|

市場調查報告書

商品編碼

1273357

水合肼市場 - 增長、趨勢和預測 (2023-2028)Hydrazine Hydrate Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計在預測期內,水合肼市場的複合年增長率將超過 4%。

2020 年,由於原材料短缺和供應鏈中斷,COVID-19 對行業增長產生了重大影響。 然而,製藥行業應用的激增推動了大流行後的行業增長。

主要亮點

- 推動市場增長的主要因素是對聚合劑和發泡劑的需求增加以及製藥行業的需求增加。

- 另一方面,由於水合肼具有致癌性和毒性,因此受到嚴格的監管,這阻礙了市場增長。

- 擴大水合肼在農化行業的應用有望為市場增長帶來各種機會。

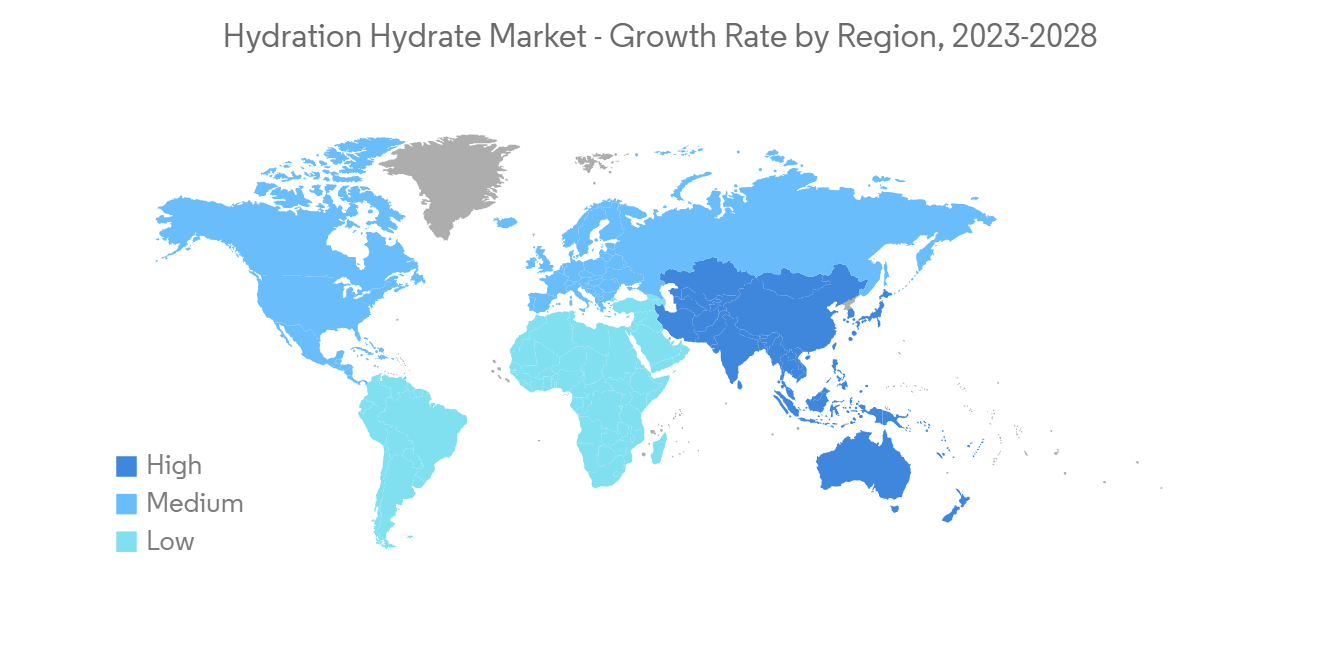

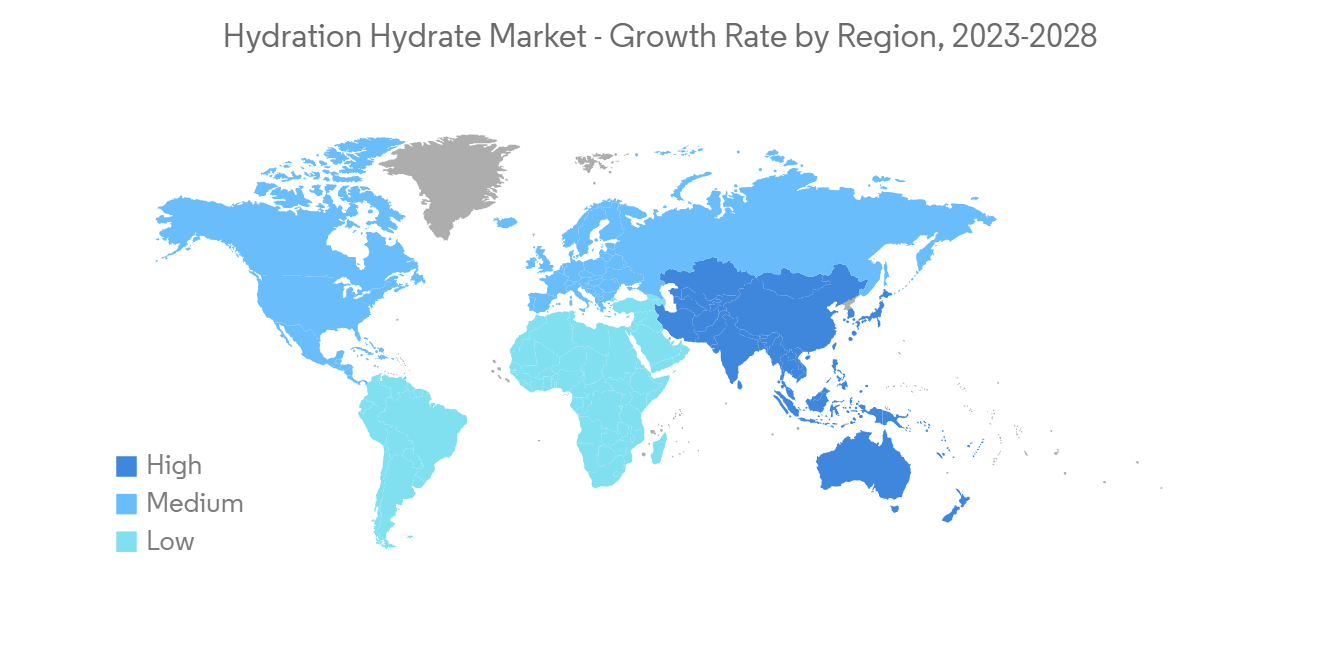

- 亞太地區主導著全球市場,其中中國、韓國和印度等國家/地區的消費量最高。

水合肼行情走勢

聚合和發泡劑領域的需求增加

- 水合肼是一種高活性且不穩定的無機化合物。 它是一種無色透明的化合物,有刺激性氣味。

- 在汽車、電子和鞋類等最終用戶行業的各種應用中,對聚合物產品的需求不斷增長,這增加了對水合肼的需求並推動了其市場的發展。

- 聚合物行業對聚合物泡沫的需求不斷增長,推動了水合肼市場的發展。 此外,水合肼用於生產橡膠和塑料化學品。

- 水合肼衍生物、偶氮二異丁腈和偶氮二甲酰胺用作聚合引髮劑和低溫發泡劑。 因此,高分子行業對水合肼的需求猛增,帶動了水合肼市場。

- 聚對苯二甲酸乙二醇酯(PET)、高密度聚乙烯(HDPE)、聚氯乙烯(PVC)、低密度聚乙烯(LDPE)、聚丙烯(PP)、聚苯乙烯/苯乙烯(PS)等主要用於周邊世界。聚合物的一部分是

- 到 2030 年,全球對聚對苯二甲酸乙二醇酯 (PET) 的需求量預計將達到 4200 萬噸,而聚對苯二甲酸乙二醇酯 (PET) 是與 PET 瓶最相關的熱塑性聚合物。

- 到 2021 年,全球塑料產量將達到約 3.91 億噸。 預計全球聚合物行業在預測期內將以超過5%的複合年增長率增長,這有望在預測期內增加對水合肼的需求並提振市場。 塑料行業的主要參與者包括埃克森美孚、中石化和利安德巴塞爾。

- 中國是世界上主要的塑料生產國和消費國。 2021年,中國將佔世界塑料材料總產量的32%左右。 此外,中國在全球塑料生產中的份額正在穩步增長。

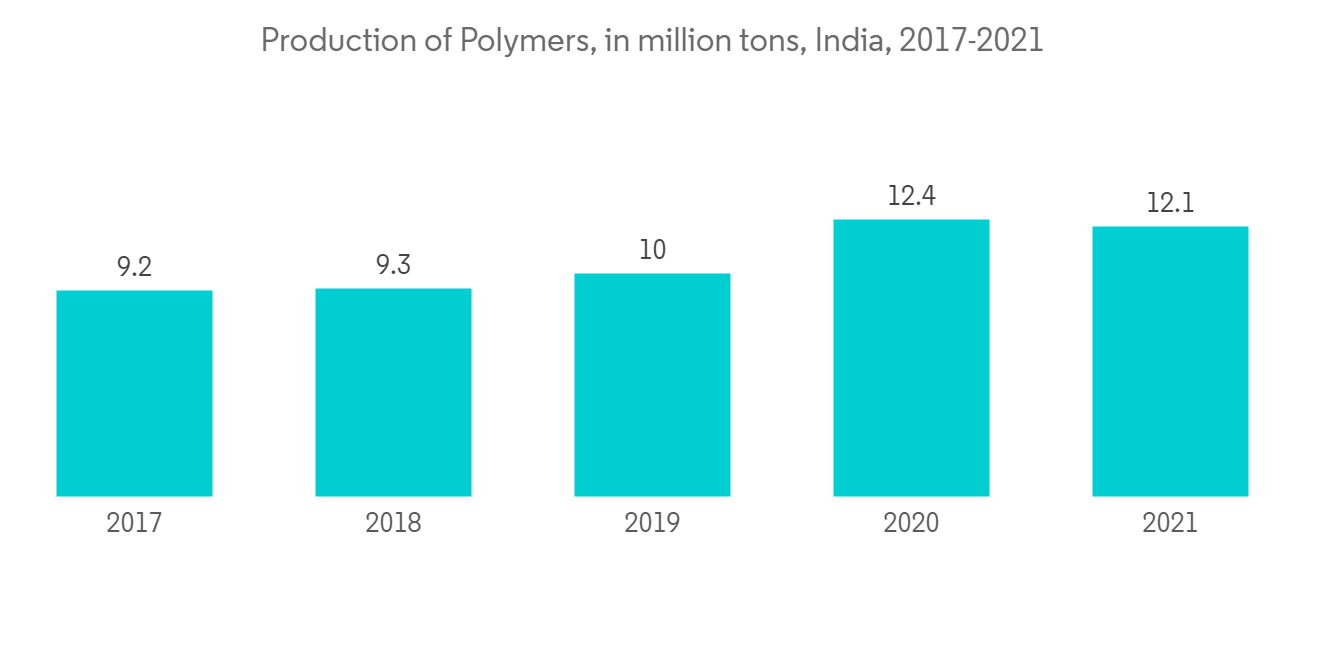

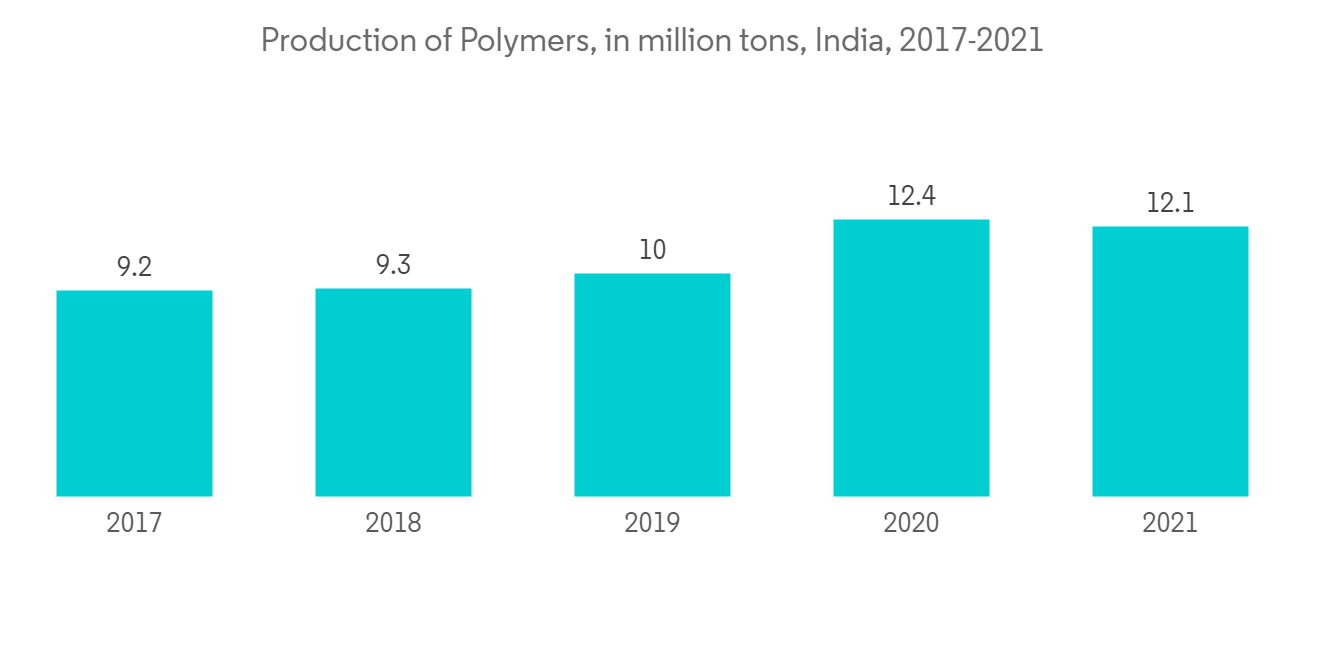

- 此外,印度還是最大的聚合物生產國之一。 到 2021 年,印度將生產超過 1210 萬噸聚合物。 汽車、消費品、電子產品和包裝等各種終端用戶行業對聚合物的需求激增預計將提振對聚合物的需求。

- 近年來,由於污染問題,人們越來越反對塑料,但塑料仍然是我們日常生活幾乎方方面面的一種非常重要的商品。 因此,塑料的需求量將持續增長,預計2050年產量將達到5.89億噸。

- 因此,由於水合肼的各種因素,預計水合肼市場在預測期內將快速增長。

亞太地區主導市場

- 肼衍生物用於製造除草劑、殺菌劑和植物生長調節劑。 根據新登記農藥統計,2021年殺菌劑19個佔48%,殺蟲劑11個佔27%,植物生長調節劑4個佔10%,除草劑6個佔15%。 2022年4月,中國生產化學農藥約2.29億噸。

- 在塑料工業中,肼衍生物用作發泡劑和聚合引髮劑。 這些衍生物也正在研究用於聚合物配方。

- 從 2000 年到 2022 年,全球高密度聚乙烯 (HDPE) 產能平均為每年 400 萬噸。 預計到2023年將增加到1200萬噸。 HDPE 在汽車和包裝行業中的使用越來越多,這將推動水合肼的消耗。

- 肼是一種高反應性雙功能分子,可以參與生成許多生物活性化合物的反應。 肼衍生物已被證明是多種藥物的活性成分,從鎮靜劑到結核病藥物。 基於肼的環系統,包括三秦、噠秦、三唑、塞二唑和吡唑,通常用於藥物中。

- 在水處理行業,聯氨有助於防止整個蒸汽發生設備(例如預熱器、鍋爐和冷凝器)發生腐蝕。 它還可以有效地用於閉式循環熱水供暖系統。

- 根據中央污染控制委員會發佈的最新報告(2021 年 3 月),印度目前的水處理能力為 27.3%,污水處理能力為 18.6%。 此外,根據印度政府 Jal Shakti 部的數據,在 2022 財年,能夠在現場獲得安全和充足飲用水的農村人口比例從 2021 財年的 55.23% 增加到 61.52%。

- 因此,預計這些趨勢將推動亞太地區水合肼的消費。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第 1 章介紹

- 調查先決條件

- 本次調查的範圍

第 2 章研究方法論

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 對聚合和發泡劑的需求不斷擴大

- 製藥領域的需求不斷擴大

- 抑制因素

- 嚴格監管水合肼

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 應用

- 醫藥

- 聚合/發泡劑

- 殺蟲劑

- 水處理

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第 6 章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%) 分析**/排名分析

- 主要公司採用的策略

- 公司簡介

- Anbros Consultants And Engineers

- Arkema Group

- Arrow Fine Chemicals

- Capot Chemical Co. Ltd

- HAIHANG INDUSTRY CO. LTD

- Hangzhou Dayangchem Co. Ltd

- Hunan Zhuzhou Chemical Industry Group

- Japan Finechem Inc.

- LANXESS

- Lonza

- Matrix Fine Chemicals GmbH

- NIPPON CARBIDE INDUSTRIES CO. INC.

- Otsuka-MGC Chemical Company Inc.

- Toronto Research Chemicals

- Weifang Yaxing Chemical Co. Ltd

- Yibin Tianyuan Group Co. Ltd

- ZEEL PRODUCT

第 7 章市場機會與未來趨勢

- 擴大在農化行業的應用

- 其他商業機會

簡介目錄

Product Code: 69367

The market for Hydrazine Hydrate is expected to register a CAGR of over 4% during the forecast period.

In 2020, COVID-19 highly impacted industry growth owing to the raw materials shortage and supply chain disruption. However, the surging application in the pharmaceutical industry propelled industry growth after the pandemic.

Key Highlights

- Major factors driving the market studied are increasing demand for polymerization, blowing agents, and growing demand from the pharmaceutical sector.

- On the flip side, stringent regulations imposed on hydrazine hydrate owing to its carcinogenic & toxic nature are the major restraints expected to hinder the market's growth.

- The growing application of hydrazine hydrate in the agrochemical industry is expected to offer various lucrative opportunities for market growth.

- Asia-Pacific dominated the global market with the largest consumption from countries such as China, South Korea, and India.

Hydrazine Hydrate Market Trends

Increasing Demand from Polymerization and Blowing Agents Segment

- Hydrazine hydrate is an inorganic compound that is highly reactive and unstable. It is a colorless compound with a pungent smell.

- The growing demand for polymer products in various applications in end-user industries such as automobiles, electronic gadgets, and footwear is increasing the hydrazine hydrate demand and propelling its market.

- The rising polymer foams demand in the polymer industry is driving the hydrazine hydrate market. Additionally, hydrazine hydrate is used to manufacture rubber and plastic chemicals.

- Derivatives of hydrazine hydrate, namely azobisisobutyronitrile, and azodicarbonamide, are used as polymerization initiators and low-temperature blowing agents. Due to this, there is a surge in hydrazine hydrate demand in the polymer industry which is propelling the hydration hydrate market.

- Polyethylene terephthalate (PET), high-density polyethylene (HDPE), polyvinyl chloride (PVC), low-density polyethylene (LDPE), polypropylene (PP), and polystyrene/styrofoam (PS) are some of the then majorly used polymers across the globe.

- The global demand for polyethylene terephthalate (PET), a thermoplastic polymer most associated with plastic bottles, is projected to reach 42 million metric tons by 2030.

- In 2021, the production of plastics amounted to around 391 million metric tons globally. The global polymer industry is expected to grow at a CAGR of over 5% during the forecast period, which would increase the demand for hydrazine hydrate and stimulate its market during the forecast period. Some of the key players within the plastics industry include ExxonMobil, Sinopec, and LyondellBasell.

- China is the leading producer and consumer of plastics across the globe. In 2021, China accounted for approximately 32% of the total global production of plastic materials. Moreover, China's share of global plastics production is growing steadily.

- Furthermore, India is also one of the largest producers of polymers. In 2021, over 12.1 million metric tons of polymers were produced across India. The surging demand for polymers in various end-user industries, including automotive, consumer goods, electronics, packaging, and others, will likely boost the demand for polymers.

- Despite the recent backlash against plastics due to pollution concerns, plastic remains a hugely important commodity in virtually all daily life. Thus, plastic demand is set to continue growing in the coming years, with production set to reach 589 million metric tons in 2050.

- Owing to all the above factors for hydrazine hydrate, its market is expected to grow rapidly over the forecast period.

Asia-Pacific to Dominate the Market

- Hydrazine derivatives are used in the manufacturing of herbicides and fungicides, as well as plant growth regulators. As per the statistics of newly registered pesticides, 19 fungicides accounted for 48%, 11 insecticides accounted for 27%, four plant growth regulators accounted for 10%, and six herbicides accounted for 15% in 2021. In April 2022, around 229 million metric tons of chemical pesticides were produced in China.

- The plastics industry uses hydrazine derivatives to create blowing agents and polymerization initiators. These derivatives are also being investigated for the formulation of polymers.

- Between 2000 and 2022, the global high-density polyethylene (HDPE) capacity was at an annual average of 4 million tons. It is expected to increase to 12 million tons in 2023. The rising application of HDPE in the automotive and packaging industries will boost the consumption of hydrazine hydrate.

- Hydrazine is a very reactive, difunctional molecule capable of entering into reactions leading to many biologically active compounds. Hydrazine derivatives have proven effective ingredients for several pharmaceuticals, from tranquilizers to the primary drug for controlling tuberculosis. Some ring systems based on hydrazine and frequently found in pharmaceuticals include triazine, pyridazine, triazole, thiadiazole, and pyrazole.

- In the water treatment industry, hydrazine can provide corrosion protection throughout the steam generating unit-in the preheater, boiler, or condensate systems. It can also be utilized effectively in closed circulating hot water heating systems.

- According to a recent report published by Central Pollution Control Board (March 2021), India's current water treatment capacity is 27.3%, and the sewage treatment capacity is 18.6%. Additionally, according to the Ministry of Jal Shakti of the Government of India, in FY 2022, the percentage of the rural population having access to safe and adequate drinking water within premises increased to 61.52% from 55.23% in FY2 021.

- Therefore, these trends above are expected to boost the consumption of hydrazine hydrate in the Asia Pacific region.

Hydrazine Hydrate Industry Overview

The hydrazine hydrate market is fragmented, with top players accounting for a marginal market share. Major companies in the market include Arkema Group, LANXESS, Lonza, Otsuka-MGC Chemical Company Inc., and Weifang Yaxing Chemical Co. Ltd., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Polymerization and Blowing Agents

- 4.1.2 Growing Demand from Pharmaceutical Sector

- 4.2 Restraints

- 4.2.1 Stringent Regulations Imposed on Hydrazine Hydrate

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Pharmaceuticals

- 5.1.2 Polymerization and Blowing Agents

- 5.1.3 Agrochemicals

- 5.1.4 Water Treatment

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anbros Consultants And Engineers

- 6.4.2 Arkema Group

- 6.4.3 Arrow Fine Chemicals

- 6.4.4 Capot Chemical Co. Ltd

- 6.4.5 HAIHANG INDUSTRY CO. LTD

- 6.4.6 Hangzhou Dayangchem Co. Ltd

- 6.4.7 Hunan Zhuzhou Chemical Industry Group

- 6.4.8 Japan Finechem Inc.

- 6.4.9 LANXESS

- 6.4.10 Lonza

- 6.4.11 Matrix Fine Chemicals GmbH

- 6.4.12 NIPPON CARBIDE INDUSTRIES CO. INC.

- 6.4.13 Otsuka-MGC Chemical Company Inc.

- 6.4.14 Toronto Research Chemicals

- 6.4.15 Weifang Yaxing Chemical Co. Ltd

- 6.4.16 Yibin Tianyuan Group Co. Ltd

- 6.4.17 ZEEL PRODUCT

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Agrochemical Industry

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219

![水合[月井]的全球市場](/sample/img/cover/42/1243401.png)