|

市場調查報告書

商品編碼

1406124

電動車和自動駕駛汽車線束:市場佔有率分析、行業趨勢和統計、2024年至2029年成長預測Electric and Autonomous Vehicles Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

電動車和自動駕駛汽車線束市場目前價值 56 億美元。

預計未來五年將成長至 155.1 億美元,預測期內收益複合年增率為 18%。

從長遠來看,世界各國對電動車的興趣和偏好正在顯著增加。此外,在全球範圍內,各國政府都鼓勵汽車製造商投資和開發電動車,以減少燃燒柴油和汽油燃料時產生的二氧化碳排放。這些因素正在推動電動車和自動駕駛汽車中使用的線束的成長。

由於技術的進步和安全標準的日益嚴格,汽車零件和電子設備的數量不斷增加,對線束的需求也不斷增加。技術進步和系統創新主要推動市場。

在新興國家,消費者對汽車便利性和安全性的偏好增強,正在推動市場成長。特別是,導航系統和資訊娛樂系統已成為全球大多數汽車的標準配備。汽車線束需要將這些系統連接到電控系統。

對車輛安全的不斷成長的需求和嚴格的政府法規正在推動 ADAS 市場的成長。隨著線控系統、盲點偵測、主動式車距維持定速系統新技術在汽車中的引入,電子設備和系統的使用不斷增加。更多電子設備的使用預計將推動電動車和自動駕駛汽車線束市場的發展。

電動車車和自動駕駛汽車線束市場趨勢

電動車和自動駕駛汽車的需求增加

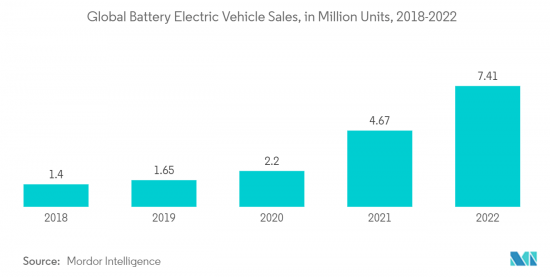

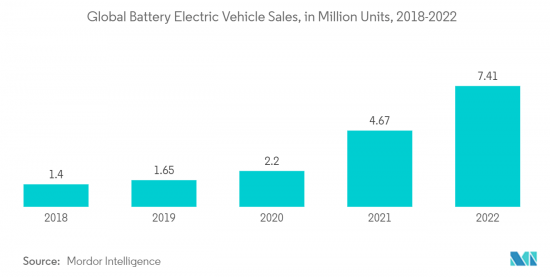

2022年全球電動車銷量將達到1,000萬輛,大幅超過2021年銷量。這個數字包括所有細分市場:小客車、輕型商用車、輕型卡車和所有推進類型。

世界各地越來越多的運動加速在小型小客車中採用電動車(EV),並逐步淘汰配備內燃機的階段車輛。平均燃油價格的上漲反映出歐洲新註冊電動車的比例高於其他地區。因此,由於燃料價格上漲而大規模採用電動車預計將擴大全球業務。

此外,全球純電動車和插電式混合動力車銷量的不斷成長也是推動電動車的主要因素。世界各地的製造商不斷推動電動車的需求。

在中國,純電動車市場也在穩定成長,由五菱宏光、特斯拉、比亞迪、日產、豐田和本田等中國頂級製造商引領。中國政府一直提供規範的獎勵計劃來促進電動車銷售。

印度政府採取了多項舉措來促進印度電動車的製造和普及,根據國際條約減少排放,並根據快速都市化發展電動車。

隨著汽車製造商宣布雄心勃勃的電動計劃,電動車成為當今的熱門話題。在印度,2021年電池式電動車銷量較2020年成長了160%,增幅驚人。電動車銷售的推動因素包括客戶對能源永續旅行偏好的改變、充電基礎設施的改善、燃油價格的上漲和下降。

印度是第二大兩輪車市場,對兩輪車市場的需求也流入該國。正因為如此,許多層級製造商,例如Okinawa Motors、UltraViolet Automotive和Revolt Motors,已進入該市場並獲得先發優勢。

隨著上述全球發展,電動車的需求預計在預測期內將會增加。

北美市場領先

市場的成長可歸因於公共和私營部門鼓勵人們轉換電動車的舉措增加。這些努力促進了電動車的銷售,同時也提高了消費者對擁有電動車好處的認知。

在美國,雖然大型商用車和大眾交通工具的電動略慢於歐洲,但由於特斯拉電動車的直接影響,電動進展顯著。

在此背景下,美國實施了積極的排放政策和區域舉措,以降低大氣中二氧化碳濃度。許多大城市,包括紐約、洛杉磯和休士頓,空氣品質很差。結果,它導致呼吸道疾病。這些條件使其很難在當前的環境中生存。

此外,福特、通用等主要電動車OEM也推出了多款電動車,引起了許多消費者的興趣。結果,電動車市場擴大了。例如,

2021年6月,通用汽車宣布計畫投資350億美元用於電動車開發並提高產能,計畫在2025年銷售超過100萬輛電動車。此外,2022年1月,通用汽車宣布計劃在2024年在其家鄉密西根州投資約66億美元,以增加電動皮卡的產量並建造一座新的電動車電池工廠。

此外,地方機構正在採取嚴厲措施,以促進電動車在全國範圍內的普及,包括核准充電站。例如,美國運輸部於 2022 年 9 月宣布,已核准在全美 50 個州、華盛頓特區和波多黎各建立電動車充電站的計劃,涵蓋約 75,000 英里的高速公路。

世界各地加速小型小客車電動車(EV) 普及並逐步淘汰傳統內燃機車的運動階段。平均燃油價格的上漲反映出歐洲新註冊電動車的比例高於其他地區。因此,由於燃料價格上漲而大規模採用電動車預計將擴大全球業務。

全球純電動車和插電式混合動力車銷量的不斷成長進一步推動了市場的發展,這也是推動電動車需求的主要因素。世界各地的製造商不斷推動電動車的需求。例如

- 2023年1月,全新沃爾沃EX90在拉斯維加斯舉辦的消費性電子展(CES)上首次在北美亮相。 CES 強調了技術合作,這將使Volvo EX90 成為有史以來最聰明、最安全的汽車。 Volvo EX90 是一款最多可容納 7 人的全電動 SUV。

上述新興市場正在全部區域開拓,預計將在預測期內擴大。

電動車和自動駕駛汽車線束產業概述

幾家主要企業主導著電動車和自動駕駛汽車線束市場,包括萊尼股份公司、古河電氣公司、Motherson Sumi、矢崎公司和李爾公司。電動車零件的製造設施正在全球迅速擴張,市場可能在預測期內出現顯著成長。例如

- 2023年1月,為滿足電動車應用對充電和高電壓電纜的需求,萊尼宣布將墨西哥奇瓦瓦州Cuauhtemoc工廠的生產面積擴大40%至10,723平方公尺。 EMOMEX(墨西哥電動車)計劃第一期工程耗資 2,700 萬美元,包括安裝用於開發和生產高電壓電纜和充電系統電纜的機械設備。

- 2022 年 9 月,萊尼股份公司宣布擴大產品開發。我們將匯集德國基青根創新工業化中心 (IIC) 的工程師來開發新的佈線系統。我們的政策是加強開發,以擴大自主移動性並滿足對佈線系統不斷成長的需求。該公司專注於較小的互鎖線束,而不是通常的中央線束。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 電動車銷量增加

- 市場抑制因素

- 維護成本高

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模)

- 按車型

- 小客車

- 商用車

- 按用途

- 動力傳動系統

- 舒適/便利

- 安全保障

- 車身接線

- 其他

- 按零件

- 金屬絲

- 終端

- 中繼

- 保險絲

- 連接器

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Furukawa Electric Group

- Leoni AG

- Motherson Sumi Systems Limited

- Sumitomo Electric Wiring Systems Inc.

- AME Systems(VIC)Pty Limited

- Electronic Technologies International Inc.

- Aptiv PLC

- Yazaki Corporation

- Patrick Industries Inc.

- Lear Corporation

- TE Connectivity Ltd.

- Elcom Inc.

第7章 市場機會及未來趨勢

The electric and autonomous vehicles wiring harness market is valued at USD 5.6 billion in the current year. It is expected to grow to USD 15.51 billion by the next five years, registering a CAGR of 18% in terms of revenue during the forecast period.

Over the long term, the interest and preferences toward electric vehicles increased significantly in various countries across the globe. Moreover, globally, the government encourages automobile manufacturers to invest and develop electric vehicles to reduce carbon emissions caused by diesel and gasoline fuel combustion. Such factors enhance the growth of the wiring harness used in electric and autonomous vehicles.

Technology advancement and increasing safety norms are increasing the components and electronics in the vehicle, which is also boosting the requirement of the wiring harness. Technological advancements and innovations in systems primarily drive the market.

In developed nations, the rising consumer preference toward driving convenience and safety is driving the market's growth. The adoption of navigation and infotainment systems, among others, became standard features in most cars across the world. To connect these systems and the central electronic control unit, automotive wiring harnesses are required.

The rising demand for vehicle safety and stringent government rules drive the ADAS market growth. Introducing new technologies in vehicles, such as x-by-wire systems, blind spot detection, collision avoidance systems, adaptive cruise control, etc., are increasing the usage of electronic equipment and systems. The use of more electronic equipment is expected to drive the wiring harness market in electric and autonomous vehicles.

Electric & Autonomous Vehicles Wiring Harness Market Trends

Increasing Demand for Electric cars and Autonomous Cars

Global EV sales were marked at 10 million units during 2022, which was significantly higher compared to sales figures in 2021. The volume includes all segments, like passenger vehicles, light commercial vehicles, light trucks, and all propulsion types.

The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase the business globally.

The market studied is furthermore driven by the increasing sales of BEVs and PHEVs globally, which also remained a major cause for bolstering electric vehicle demand. Manufacturers around the globe consistently drove the demand for EVs.

China also witnessed a steady rise in the BEV segment driven by top Chinese manufacturers, including Wuling HongGuang, Tesla, BYD, Nissan, Toyota, and Honda. The Chinese government constantly provided regulated incentive programs to elevate EV sales.

The government of India undertook multiple initiatives to promote the manufacturing and adoption of electric vehicles in India, reduce emissions from international conventions, and develop e-mobility in the wake of rapid urbanization.

Electric vehicles became a hot topic these days as automakers are announcing their ambitious electrification plans. India witnessed a phenomenal growth of ~160% in 2021, as compared to 2020 in battery electric sales. The sales of electric vehicles are attributed to shifting customer preference toward energy-sustainable mobility, improving charging infrastructure, rising fuel prices, and decreasing fuel prices.

India is the second-largest two-wheeler market, which subsequentially channelizes the demand for the two-wheeler segment in the country. In context to this, many tier-2 manufacturers, for instance, Okinawa Motors, UltraViolette Automotive, and Revolt Motors entered the market to take the early mover's advantage.

With the development mentioned above across the globe, the demand for electric vehicles is likely to enhance during the forecast period.

North America is Leading the Market

The growing initiatives taken by both the public and private sectors to encourage people to switch to electric vehicles can be attributed to market growth. These initiatives boosted the sales of electric vehicles while also raising consumer awareness of the benefits of owning one.

The United States, although a tad behind in the electrification of heavy-duty commercial and public transport vehicles as compared to Europe, witnessed a significant increase in electrification as a direct influence of Tesla's electric cars.

In view of the same, the United States is implementing aggressive emission reduction policies and regional initiatives to reduce atmospheric CO2 concentrations. Many major cities, including New York City, Los Angeles, and Houston, are plagued by poor air quality. It resulted in respiratory diseases. Such conditions make survival in the current environment difficult.

Further, key electric vehicle Original Equipment Manufacturers (OEMs), such as Ford and General Motors, offer a diverse range of electric vehicles that piqued the interest of many consumers. It resulted in an expanded market for electric vehicles. For instance,

General Motors announced plans in June 2021 to invest USD 35 billion in developing and increasing its EV production capacity to more than one million by 2025. Furthermore, General Motors announced in January 2022 that it planned to invest approximately USD 6.6 billion in its home state of Michigan by 2024 to increase electric pickup truck production and build a new EV battery cell plant.

Further, regional bodies are taking severe initiatives like approving charging stations to ramp up electric vehicle adoption across the country. For instance, in September 2022, the US Transportation Department announced the approval of electric vehicle charging station plans for all 50 states, Washington, DC, and Puerto Rico, covering roughly 75,000 miles of highways.

The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase business globally.

The market studied is further driven by the increasing sales of BEVs and PHEVs globally, which also remained a major cause for bolstering electric vehicle demand. Manufacturers around the world consistently drove the demand for EVs. For instance:

- In January 2023, the all-new Volvo EX90 was unveiled in North America for the first time at the Consumer Electronics Show (CES) in Las Vegas. It highlighted the technological collaborations that make the Volvo EX90 the company's smartest and safest vehicle yet. The Volvo EX90 is an all-electric SUV with seating for up to seven passengers.

With the development mentioned above across the region, the market is anticipated to boost during the forecast period.

Electric & Autonomous Vehicles Wiring Harness Industry Overview

Several key players, such as Leoni AG, Furukawa Electric, Motherson Sumi, Yazaki Corporation, Lear Corporation, and others, dominate the electric and autonomous vehicle wiring harness market. The rapid expansion of electric vehicle component manufacturing facilities across the globe is likely to witness major growth for the market during the forecast period. For instance,

- In January 2023, to meet the demand for charging cables and high voltage cables for Electromobility applications, Leoni announced that it had increased its production area at its plant in Cuauhtemoc, Chihuahua, Mexico by 40% to 10,723 sq m. The USD 27 million Phase I of the EMOMEX (E-Mobility Mexico) project, which included the installation of machinery and equipment for the development and production of high-voltage cables and charging system cables, was completed.

- In September 2022, the expansion of Leoni AG's (Leoni) product developments was announced. A new wiring system will be developed by the company, gathering engineers at the Innovation Industrialization Center (IIC) in Kitzingen, Germany. The company intends to boost its development to expand autonomous mobility and meet the rising demand for wiring systems. In place of the usual central cable harness, the company will concentrate on smaller-scale connected wiring harnesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Electric Vehicle Sale

- 4.2 Market Restraints

- 4.2.1 High Maintenance Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application

- 5.2.1 Powertrain

- 5.2.2 Comfort And Convenience

- 5.2.3 Safety And Security

- 5.2.4 Body Wiring

- 5.2.5 Others

- 5.3 By Components

- 5.3.1 Wires

- 5.3.2 Terminals

- 5.3.3 Relays

- 5.3.4 Fuses

- 5.3.5 Connectors

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest Of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Furukawa Electric Group

- 6.2.2 Leoni AG

- 6.2.3 Motherson Sumi Systems Limited

- 6.2.4 Sumitomo Electric Wiring Systems Inc.

- 6.2.5 AME Systems (VIC) Pty Limited

- 6.2.6 Electronic Technologies International Inc.

- 6.2.7 Aptiv PLC

- 6.2.8 Yazaki Corporation

- 6.2.9 Patrick Industries Inc.

- 6.2.10 Lear Corporation

- 6.2.11 TE Connectivity Ltd.

- 6.2.12 Elcom Inc.