|

市場調查報告書

商品編碼

1348023

手持式條碼掃描器的全球市場The Global Market for Handheld Barcode Scanners |

||||||

目標供應商

|

|

|

執行摘要

由於大流行影響、供應鏈限制、引發通膨的定價和部門需求變化,導致市場表現多年波動,但市場已經正常化,並轉向更可預測的成長模式。

同時,我們需要解決與通路庫存過剩和價格持續波動相關的問題。 此外,可穿戴式掃描器等替代外形因素帶來的挑戰,以及利用智慧型行動裝置(智慧型手機、平板電腦等)攝影機進行基於軟體的掃描的日益增多,消除了傳統上由專用手持式掃描器支持的機會。可能性。

主要發現

通路庫存過剩導致近期銷售放緩:在2023 年第一季整體強勁之後,主要供應商正在考慮產品庫存過剩對其通路合作夥伴的影響。我們預計需求模式將在年底前軟化今年的。 分銷合作夥伴承擔了大量庫存,以填補大流行期間和之後的積壓。 市場可能需要一些時間來吸收運送給分銷商和合作夥伴的產品。 VDC 預計這一問題將在 2024 年上半年緩解。

醫療保健作為一個成長市場:雖然醫療產業歷來對手持式掃描器有著持續的需求,但該產業的成長機會在過去幾年中顯著增加。 在北美尤其如此,醫療保健是繼零售和製造之後手持式掃描器的第三大市場。 醫療產業的需求還包括更昂貴和更專業的解決方案,例如需要能夠抵抗醫療環境中使用的消毒劑的特殊塑膠。

超越掃描器的差異化:隨著向2D 掃描器(從傳統雷射掃描器和線性成像儀)的過渡接近完成,原始設備製造商正在定位其產品組合,以讓自己在競爭中脫穎而出。我們正在探索替代方案讓我們與眾不同。 這包括為特殊用例設計掃描儀,例如可以承受消毒溶液的醫療掃描儀或用於工業應用的加固掃描儀。 此外,OEM 正在增加對軟體實用程式的投資,以幫助客戶支援和管理他們的掃描器。 此外,掃描引擎設計用於支援更複雜的資料擷取應用,例如同時掃描多個程式碼、識別和解碼正確的符號,以及支援 OCR 和其他影像擷取和處理功能。

不斷變化的競爭格局:全球三大手持式掃描器OEM(Zebra、Honeywell、Datalogic)憑藉差異化的產品組合和強大的合作夥伴網絡佔據有利地位。然而,競爭格局正在改變。 亞洲供應商不斷推出具有價格競爭力的產品,其中許多供應商依賴主要原始設備製造商來採購掃描引擎。 此外,新的外形尺寸正在挑戰傳統的手持式掃描器用例。 例如,在物流環境中,手套或手掌大小的掃描儀的使用尤其普遍,這為有利於免持操作的掃描密集型應用提供了更符合人體工學和無縫的選擇。 此外,基於軟體的掃描解決方案的性能不斷提高,挑戰了專用掃描引擎的現狀(儘管這對於配備掃描儀的行動數據終端來說是一個更大的挑戰)。

本報告研究和分析了全球手持式條碼掃描器市場,提供了關鍵策略問題、趨勢和驅動因素、技術趨勢、成長機會和供應商概況等資訊。

目錄

執行摘要

世界市場概覽

- 垂直市場

- 零售

- 工業/製造

- 醫療

- 交通/物流

- 商業服務

- 市場趨勢

- 2027 年日出 - GS1

- 二維、雷射、線性

- 基於軟體的掃描

- 產品趨勢

- 穿戴式

- 積壓和缺少的組件

區域預測

- 美洲

- 歐洲/中東/非洲

- 亞太地區

供應商注意事項/簡介

關於 VDC 研究

報告圖表

資料集圖

市場分析 - 美洲

INSIDE THIS REPORT:

This report provides a detailed analysis of the key strategic issues, trends and drivers for handheld barcode scanners, including 2D imagers, linear imagers (CCD scanners) and laser scanners. The research provides detailed analysis by geography, industry, distribution channel and scanner technology with detailed five-year forecasts. Our analyst research and commentary covers global and regional market forces, technology trends, growth opportunities and in-depth intelligence on over a dozen leading vendors of handheld barcode scanners.

WHAT QUESTIONS ARE ADDRESSED?

- What is the new basis of competition in the handheld industry? What is the forecast for post-pandemic growth, and what are the underlying drivers?

- How do vendors need to formulate product and market development to compete in this highly commoditized industry?

- How will traditional vertical markets and geographical regions perform in the near- and long-term for handheld barcode offerings?

- What are the changing verticals for handhelds? How are handhelds marketed in conjunction with other technologies, such as emerging wearables?

- Who and the leading and emerging handheld scanner vendors and how are they competing?

- What impact is software-based scanning and other data collection technologies such as RFID having on the handheld scanner market?

WHO SHOULD READ THIS REPORT?

This annual research has been carefully designed for senior managers and executives at barcode technology and solution provider companies, especially individuals in the following roles:

- CEOs and supporting C-level management

- Corporate development and M&A professionals

- Product Management and Marketing professionals

- Strategic Directors and Marketing Communications managers

- Business development and sales

- Channel developers and managers

- Senior management of leading retailers

VENDORS COVERED IN THIS REPORT:

|

|

|

EXECUTIVE SUMMARY:

Following several years of volatile performance - driven in part by the impact of the pandemic, supply chain constraints, inflationary pricing and shifts in demand by sector - the market is projected to normalize and transition to a more predictable growth pattern. Near term, the market will need to work through issues related to channel over-stock and continued pricing volatility. In addition, challenges from alternative form factors (such as wearable scanners) and the growing presence of SW-based scanning that leverages cameras in smart mobile devices (smartphones, tablets, etc.) could erode some of the opportunity traditionally supported by purpose-built handheld scanners.

KEY FINDINGS:

Channel overstock is slowing near-term sales: Following a generally strong Q1 2023, leading vendors are expecting softening demand patterns through the end of the year due in part to overstocking of products among channel partners. Distribution partners accumulated high stocks during the pandemic and post-pandemic period when they filled backlogged orders. The market will take some time to absorb the products that have been shipped to distributors and partners. VDC expects this issue to subside by the first half of 2024.

Healthcare as a growth market: While the healthcare sector has shown consistent historical demand for handheld scanners, opportunities in this sector have increased substantially over the past couple of years. This is especially evident in North America where healthcare is the third largest market for handheld scanners, behind retail and manufacturing. Demand in the healthcare sector is also characterized by higher value and more specialized solutions, including the need for specialized plastics that resist the disinfectants used in healthcare settings.

Differentiation beyond the scanner: With the transition to 2D scanners largely complete (from legacy laser scanners and linear imagers), OEMs are looking for alternative options to competitively differentiate their portfolios. Some of this will be designing scanners for specialized use cases - such as healthcare scanners that can tolerate disinfectants or ruggedized scanners for industrial use cases. In addition, OEMs have been investing more in software utilities for customers to support and manage their scanner fleets. They are also leveraging the scan engine's capabilities to support more sophisticated data capture applications, such as scanning multiple codes simultaneously, identifying the correct symbology to decode or supporting OCR and other image capture and image processing capabilities.

Shifting competitive landscape: While the top three global handheld scanner OEMs (Zebra, Honeywell and Datalogic) are well positioned with a differentiated product portfolio and strong partner networks, the competitive landscape is changing. The emergence of cost-competitive products from vendors in Asia continues, although several rely on the leading OEMs to source scan engines. In addition, alternative form factors are challenging some traditional handheld scanner use cases. In logistics environments, for example, the use of glove or top of hand scanners have become especially popular, providing a more ergonomic and seamless option for scan-intensive applications that benefit hands-free operations. In addition, the performance of software-based scanning solutions continues to improve, challenging the dedicated scan engine status quo (although this is more of a challenge to mobile computers with integrated scanners).

ABOUT THE AUTHORS:

Andy Adelson

Currently serving VDC's AutoID & Data Capture practice, Andy Adelson has spent his career as an analyst, consultant and research expert. During the first half of his career, Andy excelled as an IT industry analyst, covering several technologies which were precursors and adjacent to AI&DC. He has provided continuous syndicated services, plus consults to clients for their more complex challenges. During the past decade, Andrew held executive sales and management roles with research and insights providers. Andy also serves on the Board of the New England chapter of The Insights Association, the largest US trade association for research professionals. Andy earned an MBA from Babson in Marketing, and a BA from the University of Michigan in English and Economics.

Richa Gupta

Richa is a Consultant working for VDC's AutoID & Data Capture practice. She has been tracking the markets for a range of AIDC technologies at VDC since 2010, including, but not limited to, barcode scanners and printers, labeling solutions, machine vision solutions, and robotics automation. Over the years, she has undertaken market opportunity sizing and forecasting, competitive landscape analysis, and offered strategic marketing assistance, while also providing valuable thought leadership for this technology segment. Richa holds a degree in Computer Engineering and an MBA from India.

David Krebs

David has more than twenty years' experience covering enterprise and government mobility solutions, wireless infrastructure and automatic identification and data capture technologies. David's research focuses on the intersection of digital and mobile solutions with today's business and mission critical frontline mobile workforce and how organizations are leveraging mobile solutions to improve workforce productivity and enhance customer engagement. David's consulting and strategic advisory experience is far reawching and includes technology and market opportunity assessments, technology penetration and adoption analysis, product and service development and M&A due diligence support. David has extensive primary market research management and execution experience to support market sizing and forecasting, total cost of ownership (TCO), comparative product performance evaluation, competitive benchmarking and end user requirements analysis. David is a graduate of Boston University (BSBA).

Table of Contents

Executive Summary

- Key Findings

Global Market Overview

- Vertical Markets

- Retail

- Industrial/Manufacturing

- Healthcare

- Transportation & Logistics

- Commercial Services

- Market Trends

- Sunrise 2027 - GS1

- 2D, Laser and Linear

- Software-Based Scanning

- Product Trends

- Wearables

- Backlogs and Component Shortages

Regional Forecasts

- Americas

- EMEA

- Asia Pacific

Vendor Insights & Profiles

About VDC Research

Report Exhibits

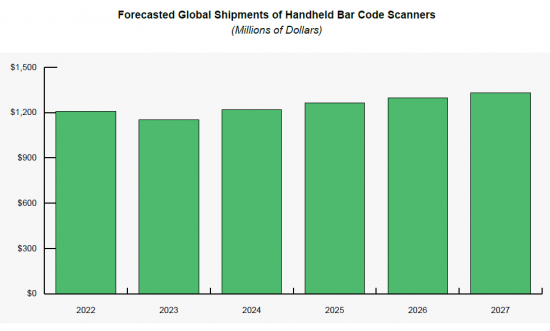

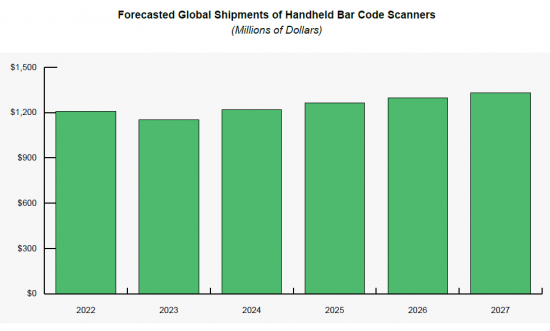

- Exhibit 1: Forecasted Global Shipments of Handheld Bar Code Scanners (Millions of Dollars)

- Exhibit 2: Forecasted Global Shipments of Handheld Bar Code Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 3: Forecasted Global Shipments of Handheld Bar Code Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 4: Long-Term Global Shipments of Handheld Barcode Scanners (Millions of Dollars)

- Exhibit 5: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 6: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 7: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 8: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 9: Global Vendor Shares of Handheld Barcode Scanners (Percentage of Dollars)

Dataset Exhibits

- Exhibit 1: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 2: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 3: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 4: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Millions of Dollars)

- Exhibit 5: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Thousands of Units)

- Exhibit 6: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 7: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 8: Forecasted Global Shipments of Handheld Linear Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 9: Forecasted Global Shipments of Handheld 2D Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 10: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Connectivity (Millions of Dollars)

- Exhibit 11: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 12: Forecasted Global Shipments of 2D Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 13: Forecasted Global Shipments of Linear Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 14: Forecasted Global Shipments of Laser Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 15: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 16: Forecasted Global Shipments of 2D Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 17: Forecasted Global Shipments of Linear Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 18: Forecasted Global Shipments of Laser Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 19: Forecasted Global Shipments of Handheld Barcode Scanners by Country Market (Millions of Dollars)

Market Analysis - Americas

- Exhibit 1: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 2: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 3: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 4: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 5: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 6: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 7: Forecasted Central & Latin American Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 8: Forecasted Central & Latin American Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 9: Forecasted Central & Latin American of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 10: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Millions of Dollars)

- Exhibit 11: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Thousands of Units)

- Exhibit 12: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Average Factory Selling Price (AFSP) - Dollars)