|

市場調查報告書

商品編碼

1435895

數位貨運:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

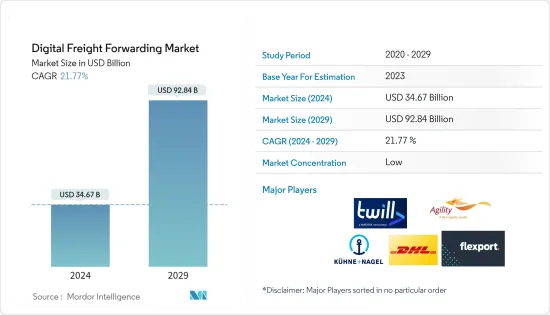

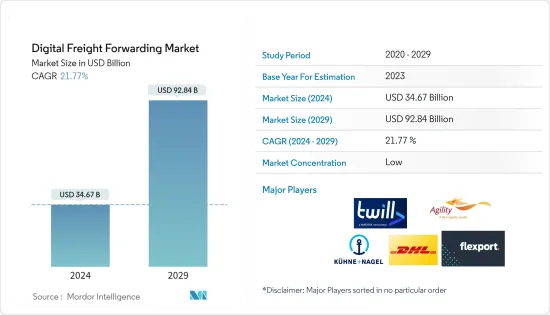

數位貨運市場規模預計到 2024 年為 346.7 億美元,預計到 2029 年將達到 928.4 億美元,預測期內(2024-2029 年)複合年成長率為 21.77%。

數位化仍然是當今經濟成長的關鍵驅動力之一。 Convoy、Uber Freight 和 uShip 等公司正在設計新平台來填補物流行業的空白。數位貨運減少了手動流程。所有貨運報價都可以在一個平台上獲得,無需花費數小時的對話和紙本記錄的麻煩。數位貨運代理的主要優勢包括即時報價、透明定價、費率和承運人比較、追蹤、輕鬆記錄等。物流業正在支持市場成長,並變得越來越無紙化和數位化。

數位貨運市場趨勢

電子商務成長推動數位貨運市場

2019年全球零售電商銷售額達到約3.53兆美國,預計未來幾年電子零售收益將進一步以更快的速度成長。網路購物是全球最受歡迎的線上活動之一,這也是國內和跨境電子商務在中國、印度和印尼等新興市場蓬勃發展的原因。這包括直接面對消費者的銷售以及電子產品、藥品和消費品的出貨。隨著網路的普及,產品製造商也逐漸從傳統貨運轉向數位化貨運。數位貨運代理的主要優勢包括即時報價、透明定價、費率和承運人比較、追蹤、輕鬆記錄等。

Flexport,數位貨運市場的領導者

Flexport 是一家位於舊金山的數位貨運代理商和物流平台。該公司成立於2013年,約有一半業務從事海運,另一半業務從事航空運輸。 2017 年 9 月資金籌措C 輪融資後,Flexport 估值達 8 億美元。 DST Global主導此輪融資。其他投資者包括創始人基金和富國銀行。 2018年,該公司獲得中國主要宅配公司順豐速運1億美元的投資。這使得 Flexport 的總資金籌措達到 3 億美元,估值超過 10 億美元。

該Start-Ups的運作收益約為 4 億美元,並且正在穩步成長。該公司每年出貨約 12 萬 TEU(20 英尺當量單位),主要在太平洋貿易航線上運輸,使其在太平洋東航線中出貨量排名第 20 位。透過提供高品質的物流服務和附加的分析報告,2019 年收益達 8.6 億美元,成為數位貨運市場的領導者。

數位貨運產業概況

數位貨運市場競爭激烈且高度分散,參與者眾多。數位貨運承攬業(DFF) 使用數位平台提供比市場或連接提供者更廣泛的物流服務。 DFF 圍繞無縫用戶體驗構建其核心價值提案,將貨物從一個地點運送到另一個地點,同時透過單一用戶介面在一個平台上集中資訊。市場上現有的主要企業包括 Flexport、Twill、FreightHub、Fleet、InstaFreight、Transporteca、Kontainers、KN Freight Net、Turvo、iContainers、DHL Group、Kuehne+Nagel International AG、Agility Logistics Pvt.有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析調查方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 價值鏈/供應鏈分析

- 投資場景

- 政府法規和舉措

- 線上貨運及數位化平台技術開發

- 電商物流貨運概況

- 電子平台與有競爭力的價值提案

- COVID-19 對市場的影響

第5章市場動態

- 促進因素

- 抑制因素

- 機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第6章市場區隔

- 透過交通途徑

- 土地

- 海洋

- 空氣

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 荷蘭

- 英國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 印度

- 新加坡

- 馬來西亞

- 印尼

- 韓國

- 其他亞太地區

- 中東和非洲

- 南非

- 埃及

- 海灣合作理事會國家

- 其他中東和非洲

- 南美洲

- 巴西

- 智利

- 南美洲其他地區

- 北美洲

第7章 競爭形勢

- 市場集中度概況

- 公司簡介

- Flexport

- Twill

- FreightHub

- Fleet

- InstaFreight

- Transporteca

- Kontainers

- KN Freight Net

- Turvo

- iContainers

- DHL Group

- Kuehne+Nagel International AG

- Agility Logistics Pvt. Ltd*

第8章市場機會及未來趨勢

第9章 免責聲明

The Digital Freight Forwarding Market size is estimated at USD 34.67 billion in 2024, and is expected to reach USD 92.84 billion by 2029, growing at a CAGR of 21.77% during the forecast period (2024-2029).

Digitization is continuing to be one of the key drivers supporting growth of the current economy. Companies like convoy, Uber Freight and uShip are coming up with new platforms to fill in the gaps in the logistics industry. With Digital freight forwarding the manual process will be reduced. All the quotations for freight forwarding will be available at one platform without the hassle of hours of conversation and paper trails. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation and others. The logistics industry is developing to a paperless digitized industry supporting the growth of the market.

Digital Freight Forwarding Market Trends

Growth in E-Commerce driving Digital Freight Forwarding Market

In 2019, retail e-commerce sales worldwide amounted to around 3.53 trillion US dollars and e-retail revenues are projected to grow even further at a quicker pace in the coming few years. Online shopping is one of the most popular online activities worldwide, both domestic and cross-border e-commerce is booming in developing markets such as China, India, and Indonesia due to that reason. This encompasses not just direct-to-consumer retail, but also shipments of electronics, pharmaceuticals, and consumer packaged goods. With increasing access to internet even the manufacturers of products are gradually moving from traditional freight forwarding to digital freight forwarding. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation and others.

Flexport leading the Digital Freight forwarding market

Flexport is a San Francisco-based digital freight forwarder and logistics platform. Founded in 2013, the company has around half of its business in ocean freight and the other half in air freight. After its Series C round of funding in September 2017, Flexport had a valuation of $800 million. DST Global led this round; other investors include Founders Fund and Wells Fargo. In 2018, the company received USD 100 million from SF Express, a leading courier company in China. This brought Flexport's total funding to USD 300 million and its valuation to more than USD 1 billion.

The startup has a run-rate revenue of approximately USD 400 million and is growing steadily. It ships roughly 120,000 TEUs (20-foot equivalent units) annually, with a focus on transpacific trade lanes, where its shipment volume is the 20th largest on the transpacific eastbound route. It reached a revenue of USD 860 million in 2019 and became the leader in digital freight forwarding market as it provides high quality logistics service with added analytical reports.

Digital Freight Forwarding Industry Overview

The Digital Freight Forwarding Market is competitive and is highly fragmented with presence of many players. Digital freight forwarders (DFFs) use a digital platform to offer a broader range of logistics services than marketplaces and connectivity providers. DFFs build their core value proposition around a seamless user experience of shipping goods from one point to another while aggregating information on one platform with a single user interface. Some of the existing major players in the market include - Flexport, Twill, FreightHub, Fleet, InstaFreight, Transporteca, Kontainers, KN Freight Net, Turvo, iContainers, DHL Group, Kuehne + Nagel International AG and Agility Logistics Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Investment Scenarios

- 4.4 Government Regulations and Initiatives

- 4.5 Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding

- 4.7 Value Propositions of E-platforms Vs Competitors

- 4.8 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transport

- 6.1.1 Land

- 6.1.2 Sea

- 6.1.3 Air

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Netherlands

- 6.2.2.4 United Kingdom

- 6.2.2.5 Italy

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 India

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Indonesia

- 6.2.3.8 South Korea

- 6.2.3.9 Rest of Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.4.1 South Africa

- 6.2.4.2 Egypt

- 6.2.4.3 GCC Countries

- 6.2.4.4 Rest of Middle East & Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Chile

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Twill

- 7.2.3 FreightHub

- 7.2.4 Fleet

- 7.2.5 InstaFreight

- 7.2.6 Transporteca

- 7.2.7 Kontainers

- 7.2.8 KN Freight Net

- 7.2.9 Turvo

- 7.2.10 iContainers

- 7.2.11 DHL Group

- 7.2.12 Kuehne + Nagel International AG

- 7.2.13 Agility Logistics Pvt. Ltd*