|

市場調查報告書

商品編碼

1407723

電信業主要廠商(2023年第三季版):支出疲軟,電信網路基礎設施收入下降,儘管美國監管,Huawei仍保持領先;兩家雲端供應商進入前20名Telecom's Biggest Vendors - 3Q23 Edition: Telco NI Revenues Collapse in 3Q23 Amid Spending Slump, Huawei Leads Despite US Curbs, Two Cloud Providers in Top 20 |

||||||

本報告基於對134家頂級電信廠商的追蹤調查,分析了全球主要電信廠商對電信網路基礎設施(Telco NI)的投資趨勢和前景。我們調查了每家電信廠商的收入金額和市場份額公司(3個季度),按公司類型和地區劃分的詳細趨勢,以及主要公司的概況和業務發展狀況。

分析概述:

營收: 2023 年第三季度,電信網路基礎設施(Telco NI) 供應商營收將達到492 億美元(年減14.2%),即每年2,178 億美元(下降7.6% ) 。 不包括Huawei在內的整個市場最近一個季度下降了13.4%,按年化計算年減了6.4%。

頂級供應商:通訊網路基礎設施排名前三的供應商仍然是Huawei□Ericsson□Nokia。 以年計算,這些供應商佔整個市場的 37.4%,僅 2023 年第三季就佔 35.5%。 自2019年初以來,ZTE和China Comservice一直在爭奪第四和第五名。

主要供應商的收入成長率(同比):排名前五的供應商中的三個- Alphabet、Microsoft和Tejas Networks - 報告了截至2023 年第三季的收入成長率(同比)。(比較與去年同期相比)季度率和年化率均相同。

支出展望:根據最新官方預測,作為電信網路基礎設施市場主要驅動力的營運商資本支出將在2023年降至3130億美元,並在2024年降至3130億美元我們預計到 2020 年這一數字將進一步下降至 3,090 億美元。 同時,預計2025年資本投資將進一步小幅下降,然後在2028年再次小幅上升,達到3,310億美元。 全球營運商資本密集度平均將從2022年的18.4%增加到2028年的17.1%。

待分析公司

|

|

目錄

第一章分析概論

第2章總結:分析結果說明

第三章電信業者NI市場:最新結果

第 4 章前 25 名供應商:可列印的剪紙

第 5 章圖表:各供應商公司概論

第6章圖表:5家供應商的比較

第 7 章研發成本:依供應商劃分

第8章原始資料:利潤金額估算(按公司)

第九章研究方法與前提

第 10 章 MTN 諮詢:概述

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-3Q23 period. Of these 134 vendors, 110 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

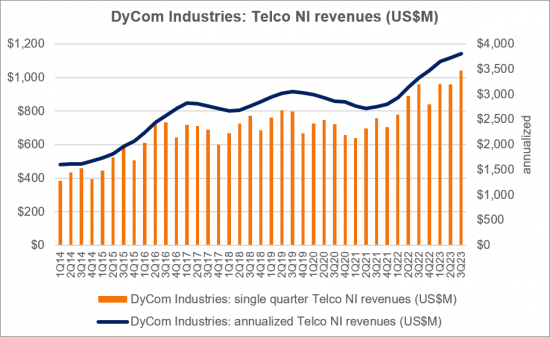

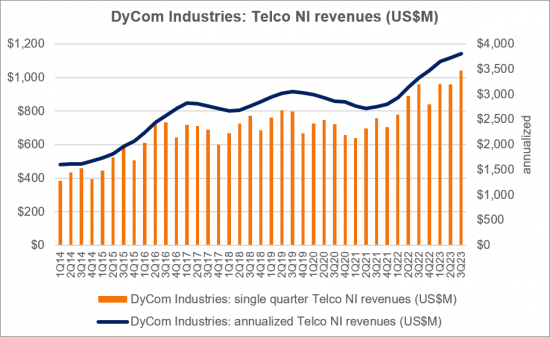

Revenues: Telco NI vendor revenues were $49.2B in 3Q23 and $217.8B for the annualized 3Q23 period overall, down 14.2% and 7.6% on a YoY basis, respectively. Excluding Huawei, the total market declined by 13.4% in the latest single quarter and by 6.4% in annualized 3Q23 on a YoY baisis.

Top vendors: The top three Telco NI vendors continue to be the usual trio: Huawei, Ericsson, and Nokia. They account for 37.4% of the total market in annualized 3Q23, or 35.5% in 3Q23 alone. ZTE and China Comservice have been jostling for the 4th and 5th positions since early 2019.

Key vendors by YoY revenue growth: Three out of the top five vendors are common, in terms of YoY revenue growth, for both single quarter and annualized 3Q23: Alphabet, Microsoft, and Tejas Networks.

Spending outlook: Per our latest official forecast, we expect telco capex - the main driver of the Telco NI market - to dip to $313B in 2023, and decline a bit more to $309B in 2024. Capex will decline slightly further in 2025, though, and then rise modestly again to reach $331B in 2028. Global telco capital intensity will average out to 17.1% in 2028, from 18.4% in 2022.

COVERAGE:

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

FIGURES (Partial list):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 3Q23 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 3Q23 ($B)

- Top 25 vendors based on Telco NI revenues in 3Q23 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 3Q23 TTM vs. 3Q22 TTM

- Telco NI annualized revenue changes, 3Q23 vs. 3Q22

- YoY growth in Telco NI revenues (3Q23)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 2Q23 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 3Q23 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (3Q21-3Q23)