|

市場調查報告書

商品編碼

1433762

鋰離子電池回收:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Lithium-ion Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

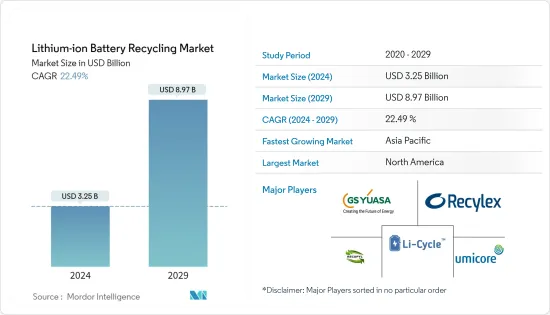

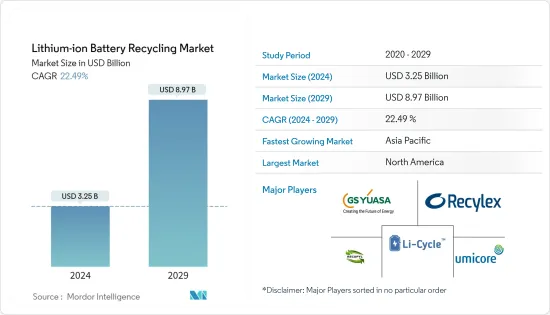

預計2024年全球鋰離子電池回收市場規模將達32.5億美元,2024-2029年預測期間複合年成長率為22.49%,預計2029年將達到89.7億美元。

在各類電池回收技術中,鋰離子電池回收市場預計將在預測期內下半年主導全球電池回收市場。此外,對電池廢棄物處理的日益關注和嚴格的政府政策,加上鋰離子電池價格的下降以及電動車的普及導致鋰離子電池的使用量增加,將在預測期間推動鋰離子電池回收市場的發展期間。我想它會被拖走。然而,雖然製造鋰離子電池的原料成本低廉,但回收成本高。除了高成本之外,缺乏健全的供應鏈以及與電池回收相關的低產量比率可能會限制預測期內電池回收市場的成長。

主要亮點

- 隨著政策層面推動可再生能源發電和電動車的大規模採用,電力產業正在經歷顯著成長,需要能源儲存解決方案。

- 電池技術的進步導致製造商開發出技術先進的電池,這可以為電池回收公司投資和引導資源創造突破性的電池回收技術創造重大機會。這是高度性感的。

- 由於製造業、可再生能源和電動車需求的成長,預計亞太地區在預測期內將引領鋰離子電池回收市場。

鋰離子電池回收市場趨勢

電力產業需求增加

- 過去十年裡,鋰離子電池的價格大幅下降。 2018年,鋰離子電池價格為每度電176美元。鋰離子電池價格持續下降,2018年價格較2017年下降17.75%。鋰離子電池用於與電力產業相關的各種應用,例如 ESS,並可能推動電力產業市場的發展。

- 成本大幅降低的兩個主要原因是:

- 透過持續的研究和開發,電池性能穩步提高,旨在改進電池材料,減少惰性材料的用量和材料成本,改善電池設計和生產產量比率,並提高生產率。

- 以中國為中心的電力產業終端用戶的產量增加,有助於實現鋰離子電池製造的規模經濟,而大規模產能的增加則加劇了製造商之間的競爭(價格進一步下跌)。製造商的盈利被犧牲)。

- 這些趨勢將導致成本快速持續降低,使鋰離子電池成為所有儲能和電力行業市場的首選電池化學材料,包括電網規模、用戶側儲能、住宅儲能和微電網。這將有助於它的建立。

- 此外,預計鋰離子電池的平均價格將繼續下降,到2025年將達到約100美元/kWh。這一趨勢將增加鋰離子電池在令人興奮的新市場中的應用,例如在預測期內與太陽能、風能和水力發電等可再生能源相結合的能源儲存系統(ESS),用於住宅和商業應用。預計兩者都會增加。

- 因此,隨著價格下降,鋰離子電池在電力行業的使用預計將會增加。為了使此類電池的採用更加永續和環保,預計在預測期內回收這些電池的需求也會加速。

亞太地區主導市場

- 鋰離子電池傳統上主要用於行動電話、筆記型電腦和個人電腦等家用電子電器,但電動車對環境的影響較小,因為它們不會排放二氧化碳和氮氧化物等溫室氣體。它們現在正在重新設計,以用作混合動力汽車和全電動汽車(EV)的動力來源。

- 電動車和能源儲存系統(ESS) 等令人興奮的新市場的出現正在推動商業和住宅應用對鋰離子電池的需求。此外,ESS與風能、太陽能和水力發電等自然能源相結合,對於提高電網穩定性在技術和商業性都是必要的,因此正在推動鋰離子電池產業的發展。

- 目前,中國是電動車最大的市場,約佔全球銷售量的40%。隨著中國努力降低國內空氣污染水平,電動車銷量預計將創下高成長率,從而導致對鋰離子電池的高需求。

- 目前,中國是最大的電動車鋰離子電池生產國。中國鋰產量從2017年的6,800噸增加到2018年的8,000噸。由於電池總是與環境問題聯繫在一起,中國政府制定了回收設施政策,因此產業必須根據需要建立回收設施。

- 此外,2018 年 8 月,印度政府宣佈為印度混合動力汽車和電動汽車快速採用和製造 (FAME) 計劃第二階段撥款 550 億盧比,以鼓勵電動汽車的採用和鋰離子電池的本地生產。 。因此,包括亞馬遜和Amara Raja Batteries在內的多家印度汽車零件製造商以及電力和能源解決方案供應商都宣布生產計畫鋰離子電池,以利用該國蓬勃發展的綠色汽車市場。

- 此外,該地區政府對技術開拓的研發投資將有助於降低迴收過程中產生的成本,激勵回收公司採用回收材料製造新產品並增加市場價值。因此,近期趨勢預計將在預測期內推動鋰離子電池回收市場。

鋰離子電池回收產業概況

由於技術複雜,鋰離子電池回收市場較為分散,企業發展該行業的公司很少。市場的主要企業包括Glencore、GS Yuasa Corporation、Li-Cycle Technology、Recupyl Sas、Umicore、Metal Conversion Technologies等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 市場規模與需求預測,10 億美元(~2025 年)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 抑制因素

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按行業分類

- 車

- 海洋

- 電力

- 其他

- 科技

- 濕式冶金工藝

- 火法冶金工藝

- 物理/機械過程

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Glencore PLC

- Green Technology Solutions, Inc.

- Li-Cycle Technology

- Recupyl Sas

- Umicore SA

- Metal Conversion Technologies LLC

- Retriev Technologies Inc.

- Raw Materials Company

- TES-AMM Pte Ltd.

- American Manganese

第7章 市場機會及未來趨勢

The Lithium-ion Battery Recycling Market size is estimated at USD 3.25 billion in 2024, and is expected to reach USD 8.97 billion by 2029, growing at a CAGR of 22.49% during the forecast period (2024-2029).

Among different types of battery recycling technology, the lithium-ion battery (LIB) recycling market is expected to dominate the global battery recycling market in the latter part of the forecast period, majorly due to the demand for lithium-ion batteries and its ability such as favorable capacity-to-weight ratio. Moreover, Rising concerns over battery waste disposal and stringent government policies clubbed with the increase in usage of lithium-ion battery due to the declining lithium-ion battery prices and growing adoption of electric vehicles, are likely to drive the lithium-ion battery recycling market during the forecast period. However, the raw materials for the manufacturing of lithium-ion batteries are available at a low cost, whereas a high cost is incurred in recycling. The high cost, along with the lack of a strong supply chain and low yield related to battery recycling, is likely to restrain the growth of the battery recycling market during the forecast period.

Key Highlights

- The power sector witnessing significant growth owing to requirement for energy storage solutions in the wake of policy-level initiatives to promote renewable power generation and massive deployment of electric vehicles.

- Advancements in battery technologies leading to the creation of technologically advanced batteries being developed by manufacturers are likely to create a massive opportunity for the battery recycling companies to invest and redirect their resources to make a breakthrough battery recycling technology.

- Asia-Pacific is expected to lead the lithium-ion battery recycling market, during the forecast period, due to the growth of the manufacturing sector, renewables power and the EV demand.

Lithium-Ion Battery Recycling Market Trends

Increasing Demand In Power Industry

- The price of lithium-ion batteries has fallen steeply over the past 10 years. In 2018, the lithium-ion battery price was USD 176 per kWh. Lithium-ion battery prices are falling continuously, and the price decreased by 17.75% in 2018 compared to the price in 2017. The lithium-ion battery used in various application related to power sector such as ESS and other, which in turn likely to drive the market in power sector.

- The two principal reasons for the drastic cost decline are:

- The steady improvement of battery performance achieved through sustained R&D, aimed at improving battery materials, reducing the amount of non-active materials and the cost of materials, improving cell design and production yield, and increasing production speed.

- Increase in production volume for end user in power industry, particularly in China, which helped in achieving the economies of scale in lithium-ion battery manufacturing, and the large capacity additions, which increased the competition among manufacturers (further declining the prices, but at the expense of the profitability of the manufacturers).

- These trends result in sharp and sustained cost reduction which is expected to help cement lithium-ion as the battery chemistry of choice in all energy storage, power industry markets, including grid-scale, behind-the-meter storage, residential storage, and micro-grids.

- Furthermore, the decline in average lithium-ion battery prices is expected to continue and reach approximately USD 100/kWh by 2025, in turn, making it much more cost-competitive than other battery types. The trend is expected to result in an increased application of lithium-ion batteries in new and exciting markets, such as energy storage systems (ESS), paired with renewables, like solar, wind, or hydro, for both residential and commercial applications, during the forecast period.

- Hence, with declining prices, the use of lithium-ion batteries is expected to rise in power industry. The need for recycling these batteries is also expected to gain pace during the forecast period, in order to make the adoption of such batteries more sustainable and eco-friendlier.

Asia-Pacific to Dominate the Market

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices, such as mobile phones, notebook, and PCs, but are now increasingly being redesigned for use as the power source of choice in hybrid and the complete electric vehicle (EV) range, owing to factors, such as low environmental impact, as EV does not emit any CO2, nitrogen oxides, or any other greenhouse gases.

- The emergence of the new and exciting markets, such as electric vehicle and energy storage systems (ESS), for both the commercial and residential applications, is driving the demand for LIB. Moreover, ESS, coupled with renewables, such as wind, solar, or hydro, is technically and commercially necessary for increasing grid stability, consequently, driving the LIB segment.

- Currently, China is the largest market for electric vehicles, as the country accounts for around 40% of the global sale. China is making efforts to reduce the air pollution level in the country, and it is expected to register a high growth rate in the electric vehicle sales, consequently, leading to the high demand for LIB.

- Currently, China is the largest manufacturer of lithium-ion battery majorly for electric vehicles. In China, lithium production in the country, increasing from 6,800 metric tons in 2017 to 8,000 metric tons in 2018. As batteries are always related to environmental concerns, the government of china presents a policy for recycling facilities that the industry must set up as required.

- Furthermore, in August 2018, the Government of India directed an outlay of INR 5,500 crore for the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme, for encouraging the adoption of EVs and local manufacturing of lithium-ion batteries. Thus, several automobile component manufacturers and power and energy solution providers in India, such as Amazon and Amara Raja Batteries, have put forth plans for manufacturing lithium-ion batteries locally, to leverage the booming green vehicles market in the country.

- Additionally, the R&D investment by the government in the region on developing technologies can help decrease the cost incurred for the recycling process, which can motivate the recycling companies to take up recycled material for manufacturing a new product, and thereby, helping the growth of the market. Hence the recent trends are expected to propel the lithium-ion battery recycling marketduring the forecast period.

Lithium-Ion Battery Recycling Industry Overview

The lithium-ion battery recycling market is moderately fragmented due to few companies operating in the industry because of the complex technology. The key players in this market include Glencore, GS Yuasa Corporation, Li-Cycle Technology, Recupyl Sas,Umicore, Metal Conversion Technologies, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, until 2025

- 4.3 Recent Trends and Developments

- 4.4 Government Policies & Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Industry

- 5.1.1 Automotive

- 5.1.2 Marine

- 5.1.3 Power

- 5.1.4 Others

- 5.2 Technology

- 5.2.1 Hydrometallurgical Process

- 5.2.2 Pyrometallurgy Process

- 5.2.3 Physical/Mechanical Process

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Glencore PLC

- 6.3.2 Green Technology Solutions, Inc.

- 6.3.3 Li-Cycle Technology

- 6.3.4 Recupyl Sas

- 6.3.5 Umicore SA

- 6.3.6 Metal Conversion Technologies LLC

- 6.3.7 Retriev Technologies Inc.

- 6.3.8 Raw Materials Company

- 6.3.9 TES-AMM Pte Ltd.

- 6.3.10 American Manganese