|

市場調查報告書

商品編碼

1334479

日本快遞、快遞和包裹 (CEP) 市場規模和份額分析 - 增長趨勢和預測(2023-2028 年)Japan Courier, Express, and Parcel (CEP) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

日本快遞、快遞和包裹(CEP)市場規模預計到2023 年為203.1 億美元,預計到2028 年將達到378.8 億美元,在預測期內(2023-2028 年)預計將以13.28% 的複合年增長率增長。

市場由全國范圍內優質產品的快速交付所驅動。此外,在倉儲和最後一英裡產品交付中使用尖端技術正在推動市場發展。

主要亮點

- 關於最後一英裡物流,人們擔心這種前景將對日本快遞公司產生影響。只要冠狀病毒爆發持續,在線送貨將繼續流行,快遞員將面臨越來越大的按時送貨壓力。該國還擁有高標準的客戶服務和熱情好客,因此即使是輕微的交貨延遲也會被客戶注意到。神奈川縣橫須賀市的送貨工人在東京舉行的新聞發布會上表示,他們過度勞累,已經精疲力盡。日本的人口正在減少。疫情還導致外勞數量大幅減少,勞動力短缺問題更加嚴重。

- 由於日本幅員遼闊,且擁有高效的物流部門,因此交付速度更快、效率更高。調查顯示,與其他國家的買家相比,日本買家從海外市場購買的可能性較小,更喜歡日本國內的送貨服務。買家對質量的關注始終高於對成本的關注。

- 參與者專注於創建提供實時分析平台並管理跨供應鍊網絡的產品和信息流的軟件。該軟件旨在通過管理生產、庫存、採購、運輸和監控產品需求,使公司的供應鏈運營更好、更穩健。它可以進行修改以滿足公司的需求,其子類別包括供應鏈規劃、運輸管理系統 (TMS)、倉庫管理系統 (WMS) 和製造執行系統。公司專注於採用人工智能、機器學習和大數據等新興技術。人工智能的使用簡化了更高效、更有利和更可靠流程的開發。物聯網 (IoT) 等技術有助於維持透明的供應鍊網絡,進而有助於提高客戶的可見性、忠誠度和信任度。

日本CEP市場趨勢

國內快遞和包裹服務的增長推動市場

過去 20 年來,日本的分銷渠道已得到顯著整合。消費品和工業品的分銷渠道完全不同。由於空間有限和城市人口密集,小型零售店一直是並且仍然是消費者銷售的主要中心。因此,零售商通常庫存的產品數量有限,而批發商則需要頻繁交付少量產品。儘管這一體係是由日本面對面開展業務的文化偏好以及人際關係中的忠誠感和義務感支撐的,但這種低效的分銷體系的成本卻轉嫁給了消費者。郊區“大盒子”零售店和電子商務的擴張對這種模式構成了威脅。

甚至在大流行導致許多人更喜歡網上購物而不是實體店(在日本,人們喜歡當地商店和現金支付)之前,許多人就認為這對老年人來說是不可能的。日本的電子商務經歷了巨大的增長在過去的十年。由於普通日本家庭空間有限,無法儲存大量商品,迫使他們幾乎每天都去附近的商店購買必需品。亞馬遜和樂天等主要電子商務平台近年來憑藉其廣泛的分銷和配送網絡獲得了可觀的利潤。

對市場驅動的最後一英裡服務的需求不斷增加

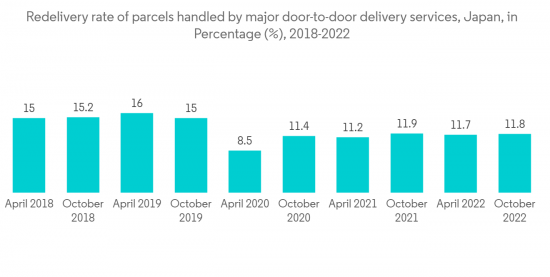

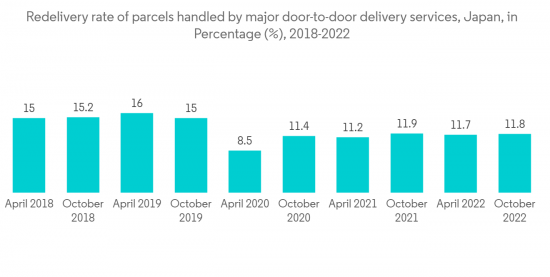

日本擁有非常強大的以最後一英裡送貨上門為中心的服務文化。大約 99% 的包裹都會被送到家,送貨員最多可以嘗試 4 次。20% 的失敗率對於承運商來說是一個很高的成本,而且隨著包裹量的增加,這一成本預計還會上升。據世界經濟論壇預測,到 2030 年,東京 23 個區的電子商務交易量將增長 85%。因此,所需的送貨車輛數量預計將增加 71%,每輛車的行駛距離要增加 25%。這種增長也影響到郊區。預計送貨車輛將增加 51% 以滿足這一需求。

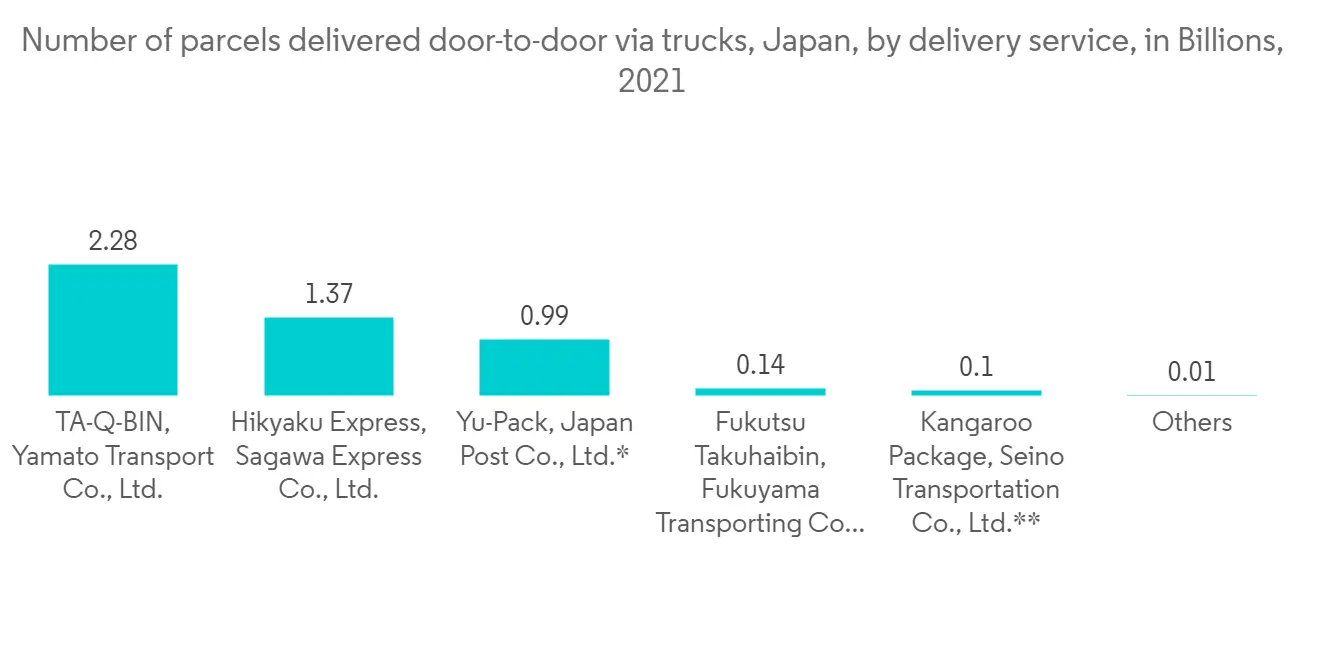

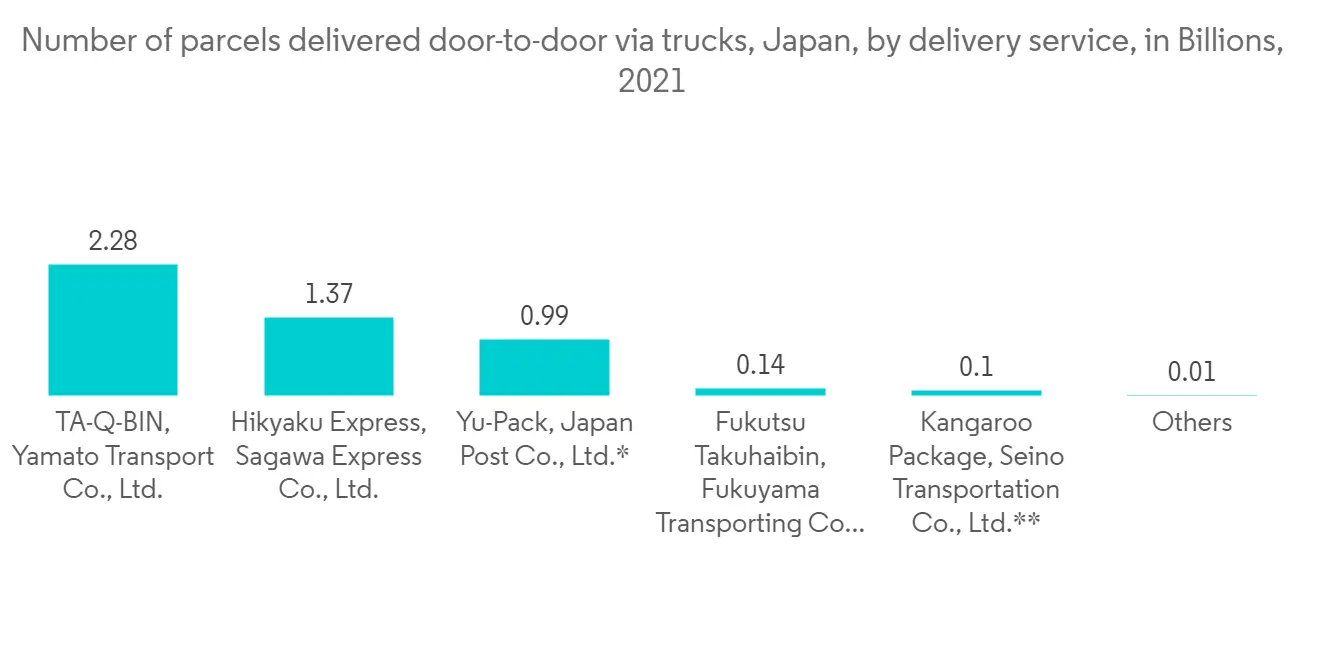

由於填補空缺職位的工作年齡司機減少以及人口老齡化,日本可能難以滿足日益增長的送貨上門需求。令人驚訝的是,日本已經擁有龐大的送貨上門網絡。例如,日本最大的快遞服務公司雅瑪多 (Yamato) 在便利、理想的地點擁有超過 250,000 個快遞取件點。在東京,95% 的居民步行 5 分鐘即可到達大和儲物櫃。但是,這些宅急便取貨地點主要用於宅急便運送。日本居民不僅使用這項服務向他人寄送包裹,還可以為自己寄送包裹,以方便旅行。例如,您可以將旅行行李直接寄送到您的酒店,或者您可以在前往球場的前一天寄送高爾夫球桿,這樣您就不必將它們帶到球場。

到目前為止,所有這些收集和運輸點都是使用紙張手動完成的,這對客戶來說既耗時又不方便。根據其 Next100 計劃,Yamato看到了將這種體驗數字化並充分利用其令人印象深刻的網絡的機會。Yamato 與 Doddle 合作,授權 PUDO 應用程序數字化並加快店內流程,具有標籤打印、包裹組織存儲、加急提貨和數字收據等功能,非常成功。該服務預計將推廣到 8,000 家商店,是 Yamato Next100 戰略的關鍵,該戰略旨在增加戶外廣告數量、在所有電子商務渠道提供高質量的客戶體驗並減輕送貨上門的壓力。

日本CEP產業概況

日本的快遞、快遞和包裹(CEP)市場分散且競爭激烈,少數公司在國際 CEP 市場上佔據主導地位。該市場較為分散,預計在預測期內將會增長。日本 CEP 市場的主要參與者是日本郵政、雅瑪多和佐川急便。訂單處理和先進技術的使用是市場領先企業脫穎而出的主要因素。準時、及時的交貨是所有在其營業地點需要此類服務的客戶的先決條件。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查先決條件

- 調查範圍

第二章研究方法論

- 分析方法

- 調查階段

第三章執行摘要

第四章市場洞察

- 目前的市場情況

- 技術趨勢

- 政府監管

- 價值鏈/供應鏈分析

- 日本物流倉儲市場概況

- 運價概覽(國內、國際運輸平均單價、趨勢等)

- CEP 市場供應鏈/價值鏈分析見解

- 聚焦日本 3PL 市場

- 逆向物流洞察

- COVID-19對CEP市場的影響(對市場和經濟的短期和長期影響)

第五章市場動態

- 促進者

- 抑製劑

- 機會

- 波特五力分析

- 供應商的議價能力

- 消費者/買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第六章市場細分

- 按目的地

- 國內的

- 國外

- 按業務

- B2B(企業對企業交易)

- B2C(企業對消費者)

- 按最終用戶

- 服務(包括BFSI(銀行、金融服務、保險)等)

- 批發/零售(包括電子商務)

- 生命科學/醫療保健

- 製造業

- 其他最終用戶

第七章 競爭格局

- 公司簡介

- Yamato

- Sagawa Express

- Japan Post

- Seino Transportation

- United Parcel Service

- FedEx

- DHL

- Takuhai

- TNT Express

- Nippon Express Company

- National Air Cargo

第八章市場機會及未來趨勢

第9章附錄

- 宏觀經濟指標(按部門劃分的GDP、建築業的經濟貢獻等)

- 資本流向洞察(交通倉儲領域投資)

- 電子商務及個人消費相關統計

- 對外貿易統計(進出口、分項、分國)

- 日本的人口統計(總人口、按年齡/性別/城市/地區劃分的人口等)

The Japan Courier, Express, and Parcel (CEP) Market size is estimated at USD 20.31 billion in 2023, and is expected to reach USD 37.88 billion by 2028, growing at a CAGR of 13.28% during the forecast period (2023-2028).

The quick delivery of high-quality goods across the nation is what drives the market. Furthermore, the use of cutting-edge technology in warehouses and product delivery to the last mile drives the market.

Key Highlights

- When it comes to last-mile logistics, the impact of this outlook on Japan's delivery agents is concerning. As long as coronavirus outbreaks keep happening, online delivery will stay popular, and delivery agents will be under more and more pressure to make deliveries on time. The country also has high standards for customer service and hospitality, so even small delays in delivery are noticed by customers. It's not surprising that Japanese delivery drivers have formed a union to protest being overworked.Workers in Yokosuka, Kanagawa Prefecture, said they had been overworked to the point of exhaustion at a press conference in Tokyo. Japan's population is falling, which has been a problem for a long time. It has put a cloud over the country's economy and could hurt it.The pandemic also caused a big drop in the number of foreign workers, which has made the shortage even worse.

- Speed of delivery is an important factor for Japanese shoppers, and one-day shipping is almost always the norm.Because of the country's size and the presence of an efficient logistics sector, deliveries can be made much faster and more efficiently. One interesting thing about Japanese customers is that they prefer to get their packages from the delivery driver instead of leaving them at the door.Studies show that Japanese buyers are less likely than buyers in other countries to buy from foreign markets, and there is a clear preference for delivery services within Japan.In the absence of this option, a reputable delivery service should suffice. Buyers consciousness of quality is consistently greater than their concern for the cost.

- Players focus on making software that provides an analytics platform in real time and manages the flow of products and information across the network of the supply chain. The software is meant to make a company's supply chain operations better and stronger by managing production, inventory, sourcing, transportation, and monitoring product demand. It can be changed to fit the needs of the company, and its subcategories include supply chain planning, transportation management systems (TMS), warehouse management systems (WMS), manufacturing execution systems, and others. Players are focusing on adopting emerging technologies such as AI, ML, and big data. The use of artificial intelligence has simplified the development of more efficient, advantageous, and dependable processes. Technology such as the Internet of Things (IoT) aids in the maintenance of a transparent supply chain network, which in turn helps bring customer visibility, loyalty, and trust.

Japan CEP Market Trends

Growth in domestic courier and parcel services driving the market

Over the last two decades, Japan's distribution channels have been significantly consolidated. Consumer goods and industrial products have very different distribution channels. Small retail stores have been and continue to be dominant points of consumer sales due to limited space and dense urban populations. As a result, retailers frequently stock limited quantities of a product, and wholesalers are required to deliver small amounts of a product more frequently. This system is maintained by the Japanese cultural preference for doing business face-to-face, as well as loyalty or a sense of obligation in relationships, but the costs of this less efficient distribution system are passed on to the consumer in the final price of the product. The expansion of suburban "big box" retailers and e-commerce is posing a threat to this model.

Even before the pandemic drove more people to prefer online shopping over brick-and-mortar (something many people thought unlikely for older demographics given the country's love affair with local shops and cash payments), Japanese e-commerce growth has been staggering over the last decade. Japan has a high density of small local stores and markets located throughout any urban city-a result of the average Japanese household's lack of space, which prevents many families from stocking up on products in large quantities and forces them to visit nearby shops for essentials on an almost daily basis. With their extensive distribution and delivery networks, major e-commerce platforms such as Amazon and Rakuten have made significant gains in recent years.

Increase in demand for last-mile services driving the market

Japan has an incredibly strong service culture, which revolves around home delivery in the last mile. About 99% of all packages are sent to homes, and the delivery person can try up to four times.With a 20% failure rate, this comes at a high cost to carriers, a cost that is only expected to rise as parcel volumes increase. According to the WEF, e-commerce volumes in central Tokyo's 23 wards will increase by 85% by 2030. Because of this, the number of delivery vehicles needed is expected to go up by 71%, and each vehicle will have to go 25% further. This will increase traffic and carbon emissions by a lot.This increase will also affect suburban areas. To meet the demand, delivery fleets are expected to grow by 51%.

With fewer working-age drivers to fill open positions and an aging population, Japan may struggle to meet the increasing demand for home deliveries. Surprisingly, Japan already has a large out-of-home delivery network in place. Yamato, Japan's largest parcel carrier, for example, has over 250,000 TA-Q-BIN collection points in desirable and convenient locations. In Tokyo, 95% of residents are within a 5-minute walk of a Yamato locker. These points, however, are primarily used for outgoing C2C parcels. Japanese residents use this service not only to send parcels to others but also to send parcels to themselves for easier travel. A customer, for example, may ship their luggage for a trip directly to a hotel or even ship golf clubs to the course the day before their visit to avoid traveling with these items.

Until recently, all of these collection and sending points used paper-based manual processes, which was time-consuming and annoying for customers. Yamato has now seen the chance to make this experience digital and make full use of its impressive network, which is in line with its Next100 plan. Yamato collaborated with Doddle to license our PUDO application to digitize and speed up the in-store process, which includes features like label printing, parcel organization for storage, quick collection, and digital receipts. This service will be rolled out to 8,000 stores and is a key component of Yamato's Next100 strategy to increase volume into OOH, provide a high-quality customer experience across all e-commerce channels, and relieve pressure on home delivery.

Japan CEP Industry Overview

The Japan courier, express, and parcel (CEP) market is fragmented and highly competitive, with a few players occupying the majority of the international CEP market. The market is fragmented, and it is expected to grow during the forecast. The major players in Japan's CEP market are Japan Post, Yamato, and Sagawa Express. Order fulfillment and the use of advanced technology have become major factors segregating big players in the market. On-time and fast delivery are the prerequisites for every customer demanding these services at their places of business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Government Regulations

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Overview of Logistics and Warehousing Market in Japan

- 4.6 Brief on Freight Rates (average.cost per parcel for domestic and international transport, trends, etc.)

- 4.7 Insights on Supply Chain/Value Chain Analysis of the CEP Market

- 4.8 Spotlight on 3PL Market in Japan

- 4.9 Insights on Reverse Logistics

- 4.10 Impact of COVID-19 on the CEP Market (short-term and long-term effects on the market, as well as economy)

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunitites

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Destination

- 6.1.1 Domestic

- 6.1.2 International

- 6.2 By Business

- 6.2.1 B2B (Business-to-Business)

- 6.2.2 B2C (Business-to-Consumer)

- 6.3 By End-User

- 6.3.1 Services (includes BFSI (Banking, Financial Services and Insurance), etc.)

- 6.3.2 Wholesale and Retail Trade (including E-commerce)

- 6.3.3 Life Sciences/ Healthcare

- 6.3.4 Industrial manufacturing

- 6.3.5 Other End-Users

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Yamato

- 7.2.2 Sagawa Express

- 7.2.3 Japan Post

- 7.2.4 Seino Transportation

- 7.2.5 United Parcel Service

- 7.2.6 FedEx

- 7.2.7 DHL

- 7.2.8 Takuhai

- 7.2.9 TNT Express

- 7.2.10 Nippon Express Company

- 7.2.11 National Air Cargo *

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Marcroeconomic Indicators (GDP breakdown by sector, Contribution of construction to economy, etc.)

- 9.2 Insights on Capital Flows (Investments in the Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics - Export and Import, by Product and Country

- 9.5 Demographics of Japan (Total Population, Population Breakdown by Age, Gender, City/Region, etc.)