|

市場調查報告書

商品編碼

1437500

汽車自動升降車門:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Automatic Liftgate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

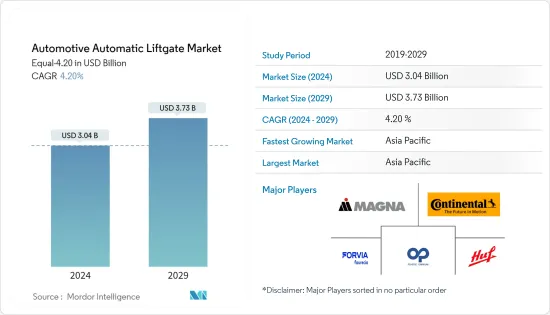

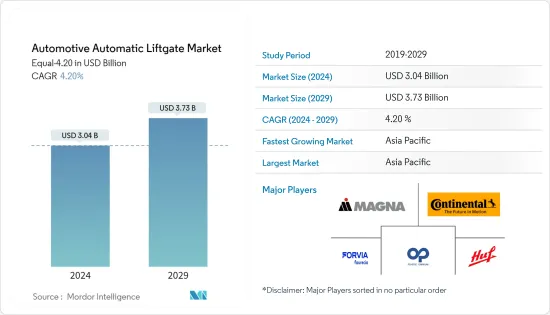

以Equal-4.20 計算的汽車自動升降車門市場規模預計將從2024 年的30.4 億美元成長到2029 年的37.3 億美元,預測期內(2024-2029 年)複合年成長率為4.20%,預計將成長到2029 年的37.3 億美元。 。

從中期來看,提高乘客舒適度是小客車外飾市場最重要的考量之一。組件必須需要最少的人力並提供最大的舒適度。因此,這方面得到了持續的發展。

消費者對汽車安全功能的趨勢不斷上升、技術進步不斷進步以及對豪華車的需求激增預計將在預測期內主要推動市場發展。

零件供應商正在加緊研究各種車輛外飾新技術,這些新技術具有多種新功能,可適應乘客和駕駛因素不斷變化的要求。這些尾門解決方案透過減輕車輛重量和改善燃油消費量來提高車輛效率。金屬化塗料進一步增強了這些特性,金屬化塗料可產生類似鉻的外觀,而不會增加使用金屬本身時會產生的額外重量。這種新的塗層技術比電鍍鉻便宜約 5-20%,總重量減輕了 10-20%。

動態也是尾門的一個重要方面。如今,在主動後擾流板和側擾流板的幫助下,尾門的空氣動力學性能得到了改善,可以更好地將空氣傳輸到車頂。新型尾門將風阻係數提高了3-4%,可減少二氧化碳排放1克/公里。

汽車自動升降車門市場趨勢

SUV推動市場成長

可能刺激汽車自動尾門產業需求的一個因素是今年SUV在小客車中的佔有率不斷增加。主要汽車OEM和外飾零件製造商正在花費數百萬美元用於未來汽車外飾的研發。

SUV區隔市場預計將維持較高的複合年成長率。小客車銷量的下降速度與 SUV 銷量的成長速度大致相同,因為該區隔市場的銷量增幅高於其他小客車區隔市場。

SUV 興起的原因包括彈性、貨物容量、機動性、駕駛座椅視野良好以及易於進入乘客艙。大多數現代 SUV 屬於跨界車類別,它們是更大、更圓潤的車輛,而不是美國基於皮卡車的運動公共事業車。

SUV 變得越來越受歡迎,因為它們比掀背車或轎車提供更多的空間和舒適度。大多數SUV都有混合版本,電動版本也越來越受歡迎。這是因為SUV對於注重環保駕駛的駕駛者來說也是一個不錯的選擇。許多最新車型都提供混合和全電動式選項。

消費者現在了解其車輛的剩餘價值、品質融資費用、可用性、支付的價格,在某些情況下,也了解交易結束時賣方的報酬率。這種認可改變了動態,並允許客戶利用他們的見解,從而增加選擇電動運動休旅車的可能性。考慮到 Majo 地區購買二手 SUV 的人群中二手車種類繁多,該市場在預測期內可能會大幅成長。

隨著全球範圍內的上述發展,未來幾年對 SUV 的需求可能會增加,預計市場在預測期內將大幅成長。

亞太地區可望引領市場

亞太地區是世界主要汽車生產國之一。中國、印度和日本是該地區市場的主要經濟體,預計也將影響全球市場。儘管受新能源車款影響,整體汽車銷售市場情緒疲軟,但2022年各地區汽車銷售仍呈現穩定成長軌跡。

該地區是許多全球和本地汽車製造商和層級參與者的關鍵市場,汽車外飾零件製造商與OEM製造商合作,為未來車輛開發下一代舉升式車門。

中國在汽車工業吞吐量和汽車產量方面在亞太地區佔據主導地位。該地區是主要OEM、汽車供應商和汽車零件製造商的所在地,在全球範圍內保持穩定的供應。 2022年中國汽車銷售總量為26,863,745輛,與前一年同期比較%。

車輛排放氣體水準的上升和對環保車輛的需求增加預計將在預測期內推動市場擴張。該全部區域對電動車不斷成長的需求可能會在未來幾年為市場創造利潤豐厚的機會。

印度公司正在進行研發活動,以開發新產品,這將對預測期內目標市場的成長產生正面影響。例如,

2022年8月,印度最大汽車製造商馬魯蒂鈴木宣布將於年終推出首款電動車。

由於汽車安全性和舒適性的提高而促使汽車銷量增加,預計未來幾年對自動尾門的需求將會增加。

汽車自動尾門產業概況

幾家主要企業主導著汽車自動尾門市場,包括麥格納國際公司、佛吉亞公司、彼歐公司和大陸集團。先進技術、感測器使用的增加、研發計劃投資的增加以及電動車市場的成長等因素正在顯著推動市場發展。為了給車主提供更便利的體驗,領先的汽車自動尾門製造商正在開發新技術,以實現更輕、更方便的尾門。例如,

2023 年 10 月,塔塔汽車有限公司在印度推出了塔塔 Harrier Facelift。新車型配備了電動尾門。透過此次發布,該公司增強了即將推出的車型的安全性和舒適性。

2023 年 10 月,義法半導體宣布推出一款新型汽車電源管理 IC,可簡化各種組件的車身控制器設計。

2022年3月,吉普印度推出了專為印度市場開發的全新三排SUV Meridian SUV。新車型配備了電動尾門。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 豪華車銷售增加

- 市場限制因素

- 與系統相關的高成本

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間敵對的強度

第5章市場區隔(以以金額為準的市場規模-美元)

- 依車型

- 掀背車

- SUV

- 轎車

- 其他

- 依材料類型

- 金屬

- 複合材料

- 依銷售管道類型

- OEM

- 售後市場

- 依地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Faurecia SE

- Magna International Inc.

- Plastic Omnium SE

- Huf Hulsbeck &First GmbH &Co.KG

- Continental AG

- STMicroelectronics NV

- Autoease Technology

- Brose Fahrzeugteile SE &Co. KG

- Aisin Seiki Co., Ltd.

- Stabilus SE

- Johnson Electric Holdings Limited.

第7章市場機會與未來趨勢

The Automotive Automatic Liftgate Market size in terms of Equal-4.20 is expected to grow from USD 3.04 billion in 2024 to USD 3.73 billion by 2029, at a CAGR of 4.20% during the forecast period (2024-2029).

Over the medium term, increasing passenger comfort has become one of the most important considerations in the passenger car exterior market. Components should take as little human effort as possible and provide the maximum level of comfort. As a result, consistent development is taking place in this regard.

Growing consumer trends toward safety features in vehicles, rising technological advancements, and a surge in demand for luxurious vehicles are likely to primarily drive the market during the forecast period.

Component suppliers are working intensively on various new technologies for vehicle exteriors with a variety of new functionalities that can be adapted to the continuously changing requirements of passengers and drivers. These liftgate solutions improve vehicle efficiency by reducing the weight of the vehicle and improving fuel consumption. Such properties are further enhanced by metalized paint that creates a chrome-like appearance without the additional weight in case of using the metal itself. This new paint technique is around 5 to 20% less expensive than chrome electroplating and reduces overall weight by 10 to 20%.

Aerodynamics is also a key aspect of the tailgate; nowadays, the tailgate aerodynamics are improved with the help of an active rear spoiler and side spoiler that transfer the air better over the car roof. The new tailgates can improve the drag coefficient by 3-4% and also reduce CO2 emissions by 1 g per km.

Automotive Automatic Liftgate Market Trends

SUV Will Fuel The Growth Of The Market

The factor that is likely to fuel the demand for the automotive automatic liftgate industry is the increasing share of SUVs in passenger cars in the current year. Leading automotive OEMs and exterior component manufacturers are spending of huge amount on research and development of exteriors for future vehicles.

The SUV segment is expected to register a high CAGR; on account of the rising sales of this segment over other passenger cars segment, passenger-vehicle sales declined at roughly the same rate as SUV sales have risen.

Some of the reasons for the rise of SUVs are flexibility, payload-carrying ability, drivability, commanding view from the driver's seat, and ease of cabin access. Most of the latest SUVs come under the crossover category, which are larger, more bulbous cars rather than the pickup truck-based sports utilities in the United States.

The rise in popularity of SUV vehicles as the vehicle offers extra space and provides better comfort as compared to hatchback and sedan vehicles. Most SUVs come in hybrid and electric versions are gaining popularity as SUVs can also be a great choice for drivers who are trying to be more eco-friendly. Many of the latest models are offered in hybrid and all-electric options.

Consumers are now aware of the vehicle's residual value, quality finance charges, availability, the price paid, and, in some cases, the seller's profit margin in a closing transaction. This awareness has changed the dynamics and allowed them to capitalize on customer insight, which in turn is likely to opt for electric sport utility vehicles. Considering the wide range of used cars among people who bought a used SUV in the Majo region, which in turn is likely to witness major growth for the market during the forecast period.

With the development mentioned above across the globe, the demand for sport utility vehicles is likely to grow in the coming years, which in turn is anticipated to witness major growth for the market during the forecast period.

Asia Pacific is Anticipated to Lead the Market

The Asia-Pacific is among the leading automobile producers in the world. China, India, and Japan are the major economies in the regional market that are anticipated to influence the global market, too. Regional automotive sales reflected a steady growth trajectory in 2022 despite weak market sentiment in overall car sales due to new energy vehicles.

The region is the main market for many global as well as local car manufacturers and tier players, the automotive exterior component manufacturers are a partnership with OEMs to develop next-generation liftgates for their future vehicles.

China holds the dominating hand in the Asia-Pacific region regarding auto industry throughput and vehicle production. Region houses leading OEM, auto suppliers, and automotive component manufacturers maintain steady supply across the globe. In 2022, the total number of vehicles sold in China stood up at 26,863,745 units as compared to 26,274,820 Units in 2021, registering a year-on-year growth of 2.2%.

Rising levels of vehicular emissions and increased demand for environmentally friendly automobiles are likely to drive market expansion over the forecast period. The rise in demand for electric vehicles across the region is likely to create a lucrative opportunity for the market in the coming years.

Indian companies are working on research and development activities to develop new products that would positively impact the target market growth during the forecast period. For instance,

In August 2022, India's largest automaker, Maruti Suzuki, confirmed that it shall soon introduce its first electric vehicle by 2025 end.

An increase in vehicle sales with the rise in safety and comfort features in vehicles is likely to enhance the demand for automatic liftgates in the coming years.

Automotive Automatic Liftgate Industry Overview

Several key players, such as Magna International Inc., Faurecia SE, Plastic Omnium, Continental AG, and others, dominate the automotive automatic liftgate market. Factors like advanced technology, more use of sensors, growing investment in R&D projects, and a growing market of electric vehicles highly drive the market. To provide a more convenient experience for the car owner, major automotive automatic liftgate manufacturers are developing new technology for lighter and more convenient liftgates. For instance,

In October 2023, Tata Motor Ltd introduced the Tata Harrier Facelift in India. The new facelift model consists of the power liftgate. Through this launch, the company enhanced its safety and comfort features in its upcoming models.

In October 2023, STMicroelectronics N.V. introduced new automotive power-management ICs that simplify the design of car-body controllers for various components.

In March 2022, Jeep India introduced the Meridian SUV, an all-new 3-row SUV developed for the Indian market. The new models come with features such as a power liftgate.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Sale of Luxury Vehicles

- 4.2 Market Restraints

- 4.2.1 High Costs Associated With the System

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sports Utility vehicle

- 5.1.3 Sedan

- 5.1.4 Other Vehicle Types

- 5.2 By Material Type

- 5.2.1 Metal

- 5.2.2 Composite

- 5.3 By Sales Channel Type

- 5.3.1 Original Equipment Manufacturers (OEM)

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Faurecia SE

- 6.2.2 Magna International Inc.

- 6.2.3 Plastic Omnium SE

- 6.2.4 Huf Hulsbeck & First GmbH & Co.KG

- 6.2.5 Continental AG

- 6.2.6 STMicroelectronics N.V.

- 6.2.7 Autoease Technology

- 6.2.8 Brose Fahrzeugteile SE & Co. KG

- 6.2.9 Aisin Seiki Co., Ltd.

- 6.2.10 Stabilus SE

- 6.2.11 Johnson Electric Holdings Limited.