|

市場調查報告書

商品編碼

1435900

壬基酚聚氧乙烯醚:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Nonylphenol Ethoxylate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

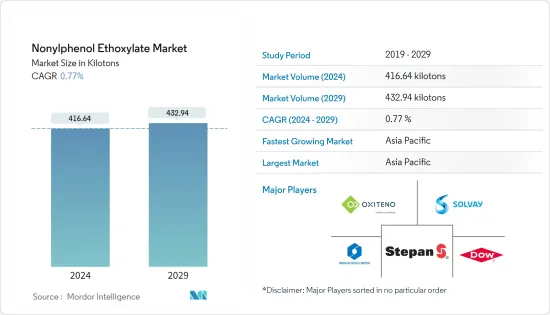

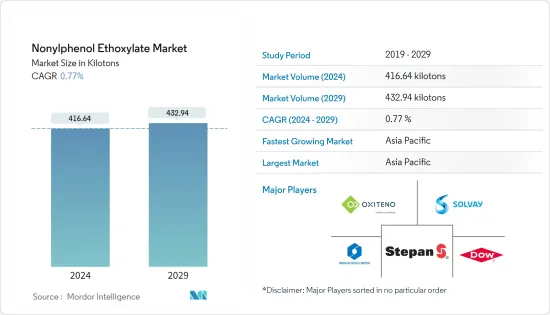

壬基酚聚氧乙烯醚的市場規模預計到2024年為416,640噸,預計到2029年將達到432,940噸,預測期間(2024-2029年)複合年成長率為0.77%。

新型冠狀病毒感染疾病(COVID-19)的爆發導致世界各地的國家封鎖,擾亂了製造活動和供應鏈,並導致生產停止,這對 2020 年的市場產生了負面影響。然而,情況在2021年開始好轉,恢復了市場的成長軌跡。

主要亮點

- 工業清洗產品需求的成長和其他最終用戶應用需求的成長預計將在預測期內推動市場發展。

- 相反,惡劣的環境條件預計將阻礙市場成長。

- 對個人保健產品的需求不斷成長預計將為所研究的市場提供利潤豐厚的機會。

- 亞太地區主導全球市場,最大的消費來自中國和印度等國家。

壬基酚聚氧乙烯醚市場趨勢

工業清洗劑需求不斷成長

- 壬基酚聚氧乙烯醚是一種低泡、非離子清潔劑,具有優異的潤濕劑、分散劑、增溶劑和乳化劑等性能。

- 歐盟已禁止在洗衣中使用壬基酚聚氧乙烯醚,因為它在環境中分解並轉化為壬基酚,對水生生物和人類生命有毒。美國環保署制定了指導方針,並允許對產品中的壬基酚聚氧乙烯醚設定一定的濃度限制。這些決定可能會阻礙預測期內壬基酚聚氧乙烯醚的成長。

- 在亞太地區,中國和印度是界面活性劑的最大消費國,這些國家可能在預測期內繼續保持其主導地位。中國合成清潔劑生產主要集中在廣東、浙江、四川三省,2022年產能分別為325萬噸、115萬噸、109萬噸。但由於中國嚴格的環保政策,國家對國內合成清潔劑市場進行了限制。

- 德國化妝品、洗護用品、香水和清潔劑協會(IKW)的資料顯示,洗衣精和清潔產品的收益將從2021 年的50.9 億歐元(55.6 億美元)增至51 億歐元(55 億美元),即8000 萬美元)。德國洗衣精和清潔產品的收益多年來一直在逐漸成長。然而,肥皂和合成清潔劑的收益從2021年的5.02億歐元(5.492億美元)下降至2022年的4.62億歐元(5.0544億美元),導致虧損。

- 英國擁有活躍的肥皂和清潔劑製造市場。該行業以強大的產品創新而聞名,製造商競相維護消費者的興趣。據英國國家統計局稱,到2023年,英國透過生產肥皂和清潔劑以及清洗和拋光產品產生的收益預計將達到約61.3億美元。

- 由於所有這些因素,壬基酚聚氧乙烯醚市場可能在預測期內在全球範圍內成長。

亞太地區主導市場

- 由於中國和印度等國家的需求不斷增加,預計亞太地區將在預測期內主導壬基酚聚氧乙烯醚市場。

- 壬基酚聚氧乙烯醚具有優異的潤濕性能、低發泡和出色的清洗性能,使其適用於所有工業和機構清洗活動。

- 中國化學工業的產品是多種產品不可或缺的,包括肥皂、清潔劑、化妝品等。超過 60 家洗衣、護理和清洗產品製造商的存在凸顯了該行業的高度競爭性。此外,中國每100戶家庭約有98.7台洗衣機,清潔產品的消費族群也不斷擴大。中國家電製造商的崛起以及對平價產品的關注增加了洗衣機的使用範圍和對清潔劑的需求。

- 此外,印度也是世界上最大的肥皂生產國之一。該國人均香皂/沐浴皂消費量量約800公克。人均香皂/沐浴皂消費量量約800公克,顯示國內肥皂產品需求穩定。此外,家庭和個人保健部門約佔印度日常消費品市場50%的佔有率。 2022會計年度合成清潔劑中間體產量持續成長至78萬噸以上,顯示清潔劑產品的需求正在增加。因此,隨著印度清潔劑市場的擴大,作為界面活性劑製造原料的非苯基乙氧基化物的需求不斷增加。

- 此外,中國耕地面積約佔全球整體面積的7%,養活了全球22%的人口。該國是水稻、棉花、馬鈴薯等多種作物的最大生產國。因此,由於國家大規模的農業活動,對農藥的需求正在迅速增加。

- 根據印度工商聯合會(FICCI)關於化肥產業的報告,印度是世界第四大農藥生產國,被公認為是出口導向農藥生產的理想中心。報告進一步強調,印度是世界上最重要的農藥出口國之一,出口到四個主要國家:美國、日本、中國和巴西。

- 2022年中國紡織服飾業產值將再創出口新高峰,貿易順差將超過3,000億美元。中國海關總署資料顯示,2022年中國紡織品服飾出口總額與前一年同期比較增加2.5%。 2022年出口將連續第三年突破3,000億美元,中國仍是全球最大的紡織品服裝出口國。

- 根據紡織部統計,22與前一年同期比較印度紡織品服裝出口(包括手工藝品)為444億美元,較去年同期成長41%。印度佔全球紡織品和服裝貿易的4%佔有率。

- 上述因素,加上政府的支持,促使預測期內亞太地區壬基酚聚氧乙烯醚市場的需求增加。

壬基酚聚氧乙烯醚產業概況

全球壬基酚聚氧乙烯醚市場已部分整合,參與者佔據了主要市場佔有率。其中一些公司包括陶氏化學 (Dow)、索爾維 (Solvay)、India Glycols Limited、Stepan Company 和 Oxiteno。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 工業清洗劑需求不斷成長

- 其他最終用戶應用程式的需求增加

- 其他司機

- 抑制因素

- 惡劣的環境條件

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模(數量))

- 目的

- 工業清洗劑

- 畫

- 農藥

- 纖維

- 油和氣

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Dow

- India Glycols Limited

- Oxiteno

- Shree Vallabh Chemicals

- Shubh Industries

- Solvay

- Stepan Company

第7章市場機會與未來趨勢

- 個人保健產品需求不斷成長

- 其他機會

The Nonylphenol Ethoxylate Market size is estimated at 416.64 kilotons in 2024, and is expected to reach 432.94 kilotons by 2029, growing at a CAGR of 0.77% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- Growing demand for industrial cleaning agents and increasing demand from other end-user applications are expected to drive the market over the forecast period.

- Conversely, stringent environmental conditions are expected to hinder market growth.

- Growing demand for personal care products is expected to offer lucrative opportunities to the market studied.

- Asia-Pacific dominates the global market, with the largest consumption from countries such as China and India.

Nonylphenol Ethoxylate Market Trends

Growing Demand for the Industrial Cleaning Agents

- Nonylphenol ethoxylate is a low-foaming non-ionic detergent with excellent properties such as wetting, dispersants, solubilizers, and emulsifiers.

- European Union has banned the use of nonylphenol ethoxylates in the laundry as they break down into the environment into nonylphenols which are toxic to aquatic and human life. The United States Environmental Protection Agency has set guidelines and allows certain concentration limits for nonylphenol ethoxylates in their products. These decisions might hinder the growth of nonylphenol ethoxylates during the forecast period.

- In Asia-Pacific, China and India are the largest consumers of surfactants, and these countries are likely to continue their dominance during the forecast period. In China, the production of synthetic detergents is mainly concentrated in Guangdong, Zhejiang, and Sichuan, with an annual production capacity of 3.25 million tons, 1.15 million tons, and 1.09 million tons, respectively, in 2022. However, strict environmental policy in the country has been restricting the synthetic detergents market in the country.

- According to data from the German Cosmetic, Toiletry, Perfumery and Detergent Association (IKW), revenues from laundry detergents and cleaning products had grown to EUR 5.10 billion (USD 5.58 billion), compared to EUR 5.09 billion (USD 5.56 billion) in 2021. Revenue from laundry detergents and cleaning products in Germany has been increasing gradually yearly. However, the revenue from soaps and synthetic detergents incurred a loss in 2022 as the revenue fell from EUR 502 million (USD 549.20 million) in 2021 to EUR 462 million (USD 505.44 million) in 2022.

- In the United Kingdom, the country's soap and detergent manufacturing market is dynamic. The industry is known for strong product innovation, as the manufacturers compete to retain consumer interest. According to the Office for National Statistics, in the United Kingdom, the revenue generated through manufacturing soap and detergents and cleaning and polishing preparations is likely to reach about USD 6.13 billion by 2023.

- Owing to all these factors, the market for nonylphenol ethoxylate will likely grow worldwide during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for nonylphenol ethoxylate during the forecast period due to increased demand from countries like China and India.

- Nonylphenol ethoxylate offers excellent wetting, low-foaming, and superior cleaning properties and is suitable for all industrial and institutional cleaning activities.

- The output from the Chinese chemical industry is essential in various products, which include soaps, detergents, cosmetics, etc. The presence of over 60 washing, care, and cleaning agent manufacturers underscores this sector's competitive nature. Furthermore, with approximately 98.7 washing machines per one hundred households in China, there is a growing consumer base for cleaning products. The rise of Chinese household appliance producers and their focus on affordable products have increased access to washing machines, resulting in a higher demand for detergents.

- Moreover, India is one of the largest producers of soaps in the world. The per capita consumption of toilet/bathing soaps in the country is around 800 grams. The per capita consumption of toilet/bathing soaps, averaging around 800 grams, further indicates the country's steady demand for soap products. Additionally, the household and personal care segment accounts for around 50% share of the FMCG market in India. The consistent increase in the production of synthetic detergent intermediates to over 780 thousand metric tons in FY 2022 indicates the rising demand for detergent products. Consequently, the demand for nonphenyl ethoxylate as raw materials in surfactant production experiences growth alongside the expansion of the detergent market in India.

- Furthermore, China accounts for approximately 7% of the overall agricultural acreage globally, thus feeding 22% of the world's population. The country is the largest producer of various crops, including rice, cotton, potatoes, and others. Hence, agrochemical demand is rapidly increasing due to the country's large-scale agricultural activities.

- India is the fourth largest agrochemical producer in the world and is recognized as an ideal base for export-oriented agrochemical production, as per the Federation of Indian Chambers of Commerce and Industry (FICCI) report on the fertilizers sector. The report further highlights that India is one of the most important agrochemical exporters in the world, exporting to four major countries: the United States, Japan, China, and Brazil.

- The output value of China's textile and garment industry reached a new export peak in 2022, with a trade surplus of over USD 300 billion. According to data from the General Administration of Customs of China, the total value of China's textile and apparel exports in 2022 increased by 2.5% year-on-year. With exports exceeding USD 300 billion for the third consecutive year in 2022, China remains the world's largest exporter of textiles and apparel.

- According to the Ministry of Textiles, India's textile and apparel exports (including handicrafts) stood at USD 44.4 billion in FY22, a 41% increase YoY. India has a 4% share of the global trade in textiles and apparel.

- The factors mentioned above, coupled with government support, contribute to the increasing demand for the nonylphenol ethoxylate market in the Asia-Pacific during the forecast period.

Nonylphenol Ethoxylate Industry Overview

The global nonylphenol ethoxylate market is partially consolidated, with players accounting for a major share of the market. A few companies include Dow, Solvay, India Glycols Limited, Stepan Company, and Oxiteno.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand For the Industrial Cleaning Agents

- 4.1.2 Increasing Demand from Other End-user Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Conditions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Industrial Cleaning Agents

- 5.1.2 Paints

- 5.1.3 Agrochemicals

- 5.1.4 Textile

- 5.1.5 Oil and Gas

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow

- 6.4.2 India Glycols Limited

- 6.4.3 Oxiteno

- 6.4.4 Shree Vallabh Chemicals

- 6.4.5 Shubh Industries

- 6.4.6 Solvay

- 6.4.7 Stepan Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from Personal Care Products

- 7.2 Other Opportunities