|

市場調查報告書

商品編碼

1404552

智慧建築:市場佔有率分析、產業趨勢與統計、成長預測,2024-2029Smart Building - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

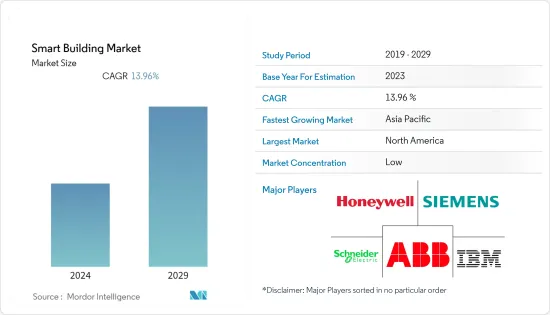

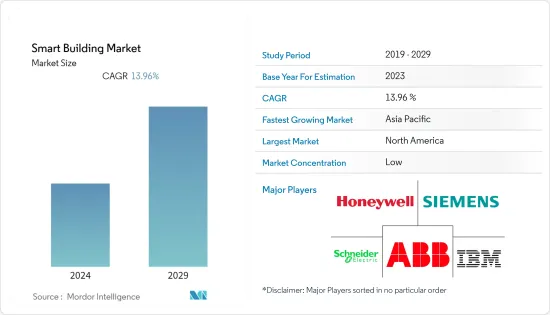

上年度智慧建築市場價值為 828.5 億美元,預計複合年成長率為 13.96%,在預測期內達到 828.5 億美元。

智慧城市領域的成長、對節能建築的需求不斷成長以及市場參與者的發展預計將推動對智慧建築的需求。

主要亮點

- 智慧城市的概念透過物聯網在能源、廢棄物和基礎設施領域創造了巨大的商機。智慧家庭是智慧城市計畫的重要趨勢,具有多種優勢。目前,多個智慧城市計劃和舉措正在進行中。許多智慧城市計劃和措施正在世界各地實施,以透過都市化促進全球投資。經合組織估計,2010 年至 2030 年間,全球智慧城市計畫的大都會基礎建設計劃投資額可能達到約 1.8 兆美元。

- 對全球能源消耗快速成長的日益擔憂預計將推動更先進和節能的技術。然而,對能源消耗的嚴格控制和綠色建築措施也推動了整個建築對節能技術的需求。預計這一因素將推動全球智慧建築解決方案的採用。

- 因此,任何行業的公司都可以透過採用智慧恆溫器和照明系統等物聯網設備來最大限度地減少電力消耗,並使建築物更具永續。支援物聯網的建築管理系統的採用正在迅速增加,從而提高了人們對空間利用和高效能源利用的行業標準的認知。

- 此外,能源服務和技術公司正在整合他們的解決方案並開發先進的機制,以幫助消費者應對能源價格急劇上升和涉及的體力勞動等挑戰。您被要求這樣做。科技創新的快速發展為改善人們的生活和促進永續性提供了令人興奮的機會。這進一步為參與者透過策略開拓擴大其市場地位提供了有利可圖的機會。

- 然而,缺乏熟練評估智慧解決方案系統的專業人士預計將阻礙市場成長。該領域的專業人員必須熟悉設計變更和安裝,以適應未來的需求。

- 據預測,新冠肺炎 (COVID-19) 疫情後辦公室的重新開放將增加對安全環境智慧技術的需求。商業建築的設施管理者和租戶公司需要在關閉後提供安全的辦公環境。因此,智慧技術可以管理定期清潔和消毒、適當的辦公室通風、智慧存取控制、溫度測量設備以及最佳化空間以保持身體距離等事項。這些因素預計將增加對智慧建築解決方案的需求。

智慧建築市場趨勢

智慧型安防系統成為成長最快的解決方案領域

- 在這個市場中,智慧型安全系統是指利用自動化、感測器和資料分析來增強建築物內居住者和資產安全的技術和解決方案。

- 智慧城市和智慧型建築的穩定成長提出了提高資產和個人安全的需求。隨著設施的互聯程度越來越高,安全漏洞和入侵也隨之增加。智慧建築中使用的智慧型安防系統解決方案包括消防安全、視訊監控、門禁控制、盜竊偵測、入侵偵測和網路系統。

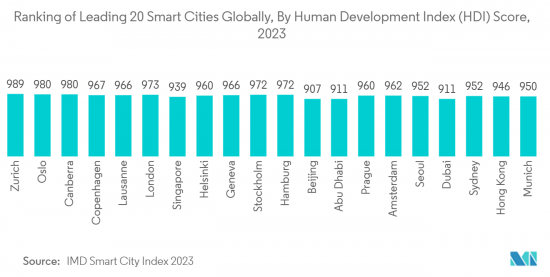

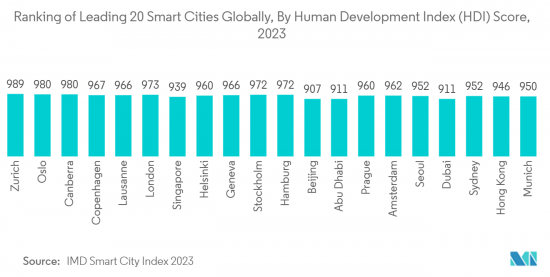

- 根據 IMD 2023 年智慧城市指數,蘇黎世是領先的智慧城市,在人類發展指數上得分最高,也是世界上最宜居的城市之一。 HDI 指數和 IMD 指數中值得注意的例外是杜拜、北京和阿布達比。北京在數位智慧城市排名中位列第12位,但HDI得分落後蘇黎世近90分。同時,慕尼黑是第 20 個數位城市,其 HDI 值為 950。

- 支援物聯網的緊急照明解決方案旨在為任何建築物(從酒店到辦公室、學校、醫院、體育場館和火車站)發生任何類型的緊急情況或火災時提供安全疏散的廣泛解決方案。這些解決方案為智慧型建築提供了更好的安全解決方案,並提供了更全面的方法,同時降低了整個建築生命週期的總擁有成本。

- 利用運動偵測、存在類比和遠端視訊存取等支援物聯網的工具,可以將更大的控制權重新交到客戶手中。門禁系統等解決方案透過提供門禁、存取控制和視訊監控之間的交互來提供試運行和高級使用,從而增強安全性和通訊,從而縮短建築物內的距離。現在只是一個 IP 連接問題。智慧型安全技術解決方案可以進一步協助建立監控並向您發出詐欺的入侵警報。這些系統還可以監督建築物、緊急呼叫站以及水、煙霧和瓦斯洩漏偵測警報的安全疏散。

預計北美將佔據較大市場佔有率

- 北美是智慧建築和物聯網智慧設備的主要市場之一,該地區智慧建築解決方案的應用和接受度不斷增加。

- 透過解決方案,智慧型安全系統預計將在北美出現顯著成長。隨著環保意識的增強,越來越多的美國正在尋求具有附加功能(例如消防安全、安全和警報系統、監控和安全)的互聯、智慧和自動化建築解決方案。因此,基於物聯網的智慧建築解決方案在美國已被廣泛接受。

- 在北美地區,美國是最大的物聯網市場之一,因為它是物聯網設備的最大消費者。此外,它擁有最多數量的與智慧連網型建築、智慧型能源和智慧城市相關的物聯網計劃,預計將為市場提供充足的成長機會。

- 高速網際網路和高網際網路普及使北美國家成為物聯網、人工智慧和智慧建築計劃的理想熱點。消費者購買新技術的能力也推動了新技術的廣泛採用,供應商也推出了針對不同需求的新解決方案。隨著半導體和感測器的成本最小化,越來越多的公司和新興企業正在合作創造更好的智慧建築技術。美國尤其是新興企業的中心,其強大的經濟和金融實力使其成為新技術市場(包括智慧建築解決方案)的關鍵點。

- 2022 年11 月,智慧建築技術公司View Inc. 推出了View Partner Marketplace,這是一個應用程式商店,可供其最近發布的智慧建築雲(Smart Building Cloud) 的客戶使用,智慧建築雲是業界第一個完全雲端原生的智慧建築平台。該市場允許業主和營運商透過一鍵部署流行的房地產應用程式、軟體平台和感測器來快速、安全地數位化他們的投資組合。

- 總體而言,隨著與智慧建築相關的發展(例如合作夥伴關係、產品發布和投資)的不斷增加,市場預計將全面擴大。

智慧建築產業概況

智慧建築市場分散,知名的全球和國內公司分佈在世界不同地區。預計該市場將受到吸引最終用戶的客製化和新興技術的推動。供應商主要致力於提供創新的解決方案和產品,以最佳化能源消耗並適應高水準的建築自動化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場洞察

- 市場促進因素

- 對能源消耗的日益關注導致採用智慧解決方案

- 政府針對智慧基礎設施計劃的舉措

- 市場挑戰

- 技術協作和缺乏熟練專家

第6章市場區隔

- 按成分

- 解決方案

- 建築能源管理系統(BEMS)

- 基礎設施管理系統

- 智慧型安防系統

- 其他

- 服務

- 解決方案

- 按申請

- 住宅

- 商業設施

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Honeywell International Inc.

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- IBM Corporation

- Huawei Technologies Co. Ltd

- Cisco Systems Inc.

- Johnson Controls International PLC

- Legrand SA

- Avnet Inc.

- Hitachi Ltd

- Softdel(A UNIDEL Company)

第8章投資分析

第9章市場的未來

The smart buildings market was valued at USD 82.85 billion the previous year and is expected to grow at a CAGR of 13.96%, reaching USD 82.85 billion over the forecast period.

The growing smart cities sector, rising demand for energy-efficient buildings, and developments by market players are expected to drive the demand for smart buildings.

Key Highlights

- The concept of smart cities created considerable opportunities in the energy, waste, and infrastructure sectors with the Internet of Things. Smart homes, a significant trend in smart city concepts, have several advantages. Several smart city projects and initiatives are currently underway. Many smart city projects and initiatives are being implemented worldwide, driving global investment through urbanization. The OECD estimates that global investment in smart city initiatives may reach approximately USD 1.8 trillion between 2010 and 2030 across all metropolitan infrastructure projects.

- Rising concerns about the surge in energy consumption globally are anticipated to fuel more advanced and energy-efficient technologies. However, stringent governance on energy consumption and green building initiatives also augment the demand for energy-efficient technology across buildings. This factor is expected to propel the implementation of smart building solutions globally.

- Therefore, businesses in any industry can adopt IoT devices, comprising smart thermostats and lighting systems, to minimize their electrical consumption and make buildings more sustainable. Since the adoption of IoT-enabled building management systems is increasing rapidly, it is creating awareness about space utilization industry standards and efficient energy usage.

- In addition to this, the demand is pushing energy services and technology companies to integrate their solutions and develop advanced mechanisms that can help consumers address challenges such as high energy bills and the removal of manual processes in doing so. The rapid pace of technological innovation presents exciting opportunities to enhance people's lives and promote sustainability. This furthermore provides lucrative opportunities for players to expand their position in the market with strategic developments.

- However, the market's growth is expected to be hampered by a shortage of competent professionals skilled in evaluating smart solution systems. Professionals in this field must be aware of design modifications and installations for future needs.

- The office reopening post-COVID-19 was projected to increase the smart technology demand for safe surroundings. Facility managers and tenant companies of commercial buildings needed to provide a secure office environment post-lockdown. Therefore, smart technology could manage regular cleaning and disinfection, proper ventilation of offices, smart access controls, temperature measurement devices, and optimization of spaces to maintain physical distancing. These factors are anticipated to increase the demand for smart building solutions.

Smart Building Market Trends

Intelligent Security Systems to be the Fastest Growing Solution Segment

- Intelligent security systems in the market refer to technologies and solutions that use automation, sensors, and data analytics to enhance the safety and security of occupants and assets within a building.

- With the steady growth of smart cities and intelligent buildings, there comes an inherent need for greater security for property and individuals. As facilities become more connected, security breaches and invasions are also predicted. Some intelligent security system solutions used in smart buildings are fire safety, video surveillance, access controls, theft detection, intrusion detection, network systems, etc.

- According to the IMD Smart City Index 2023, Zurich is an advanced smart city with the highest Human Development Index score, making it one of the most livable cities in the world. Notable exceptions to the HDI to IMD index were Dubai, Beijing, and Abu Dhabi. Beijing is a notable outlier, ranking 12th in the Digital Smart City rankings, but is almost 90 points behind Zurich in the HDI score. On the other hand, Munich is the 20th digital city with an HDI value of 950.

- IoT-enabled emergency lighting solutions are designed to provide a wide range of solutions for safe evacuation in some emergency or fire for all buildings, from hotels to offices, schools, hospitals, stadiums, and train stations. These solutions drive more excellent security solutions for intelligent buildings and give a more holistic approach while reducing the total cost of ownership throughout the building life cycle.

- The leverage of IoT-enabled tools, such as motion detection, presence simulation, and remote video access, will put greater control back in the hands of the customer. Solutions like door entry systems now provide commissioning and good usage for enhanced security and communication by offering interaction between door entry, access control, and video surveillance so that distance in buildings is now only a matter of IP connectivity. Intelligent security technology solutions can further assist in monitoring a building and warn about unauthorized entry. These systems can also supervise safe building evacuation, emergency call stations, and detection alarms for water, smoke, and gas leaks.

North America is Expected to Hold Significant Market Share

- North America is one of the significant markets for smart buildings and IoT-enabled smart devices, and the region witnesses an increased application and acceptance of smart building solutions.

- By solution, intelligent security system is expected to grow exponentially in North America. With increasing environmental awareness, more Americans are looking for connected, smart, and automated building solutions with add-in capabilities, like fire safety, safety and alarm systems, surveillance, and security. Hence, IoT-enabled smart building solutions are widely accepted in the United States.

- In the North American region, the United States is one of the largest IoT-enabled markets as it is the largest consumer of IoT-compatible devices. Moreover, it has the highest number of ongoing IoT projects related to smart and connected buildings, smart energy, and smart cities, which is expected to create ample growth opportunities for the market.

- High Internet Speed and greater internet penetration make the North American countries an ideal hotspot for IoT, AI, and Smart Buildings projects. Consumer spending capabilities for newer technology are also augmenting the adoption and driving vendors to introduce new solutions targeting different needs. With minimized semiconductor and sensor costs, more companies and start-ups are thus working together to produce better Smart Building Technology. The United States, especially being a hub for start-ups and its robust economic and financial presence, has become a significant spot for new technology markets, including Smart Building Solutions.

- In November 2022, View Inc., a provider of smart building technologies, introduced the View Partner Marketplace, an app store available to the customers of the company's recently launched Smart Building Cloud, the industry's first complete cloud-native platform for smart buildings. The View Partner Marketplace allows customers to deploy popular real estate applications, software platforms, and sensors with a single click, making it much easier for owners and operators to digitize their portfolios quickly and securely.

- Overall, with the rise in developments related to smart buildings, including partnerships, product launches, and investments, the market is expected to expand comprehensively.

Smart Building Industry Overview

The smart buildings market is fragmented, with a presence of reputable global and national companies worldwide. The market is expected to be driven by customizations and modern technologies to attract end users. Suppliers are mainly focused on providing innovative solutions and products that can optimize energy consumption and meet high levels of building automation. Furthermore, companies are involved in various strategies to gain a competitive edge. Some of the major players in the market are Honeywell International Inc., Siemens AG, ABB Ltd, Schneider Electric SE, and IBM Corporation.

- In July 2023, Siemens partnered with PRODEA Investments, one of the real estate investment companies in Greece, to implement Building X. Building X is a Siemens digital building platform.

- In April 2023, Obayashi Corporation and Hitachi Solutions Ltd incorporated Oprizon Ltd, a joint venture for providing smart building-related services, based on the Joint Venture Agreement executed in January 2023, to become the leading smart building service provider and started operation in April 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19's Impact on the Market

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Growing Concerns about the Energy Consumption Leading to Adopt Smart Solutions

- 5.1.2 Government Initiatives on Smart Infrastructure Projects

- 5.2 Market Challenges

- 5.2.1 Lack of Technology Alignment and Skilled Professionals

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.1.1 Building Energy Management Systems

- 6.1.1.2 Infrastructure Management Systems

- 6.1.1.3 Intelligent Security Systems

- 6.1.1.4 Other Solutions

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Siemens AG

- 7.1.3 ABB Ltd.

- 7.1.4 Schneider Electric SE

- 7.1.5 IBM Corporation

- 7.1.6 Huawei Technologies Co. Ltd

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Johnson Controls International PLC

- 7.1.9 Legrand SA

- 7.1.10 Avnet Inc.

- 7.1.11 Hitachi Ltd

- 7.1.12 Softdel (A UNIDEL Company)