|

市場調查報告書

商品編碼

1297864

中國的小客車用HUD產業鏈的發展(2023年)China Passenger Car HUD Industry Chain Development Research Report, 2023 |

||||||

本報告提供中國的小客車用HUD產業鏈調查分析,HUD技術,主要元件,供應商等資訊。

目錄

第1章 HUD產業概要

- HUD產業概要

- HUD的發展的背景

- 情報成為在HUD的差異化競爭中焦點

- HUD的分類和比較

- HUD的技術原理

- 汽車用HUD成像的原理主要的必要條件

- HUD的主要的技術與其變遷

- HUD的投影成像技術的簡介

- 主流的投影成像技術的比較

- 主流的投影技術間的光學零組件的比較

- HUD製造的目前技術障礙

- HUD的主要零組件

- HUD的主要零組件 - 影像的來源

- HUD的主要零組件 - 光學顯示器

- HUD的主要零組件 - 其他的硬體設備

- HUD市場現狀

- 中國的HUD的市場規模

- 競爭情形

- 經營模式

- HUD產業鏈

- HUD產業鏈的上游,中游,下游的廠商

- HUD產業鏈的代表性的企業

第2章 PGU模組的供應商

- Summary of Optical Device Suppliers

- Kyocera

- BOE

- Tianma Microelectronics

- iView Displays

- Goertek

- Zhejiang Crystal-Optech

- ASU Tech

- Huawei

- AR-HUD

- Raythink

- Summary of Chip Vendors

- TI

- Himax Technologies

- Nanjing Smartvision

- Huixinchen

- Microvision

- Summary of Light Source Suppliers

- Nichia

- ams OSRAM

- Jufei Electronics

第3章 擋風玻璃的供應商

- Summary of Windshield Suppliers

- Fuyao Glass

- AGC

- Saint-Gobain

- Summary of Wedge Film Suppliers

- Sekisui Chemical

- Eastman

第4章 光學鏡的供應商

- Freeform Mirror Suppliers

- Sunny Optical Technology

- Fran Optics

- Optical Waveguide Suppliers

- Lochn Optics

- Tripole Optoelectronics

- SVG Tech Group

- DigiLens

第5章 HUD市場趨勢與預測

- HUD的發展趨勢

- AR-HUD的發展趨勢

- PGU零組件的發展趨勢

- 光學鏡零組件的發展趨勢

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a "standard configuration".

As HUD technology advances, AR-HUD, which can combine virtual information and real road scenes in the form of images, is favored by automakers. With maturing technology and declining cost, HUD has begun to penetrate into low-price vehicle models, and will become a "standard configuration" for smart cars in the future. For example, Changan Deepal S7, a model unveiled in early March 2023 with starting price of RMB169,900, cancels the dashboard and uses a 53-inch holographic AR-HUD system instead. The AR-HUD supplier is Zhejiang Crystal-Optech.

The AR-HUD industry chain covers suppliers of picture generation units (PGU), optical mirrors, glass, software and other components. Among them, the PGU plays the most crucial part at the upstream end, making up 50% of the total cost of HUD, and the optical mirror follows, taking a 20% share. The lower cost of the two major components, namely PGU and optical mirror, means a reduction in the total cost of AR-HUD, bringing an extremely fast progress in the implementation of AR-HUD. Therefore the new technologies related to the two components have developed rapidly in recent years.

Emerging projection technologies such as LCoS and LBS are capturing market shares.

PGU is used to generate pictures and control brightness. At present, the most mature PGU technology path for AR HUD is DLP, a high-cost technology monopolized by TI. Yet Chinese suppliers conduct in-depth research on emerging projection technologies like LCoS and LBS, aiming to seize the initiative and overtake on the bend.

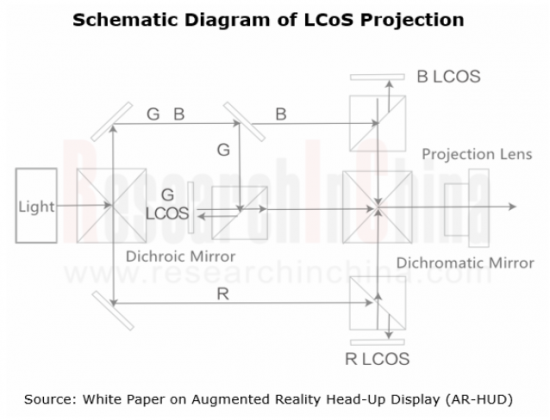

LCoS technology uses the LCoS panel to modulate the optical signal emitted by the light source and projected to the screen, but the light emitted will not penetrate the reflective LCoS panel. LCoS offers the following benefits: 1. High light use efficiency, up to 40% or higher; 2. High resolution, up to 4k or even 8k, and wide color gamut; 3. Low cost after the process matures.

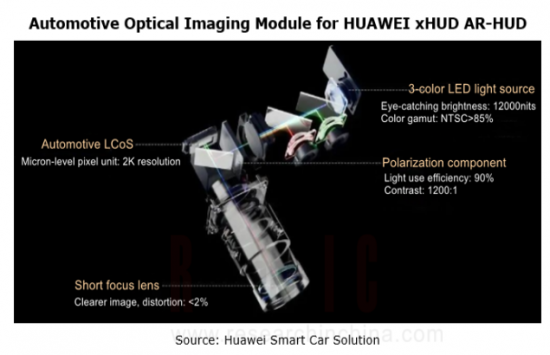

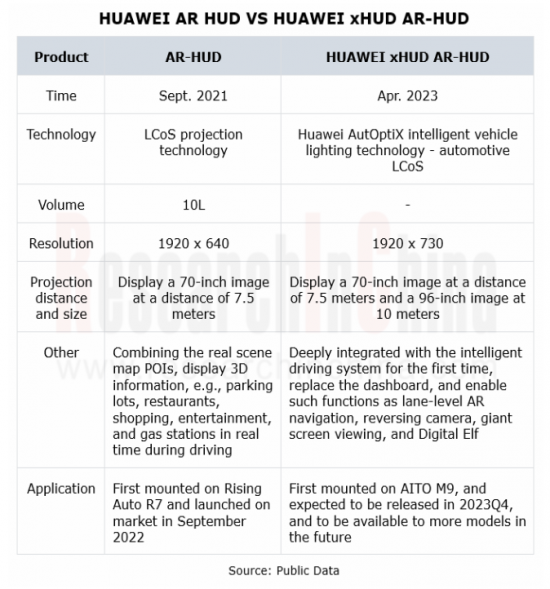

In September 2021, Huawei introduced its AR-HUD product, and in April 2023, Huawei released the xHUD AR-HUD. Both products use LCoS projection technology and feature small size and large format. HUAWEI xHUD AR-HUD can display a 70-inch image at a distance of 7.5 meters, and a 96-inch image at 10 meters. This product can support such applications as intelligent driving visualization, lane-level navigation, reversing camera, Digital Elf, and giant screen viewing.

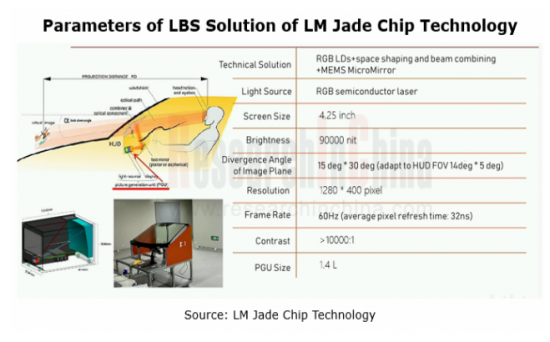

LBS, a laser scanning and projection technology, uses lasers as the light source, and realizes projection via a MEMS micro-mirror. It offers the following benefits: 1. Greatly simplified optical engine, and small size; 2. High contrast, easily up to 7000:1; 3. High brightness and wide color gamut (>150%); 4. Low power consumption (<4-6W), and low heat generation. Nevertheless, for the temperature-sensitive laser diodes fall short of the working requirements of 85°C, LBS has yet to be mature enough to be applied.

Founded in 2021, LM Jade Chip Technology is a Chinese company engaged in development and industrial application of MEMS chips and laser scanning micro-display modules. For AR-HUD, it has developed a complete LBS-based solution LM-PGU-1000 and provided to its partners such as Sunny Optical Technology, OFILM and Aptiv. LM-PGU-1000 has the following features: 1. A solution to display speckle, speckle contrast: <4%; 2. Higher horizontal resolution and larger horizontal FOV; 3. Lower power consumption and higher brightness; 4. Higher contrast.

Waveguide technology will become the ultimate optical display solution.

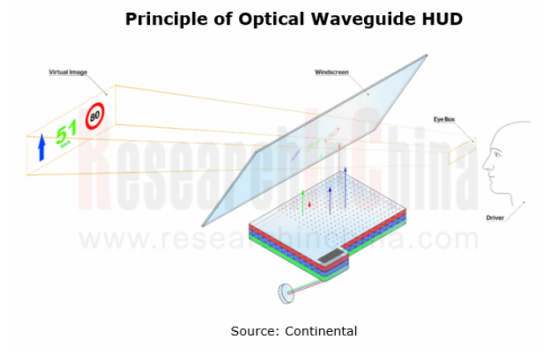

Too large installation size and fairly high cost of AR HUD are currently the sore points for the industry. The waveguide technology allows for removal of the mechanical and optical mechanisms inside conventional HUDs, which means the first two reflections are omitted so that the information from the light source is directly projected onto the windshield. AR HUD occupies space one tenth of conventional mechanical solutions. In addition, the optical waveguide solution delivers high light transmittance, large FOV, and good display effect.

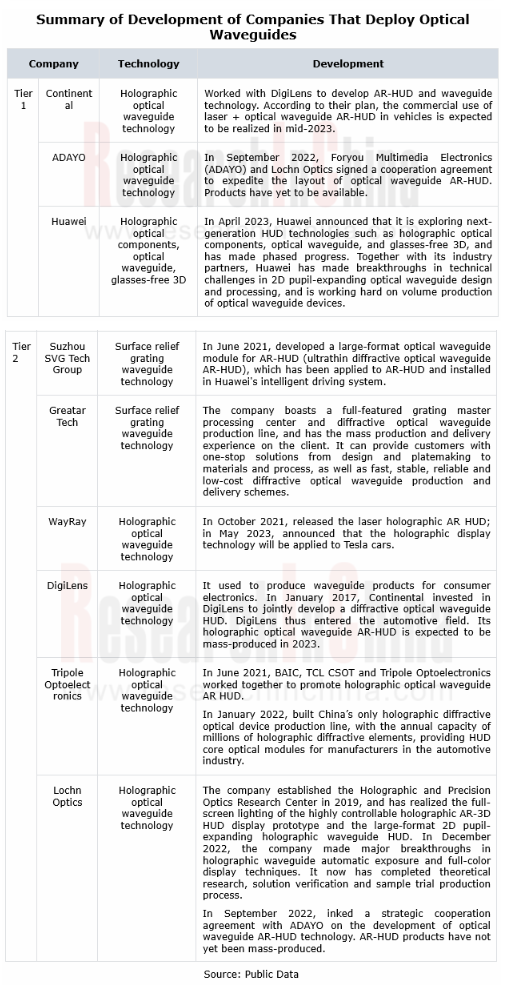

Optical waveguide falls into geometric optical waveguide and diffractive optical waveguide. Wherein, the diffractive optical waveguide technology is the key development direction of AR-HUD, and is divided into surface relief grating waveguide and volume holographic grating waveguide.

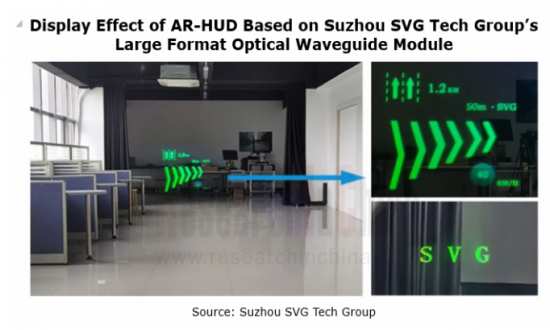

Surface relief grating waveguide, a mature technology often seen in AR near-eye display devices, provides thinness, large field of view, and large eye movement range. At present, it is a mainstream optical waveguide solution for AR-HUD, and manufacturers such as Suzhou SVG Tech Group and Greatar Tech are all making layout of it.

With independent R&D of 3D lithography equipment as the core driver, Suzhou SVG Tech Group works on research and industrialization of optoelectronic materials and devices for the fields of information photonics and new displays. In June 2021, the joint-stock private company announced a large-format optical waveguide module for AR-HUD. This module offers the display effects of ultra-thinness, large field of view, and long virtual image viewing distance. Based on the self-developed micro-nano lithography equipment and platform, this module can process about 2x1011 nanometer units on the 20cmx20cm waveguide surface, and provide a projection distance longer than 15 meters. Currently this module has been used in AR-HUD and installed in Huawei's intelligent driving system.

The volume holographic grating waveguide can reduce the volume of AR-HUD to one fifth to one tenth of the conventional geometric optics ones. Compared with reflector-type AR-HUD with a volume of 22L, the holographic optical waveguide enables a volume of only 2.4L; the main imaging module can also standardized and mass-produced at low cost. Such AR-HUD is promising. However the production process is complicated, and currently few manufacturers have the ability to produce in quantities. It is in 2023 that the application of corresponding AR-HUD products will start.

Tripole Optoelectronics began to deploy volume holographic diffractive optical waveguide technology in 2019. In June 2021, Tripole Optoelectronics worked with BAIC and TCL CSOT to promote holographic optical waveguide AR-HUD. In January 2022, the company built a holographic diffractive optical device production line with the annual capacity of millions of holographic diffractive elements, providing large-area holographic optical waveguide AR-HUD products for manufacturers in automotive industry.

Table of Contents

1 Overview of HUD Industry

- 1.1 Overview of HUD Industry

- 1.1.1 Development Background of HUD

- 1.1.2 Intelligence Becomes the Focus in the HUD Differentiation Competition

- 1.1.3 Classification of HUDs and Comparison

- 1.2 Technical Principle of HUD

- 1.2.1 Automotive HUD Imaging Principle and Core Requirements

- 1.2.2 Main Technologies and Iteration of HUD

- 1.2.3 Introduction to HUD Projection Imaging Technologies

- 1.2.4 Comparison between Mainstream Projection Imaging Technologies

- 1.2.5 Comparison of Optical Components between Mainstream Projection Technologies

- 1.2.6 Current Technical Barriers to HUD Production

- 1.3 Key Components of HUD

- 1.3.1 Key Components of HUD - Source of Image

- 1.3.2 Key Components of HUD - Optical Display

- 1.3.3 Key Components of HUD - Other Hardware

- 1.4 Status Quo of HUD Market

- 1.4.1 China's HUD Market Size

- 1.4.2 Competitive Landscape

- 1.4.3 Business Models

- 1.4.4 HUD Industry Chain

- 1.4.5 Upstream, Midstream and Downstream Manufacturers in HUD Industry Chain

- 1.4.6 Typical Companies in HUD Industry Chain

2 PGU Module Suppliers

- Summary of Optical Device Suppliers

- 2.1 Kyocera

- 2.1.1 Profile

- 2.1.2 HUD Product Roadmap

- 2.1.3 Parameter Comparison between HUD Products and Partners

- 2.1.4 Typical HUD Products

- 2.1.5 3D-HUD and HAPTIVITY Module Technology

- 2.2 BOE

- 2.2.1 Profile

- 2.2.2 Development History of HUD

- 2.2.3 Operation of BOE Varitronix

- 2.2.4 HUD Products

- 2.2.5 Implementation of HUD Products and Dynamics

- 2.2.6 TFT Module Products and Technologies of BOE Varitronix

- 2.2.7 Strategic Layout of HUD

- 2.2.8 Cooperative Layout of HUD

- 2.3 Tianma Microelectronics

- 2.3.1 Profile

- 2.3.2 Operation

- 2.3.3 Display Technology Layout

- 2.3.4 Iteration of Micro-LED Products

- 2.3.5 HUD Products

- 2.4 iView Displays

- 2.4.1 Profile

- 2.4.2 Product Planning

- 2.4.3 PGU Products

- 2.4.4 Product Comparison

- 2.4.5 Dynamics in Mass Production of PGU

- 2.5 Goertek

- 2.5.1 Profile

- 2.5.2 History of DLPR Products for Optical Microprojection

- 2.5.3 Optical Module Products and Application Fields

- 2.5.4 Technical Strength in AR Optics

- 2.5.5 HUD Product - PGU Module

- 2.5.6 Resource Planning for Automotive Optics Business

- 2.6 Zhejiang Crystal-Optech

- 2.6.1 Profile

- 2.6.2 Development History

- 2.6.3 Operation

- 2.6.4 Products and Technologies

- 2.6.5 Recent Cooperation

- 2.7 ASU Tech

- 2.7.1 Profile

- 2.7.2 AR-HUD Technology

- 2.7.3 AR-HUD LCOS Core Optical Devices

- 2.7.4 AR-HUD Solution

- 2.7.5 W-HUD Products

- 2.8 Huawei

- 2.8.1 HUD Layout

- 2.8.2 AR-HUD

- 2.8.3 Application Cases

- 2.8.4 HUAWEI xHUD AR-HUD

- 2.9 Raythink

- 2.9.1 Profile

- 2.9.2 Core Technologies

- 2.9.3 OpticalCore® Light Source Module Based on LBS

- 2.9.4 Parameters of OpticalCore®

- 2.9.5 Technical Benefits and Application Fields of OpticalCore®

- 2.9.6 Multilayer Optical Waveguide 3D PGU

- 2.9.7 AR Platform-based Software Architecture

- 2.9.8 AR HUD Imaging Test System

- 2.9.9 W-HUD Products

- 2.9.10 AR-HUD Solution

- 2.9.11 AR-HUD Products

- 2.9.12 AR-HUD PRO Products

- 2.9.13 Future Planning for AR-HUD and Dynamics in Cooperation

- Summary of Chip Vendors

- 2.10 TI

- 2.10.1 Automotive Electronics Business

- 2.10.2 Development History of DLP Products

- 2.10.3 Technical Benefits of DLP

- 2.10.4 Application of DLP in Vehicles and Business Model

- 2.10.5 HUD Products

- 2.10.6 1st Generation HUD Chip

- 2.10.7 2nd Generation HUD Chip

- 2.10.8 3rd Generation HUD Chip

- 2.10.9 Latest HUD Chip

- 2.10.10 Development of HUD

- 2.11 Himax Technologies

- 2.11.1 Profile

- 2.11.2 Phase Modulation LCoS

- 2.12 Nanjing Smartvision

- 2.12.1 Profile

- 2.12.2 HUD Products

- 2.13 Huixinchen

- 2.13.1 Profile

- 2.13.2 Core Technologies, and R&D and Production Layout

- 2.13.3 LCoS Chip

- 2.14 Microvision

- 2.14.1 Profile

- 2.14.2 Development History of Products

- 2.14.3 Technical Principle of HUD

- 2.14.4 PicoP Laser Scanning Engine

- 2.14.5 MicroPicoP is the Most Typical Laser Scanning Engine

- 2.14.6 The Laser Scanning HUDs of Mitsubishi and Pioneer Use Patents of MicroVision

- 2.14.7 Infineon's MEMS Scanning Solution for AR HUD

- Summary of Light Source Suppliers

- 2.15 Nichia

- 2.15.1 Profile

- 2.15.2 Laser Diode (LD) Products

- 2.15.3 Light-Emitting Diode (LED) Products (1)

- 2.15.4 Light-Emitting Diode (LED) Products (2)

- 2.16 ams OSRAM

- 2.16.1 Profile

- 2.16.2 HUD Light Source Solutions

- 2.16.3 HUD Light Source Products - LED

- 2.16.4 HUD Light Source Products - Laser

- 2.16.5 Application and Development of HUD Products

- 2.17 Jufei Electronics

- 2.17.1 Profile

- 2.17.2 Vehicle DLP Projection Display Technology of Jufei Optoelectronics

3 Windshield Suppliers

- Summary of Windshield Suppliers

- 3.1 Fuyao Glass

- 3.1.1 Profile

- 3.1.2 HUD Glass Products

- 3.1.3 HUD Glass Product Technology and Application in Vehicles

- 3.2 AGC

- 3.2.1 Profile

- 3.2.2 HUD Glass Technology

- 3.2.3 AGC and EyeLights Cooperated to Develop AR HUD

- 3.3 Saint-Gobain

- 3.3.1 Profile

- 3.3.2 W-HUD Products

- Summary of Wedge Film Suppliers

- 3.4 Sekisui Chemical

- 3.4.1 Profile

- 3.4.2 Operation

- 3.4.3 Interlayer Film Production Business

- 3.4.4 HUD Wedge Film Products

- 3.4.5 S-LECTM Sound and Solar Film Products

- 3.4.6 HUD Wedge Film Product Planning

- 3.5 Eastman

- 3.5.1 Profile

- 3.5.2 HUD Products (1)

- 3.5.3 HUD Products (2)

- 3.5.4 HUD Products (3)

- 3.5.5 Recent Developments

4 Optical Mirror Suppliers

- Freeform Mirror Suppliers

- 4.1 Sunny Optical Technology

- 4.1.1 Profile

- 4.1.2 Product Lineup and Revenue of Automotive Business

- 4.1.3 HUD Products

- 4.1.4 HUD Optical Solutions and Application

- 4.2 Fran Optics

- 4.2.1 Profile

- 4.2.2 HUD Freeform Mirror

- Optical Waveguide Suppliers

- 4.3 Lochn Optics

- 4.3.1 Profile

- 4.3.2 Main Products

- 4.3.3 Holographic AR-3D HUD Optical Display System

- 4.3.4 Breakthroughs in HUD Technology

- 4.3.5 Dynamics in Automotive AR-HUD Cooperation

- 4.4 Tripole Optoelectronics

- 4.4.1 Profile

- 4.4.2 Main Products

- 4.4.3 Large Area AR HUD Holographic Optical Waveguide

- 4.4.4 Core Manufacturing Technology and Process for Holographic Optical Waveguide

- 4.4.5 System Design of Holographic Optical Waveguide

- 4.4.6 Layout History of Large Area Holographic Waveguide

- 4.4.7 Dynamics in Cooperation

- 4.5 SVG Tech Group

- 4.5.1 Profile

- 4.5.2 Optical Waveguide Technology

- 4.5.3 Ultrathin Diffractive Optical Waveguide AR-HUD

- 4.6 DigiLens

- 4.6.1 Profile

- 4.6.2 Development History

- 4.6.3 Using Switchable Bragg Grating Array Structure

- 4.6.4 Integrated Double Axis Technology

- 4.6.5 MotoHUD

- 4.6.6 AutoHUD2020 Jointly Developed with Continental

- 4.6.7 Laser Backlight LCOS Optical Device

- 4.6.8 AR HUD - CrystalClear

5 HUD Market Trends and Forecast

- 5.1 Development Trends of HUD

- 5.1.1 Trend 1

- 5.1.2 Trend 2

- 5.1.3 Trend 3

- 5.2 Development Trends of AR-HUD

- 5.2.1 Trend 1

- 5.2.2 Trend 2

- 5.3 Development Trends of PGU Components

- 5.3.1 Trend 1

- 5.3.2 Trend 2

- 5.3.3 Trend 3

- 5.4 Development Trends of Optical Mirror Components

- 5.4.1 Trend 1

- 5.4.2 Trend 2