活動提供響亮而清晰的聲音,並提供充滿整個房間的強勁聲音。另一方面,SRS-XB100 是一款小型無線揚聲器,具有強勁、清晰的聲音和令人難以置信的攜帶性。

2023年7月,行動配件大品牌Inbase Technologies發表了一款配備無線卡拉OK麥克風的小型藍牙音箱「Boom Box」。這款揚聲器配備 3 種不同的音訊模式,可帶來更高水準的卡拉 OK 體驗,具有出色的音質和響亮的無線卡拉 OK 麥克風。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 宏觀因素對市場的影響

第5章市場動態

- 市場促進因素

- 新興地區連接的最新發展和對連網型設備日益成長的需求

- 對線上串流媒體服務的需求和訪問增加

- 市場抑制因素

- 盜版的威脅

第6章市場區隔

- 行動性愛

- 攜帶的

- 固定式

- 按用途

- 住宅

- 商務用

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區 中東/非洲

第7章競爭形勢

- 公司簡介

- Sony Corporation

- Koninklijke Philips NV

- Samsung Electronics Co. Ltd.(Harman International Industries)

- Bose Corporation

- Beat Electonics

- Panasonic Corporation

- LG Electronics Inc.

- Best IT World Pvt. Ltd(iBall)

- Logitech International

- Yamaha Corporation

- Altec Lansing

- JVC Kenwood Corporation

- AOMAIS(JinWenHua Audio)

- Forcovr(Shenzhen Guiwei Security)

- Anker Innovations Technology

- Onkyo Corporation(Pioneer)

- SoundBot

- Zebronics

第8章投資分析

第9章 市場機會及未來趨勢

The Bluetooth Speaker Market size is estimated at USD 15.24 billion in 2024, and is expected to reach USD 38.28 billion by 2029, growing at a CAGR of 20.22% during the forecast period (2024-2029).

The shift in consumer preferences toward wireless and portable speakers over cable speakers has increased demand for Wireless speakers. Additionally, the rising need for low-maintenance and battery-powered equipment for outdoor applications and the increasing usage of Bluetooth in the audio-visual industries also continue to raise product demand.

Key Highlights

- Bluetooth speakers are audio devices that use the same technology as a car radio. These devices connect directly to the source of the sound instead without requiring any wires, allowing the speaker to be moved around and still play the audio track. In recent years, various technological innovations have been witnessed in Bluetooth connectivity to enhance privacy and quality further. For instance, in May 2023, Promate launched its first Bluetooth speaker, Glitz-L, in India. The portable outdoor speaker enhances the listening experience with LumiSound technology, bringing 360-degree surround sound with a light show matching every beat of the music.

- Moreover, the evolution of lithium-ion batteries has also helped the portable Bluetooth speaker market immensely by offering more playtime without frequent charging. Quick charging technology and Power banks have also assisted in fueling the demand by reducing the weight of speakers and addressing charging concerns.

- With the growing demand for Bluetooth speakers in the market, various companies have been launching new products in the market. For instance, in June 2022, Bose, a major provider of bluetooth speakers, introduced the Soundlink Flex, its new Bluetooth speaker with a specialized transducer. According to the company, the Bose SoundLink Flex maximizes clarity and produces strong bass so customers can perceive every instrument and vocal. Such initiatives by the company are expected to fuel the demand for Bluetooth speakers in the market during the forecast period.

- Another major factor driving the growth of the Bluetooth speaker market is the growing recorded music industry. According to the International Federation of Phonographic Industry (IFPI), in 2022, the global recorded music market grew by 9 percent, driven by growth in paid subscription streaming. Furthermore, according to IFPI's Global Music Report, in 2022, there were 589 million paid subscription account users, which contributed significantly to subscription audio streaming revenues, helping it increase by 10.3 percent to USD12.7 billion. As Bluetooth speakers are becoming a popular device for home entertainment, such trends are anticipated to continue to support the market's growth.

- Home automation is now poised to scale, owing to Bluetooth full-home automation systems. The Bluetooth mesh will continue to provide a reliable wireless connectivity platform that enables automatic control of lights, thermostats, smoke detectors, cameras, doorbells, and locks. However, the smart speaker has emerged as a potential central control unit for the smart home. Smart speaker volume is forecasted to grow multiple times in the coming years, which may challenge the market's growth.

- Furthermore, technical limitations of Bluetooth speakers, such as range limitations, also restrain the studied market's growth, as even the best portable Bluetooth speakers do not guarantee to offer a range as wide as Wi-Fi. As a result, users notice some signal loss when they step away from the speaker.

Bluetooth Speaker Market Trends

Portable Bluetooth Speaker Segment to Witness Fastest Growth

- Portable Bluetooth speakers are comparably smaller, lighter, and can be moved anywhere. Portable speakers come in many shapes and sizes. Soundbars, tubes, and clips are some of the most widely consumed models in the market. Changing consumer dynamics in the market and increasing consumer preference toward portable devices support the market's growth.

- The demand for portable speakers is increasing as customer choices regarding how to listen to audio are changing. Manufacturers are encouraged to innovate, develop, and seek improvement in audio performance due to the shift in music style between digitized and hi-fi systems.

- Audio and voice user interface technologies in the portable audio device segment have also progressed tremendously, resulting in a wide range of platforms that enable more integration, immersive sound quality, wireless connectivity, and on-device AI for more innovative devices, which has increased the demand for portable Bluetooth speakers, contributing to market growth.

- Moreover, portable Bluetooth speakers tend to be energy efficient, which has helped increase their adoption. There is no need to plug these speakers into an electrical outlet, and either disposable or rechargeable batteries power them. As such, they don't consume much power. For instance, according to Bluetooth SIG, the global shipment of Bluetooth audio devices is estimated to grow from 0.77 billion in 2015 to 1.8 billion by 2026. A similar trend is anticipated to be reflected in the portable Bluetooth device segment as it is gaining prominence, especially in the younger consumer segment.

North America to Hold a Significant Market Share

- North America is expected to hold a significant share of the Bluetooth speaker market as the region leads the world in adopting new and advanced technologies. Furthermore, having a large music industry also creates a favorable outlook for the studied market's growth in the region. For instance, according to RIAA, the recorded music industry in the United States grew by about 6 percent, with estimated retail revenue reaching USD 15.9 billion in 2022.

- Due to their reliable and high-quality products and services, American electronic businesses make up the majority of the region's worldwide electronics sector. Some of the biggest and most prominent electronics companies in the United States include KEF, JBL, Klipsch, Bose, and others.

- Furthermore, the growing adoption of audio streaming services has been critical in propelling the expansion of the North American wireless speaker industry. For instance, in recent years, Spotify and some other music streaming platforms have witnessed tremendous growth in the United States. According to the RIAA, the US was home to 92.0 million music streaming subscribers in 2022, up by 8 million year-on-year (vs. 2021).

- Moreover, the increased prevalence of audio podcast listeners is projected to substantially impact the North American Bluetooth speakers market over the forecast period. For instance, according to Buzzsprout, as of July 2023, the United States has 49.9 percent of podcast listeners, trailed by the United Kingdom (6.1 percent) and Canada & Australia (4.3 percent). Thus, a high number of podcast listeners in the North American region is expected to increase the demand for Bluetooth speakers.

Bluetooth Speaker Industry Overview

The Bluetooth speaker market is fragmented, as changing consumer demands push companies to innovate to attract more consumers. The competition in this market has intensified over the years, with companies launching a multitude of products to attract consumers. Some of the key players in the market are Sony Corporation, Koninklijke Philips NV, Samsung Electronics Co. Ltd (Harman International Industries), and Bose Corporation.

In May 2023, Sony Electronics Inc. launched two new wireless speakers, the SRS-XV800 and the SRS-XB100. According to the company, the new SRS-XV800 speaker is built for loud and clear sound for house events and provides a powerful, room-filling sound; it also features Bluetooth Fast Pair2 for Android. In contrast, the SRS-XB100 is a small wireless speaker featuring a powerful, clear sound with incredible portability.

In July 2023, Inbase Technologies, a leading mobile accessories brand, launched a compact Bluetooth Speaker, "Boom Box," with a wireless karaoke mic. This speaker comes with 3 different voice modes for the next-level karaoke experience, featuring great sound and a loud wireless karaoke mic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of Macro Factors on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent Advancements in Connectivity and Growing Demand for Connected Devices in Emerging Regions

- 5.1.2 Increased Demand and Access to Online Streaming Services

- 5.2 Market Restraints

- 5.2.1 Threats of Piracy

6 MARKET SEGMENTATION

- 6.1 By Portability

- 6.1.1 Portable

- 6.1.2 Fixed

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sony Corporation

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Samsung Electronics Co. Ltd. (Harman International Industries)

- 7.1.4 Bose Corporation

- 7.1.5 Beat Electonics

- 7.1.6 Panasonic Corporation

- 7.1.7 LG Electronics Inc.

- 7.1.8 Best IT World Pvt. Ltd (iBall)

- 7.1.9 Logitech International

- 7.1.10 Yamaha Corporation

- 7.1.11 Altec Lansing

- 7.1.12 JVC Kenwood Corporation

- 7.1.13 AOMAIS (JinWenHua Audio)

- 7.1.14 Forcovr (Shenzhen Guiwei Security)

- 7.1.15 Anker Innovations Technology

- 7.1.16 Onkyo Corporation (Pioneer)

- 7.1.17 SoundBot

- 7.1.18 Zebronics