|

市場調查報告書

商品編碼

1435894

航空貨運:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Air Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

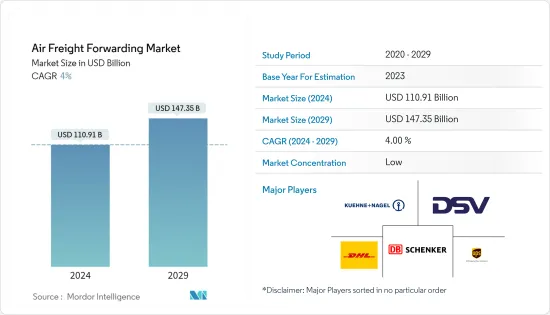

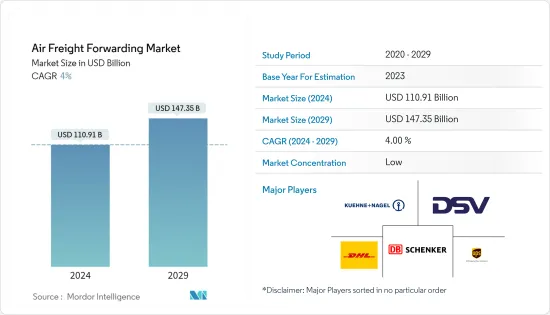

航空貨運市場規模預計到 2024 年為 1,109.1 億美元,預計到 2029 年將達到 1,473.5 億美元,預測期內(2024-2029 年)複合年成長率為 4%。

儘管陸路和海上貨運仍然是一個不錯的選擇,但空運被認為是最快且不受阻礙的方法。 10月份全球航空貨運需求(以貨運噸公里(CTK)計算)達211億,季增3.5%。但產業CTK與前一年同期比較減13.6%,較2019年疫情前水準下降6.2%。 2022 年 10 月經季節性已調整的(SA)航空貨運需求較上月略為放緩至 2.3%。較9月有所減少。與 CTK 類似,SA CTK與前一年同期比較%,較 2019 年 10 月下降 6.1%。

由於已開發國家通膨率高、全球貨物和服務流動放緩、烏克蘭持續戰爭以及美國異常堅挺,航空貨運業的狀況在2022年10月持續。所有這些因素都給航空貨運成長帶來下行壓力。歷史上,新出口訂單一直是航空貨運的領先指標,但仍然疲軟。全球 PMI 仍低於 50 臨界線,顯示全球平均持續收縮。中國和韓國2022年10月錄得新出口訂單,略高於2022年9月,但仍低於50。其他主要國家均維持下降趨勢。尤其是德國,自 3 月以來一直穩定在 50 以下,這表明東歐戰爭對經濟的影響仍在持續。

與 9 月相比,以有效貨運噸公里 (ACTK) 衡量的全行業航空貨運能力增加了 2%。 10 月份行業貨運載運率 (CLF) 為-7.4%,低於 9 月份的-7.0%。與 2021 年 10 月相比,該行業的 SA ACTK 大致保持在同一水平。拉丁美洲實現了 SA ACTK 最高的與前一年同期比較成長 20.3%。其次是北美,與前一年同期比較成長了 3%,中東則成長了 1.1%。相較之下,今年10月份SA ACTK與前一年同期比較負成長的地區是非洲(-7.5%)、歐洲(-5%)和亞太地區(-2.1%)。

航空貨運市場趨勢

電子商務的成長推動市場

預計未來五年全球電子商務將成長 14%。這對航空貨運業來說是一個絕佳的機會,由於中美關稅戰,航空貨運業經歷了十年來最糟糕的一年。全球電子商務產業佔航空貨運業務總量的16%,預計將從2022年的3.5兆美元成長到2025年的7兆美元。

一些全球通訊業者正在努力搶佔宅配市場的更大佔有率,該市場由亞馬遜、阿里巴巴和京東等網路購物巨頭主導。總部位於杜拜的阿拉伯聯合大公國航空推出了“Emirates Delivers”,漢莎航空推出了 Hayday,英國航空的母公司 IAG 推出了 Zenda。不過,國際航空運輸協會指出,儘管出現這種下降,11月的表現仍是八個月來的最高水平,也是自2019年3月以來與前一年同期比較減。

航空貨運業處於有利位置,可以充分利用電子商務的成長。空運是為了處理電子商務而建立的,大約80%的企業對消費者跨境電子商務是透過航空運輸的。對於電子設備,空運是首選的運輸方式,因為與較昂貴的物品相比,空運的體積和噸位相對較低。

因此,隨著網路購物增加了全球對小包裹遞送服務的需求,電子商務預計將推動航空貨運業的發展。空運滿足客戶需求,快速、有效率、可靠地交付貨物。快速成長的跨境電商市場以及大大小小的電子零售商不斷增加的國內貨運量正在推動全球航空貨運市場的成長。

亞太地區航空貨運的最大貢獻者

儘管由於許多亞太國家實行旅行限制,導致航空業因COVID-19感染疾病而放緩,但航空貨運需求仍然相對強勁。然而,由於不確定性加劇和失業率上升,供應鏈中斷、商業和消費者信心下降,對航空貨運業務產生了負面影響。

亞太航空協會(AAPA)表示,航空貨運業正積極努力運輸重要的醫療設備和用品。許多亞太國家鼓勵多家航空公司將客機暫時改裝為航空貨運。標準客機ATR72-600只能運載1.7噸的貨物,但改裝後的貨機模型可以運載高達8噸的貨物,適合太平洋島國當地的需求和營運條件。

2022年,韓國在亞太航空貨運市場佔有率中佔據第四位。韓國擁有世界上最重要的航空貨運業之一。當客運崩壞減少可用運輸空間時,它受益於強勁的需求。該航空公司在聲明中表示,貨運銷售受到該航空公司提高貨機機隊利用率和利用閒置客機進行運輸的策略的支持。韓國最大的兩家航空公司大韓航空和韓亞航空利用貨運需求激增抵銷旅客數量下降的機會,2021年營業收益大幅增加。

隨著對COVID-19感染疾病套件和汽車零件的需求增加,海運需求轉向空運,空運銷售增加。因此,這將促使韓國航空貨運市場顯著成長。此外,大韓航空希望在 2022 年 6 月過渡到空中巴士和波音公司近幾個月宣布的新型寬體貨機,以滿足持續高漲的貨運需求。此外,由於長期貨運需求強勁,空中巴士去年於2021年投入使用A350貨機,波音於2022年1月推出777X貨機。因此,貨運服務飛機數量的增加將在預測期內推動亞太航空貨運市場的發展。

航空貨運業概況

航空貨運市場集中度適度,國際知名企業雲集。大多數服務供應商提供捆綁解決方案,例如包裝、標籤、文件、包機服務和貨運代理。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析調查方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 價值鏈/供應鏈分析

- 科技趨勢

- 投資場景

- 政府法規和舉措

- 焦點 - 空運運輸成本/運費

- 電商產業洞察

- COVID-19 對航空貨運市場的影響

第5章市場動態

- 促進因素

- 航空貨運能力的需求增加

- 電子商務的興起

- 抑制因素

- 貨物限制

- 機會

- 整合人工智慧和自動化

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第6章市場區隔

- 依服務

- 航空

- 郵政

- 其他服務

- 目的地

- 國內的

- 國際的

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 荷蘭

- 英國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 印度

- 新加坡

- 馬來西亞

- 印尼

- 韓國

- 其他亞太地區

- 中東和非洲

- 南非

- 埃及

- 海灣合作理事會國家

- 其他中東和非洲

- 南美洲

- 巴西

- 智利

- 南美洲其他地區

- 北美洲

第7章 競爭形勢

- 市場集中度概況

- 公司簡介

- DHL Supply Chain &Global Forwarding

- Kuehne+Nagel

- DB Schenker Logistics

- DSV Panalpina

- UPS Supply Chain Solutions

- Expeditors International

- Nippon Express

- Bollore Logistics

- Hellmann Worldwide Logistics

- Kintetsu World Express*

第8章市場機會及未來趨勢

第9章 附錄

The Air Freight Forwarding Market size is estimated at USD 110.91 billion in 2024, and is expected to reach USD 147.35 billion by 2029, growing at a CAGR of 4% during the forecast period (2024-2029).

Although land and ship cargo transportation remain outstanding options, goods transport by air is considered the quickest and unhindered mode. Global air cargo demand, measured by cargo tonne-kilometers (CTKs), was 21.1 billion in October, increasing by 3.5% month-on-month (MoM). However, industry CTKs fell by 13.6% YoY compared to the same month in 2022 and were also 6.2% lower than the pre-pandemic levels in 2019. Seasonally adjusted (SA) air cargo demand softened slightly in October 2022, with a 2.3% MoM decline compared with September. Similar to the CTKs, SA CTKs contracted by 13.1% YoY and were 6.1% lower than in October 2019.

The air cargo industry persisted in October 2022, including high inflation rates in advanced economies, weak performance in the global flows of goods and services, the ongoing war in Ukraine, and the unusual strength of the US dollar. All of these factors put downward pressure on air cargo growth. The new export orders, historically a leading indicator for air cargo shipments, were still not buoyant. The global PMI remains below the critical 50 lines, suggesting continued contraction on average globally. China and Korea registered slightly higher new export orders in October 2022 than in September 2022, although they remained below 50. Other significant economies maintained a downward trend. Notably, Germany moved sideways at levels below 50 since March, signaling the continuous impact on the economy of the war in Eastern Europe.

Industry-wide air cargo capacity, measured by available cargo tonne-kilometers (ACTKs), increased by 2% compared with September. It produced an industry cargo load factor (CLF) of -7.4% in October, down from -7.0% in September. Industry SA ACTKs remained at about the same level compared with October 2021. Latin America achieved the highest YoY growth in SA ACTKs, at 20.3%. North America follows this with 3% YoY and the Middle East with 1.1% on the same basis. In comparison, regions that saw negative YoY growth in SA ACTKs this October were Africa (-7.5%), Europe (-5%), and Asia Pacific (-2.1%).

Air Freight Forwarding Market Trends

The increase in E-Commerce is driving the Market

E-commerce is forecast to grow 14% globally over the next five years. It creates an excellent opportunity for the air cargo industry, which witnessed its worst year in a decade due to the US-China tariff war. The global e-commerce industry, which makes up 16% of the total air cargo business, is projected to increase from USD 3.5 trillion in goods in 2022 to USD 7 trillion by 2025.

Some global carriers are working to gain a more significant share of the door-to-door delivery market that online shopping giants such as Amazon, Alibaba, and JD.com dominate. Dubai-based Emirates launched Emirates Delivers, Lufthansa includes Heyday, and British Airways parent IAG includes Zenda. However, IATA pointed out that despite this decline, November's performance was the best in eight months, with the slowest year-on-year rate of contraction recorded since March 2019.

The air cargo industry is well-positioned to capitalize on the growth in e-commerce. Air cargo is built to handle e-commerce, and approximately 80% of business-to-consumer cross-border e-commerce is transported by air. Air cargo is the preferred way of shipment for electronics due to the relatively small volume or tonnage compared to high value.

Thus, e-commerce is expected to fuel the air cargo industry, as online shopping boosts the demand for parcel delivery services across the globe. Air cargo can serve customers' needs and deliver goods with speed, efficiency, and reliability. The fast-growing cross-border e-commerce market and the rising domestic volumes sent by large and small e-retailers are driving growth in the global air cargo market.

APAC Largest Contributor to Air Freight

Irrespective of a downfall in the airline sector during the COVID-19 pandemic due to travel restrictions imposed in many Asian-Pacific countries, air cargo demand held up relatively well. However, supply chain disruptions and weakening business and consumer confidence due to increased uncertainties and rising unemployment adversely affected the air cargo businesses.

The Association of Asia-Pacific Airlines (AAPA) states that the air cargo sector is active in transporting essential medical equipment and supplies. Many Asian-Pacific countries encouraged several airlines to modify their passenger aircraft for air freight transport temporarily. While a standard passenger ATR72-600 can only carry 1.7 metric tons of cargo, its freighter-modified model can carry up to 8 metric tons, making it suitable for Pacific Island countries, given the region's demand and operating conditions.

South Korea accounted for the fourth-largest market share in the Asia-Pacific air cargo market share in 2022. South Korea includes one of the world's most significant air cargo carrier industries. It benefitted from strong demand when the collapse of passenger traffic reduced available transport space. Cargo sales were underpinned by the airline's strategy to increase the cargo plane operation rate and utilize idle passenger planes for transport, the airline said in a statement. Korean Air and Asiana Airlines, South Korea's two largest airlines, increased their operational earnings significantly in 2021, harnessing surging demand for cargo transport to help offset low passenger traffic.

The need for COVID-19 diagnostic kits and auto parts increased, and the sea cargo demand transferred to air transport, driving air cargo sales. Therefore, this leads to significant air cargo market growth in South Korea. Further, in June 2022, as Korean Air continues to position itself for high cargo demand, it is considering a move for the new wide-body freighters released by Airbus and Boeing in recent months. Long-term strong cargo demand also prompted Airbus to launch its A350 freighter last year in 2021 and Boeing its 777X freighter in January 2022. Thus, increasing the number of aircraft in cargo service will boost the Asia-Pacific air cargo market during the forecast period.

Air Freight Forwarding Industry Overview

The Air Freight Forwarding Market is moderately concentrated with the presence of prominent international players. Most service providers offer bundled solutions, such as packaging, labeling, documentation, charter services, and freight transportation. Some of the existing major players in the market include - DHL Supply Chain & Global Forwarding, Kuehne + Nagel, DB Schenker Logistics, DSV Panalpina, UPS Supply Chain Solutions, Expeditors International, Nippon Express, Bollore Logistics, Hellmann Worldwide Logistics, and Kintetsu World Express.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Technological Trends

- 4.4 Investment Scenarios

- 4.5 Government Regulations and Initiatives

- 4.6 Spotlight - Air Freight Transportation Costs/Freight Rates

- 4.7 Insights on the E-commerce Industry

- 4.8 Impact of Covid-19 on Air Freight Forwarding Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increase in the demand for the Air Cargo Capacity

- 5.1.2 The Rise of E-commerce

- 5.2 Restraints

- 5.2.1 Cargo Restrictions

- 5.3 Opportunities

- 5.3.1 AI and Automation Integration

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Airlines

- 6.1.2 Mail

- 6.1.3 Other services

- 6.2 By Destination

- 6.2.1 Domestic

- 6.2.2 International

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Netherlands

- 6.3.2.4 United Kingdom

- 6.3.2.5 Italy

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Australia

- 6.3.3.4 India

- 6.3.3.5 Singapore

- 6.3.3.6 Malaysia

- 6.3.3.7 Indonesia

- 6.3.3.8 South Korea

- 6.3.3.9 Rest of Asia-Pacific

- 6.3.4 Middle East & Africa

- 6.3.4.1 South Africa

- 6.3.4.2 Egypt

- 6.3.4.3 GCC Countries

- 6.3.4.4 Rest of Middle East & Africa

- 6.3.5 South America

- 6.3.5.1 Brazil

- 6.3.5.2 Chile

- 6.3.5.3 Rest of South America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL Supply Chain & Global Forwarding

- 7.2.2 Kuehne + Nagel

- 7.2.3 DB Schenker Logistics

- 7.2.4 DSV Panalpina

- 7.2.5 UPS Supply Chain Solutions

- 7.2.6 Expeditors International

- 7.2.7 Nippon Express

- 7.2.8 Bollore Logistics

- 7.2.9 Hellmann Worldwide Logistics

- 7.2.10 Kintetsu World Express*