|

市場調查報告書

商品編碼

1273331

柔性泡沫市場增長、趨勢、COVID-19 的影響和預測 (2023-2028)Flexible Foam Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,軟質泡沫市場的複合年增長率預計將超過 7%。

隨著建築、家具和汽車行業的需求直線下降,COVID-19 衝擊了軟質泡沫塑料市場。 由於許多項目被擱置並且對家庭和辦公室家具的需求減少,建築業受到了封鎖。 然而,市場預計將在 2021 年加快步伐,並在預測期內以健康的速度增長。

主要亮點

- 包裝行業對軟質泡沫材料的需求不斷增長,這將是未來幾年推動市場研究的主要因素。 此外,使用軟質泡沫的地毯墊正在增加,預計研究目標市場的需求將擴大。

- 但是,柔性泡沫材料的昂貴製造工藝預計會減緩所研究市場的增長。

- 在預測期內,市場預計將受益於電動汽車坐墊需求的增加。

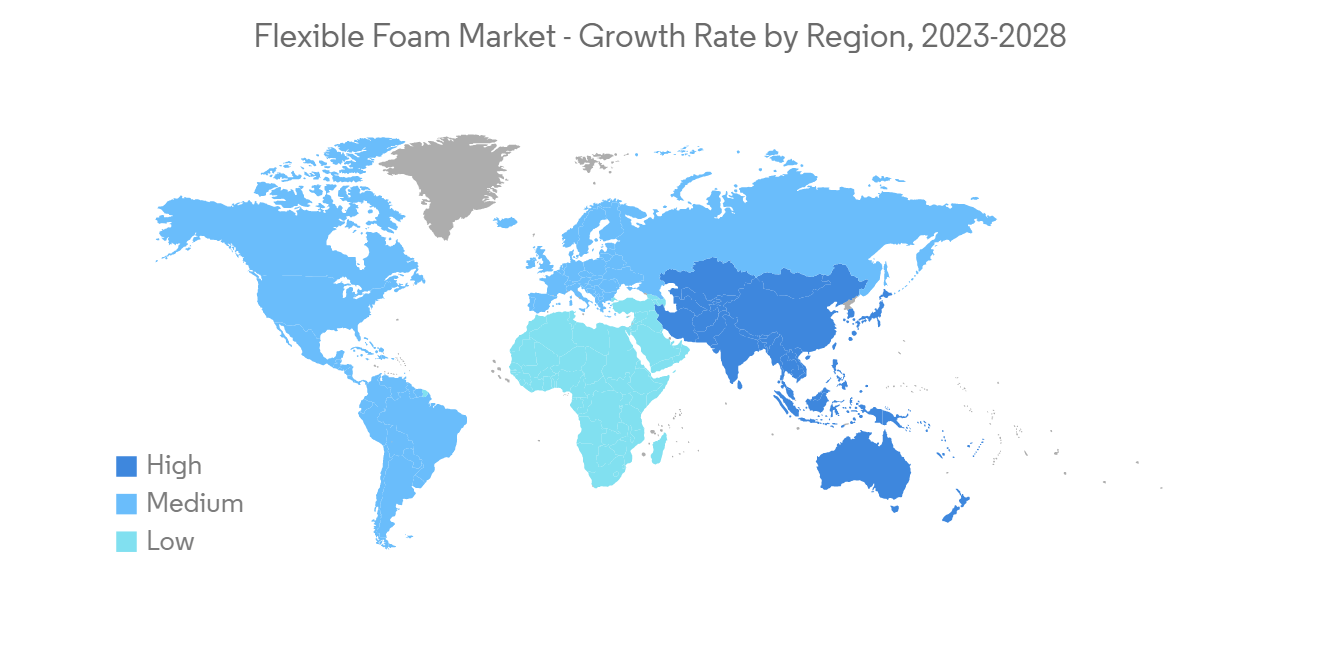

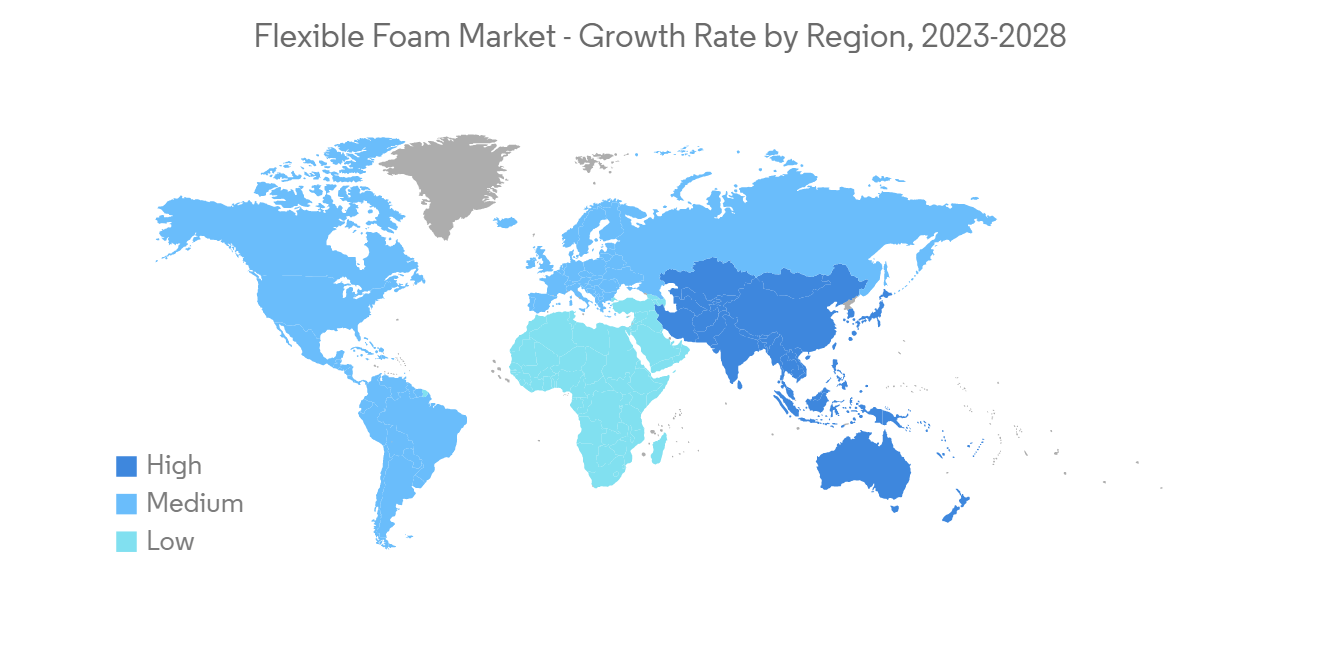

- 預計亞太地區將主導全球市場,其中中國、印度和日本等國家/地區的消費量最大。

軟質泡沫市場趨勢

家具行業對軟質泡沫的需求不斷擴大

- 軟質泡沫因其可靠性高而廣泛用於各種工業應用。 除了優異的性能外,原材料成本的降低是使用這些材料的主要優勢。

- 軟質泡沫作為結構材料用途廣泛,因此也可用於家具。 由於其重量輕、抗菌性能優異以及可以模製成各種形狀,因此被廣泛用於家具應用,例如兒童凳子、辦公室隔板和書架。

- 國際知名家居零售商宜家在其年度報告中表示,從 2021 年到 2022 年,年銷售額將增長近 6%,每筆銷售額達 419 億歐元(450 億美元),報告為 446 億歐元(612 億美元) .

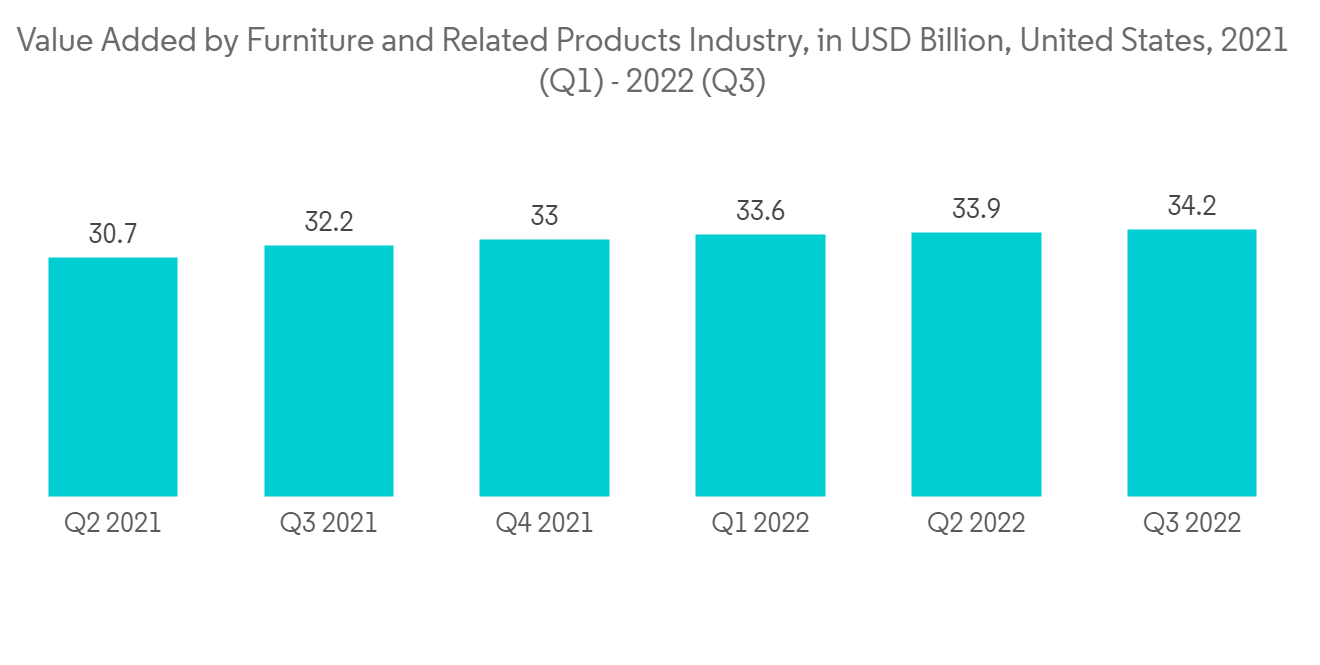

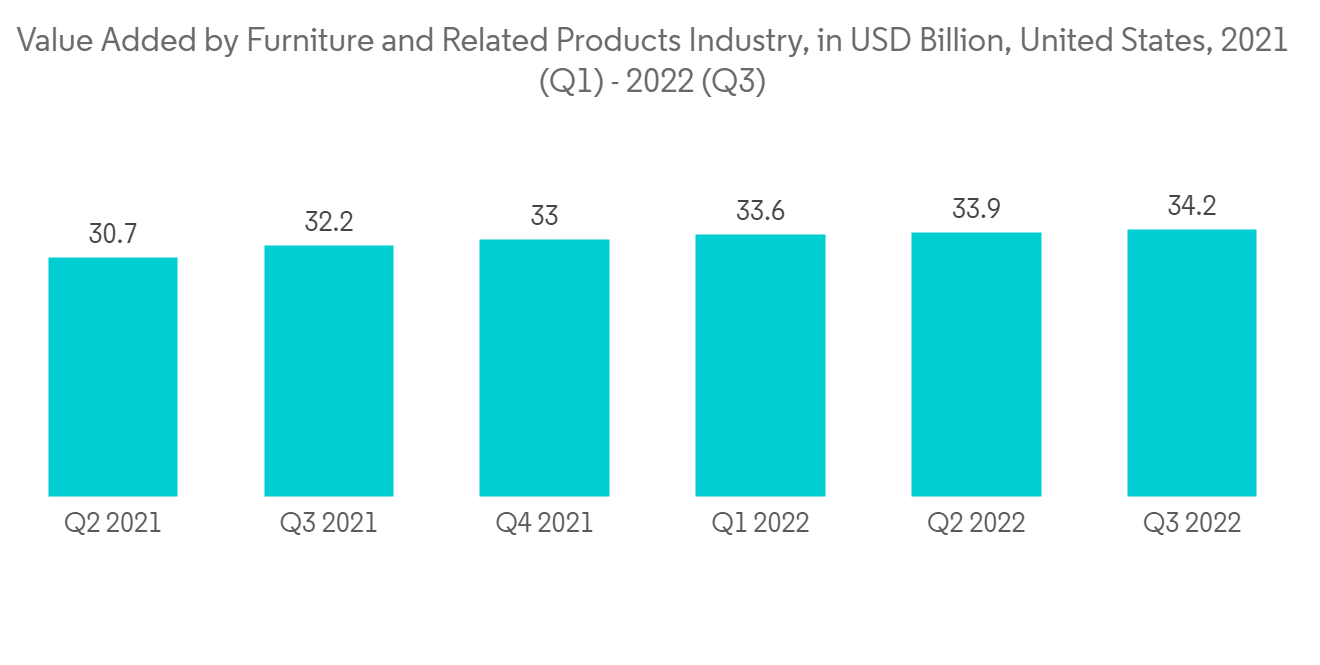

- 此外,經濟分析局估計,經季節性調整後,美國家具及相關產品行業在 2022 年第三季度的貢獻約為 340 億美元,比去年同期高出約 6%去年同期的貢獻。2022年第一季度至第三季度,家具及相關產品行業增加值約為1017億美元。

- 此外,根據國家統計局的數據,英國家庭在 2021 年購買了約 245 億英鎊(約合 337 億美元)的家具和家具,而上一年為 241.3 億英鎊。超過英鎊(約合 33.05億美元)。

- 基於上述因素,預計在預測期內,軟質泡沫材料作為替代品在家具行業中的應用將佔據主導地位。

亞太地區主導市場

- 未來幾年,軟質泡沫塑料市場預計將由亞太地區推動。 市場增長預計將受到該地區許多終端用戶行業(如家具、包裝、消費品和汽車)產品需求增加的影響。

- 軟質泡沫是一種流行的聚氨酯泡沫,它重量輕、耐用,並且可以模塑成各種形狀。 它通常用於提高汽車的舒適度和在家中用作絕緣材料。

- 中國是世界上汽車零部件製造和使用數量最多的國家,預計對軟質泡沫的需求量最大。 據中國汽車工業協會預測,2022年中國汽車產量同比增長3.4%,高於2021年的2608萬輛,達到2700萬輛左右。

- 此外,隨著日本汽車工業的發展,各種汽車製造商都擴大了在日本的生產能力。 根據日本汽車經銷商協會 (JADA) 的數據,到 2022 年,豐田將成為日本最大的汽車製造商,銷量約為 125 萬輛,其次是鈴木,銷量超過 60 萬輛。 因此,軟質泡沫作為緩衝材料的需求不斷增加,市場有望擴大。

- 隨著中國人口的不斷增長,家庭和辦公室需要家具,並且預計將佔世界家具的很大一部分。 根據中國國家統計局的數據,2022 年 12 月中國家具零售額約為 174 億元人民幣(25 億美元)。 然而,這相當於比去年同期下降了 5.8%。 但是,與 2022 年 11 月的銷售額相比,銷售額增長了 3%。

- 此外,根據總務省統計局和經濟產業省的一項調查,2021年日本家具和室內裝飾批發業的銷售額將達到約4.5萬億日元( 410.6億美元),預計2010年這一數字將上升,首次創下最高水平。

- 因此,預計亞太地區的軟質泡沫材料市場在研究期間將顯著增長。 這是因為許多行業都在增長。

軟泡行業概覽

軟質泡沫塑料市場部分分散,只有少數大型企業主導著市場。 主要公司包括 BASF SE、Rogers Corporation、Huntsman International LLC、Inoac Corporation 和 Recticel NV/SA(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 動力

- 包裝中對軟質泡沫的需求不斷擴大

- 對地毯墊中軟質泡沫的需求不斷擴大

- 其他動力

- 約束因素

- 製造過程中的環境惡化

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原材料分析

第 5 章市場細分

- 類型

- 聚氨酯

- 滌綸

- 聚醚

- 聚乙烯

- 橋接類型

- 非交聯

- 聚丙烯

- 聚氨酯

- 用法

- 建築領域

- 消費品

- 家具

- 運輸設備

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%) 分析/市場排名分析

- 主要公司採用的策略

- 公司簡介

- American Excelsior Company

- BASF SE

- Carpenter Co.

- Changzhou Xingang Plastic Products Co., Ltd.

- Covestro AG

- Dow

- Greiner AG

- Huntsman International LLC

- Inoac Corporation

- KANEKA CORPORATION

- ORSA foam SpA

- Recticel NV/SA

- Rogers Corporation

- SEKISUI CHEMICAL CO., LTD.

- Sheela Foam Ltd

- Wm. T. Burnett & Co.

- Woodbridge

第七章市場機會與未來趨勢

- 電動汽車領域對軟墊座椅的需求增加

- 其他市場機會

The flexible foam market is projected to register a CAGR of over 7% during the forecast period.

COVID-19 hurt the market for flexible foam because there was a big drop in demand from the construction, furniture, and auto industries.The lockdown hurt the building industry because many projects were put on hold, which led to less demand for furniture in homes and offices.However, the market gained pace in 2021 and is expected to grow at a healthy rate during the forecast period.

Key Highlights

- The packaging industry's growing need for flexible foam material is the main thing that will drive the market studied over the next few years.Also, more carpet cushions are being made with flexible foam, which is expected to increase demand for the market studied.

- But the process of making flexible foam materials, which is expensive, is likely to slow the growth of the market studied.

- During the time frame of the forecast, the market is likely to benefit from the growing demand for cushion seats in electric vehicles.

- The Asia-Pacific region is expected to dominate the market globally, with the most consumption coming from countries such as China, India, and Japan.

Flexible Foam Market Trends

Growing Demand for Flexible Foam in Furniture Industry

- Flexible foam is widely used in various industrial applications, due to its reliability in the sector. Apart from the excellent properties, the reduction of the cost of raw materials is a significant advantage in using these materials.

- Flexible foam is used in furniture applications, owing to the versatility of the product as a structural material. Some of the characteristics of flexible foam, such as being lightweight, anti-microbial, and its ability to mold into a wide range of shapes, makes it usable in a wide range of furniture applications, such as child stools, office wall partition, and bookshelves.

- IKEA, a well-known international retailer of home furnishings, reported in its annual report that its yearly revenue climbed by almost 6% between 2021 and 2022, when its sales were EUR 41.9 billion (USD 45 billion) and EUR 44.6 billion (USD 61.2 billion), respectively.

- The Bureau of Economic Analysis also estimated that the value contributed by the furniture and related products industry in the third quarter of 2022 in the United States was about USD 34 billion at a seasonally adjusted rate, or about 6% greater than the value added for the same time period the previous year. Over the first three quarters of 2022, the value added by the furniture and related products industry was roughly USD 101.7 billion.

- Moreover, according to Office for National Statistics (UK), In 2021, United Kingdom households purchased approximately GBP 24.5 billion (~USD 33.7 billion) worth of furniture and furnishings, up from GBP 24.13 billion (~USD 33.05 billion) purchase registered a year earlier.

- Owing to the factors mentioned above, the application of flexible foam material as an alternative in the furniture industry is expected to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- Over the next few years, the flexible foam market is expected to be led by the Asia-Pacific region.Market growth is expected to be affected by the rise in demand for the product from the region's many end-user industries, such as furniture, packaging, consumer goods, and automotive.

- Flexible foam is a popular type of polyurethane foam that is lightweight, durable, and can be molded into many shapes. It is often used to make the inside of cars more comfortable and to insulate homes against heat loss.

- China, which makes and uses the most auto parts in the world, is expected to have the highest demand for flexible foam.The Chinese Association of Automobile Manufacturers says that China made 3.4% more cars in 2022 than it did the year before.In 2022, roughly 27 million vehicles were produced, up from 26.08 million units in 2021.

- Furthermore, with the growing automotive industry in Japan, various car manufacturers expanded their production capacity in the country. According to the Japan Automobile Dealers Association (JADA), Toyota will be the leading car manufacturer in Japan in 2022, selling around 1.25 million vehicles domestically, followed by Suzuki, which sold slightly over 600,000 vehicles domestically in the same year. This in turn would increase the need for flexible foam for cushioning, thus driving the market forward.

- Because of the country's growing population, China is predicted to have a huge fraction of the world's furniture business, owing to the need for furniture in residential areas, offices, and other locations. According to the National Bureau of Statistics of China, retail sales of furniture in China in December 2022 were roughly CNY 17.4 billion (USD 2.5 billion). This, though, amounted to a 5.8 percent decline in revenue compared to the same time the prior year. Nonetheless, a 3% rise in sales was noted when compared to the revenue generated in November 2022.

- Moreover, according to the Statistics Bureau of Japan and a survey conducted by the Ministry of Economy, Trade, and Industry of Japan, furniture and home furnishings sales in Japan's wholesale sector reached around JPY 4.5 trillion (USD 41.06 billion) in 2021, reaching a decade-high.

- Because of this, the market for flexible foam material in the Asia-Pacific region is expected to grow a lot during the study period. This is because many industries are growing.

Flexible Foam Industry Overview

The flexible foam market is partially fragmented, with only a few major players dominating the market. Some of the major companies are BASF SE, Rogers Corporation, Huntsman International LLC, Inoac Corporation, and Recticel NV/SA, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand of Flexible Foam in Packaging

- 4.1.2 Increasing Demand for Flexible Foam in Carpet Cushion

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Degradation while Fabrication

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyurethane

- 5.1.1.1 Polyester

- 5.1.1.2 Polyether

- 5.1.2 Polyethylene

- 5.1.2.1 Cross linked

- 5.1.2.2 Non-cross linked

- 5.1.3 Polypropylene

- 5.1.1 Polyurethane

- 5.2 Application

- 5.2.1 Construction

- 5.2.2 Consumer Goods

- 5.2.3 Furniture

- 5.2.4 Transportation

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Excelsior Company

- 6.4.2 BASF SE

- 6.4.3 Carpenter Co.

- 6.4.4 Changzhou Xingang Plastic Products Co., Ltd.

- 6.4.5 Covestro AG

- 6.4.6 Dow

- 6.4.7 Greiner AG

- 6.4.8 Huntsman International LLC

- 6.4.9 Inoac Corporation

- 6.4.10 KANEKA CORPORATION

- 6.4.11 ORSA foam SpA

- 6.4.12 Recticel NV/SA

- 6.4.13 Rogers Corporation

- 6.4.14 SEKISUI CHEMICAL CO., LTD.

- 6.4.15 Sheela Foam Ltd

- 6.4.16 Wm. T. Burnett & Co.

- 6.4.17 Woodbridge

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Cushion Seats in the Electric Vehicles Segment

- 7.2 Other Opportunities