|

市場調查報告書

商品編碼

1284310

智慧建築的初創企業格局 (2023年):初創企業格局概述。The Smart Building StartUp Landscape 2023: Overview of the Startup Landscape. Who is Gaining Traction? |

||||||

本報告提供智慧建築相關的Start-Ups企業趨勢調查,彙整Start-Ups企業的技術類別,地區的分佈,專門領域,收購·撤退等趨勢。

上市公司包括(但不限於下列)::

|

|

目錄

摘要整理

第1章 全球智慧建築市場Start-Ups企業

- 智慧建築的Start-Ups企業:技術類別

- 新加入企業概要

- 類別和市場區隔

- 智慧建築Start-Ups:各市場區隔

- Start-Ups的地區分佈

第2章 氣勢漸增的智慧建築Start-Ups

- BIoT (Internet of Things in Buildings)

- IoT平台的建立

- 數位雙胞胎解決方案

- 大樓能源管理

- 活用AI的HVAC的最佳化

- 永續性與碳管理

- 再生能源管理

- propTec

- 資產管理·維護

- 佔有分析

- 特定產業的解決方案

- 物理的保全

- 存取控制

- 影音分析

第3章 Start-Ups的撤退

- 非經營性啟動和關閉

- 裁員和裁員

第4章 Start-Ups的未來展望

This Report is a New 2023 Definitive Resource for Evaluating the Smart Building & PropTech Landscape.

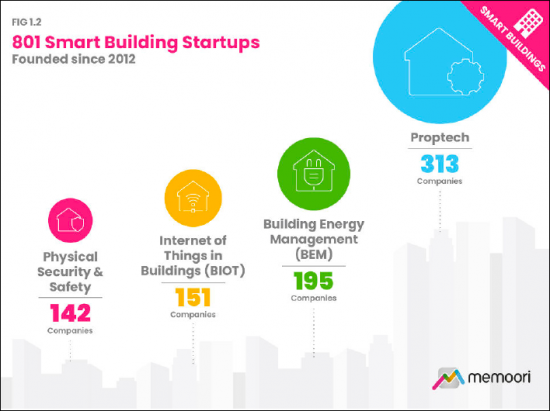

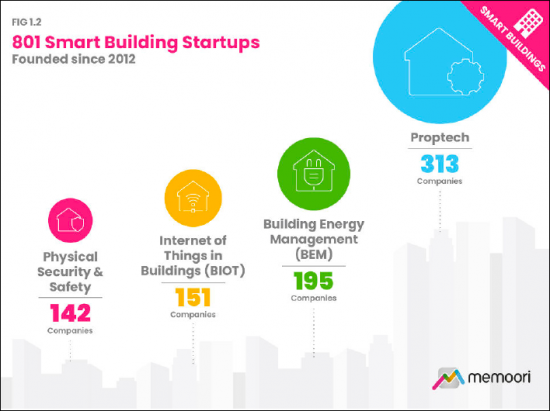

Of the 1,266 companies founded since 2012 in the management and operations phase of the global smart commercial buildings space, 801 are active and fit our definition of a Startup. This report selects 100 startups for further analysis that have gained traction in the last 2 years across 10 major segments.

Our definition of a Startup is "a private company formed no earlier than 2012 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company and is often financed by venture capital or private equity funding."

The report INCLUDES at no extra cost, a presentation file with high-resolution charts from the report.

What does this Report tell You?

- The number of companies identified which fit our definition has increased by 20% compared to the 665 startups in the 3rd edition of this report published in 2021. The smart building startup landscape is continuing to expand, but at a slower rate than in 2021, when we saw a 38% increase in the number of new entrants founded.

- A further 352 startups have been acquired between 2012 and 2022 - 28% of the total.

- Non-operational and closed startups account for around 6% of the total landscape.

The information and analysis in this report is based on research and interviews with emerging players in the Smart Building Space. It benefits from Memoori's previous reports over the last 2 years on subjects such as the Building Internet of Things (BIoT), Cyber Security, Physical Security and the Digital Workplace.

It demonstrates the critical contribution that Startups are making to the introduction of innovation in Smart Buildings & PropTech spaces.

Within its 103 Pages and 42 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand what the StartUp Landscape looks like in 2023 and how these Companies are Shaping the Future of PropTech.

The report shows how technology segments gaining traction are impacted by the increased demand for climate-related technologies to address energy efficiency, grid interactive buildings and carbon emissions management in commercial real estate.

This report provides valuable information for all stakeholders and investors to assess the impact and range of companies in all growth sectors of the smart buildings space.

Companies Mentioned Include (BUT NOT LIMITED TO):

|

|

Table of Contents

Executive Summary

1. The Global Smart Buildings Landscape of Startups

- 1.1. Technology Categories for Smart Building Startups

- 1.2. Overview of New Entrants

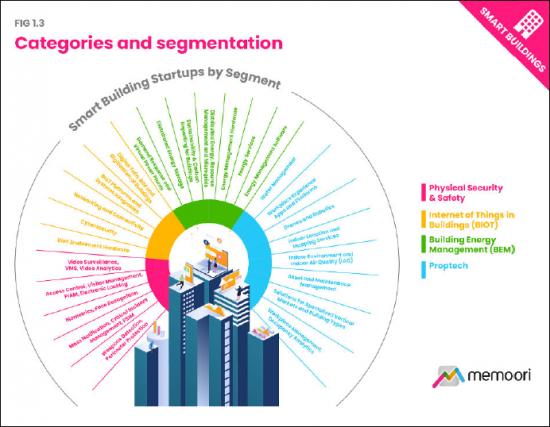

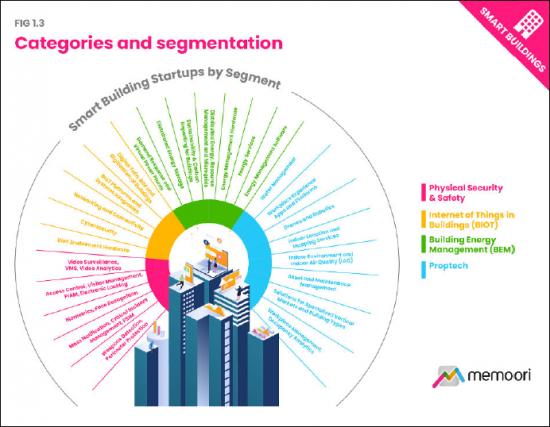

- 1.3. Categories and Segmentation

- 1.4. Smart Building Startups by Segment

- 1.5. Regional Distribution of Startups

2. Smart Building Startups Gaining Traction

- 2.1. Internet of Things in Buildings (BIoT)

- 2.1.1. Building IoT Platforms

- 2.1.2. Digital Twin Solutions

- 2.2. Building Energy Management

- 2.2.1. AI-Powered HVAC Optimization

- 2.2.2. Sustainability and Carbon Management

- 2.2.3. Renewable Energy Management

- 2.3. PropTech

- 2.3.1. Asset Management and Maintenance

- 2.3.2. Occupancy Analytics

- 2.3.3. Solutions for Specific Vertical Markets

- 2.4. Physical Security

- 2.4.1. Access Control

- 2.4.2. Video Analytics

3. Startup Closures

- 3.1. Non-Operational Startups and Closures

- 3.2. Layoffs and Redundancies

4. Future Outlook for Startups

List of Charts and Figures

- Fig 1. The Global Smart Building Landscape of Startups

- Fig 1.1. Technology Categories for Smart Building Startups

- Fig 1.2. 801 Active Smart Building Startups Founded Since 2012

- Fig 1.3. Categories and Segmentation

- Fig 1.4. Smart Building Startups by Segment

- Fig 1.5. Regional Distribution of Startups

- Fig 2. Smart Building Startups Gaining Traction

- Fig 2.1. Internet of Things in Buildings (BIoT) Landscape

- Fig 2.1.1. BIoT Platforms Landscape and Startups Gaining Traction

- Fig 2.1.2. Digital Twin Solutions in Buildings Landscape and Startups Gaining Traction

- Fig 2.2. Building Energy Management Landscape

- Fig 2.2.1. AI-Powered HVAC Optimization Startups Gaining Traction

- Fig 2.2.2. Sustainability & Carbon Management Startups Gaining Traction

- 2.2.3. Renewable Energy Management Startups Gaining Traction

- Fig 2.3. PropTech

- Fig 2.3.1. Asset Management & Maintenance Startups Gaining Traction

- Fig 2.3.2. Occupancy Analytics Startups Gaining Traction

- Fig 2.3.3. Retail Sector Startups Gaining Traction

- Fig 2.4. Physical Security in Buildings Landscape

- Fig 2.4.1. Access Control Startups Gaining Traction

- Fig 2.4.2. Video Analytics Startups Gaining Traction

- Fig 3.1 10. Closed Startups since 2021

- Fig 3.2. Layoffs & Redundancies in the Smart Building Space