|

市場調查報告書

商品編碼

1403075

氣體感測器:市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

氣體感測器市場規模預計到 2024 年為 15.3 億美元,預計到 2029 年將達到 25.2 億美元,在預測期內(2024-2029 年)複合年成長率為 10.40%。

主要亮點

- 除了無線功能和小型化方面的進步之外,通訊功能的改進也促進了與各種設備和機械的整合,同時又不降低在安全距離檢測有毒或可燃性氣體的能力,正在推動感測器市場的發展。除此之外,COVID-19大流行進一步強調了維持空氣質量,尤其是室內空氣品質的重要作用,無論是在辦公室、家庭或其他公共場所。

- 值得注意的是,工業生產過程不僅使用多種氣體,而且在環境排放總量中也佔很大比例。各國政府正在監管此類氣體洩漏,這增加了對氣體感測器的需求。例如,歐盟頒布了2010/75/EU指令來規範工業設施向大氣中排放污染物。最近,歐盟政策制定者提案立法,迫使石油和天然氣公司報告其國內甲烷排放,並修復這種強大的溫室氣體的洩漏問題。這是因為甲烷氣體是繼二氧化碳之後導致氣候變遷的第二大原因,並且具有極其巨大的暖化效應。為了避免災難性的氣候變化,全球甲烷排放必須在未來10年內大幅減少。

- 世界各國政府和政治機構都訂定了減少溫室氣體排放的目標。例如,歐盟設定了2050年實現溫室氣體淨零排放的目標。此外,中國、美國、印度和俄羅斯等國家也擴大採用嚴格的法規來控制排放率。

- 近日,2022年8月,印度石化燃料內閣宣布,到2030年,GDP排放強度將比2005年降低約45%,並於2030年左右核准了印度最新的國家自主貢獻(NDC),承諾實現50%。

- 此外,政府有關職場和勞動安全的法規變得越來越嚴格,遵守這些法規對於組織的業務永續營運至關重要。例如,在歐洲,EU-OSHA 透過連結歐洲工作場所來共用資訊和知識來促進風險預防文化。歐洲社會權利支柱行動計畫5中宣布的職業安全與衛生框架也確定了未來幾年在大流行後世界背景下加強工人安全和健康所需的關鍵優先事項和行動。

- 這些法規要求雇主採取措施保護工人免受職場危險(例如暴露於有害氣體),從而推動了對氣體感測器的需求。

- 傳統發電廠中的氣體感測器不斷增加,以限制硫氧化物、汞、氮氣和二氧化碳等污染物的排放。這些法規旨在透過有效利用資源來最大限度地減少溫室氣體排放和其他污染。感測器有助於提高渦輪機效率、提高工廠安全性、減少電力傳輸損失並減少對環境的影響。

- 此外,新興市場正在經歷快速變化,不同類型的感測器可用於檢測一氧化碳和二氧化碳等關鍵氣體。此外,成本增加、技術創新和產品差異化低也是不斷變化的市場面臨的挑戰。

氣體感測器市場趨勢

安全和監管是工業採用的關鍵驅動力

- 近年來,各種類型的氣體已被用作各行業的原料。如果發生氣體洩漏,不僅會危及人身安全,還會造成財產損失,因此控制和監測這些氣體極為重要。因此,持續監測和控制排放氣體的需求催生了工業中對氣體感測器的需求。

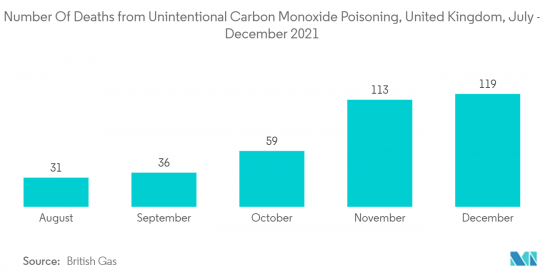

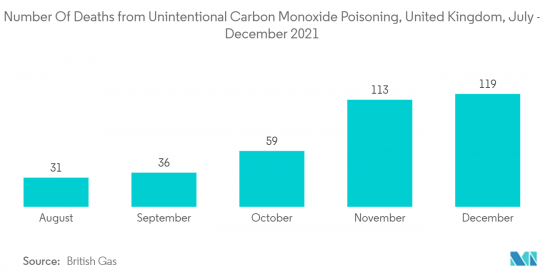

- 此外,嚴格的政府法規進一步強制要求氣體感測器的應用,以使業界更加安全。這給了業界預防瓦斯洩漏事故的信心。例如,根據疾病管制與預防中心的研究,加拿大每年約有 50 人死於一氧化碳中毒。因此,使用一氧化碳 (CO) 氣體感測器是有益的。這些產品可能會在不知不覺中使您家中的二氧化碳氣體濃度達到危險水平。

- 此外,氣體感測器由於其高效的能源利用和居住者的安全而擴大被智慧型住宅採用。此外,有關此類設備的安裝和安裝的政府標準和法規也已到位。例如,美國國家消防協會發布了一項名為 NFPA720 的標準,其中第 5.1.1.1 和 5.1.1.2 節規定,所有 CO 感測器必須放置在每個睡眠區域的緊鄰位置。所有偵測都必須安裝天花板、牆壁或設備隨附的安裝說明中指定的其他位置。

- 此外,快速工業化以及精製和製藥行業污水處理需求的增加是推動市場成長的關鍵因素。全球飲用水需求的不斷成長也對氣體感測器的需求產生了積極影響。氣體感測器主要用於水處理設施中,用於監測氯等各種化學物質的存在,並在發生洩漏或其他問題時向工人發出警報。在此背景下,中央污染控制委員會聯合國家污染控制委員會和污染控制專員向污水處理廠等17類主要污染企業發出指示。還有政府規定,例如向組織發出指示根據《水和空氣法》第18條第1(b) 款。

- 世界人口的成長和製造業的擴張加劇了對經過處理的清潔水的迫切需求。因此,氣體感測器常用於污水處理設施中,用於監測硫化氫、甲烷、二氧化碳等各種氣體。

亞太地區可望成為快速成長的市場

- 亞太地區被認為是氣體感測器市場成長最快的地區之一,預計在預測期內將繼續引領市場。印度和中國等國家對空氣污染物對人體影響的認知不斷提高,推動了對用於空氣品質監測的氣體感測器的需求。

- 例如,2022年9月,Figaro Engineering Inc.宣布推出KE-LF系列無鉛原電池氧感測器,用於安全、環境氣體監測、食品和教育應用。此產品類型由 Maxell Corporation 在日本開發,由鉛原電池氧氣感測器KE-25LF 和 KE-25F3LF 組成。具有優異的化學耐久性,常溫不受H2S、CO2、SO2的影響,壽命長約5年。此外,其尺寸與現有KE系列氧氣感知器相同,方便現場更換。

- 為了乘客的舒適性和安全性,氣體感測器在汽車中的使用越來越多,這進一步推動了製造的氣體感測器應用的成長。 IBEF的數據顯示,印度無論是國內需求或出口方面都是一個強勁的市場,2022會計年度小客車總銷量約為307萬輛,出口量為5,617,246輛。

- 此外,印度也是全球最大的學名藥供應國。此外,印度的製藥業滿足全球需求的50%。這些藥品製造設施在製造過程中使用各種溶劑和氣體,並且需要持續監控,導致對氣體感測器的需求急劇增加並提高了市場成長率。

氣體感測器產業概況

氣體感測器市場分散,有許多公司參與。此外,提供各種類型氣體感測器的公司正試圖在技術上使他們的產品脫穎而出。因此,他們採取與競爭的價格競爭策略來獲得市場佔有率。

2023年6月,Sciosense宣布推出新產品ENS161。 ENS161 是一款低功耗多氣體感測器,使穿戴式和攜帶式設備僅由小容量電池供電。該設備能夠連續監測空氣品質。

2023 年 2 月,H2scan 宣布推出 HY-ALERTA 5021 固態區域氫氣監測儀產品,可保護電池室免受爆炸性氫氣積聚的影響,並且 10 多年免維護。即使有其他可能導致其他感測器技術誤報的氣體,HY-ALERTA 5021 也能夠檢測低含量的氫氣。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 為了遵守政府法規,對汽車氣體感測器的需求不斷增加

- 提高對主要行業職業事故的認知

- 市場抑制因素

- 成本上升,產品缺乏差異化

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按類型

- 氧

- 一氧化碳 (CO)

- 二氧化碳(CO2)

- 氮氧化物

- 烴

- 其他類型

- 依技術

- 電化學公式

- 光電離檢測器(PID)

- 固體/金屬氧化物半導體

- 催化型

- 紅外線的

- 半導體

- 按用途

- 醫療用途

- 建築自動化

- 工業的

- 食品和飲料

- 車

- 運輸/物流

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第6章競爭形勢

- 公司簡介

- Figaro Engineering Inc.

- Membrapor AG

- AlphaSense Inc.

- Nemoto & Co. Ltd

- Robert Bosch GmbH

- Amphenol Advanced Sensors

- AMS AG

- Trolex Ltd.

- ABB Ltd

- Siemens AG

- City Technology Ltd.

第7章 投資分析

第8章市場的未來

The Gas Sensors Market size is estimated at USD 1.53 billion in 2024, and is expected to reach USD 2.52 billion by 2029, growing at a CAGR of 10.40% during the forecast period (2024-2029).

Key Highlights

- The evolution of wireless capabilities and miniaturization, along with improved communication capabilities that facilitate their integration into different devices and machines without minimizing the detection capabilities of toxic or flammable gases at safe distances, propels the gas sensors market. In addition to this, the COVID-19 pandemic further stressed the crucial role of maintaining air quality, especially indoor air quality, whether at the office, home, or other public spaces.

- Notably, the industrial production process not only involves the use of various gases but also shares a considerable share of the overall environmental emissions. The government regulates the leakage of such gases, and this is where the demand for gas sensors is increasing. For instance, the EU incorporated Directive 2010/75/EU, an instrumental regulation in controlling pollutant emissions into the atmosphere by industrial installations. Moreover, recently, the EU policymakers proposed legislation for making oil and gas companies report their domestic methane emissions and fix leaks of the potent greenhouse gas. This is because Methane is the second biggest reason for climate change after carbon dioxide and has led to a significantly large warming effect, meaning deep cuts in global methane emissions are required this decade to avert disastrous climate change.

- Governments all over the world and political bodies are largely setting targets to decrease the emission of greenhouse gases. For example, the EU has set itself a goal of net-zero greenhouse gas emissions by 2050. Also, countries such as China, the United States, India, and Russia are increasingly adopting stringent regulations to tackle emission rates.

- Recently, in August 2022, the Union Cabinet of India approved India's updated Nationally Determined Contribution (NDC) for commitment towards the reduction of emissions intensity of its GDP by about 45 percent by 2030, compared to the 2005 level and attain about 50 percent integrated electric power installed capacity from non-fossil fuel-based energy resources by 2030.

- Moreover, government regulations for workplace and labor safety are increasingly becoming stringent, and adherence to such rules is vital in business continuity for organizations. For instance, in Europe, EU-OSHA does this by bringing together European workplaces to share information and knowledge for promoting a culture of risk prevention, and the OSH framework, announced in the European Pillar of Social Rights action plan 5, sets out the crucial priorities and actions necessary for enhancing workers' health and safety in the upcoming years in the context of the post-pandemic world.

- Such regulations have increased the demand for gas sensors by requiring employers to take measures to protect workers from hazards in the workplace, such as exposure to hazardous gases.

- Gas sensors present in conventional power plants have been surging to limit emissions of pollutants, such as sulfur oxides, mercury, nitrogen, and carbon dioxide, owing to the stringent government regulations for attaining sustainability goals. These try to minimize greenhouse emissions and other types of pollution by using resources effectively. Sensors contribute to surged turbine efficiency, more plant safety, low transmission losses, and low environmental impact.

- Furthermore, the developing nature of the market is resulting in rapid changes and the availability of different types of sensors for major gases like carbon monoxide and carbon dioxide. Additionally, increasing costs are also an issue in the ever-changing market, along with innovations and low product differentiation.

Gas Sensors Market Trends

Safety and Regulations are the Primary Drivers for Industrial Implementation

- Various sorts of gases have been utilized as raw materials in different industries in recent years. It becomes significantly crucial to control and monitor these gases, as there is a large risk of damage to property as well as human lives if a leak occurs. Therefore, the necessity to continually monitor and control the gases emitted sprouted a requirement for gas sensors in industries.

- Moreover, the stringent government regulations further mandated the gas sensors' applications in order to make the industries safer. This turned industries more confident about preventing accidents related to gas leaks. For instance, as per the Center for Disease Control and Prevention study, approximately 50 people in Canada die per year from CO poisoning. Resultantly, adopting carbon monoxide (CO) gas sensors is beneficial, as these products can unknowingly lead to dangerous levels of CO gas building up within the homes.

- Furthermore, gas sensors have witnessed increased adoption in intelligent homes due to efficient energy usage and the safety of inhabitants. Furthermore, the implementation of government standards and regulations for following and installing these devices. For instance, the National Fire Protection Association published a standard that is referred to as NFPA 720 includes sections 5.1.1.1 and 5.1.1.2, as per which all CO sensors should be located outside of each sleeping area in the immediate vicinity of all the bedrooms, and every detector should be located on the ceiling, walls, or other locations as mentioned in the installation instructions that accompany the unit.

- Moreover, rapid industrialization, coupled with the increasing requirement for wastewater treatment from the refining and pharmaceutical industries, are among the important factors driving the growth of the market. Also, the rising demand for potable water across the world is having a positive impact on the demand for gas sensors as they are largely used in water treatment facilities to monitor for the presence of various chemicals such as chlorine and alert workers if there is a leak or other problem. This is because of government norms such as the Central Pollution Control Board issued directions under section 18(1) b of the Water and Air Acts to the State Pollution Control Boards and Pollution Control Committees for directing the 17 categories of largely polluting industries that include Sewage Treatment Plants (STP).

- The pressing requirement for treated, clean water is being accelerated by the increasing global population and expanding manufacturing sector. Thus, gas sensors are commonly used in wastewater treatment facilities to monitor a variety of gases, such as hydrogen sulfide, methane, and carbon dioxide, that are often used in wastewater facilities.

Asia-Pacific is Expected to be the Fastest Growing Market

- The Asia-Pacific region has been considered one of the most rapidly rising regions for the gas sensors market, and it is expected to be the market leader during the forecast period. The rising awareness regarding the impact of air pollutants on human health in countries such as India and China is propelling demand for gas sensors for air quality monitoring.

- For instance, in September 2022, Figaro Engineering Inc. announced the introduction of the KE-LF series of lead-free galvanic cell oxygen sensors for safety, environmental gas monitoring, food, and educational applications. Maxell Ltd. develops this product in Japan and consists of the KE-25LF and KE-25F3LF, lead-free galvanic cell-type oxygen sensors. They incorporate a long life expectancy of around five years in excellent chemical durability, ambient air, and no influence from H2S, CO2, or SO2. Moreover, these new sensors have the same dimensions as existing KE series oxygen sensors, facilitating onsite quick and easy replacement of current KE series oxygen sensors.

- The rising use of gas sensors in automobiles for passenger comfort and safety has been further driving the growth of manufacturing gas sensing applications. As per the IBEF, India has turned out to be a strong market in terms of both domestic demand and exports, and the total passenger vehicle sales in FY22 approximated 3.07 million, with India exporting 5,617,246 vehicles.

- Furthermore, India is also the largest provider of generic drugs globally. Furthermore, the Indian pharmaceutical sector supplies 50 percent of the global demand. These pharmaceutical production facilities utilize various solvents and gases in the manufacturing process and are required to be continuously monitored, which surges the demand for gas sensors, thereby increasing the market growth.

Gas Sensors Industry Overview

The gas sensors market is fragmented due to many players operating in the market. Further, the companies providing various types of gas sensors have technological product differentiation. Hence, they are adopting competitive pricing strategies to gain market share.

In June 2023, ScioSense announced the launch of its new product, ENS161, a low-power multi-gas sensor that enables wearable and portable devices powered only by small-capacity batteries. The device is capable of continuous air quality monitoring.

In February 2023, H2scan announced the launch of its HY-ALERTA 5021 Solid-State Area Hydrogen Monitor product, which protects battery rooms from explosive hydrogen build-up and is maintenance-free for more than 10 years. The HY-ALERTA 5021 has the capability of detecting low levels of hydrogen even in the presence of other gases that can cause false alarms with other sensor technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Gas Sensors in Automobiles for Compliance with Governmental Regulations

- 4.2.2 Growing Awareness on Occupational Hazards across Major Industries

- 4.3 Market Restraints

- 4.3.1 Rising Costs and Lack of Product Differentiation

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Oxygen

- 5.1.2 Carbon Monoxide (CO)

- 5.1.3 Carbon Dioxide (CO2)

- 5.1.4 Nitrogen Oxide

- 5.1.5 Hydrocarbon

- 5.1.6 Other Types

- 5.2 By Technology

- 5.2.1 Electrochemical

- 5.2.2 Photoionization Detectors (PID)

- 5.2.3 Solid State/Metal Oxide Semiconductor

- 5.2.4 Catalytic

- 5.2.5 Infrared

- 5.2.6 Semiconductor

- 5.3 By Application

- 5.3.1 Medical

- 5.3.2 Building Automation

- 5.3.3 Industrial

- 5.3.4 Food and Beverages

- 5.3.5 Automotive

- 5.3.6 Transportation and Logistics

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of the Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of the Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.4.4 Rest of the Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Figaro Engineering Inc.

- 6.1.2 Membrapor AG

- 6.1.3 AlphaSense Inc.

- 6.1.4 Nemoto & Co. Ltd

- 6.1.5 Robert Bosch GmbH

- 6.1.6 Amphenol Advanced Sensors

- 6.1.7 AMS AG

- 6.1.8 Trolex Ltd.

- 6.1.9 ABB Ltd

- 6.1.10 Siemens AG

- 6.1.11 City Technology Ltd.