|

市場調查報告書

商品編碼

1413697

濺鍍靶材全球市場分析(2023-2024)Sputter Targets Market Report (a Critical Materials Report) 2023-2024 |

||||||

價格

簡介目錄

本報告分析了半導體裝置製造中使用的主要金屬濺鍍靶材和供應鏈。濺鍍靶材在半導體製造中至關重要,因為它們能夠沉積各種材料以形成半導體裝置、MEMS 和感測器的互連、阻擋層和其他薄膜。

有關濺鍍靶材市場最新資訊和報告亮點的特色新聞稿:

目錄

第一章執行摘要

第二章 研究範圍、目的與研究方法

第三章 半導體產業市場現況與展望

- 世界經濟

- 連結半導體產業與全球經濟

- 半導體銷售額成長率

- 台灣月度銷售趨勢

- 晶片銷售:以電子領域分類

- 手機

- PC 出貨量

- 伺服器/IT市場

- 半導體製造業的成長與擴張

- 鑄造廠擴建公告:概述

- 透過在世界各地擴大鑄造廠來加速成長

- 資本支出趨勢

- 技術路線圖

- 代工投資評估

- 政策和貿易趨勢及影響

- 半導體材料概述

- 晶片生產進度可能受到材料產能限制

- 緩解物流問題

- TECHCET晶圓投入量預測(至2027年)

- TECHCET材料預測

第四章 濺鍍靶材市場現況及預測

- 市場狀況:概論(2023)

- 市場統計與預測

- 預測方法

- 目標市場預測

- 目標市場規模:按類型劃分(2023 年)

- 貴金屬目標市場估算

- 濺鍍靶材市場:整體預測

- 銅市場預測

- 鉭市場預測

- 鋁市場預測

- 鈦市場預測

- 功率元件(寬頻隙元件)中使用的 NiV、Al、Ag、Au、Ti 靶材

- 目標金屬預測:依功率元件類型

- 目標金屬預測:SiC/Ga功率元件

- 供應商市場佔有率和活動

- 目標供應商最新消息

- 目標公司最新消息

- 釕靶材供應商

- 對區域趨勢/驅動因素的評論

- 區域趨勢和挑戰

- 濺鍍靶材生產領域:區域趨勢

- 按地區劃分的市場規模和趨勢

- 金屬目標成本結構

- EHS/永續性、監管和物流問題

- 併購活動和夥伴關係

- 工廠關閉 - 無

- 新進入者 - 無

- 風險和取消

- TECHCET分析師的目標供應商和市場評估

第五章 下游供應鏈

- 銅(Cu)金屬:原料

- 銅金屬:原料供應鏈

- 銅金屬:市場需求

- 車輛銅需求量

- LME銅金屬價格

- 鉭(TA):原料

- TA 金屬:礦山供應趨勢

- TA 金屬:全球需求

- TA Metals:封閉市場經濟趨勢

- 鋁(Al)金屬:鋁土礦和氧化鋁開採

- 鋁金屬:精煉

- 鋁金屬:全球需求

- LME金屬鋁價格

- 鈦(Ti)金屬: 鈦精礦

- 鈦精礦價格

- 鈦金屬:拉絲材需求

- 金屬鈦:海綿產量及產能

- 金屬鈦:海綿產量及產能

- 鈦金屬市場趨勢:俄羅斯/烏克蘭衝突

- 金屬鈦:半導體用海綿鈦

- 金屬鈦:中國海綿鈦生產活動

- 鎢(W)金屬開採

- W金屬-世界需求

- W供應鏈與中國

- 鎢金屬:高純度鎢粉供應商

- W金屬價格

- 鈷(Co)金屬開採

- 鈷金屬需求

- 鈷金屬價格

- 鉬(Mo)金屬開採

- Mo的供應鏈概括

- 鉬的用途

- 貴金屬:礦金(Au)

- 貴金屬:銀(Ag)開採

- 貴金屬消耗:依用途

- 貴金屬供需趨勢

- 貴金屬價格

- 貴金屬價格

- 高純度錳(Mn)

- 下游供應鏈:中斷

- 供應鏈下游:併購活動

- 下游供應鏈:EHS 與物流問題

- 下游供應鏈:TECHCET 分析師評估

- 濺鍍靶材市場:虛擬市場評估

第六章 技術推動因素/實質變化/轉變

- 300mm 目標細分市場驅動器/設備

- 200mm 目標區隔市場驅動因素

- 邏輯:通用製程流程邏輯 PVD 10 NM 或更少

- 通用製程流程:進階 DRAM

- 新興技術/市場趨勢:大學和供應商研發(未來 5-7 年內)

- 電源軌

- 特殊(STT MRAM、FE RAM等)記憶體PVD材料

- 壓電材料:PZT

第七章 供應商簡介

- FURUYA METAL CO.

- GO ELEMENT

- GRIKIN

- HONEYWELL

- HUIZHOU TOP METAL MATERIAL (TOPM)

- 超過 15 家其他公司

第8章附錄

簡介目錄

This report covers the sputtering targets and supply-chain for key metals used in semiconductor device fabrication. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research. Sputtering targets are critical in semiconductor manufacturing as sputtering allows the deposition of different materials to form interconnects, barriers layers, and other films for semiconductor devices, MEMS, and sensors.

This report comes with 3 Quarterly Updates featuring updated market information and forecasting from the report analyst.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. TARGET BUSINESS-MARKET OVERVIEW

- 1.2. TARGET MARKET TRENDS IMPACTING 2023 OUTLOOK

- 1.3. TECHNOLOGY TRENDS

- 1.4. TARGET MARKET FORECAST

- 1.5. COMPETITIVE LANDSCAPE

- 1.6. EHS ISSUES/CONCERNS

- 1.7. TARGET MARKET ASSESSMENT

2. SCOPE, PURPOSE AND METHODOLOGY

- 2.1. SCOPE

- 2.2. PURPOSE

- 2.3. METHODOLOGY

- 2.4. OVERVIEW OF OTHER TECHCET CMR™ REPORTS

3. SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1. WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1. SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2. TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.1.3. SEMICONDUCTOR SALES GROWTH

- 3.2. CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1. SMARTPHONES

- 3.2.2. PC UNIT SHIPMENTS

- 3.2.3. SERVERS / IT MARKET

- 3.3. SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1. FAB EXPANSION ANNOUNCEMENT SUMMARY

- 3.3.2. WW FAB EXPANSION DRIVING GROWTH

- 3.3.3. EQUIPMENT SPENDING TRENDS

- 3.3.4. TECHNOLOGY ROADMAPS

- 3.3.5. FAB INVESTMENT ASSESSMENT

- 3.4. POLICY & TRADE TRENDS AND IMPACT

- 3.5. SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1. COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES?

- 3.5.2. LOGISTICS ISSUES EASED DOWN

- 3.5.3. TECHCET WAFER STARTS FORECAST THROUGH 2027

- 3.5.4. TECHCET'S MATERIAL FORECAST

4. SPUTTERING TARGET MARKET LANDSCAPE AND FORECAST

- 4.1. CY2023 MARKET LANDSCAPE HIGHLIGHTS

- 4.2. MARKET STATISTICS & FORECASTS

- 4.3. FORECAST METHODOLOGY

- 4.3.1. TARGET MARKET FORECAST

- 4.3.2. 2023 TARGET MARKET SIZE BY TYPE

- 4.3.3. ESTIMATE FOR PRECIOUS METAL TARGET MARKET

- 4.3.4. TOTAL SPUTTERING TARGET MARKET FORECAST

- 4.3.5. COPPER MARKET FORECAST

- 4.3.6. TANTALUM MARKET FORECAST

- 4.3.7. ALUMINUM MARKET FORECAST

- 4.3.8. TITANIUM MARKET FORECAST

- 4.3.9. NIV, AL, AG, AU, TI TARGETS USED IN POWER DEVICES-WIDE BAND GAP DEVICES

- 4.3.10. TARGET METAL FORECAST BY POWER DEVICE TYPE

- 4.3.11. TARGET METAL FORECAST FOR SIC AND GAN POWER DEVICES

- 4.4. SUPPLIER MARKET SHARE AND ACTIVITY

- 4.4.1. TARGET SUPPLIER UPDATES-1 OF 3

- 4.4.2. TARGET COMPANY UPDATES-2 OF 3

- 4.4.3. RUTHENIUM TARGET SUPPLIERS

- 4.5. COMMENT ON REGIONAL TRENDS/DRIVERS

- 4.5.1. REGIONAL TRENDS AND ISSUES

- 4.5.2. SPUTTERING TARGET PRODUCTION LOCATIONS-REGIONAL TRENDS

- 4.5.3. REGIONAL MARKET SIZE AND TRENDS

- 4.6. METAL TARGET COST STRUCTURE

- 4.7. EHS/SUSTAINABILITY, REGULATIONS, AND LOGISTIC ISSUES

- 4.8. M&A ACTIVITY AND PARTNERSHIPS

- 4.9. PLANT CLOSURES-NONE

- 4.10. NEW ENTRANTS-NONE

- 4.11. RISKS & DISCONTINUATIONS

- 4.12. TECHCET ANALYST ASSESSMENT OF TARGET SUPPLIERS AND MARKET

5. SUB-TIER SUPPLY-CHAINS

- 5.1. COPPER (CU) METAL-RAW MATERIAL

- 5.1.1. CU METAL- RAW MATERIAL SUPPLY CHAIN

- 5.1.2. CU METAL-MARKET DEMAND

- 5.1.3. CU DEMAND IN VEHICLES

- 5.1.4. LME CU METAL PRICING

- 5.2. TANTALUM (TA)-RAW MATERIAL

- 5.2.1. TA METAL-MINING SUPPLY CHAIN TRENDS

- 5.2.2. TA METAL-GLOBAL DEMAND

- 5.2.3. TA METAL-CLOSED MARKET ECONOMICS

- 5.3. ALUMINUM (AL) METAL-BAUXITE AND ALUMINA MINING

- 5.3.1. AL METAL-SMELTING

- 5.3.2. AL METAL-GLOBAL DEMAND

- 5.3.3. LME AL METAL PRICING

- 5.4. TITANIUM (TI) METAL- TI MINERAL CONCENTRATE

- 5.4.1. TI MINERAL CONCENTRATE PRICING

- 5.4.2. TI METAL-MILL PRODUCT DEMAND

- 5.4.3. TI METAL-SPONGE PRODUCTION AND CAPACITY

- 5.4.4. TI METAL-SPONGE PRODUCTION AND CAPACITY

- 5.4.5. TI METAL MARKET TRENDS-RUSSIA/UKRAINE CONFLICT

- 5.4.6. TI METAL-TI SPONGE FOR SEMICONDUCTOR

- 5.4.7. TI METAL- TI SPONGE PRODUCTION ACTIVITY IN CHINA

- 5.5. TUNGSTEN (W) METAL-MINING

- 5.5.1. W METAL-GLOBAL DEMAND

- 5.5.2. W SUPPLY CHAIN AND CHINA

- 5.5.3. W METAL-HIGH PURITY W POWDER SUPPLIERS

- 5.5.4. W METAL PRICING

- 5.6. COBALT (CO) METAL-MINING

- 5.6.1. CO METAL-DEMAND

- 5.6.2. CO METAL PRICING

- 5.7. MOLYBDENUM (MO) METAL-MINING

- 5.7.1. GENERALIZATION OF MO SUPPLY CHAIN

- 5.7.2. MO APPLICATIONS

- 5.8. PRECIOUS METALS-GOLD (AU) MINING PRODUCTION

- 5.8.1. PRECIOUS METALS-SILVER (AG) MINING

- 5.8.2. PRECIOUS METALS CONSUMPTION BY APPLICATIONS

- 5.8.3. PRECIOUS METAL SUPPLY/DEMAND TRENDS

- 5.8.4. PRECIOUS METAL PRICING

- 5.8.5. PRECIOUS METAL PRICING

- 5.8.6. HIGH-PURITY MANGANESE (MN)

- 5.9. SUB-TIER SUPPLY-CHAIN: DISRUPTIONS

- 5.10. SUB-TIER SUPPLY-CHAIN M&A ACTIVITY

- 5.11. SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 5.12. SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

- 5.12.1. SPUTTER TARGETS SUB-TIER MARKET ASSESSMENT

6. TECHNICAL DRIVERS/MATERIAL CHANGES AND TRANSITIONS

- 6.1. 300 MM TARGET MARKET SEGMENT DRIVERS DEVICES

- 6.1.1. 200 MM TARGET MARKET SEGMENT DRIVERS

- 6.1.2. LOGIC-GENERAL PROCESS FLOW LOGIC PVD 10 NM & BELOW

- 6.1.3. GENERAL PROCESS FLOW ADVANCED DRAM

- 6.2. NEW DEVELOPMENTS IN THE TECHNOLOGY OR MARKETS: UNIVERSITY AND SUPPLIER R&D IN 5-7 YEARS

- 6.2.1. POWER RAIL

- 6.2.2. SPECIALTY (STT MRAM, FE RAM, OTHER) MEMORY PVD MATERIALS

- 6.2.3. PIEZOELECTRIC MATERIALS-PZT

7. SUPPLIER PROFILES

- FURUYA METAL CO.

- GO ELEMENT

- GRIKIN

- HONEYWELL

- HUIZHOU TOP METAL MATERIAL (TOPM)

- ...and 15+ more

8. APPENDICES

TABLE OF FIGURES

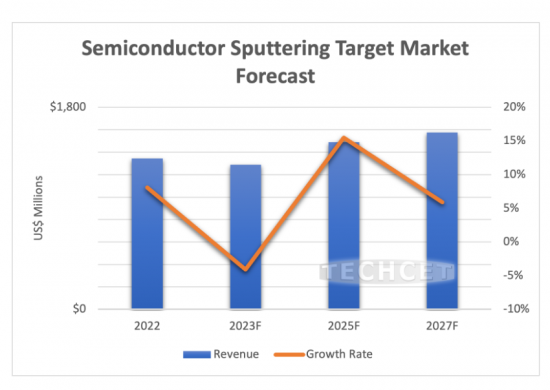

- FIGURE 1: TOTAL SPUTTERING TARGET MARKET REVENUES

- FIGURE 2: SEMICONDUCTOR TARGET MARKET FORECAST

- FIGURE 3: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022)

- FIGURE 4: 3-MONTH AVERAGE MONTHLY SALES FROM TAIWAN (TSMC, UMC, VIS, ASE GLOBAL, CHIPMOS, KYEC)

- FIGURE 5: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 6: 2022 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 7: MOBILE PHONE SHIPMENTS WW ESTIMATES

- FIGURE 8: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 9: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 10: SEMICONDUCTOR AUTOMOTIVE PRODUCTION

- FIGURE 11: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40B

- FIGURE 12: CHIP EXPANSIONS 2022-2027 US $366B

- FIGURE 13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 14: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B)

- FIGURE 15: OVERVIEW OF ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP

- FIGURE 16: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 17: EUROPE CHIP EXPANSION UPSIDE

- FIGURE 18: PORT OF LA

- FIGURE 19: TECHCET WAFER START FORECAST BY NODE

- FIGURE 20: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK

- FIGURE 21: SPUTTERING TARGET MARKET FORECAST

- FIGURE 22: ESTIMATED 2023 SPUTTERING TARGET MARKET SIZE BY MATERIAL SEGMENT (IN US$ MILLIONS)

- FIGURE 23: PRECIOUS METAL TARGET FORECAST (AFTER PRECIOUS METAL VALUE PASS THROUGH)

- FIGURE 24: TOTAL METAL TARGET FORECAST (AFTER PRECIOUS METAL VALUE PASS THROUGH

- FIGURE 25: SPUTTERING TARGET MARKET FORECAST

- FIGURE 26: ESTIMATE OF 2022 CU TARGET SALE BY TYPE

- FIGURE 27: ESTIMATE CU AND TA TARGETS SALES BY LOGIC NODE

- FIGURE 28: TA SPUTTERING TARGET MARKET FORECAST

- FIGURE 29: AL SPUTTERING TARGET MARKET FORECAST

- FIGURE 30: TI SPUTTERING TARGET MARKET FORECAST

- FIGURE 31: 2022 POWER DEVICE TARGET MARKET SIZE

- FIGURE 32: 2027 FORECASTED POWER DEVICE MARKET SIZE

- FIGURE 33: 2022 TARGET MARKET SIZE FOR SIC AND GAN POWER DEVICES

- FIGURE 34: 2027 FORECASTED TARGET MARKET SIZE FOR SIC AND GAN POWER DEVICES

- FIGURE 35: EST. 2022 SUPPLIER MARKET SHARE(EXCLUDING PRECIOUS METALS)

- FIGURE 36: 2022 REGIONAL SHARE (AS A % OF TOTAL TARGET DEMAND BY USD)

- FIGURE 37: 2021 EST. GLOBAL CU MINE PRODUCTION 21 MILLION MT

- FIGURE 38: 2022 EST. GLOBAL REFINED CU CONSUMPTION 25 MILLION MT

- FIGURE 39: ESTIMATE COPPER CONSUMPTION BY VEHICLE TYPE (KG PER VEHICLE)

- FIGURE 40: LME CU PRICE CHART

- FIGURE 41: 2022 EST. TANTALUM MINE PRODUCTION 2000 MT

- FIGURE 42: 2021 TANTALUM APPLICATION (~2,200 T)

- FIGURE 43: EST. WORLD BAUXITE MINING PRODUCTION 2022 380 MILLION MT

- FIGURE 44: EST. WORLD ALUMINUM SMELTING PRODUCTION 2022 69 MILLION MT

- FIGURE 45: EST. 2022 GLOBAL AL DEMAND 96 MILLION MT

- FIGURE 46: LME AL PRICE CHART

- FIGURE 47: EST. GLOBAL TI CONCENTRATE MINING PRODUCTION -2022 9,500 MILLION MT

- FIGURE 48: TI MINERAL CONCENTRATE PRICING

- FIGURE 49: EST. GLOBAL 2020 TI MILL PRODUCT OUTPUT, ~175,000 MT

- FIGURE 50: EST. GLOBAL TI SPONGE PRODUCTION-2022 260,000 THOUSAND MT

- FIGURE 51: EST. GLOBAL TI SPONGE CAPACITY-2022 350,000 THOUSAND MT

- FIGURE 52: EST. 2022 W MINE PRODUCTION 84,000 T

- FIGURE 53: W PRICE CHART

- FIGURE 54: EST. 2022 CO MINE PRODUCTION 190,000 MT

- FIGURE 55: EST. 2020 GLOBAL CO DEMAND 175,000 MT

- FIGURE 56: LME CO METAL PRICE CHART

- FIGURE 57: EST. 2021 MOLYBDENUM MINING PRODUCTION, 300,000 METRIC TONS

- FIGURE 58: GENERALIZATION OF MO SUPPLY CHAIN

- FIGURE 59: EST 2020 MOLYBDENUM USE BY APPLICATION

- FIGURE 60: 2022 AU MINING PRODUCTION 3,100 MT

- FIGURE 61: 2022 AG MINING PRODUCTION ~26,000 MT

- FIGURE 62: GOLD METAL PRICE CHARTS

- FIGURE 63: SILVER METAL PRICE CHARTS

- FIGURE 64: PALLADIUM METAL PRICE CHARTS

- FIGURE 65: PLATINUM METAL PRICE CHARTS

- FIGURE 66: 3DNAND

- FIGURE 67: BURIED POWER RAIL STRUCTURE

- FIGURE 68: MRAM DEVICE STRUCTURE

- FIGURE 69: CHALCOGENIDE MEMORY ROADMAP (SK HYNIX)

TABLES

- TABLE 1: CHINA'S INTERESTS IN MINING AND REFINING THAT RELATE TO SEMICONDUCTOR SPUTTER TARGET METALS

- TABLE 2: GLOBAL GDP AND SEMICONDUCTOR REVENUES*

- TABLE 3: IMF ECONOMIC OUTLOOK*

- TABLE 4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022

- TABLE 5: WIDE BAND GAP (WBG) SEGMENT REVENUES AND CAGRS

- TABLE 6: ESTIMATED NUMBER OF TARGETS BY POWER DEVICE TYPE 2022 (# OF 200 MM TARGETS, WITH SIC EXPRESSED AS 150MM)

- TABLE 7: RUTHENIUM TARGET SUPPLIERS

- TABLE 8: SPUTTERING TARGET SUPPLIER MANUFACTURING LOCATIONS

- TABLE 9: REGIONAL SPUTTERING MARKETS

- TABLE 10: ESTIMATED TARGET COST STRUCTURE (FOR REFERENCE ONLY)

- TABLE 11: PRECIOUS METAL CONSUMPTION BY APPLICATION

- TABLE 12: LOGIC PVD APPLICATIONS

- TABLE 13: 3DNAND PVD APPLICATIONS

- TABLE 14: DRAM PVD APPLICATIONS

- TABLE 15: PHASE CHANGE MATERIAL TARGET SUPPLIERS

- TABLE 16: MRAM TARGET SUPPLIERS

02-2729-4219

+886-2-2729-4219