|

市場調查報告書

商品編碼

1403819

低溫冷凍機-市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測Cryocooler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

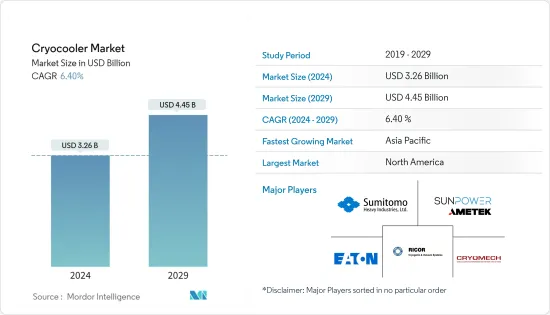

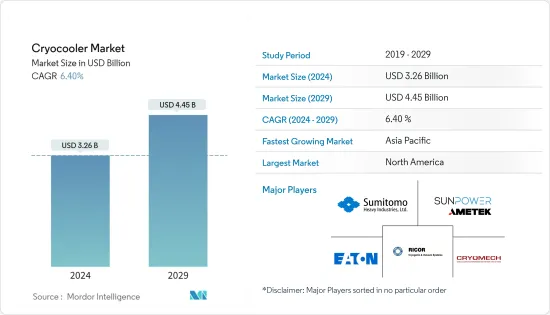

低溫冷凍機市場規模預計到 2024 年為 32.6 億美元,預計到 2029 年將達到 44.5 億美元,在預測期內(2024-2029 年)複合年成長率為 6.40%。

主要亮點

- 低溫冷凍機技術的發展大大擴展了夜視設備設備的應用,從醫院的磁振造影(MRI)到軍事夜視設備,甚至太空望遠鏡低溫冷凍機的長波儀器。

- 推動低溫冷凍機採用的關鍵因素包括其在軍事和國防部門中的日益成長的使用,以維持夜視設備中紅外線感測器的低溫。近年來,隨著各國國防能力的提高,夜視設備的使用大幅增加。此外,各國正在增加軍事開支以採用新技術。根據SIPRI統計,2022年美國軍事開支約8,769.4億美元。

- 此外,低溫冷凍機廣泛用於國防應用,主要用於冷卻紅外線焦平面。具體來說,低溫冷凍機用於冷卻中波長紅外線(標稱波長3-5微米)和長波長紅外線(標稱波長9-12微米)感測器的固有半導體焦平面。

- 過去 20 年來,低溫冷凍機取得了許多改進,導致低溫技術的許多應用蓬勃發展並進入市場。

- 紅外線和可見光相機的冷卻繼續為小型低溫冷凍機提供機會。近年來,紅外線熱像儀已從冷卻型轉向非冷卻型,但由小型斯特林循環冷凍冷卻的高性能紅外線成像儀仍然存在市場。

- 開發依賴可預測的低溫冷凍機性能的太空船溫度控管系統是空間熱系統設計中最具挑戰性的方面之一。許多開發人員在進行系統級權衡時依賴非常稀疏的製冷機性能資料。

低溫冷凍機市場趨勢

最大的最終用戶領域是醫療保健

- 低溫冷凍機在醫學上的需求量很大,因為它們廣泛應用於 MRI 系統、果凍和質子治療。低溫冷凍機用於冷卻該醫療設備中的超導性磁鐵。低溫冷凍機的持續研究和開發使其在醫療行業的各種應用中越來越被接受。

- 據稱,低溫冷凍機的高輸入電力消耗是一個限制。然而,在醫學中使用低溫冷凍機的好處大於缺點。在醫療領域,低溫冷凍機擴大用於磁振造影(MRI) 和核磁共振 (NMR) 機器,技術也有進步。

- 醫療設備數量的增加可能為研究目標市場創造成長機會。根據經濟合作暨發展組織(OECD) 的數據,去年美國每百萬人安裝了超過 37.99 台 MRI,紐西蘭每百萬人安裝了 16.62 台 MRI。

- 此外,印度醫學研究委員會 (ICMR) 和印度理工學院 (IIT) 共同建立了卓越中心 (CoE),以促進醫療設備領域印度製造產品的開發和商業化。根據IBEF統計,2000年4月至2022年6月,流入醫療手術設備領域的FDI總合27.1億美元。

- 此外,低溫冷凍機還可用於低溫保存,這是一種透過將樣品冷卻至極低溫度來保存細胞、組織、細胞器和其他生物結構的過程。細胞和組織冷凍保存的技術和理解正在迅速發展。冷凍生物學廣泛應用於許多領域,包括生殖醫學、癌症造血幹細胞治療、CAR T細胞等標靶免疫細胞治療以及動植物性因庫。

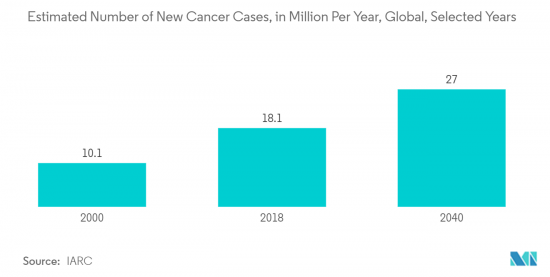

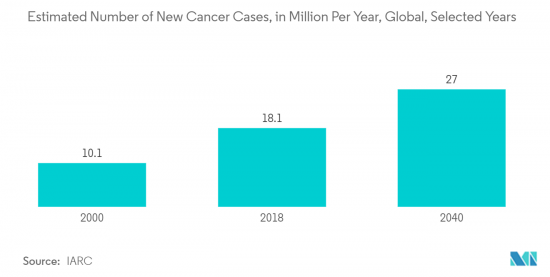

- 根據IARC的世界癌症報告,儘管癌症預防和治療不斷取得進展,但2018年至2040年間新患者數預計將增加50%,導致全球癌症負擔持續增加。 IARC估計,2000年將有1,010萬新癌症病例,2018年將有1,810萬新病例,到2040年每年將有2,700萬新病例。這些因素預計將推動低溫冷凍機的需求。

預計北美將佔據最大佔有率

- 由於軍事和醫療領域投資的增加,北美在很大程度上推動了低溫冷凍機市場的成長。根據SIPRI的數據,美國以8,769.4億美元的軍事開支位居2022年軍費最高國家榜首。

- 美國政府航太機構正在投入大量研發資金來實施創新的低溫冷卻技術。這可能會在未來幾年促進該國航太部門的成長。根據美國預算辦公室的數據,2013年至2022年間,美國在核武上花費了3,920億美元,在飛彈防禦上花費了970億美元,在環境和健康成本上花費了1,000億美元。

- 在醫療領域,低溫冷凍機在質子治療、果凍、MRI系統和醫院氧氣液化中的廣泛使用導致該地區對低溫冷凍機的需求增加。該地區是新的癌症藥物和快速發展的技術(例如低溫冷凍機設備)的主要開發商,其中一些最著名的團體致力於治療固態腫瘤、肺癌和白血病。

- 肺腫瘤和腦腫瘤的質子治療已被證明對於局部癌症患者來說是合理的治療方法。腦腫瘤是 0 至 14 歲兒童癌症相關死亡的主要原因。該地區上述癌症病例的不斷增加可能會推動質子治療的成長,從而推動所研究市場的成長。據國家質子治療協會稱,美國42 個質子治療中心治療患者。

- 低溫冷凍機用於維持安裝在夜視設備、衛星監視、飛彈導引等中的紅外線感測器的極低溫度,因此北美軍事和監視領域對低溫冷凍機的需求不斷增加,帶動了北美地區低溫冷凍機的需求。地區。它正在推動市場上漲。

低溫冷凍機產業概況

低溫冷凍機市場有幾家主要企業,包括住友和巴里自動化公司,他們與其他競爭一起試圖在這個適度分散的市場空間中獲得優勢。這些公司採用產品創新、投資、收購和策略夥伴關係等強力的競爭策略來維持其市場地位和競爭。在研究期間,市場競爭企業之間的敵意表現出中等程度的高水準。

2023 年 3 月,Cryomech Inc. 在美國物理學會 (APS) 2023 年 3 月會議上推出了其業界領先的 PT450 脈衝管低溫冷凍機和 CP3000 系列氦壓縮機。

2023年2月,低溫測量系統製造商Bluefors (Cryomech Inc.)策略性地宣布有意收購Cryomech。此次收購增強了公司的能力,並將業務擴展到新的地區,包括芬蘭、荷蘭和美國。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 技術簡介

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 新興經濟體醫療保健服務的成長

- 增加液化天然氣產量

- 市場抑制因素

- 低溫冷凍機性能限制

第6章市場區隔

- 按最終用戶產業

- 宇宙

- 醫療保健

- 軍隊

- 商業的

- 運輸

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區 中東/非洲

第7章競爭形勢

- 公司簡介

- Sumitomo Heavy Industries Limited

- Sunpower Inc.(AMETEK Inc.)

- Ricor Systems

- Eaton Corporation PLC

- Cryomech Inc.(Bluefors OY)

- Chart Industries Inc.

- Janis Research Company LLC

- Advanced Research Systems Inc.

- Air Liquide Advanced Technologies

- Stirling Cryogenics BV

- Northrop Grumman Corporation

- Thales Group

第8章投資分析

第9章市場的未來

The Cryocooler Market size is estimated at USD 3.26 billion in 2024, and is expected to reach USD 4.45 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

Key Highlights

- Technological development of cryocooler technology significantly expanded the use of these devices, as they can extend from a hospital magnetic resonance imaging (MRI) machine to military night vision devices to even longwave instruments on a space telescope.

- Some of the major factors driving the adoption of cryocoolers included the growing adoption across the military and defense sectors to maintain cryogenic temperatures for IR sensors installed in night-vision-based systems. The use of night vision devices has significantly increased in the last few years as countries advance their defense capabilities. Moreover, countries are increasing their military spending to adopt new technologies. As per SIPRI, in 2022, the United States spent around USD 876.94 billion on its military.

- Further, cryocoolers are used extensively in defense applications, mainly for the cooling of infrared focal planes. Quite specifically, cryocoolers are typically used to cool intrinsic semiconductor-type focal planes for mid-wave infrared (nominally 3-5-micron wavelength) and longwave infrared (nominally 9-12 micron) sensors.

- A significant number of improvements to cryocoolers have occurred in the past two decades, which, in turn, have allowed many more applications of cryogenics to flourish and find their way into the marketplace.

- Cooling of infrared and visible cameras continues to provide opportunities for small cryocoolers. While recent years have witnessed a shift from cooled to uncooled IR cameras, a market remains for high-performance infrared imagers cooled by small Stirling cycle cryocoolers.

- Developing spacecraft thermal management systems that depend on predictable cryocooler performance is one of the most challenging aspects of space thermal system design. Most of the developers rely on very sparse cryocooler performance data when conducting their system-level trade-offs.

Cryocooler Market Trends

Healthcare to be the Largest End-user Vertical

- Cryocoolers are in high demand in healthcare due to their widespread application in MRI systems, cryosurgery, and proton therapy. Cryocoolers are used to keep the superconducting magnets in this medical equipment cool. The continued study and development of cryocoolers have enhanced their acceptance in the healthcare industry for various applications.

- The high input power consumption of cryocoolers is claimed to be a limitation. However, the benefits of using cryocoolers in healthcare exceed the drawbacks. The use of cryocoolers in magnetic resonance image (MRI) and nuclear magnetic resonance (NMR) equipment is increasing in the medical field. There are also technological advancements.

- The rise in the number of medical machines would create an opportunity for the studied market to grow. According to the Organization for Economic Co-operation and Development (OECD), Over 37.99 MRI units were available per every million of its population in the United States last year, and New Zealand had 16.62 MRI units available per every million of its population.

- Additionally, the Indian Council of Medical Research (ICMR) and Indian Institutes of Technology (IITs) cooperated in establishing 'ICMR at IITs' by establishing Centers of Excellence (CoE) for Make-in-India product development and commercialization in the medical devices space. According to IBEF, FDI inflows into the medical and surgical appliances sector totaled USD 2.71 billion from April 2000 to June 2022.

- In addition, cryocoolers also find use in cryopreservation, which is a process that preserves cells, tissues, organelles, or any other biological construct by cooling the samples to very low temperatures. The technologies and understanding of cell and tissue cryopreservation have developed rapidly. There is widespread application of cryobiology in many areas, including reproductive medicine, hematopoietic stem cell treatments in cancer, targeted immune cell therapies such as CAR T-cells, and animal and plant gene banks.

- According to the IARC's World Cancer Report, despite constant progress in cancer prevention and treatment, the global cancer burden kept growing, as the number of new cases was anticipated to increase by 50% between 2018 and 2040. The IARC recognized 10.1 million new cancer cases in 2000 and 18.1 million in 2018 and expects 27 million new cases annually by 2040. Such factors are expected to drive the demand for cryocoolers.

North America is Expected to Hold the Largest Share

- North America is significantly driving the growth of cryocoolers in the market due to rising investment in the military and healthcare sectors. According to SIPRI, the United States led the ranking of countries with the highest military spending in 2022, with USD 876.94 billion dedicated to the military.

- Government space organizations in the United States have invested significant research and development funds in introducing innovative cryogenic cooling technology. This will help the space sector in the country grow in the coming years. According to the US Congressional Budget Office, between 2013 and 2022, the United States spent USD 392 billion on nuclear weapons, USD 97 billion on missile defenses, and USD 100 billion on environmental and health costs.

- In the healthcare sector, the rising demand for cryocoolers in the region is attributed to their extensive utilization in proton therapy, cryosurgery, MRI systems, and the liquefaction of oxygen in hospitals. The region is a significant developer of new cancer drugs and rapidly evolving technologies, such as cryocooler devices, with the most prominent groups aimed at treating solid tumors, lung cancer, and leukemia.

- Proton therapy for lung and brain cancer has proven to be a reasonable treatment for patients whose cancer is limited to the local area. Brain tumors are the leading cause of cancer-related death among children ages 0-14. The expansion in the cases of the cancers mentioned above in the region may drive the growth of proton therapy, thereby driving the studied market growth. According to the National Association of Proton Therapy, 42 proton therapy centers are treating patients in the United States.

- Since cryocoolers are used to maintain cryogenic temperatures for IR sensors installed in night vision-based systems, satellite-based surveillance, and missile guidance, the growing demand for cryocoolers across North America's military and surveillance sectors has been boosting the cryocoolers market in the region.

Cryocooler Industry Overview

The cryocooler market is home to multiple key players, including Sumitomo and Barry Automation Inc., alongside other contenders, all striving for prominence within this moderately fragmented market space. These companies have embraced potent competitive strategies, such as product innovations, investments, acquisitions, and strategic partnerships, in order to maintain their relevance and competitive edge in the market. During the study period, the competitive rivalry within the market exhibited a moderately high level of intensity.

In March 2023, Cryomech Inc. unveiled the industry-leading PT450 Pulse Tube Cryocooler and CP3000-Series Helium Compressor at the American Physical Society (APS) March 2023 Meeting.

In February 2023, Bluefors (Cryomech Inc.), a manufacturer of cryogenic measurement systems, made a strategic announcement regarding its intention to acquire Cryomech. This acquisition is poised to bolster the company's capabilities and expand its presence to new regions, including Finland, the Netherlands, and the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Medical and Healthcare Services in Developing Economies

- 5.1.2 Increasing Production of Liquefied Natural Gas

- 5.2 Market Restraints

- 5.2.1 Performance Constraint of Cryocoolers

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Space

- 6.1.2 Healthcare

- 6.1.3 Military

- 6.1.4 Commercial

- 6.1.5 Transportation

- 6.1.6 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sumitomo Heavy Industries Limited

- 7.1.2 Sunpower Inc. (AMETEK Inc.)

- 7.1.3 Ricor Systems

- 7.1.4 Eaton Corporation PLC

- 7.1.5 Cryomech Inc. (Bluefors OY)

- 7.1.6 Chart Industries Inc.

- 7.1.7 Janis Research Company LLC

- 7.1.8 Advanced Research Systems Inc.

- 7.1.9 Air Liquide Advanced Technologies

- 7.1.10 Stirling Cryogenics BV

- 7.1.11 Northrop Grumman Corporation

- 7.1.12 Thales Group