|

市場調查報告書

商品編碼

1405719

消磁系統:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Degaussing Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

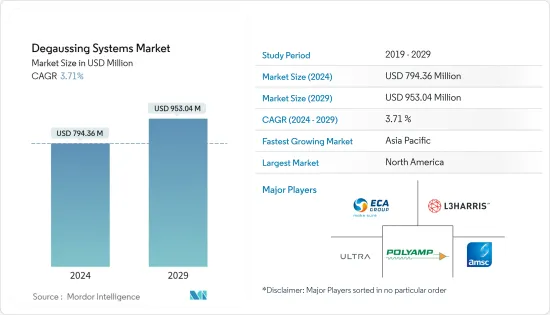

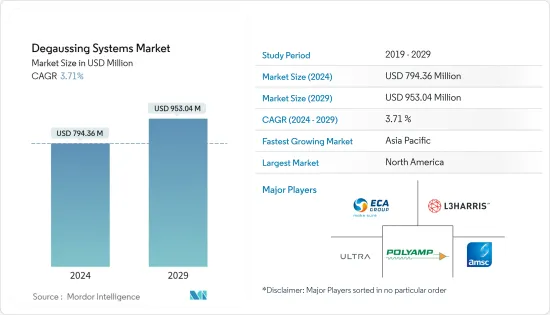

消磁系統市場規模預計到2024年為7.9436億美元,預計到2029年將達到9.5304億美元,在預測期內(2024-2029年)複合年成長率為3.71%。

為了防止船舶的磁訊號觸發水雷和魚雷,需要採取有效的對策來控制船舶的磁訊號。世界各地海軍艦艇數量的不斷增加推動了抑制這種磁訊號的需求,從而產生了對海軍艦艇上新型消磁系統的需求。使用超導性等新材料開發先進的退磁系統預計將減輕船舶的重量和退磁設備的能源消耗,從而推動未來幾年退磁系統市場的成長。然而,高昂的安裝和維修成本以及纖維複合材料在軍艦上的使用可能會阻礙未來的市場成長。

消磁系統市場趨勢

護衛艦細分市場預計將佔據最高市場佔有率

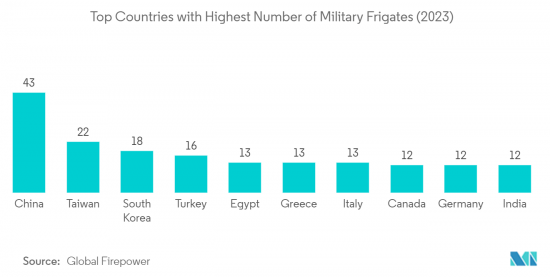

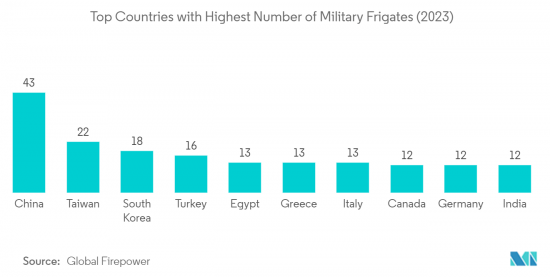

護衛艦的高殺傷力和低探測能力是世界各國海軍越來越多採購護衛艦的主要原因。對護衛艦的需求是由國家更新計畫推動的,該計畫旨在用具有反艦、反潛和防空能力的現代探測和武器系統取代目前老化的戰艦艦隊。

未來幾年,各國海軍預計將隨著老化而更新其護衛艦艦隊。例如,2022年初,台灣海軍撥款13.7億美元預算升級6艘康定級(拉法葉)護衛艦。在預測期內,大部分護衛艦採購計畫在歐洲進行。 2022 年 11 月,英國國防部 (MoD) 授予 BAE Systems plc 一份價值 44 億美元的契約,為格拉斯哥英國海軍建造 5 艘城市級 26 護衛艦。因此,所研究市場的護衛艦部分預計將在預測期內穩定成長。

預計亞太地區在預測期內將快速成長

隨著海上邊界糾紛加劇,亞太地區國家不斷增加軍費開支。澳洲、印度、中國和印尼等國正在投資建立具有先進能力的海軍艦隊現代化。作為這些計劃的一部分,預計各國將在預測期內開發、建造和採購新的海軍艦艇。例如,2022年12月,印度海軍接收了-75型卡爾巴里級計劃中的第五艘潛艦「瓦吉爾號」。該潛艇由孟買馬扎貢碼頭造船有限公司(MDL)與海軍集團合作建造。同時,中國正在透過建造現代化水面戰艦、擴大航空母艦和後勤力量來擴大其海軍影響力。到2025年,解放軍海軍艦艇數量預計將從340艘增加到400艘。這種海軍現代化是為了在南海緊張局勢中加強國家的能力。同樣,其他東南亞國家目前正在增強其海軍能力,預計這將推動消磁系統市場的成長。

消磁系統行業概況

消磁系統市場是半整合的。消磁系統市場的主要參與者包括 L3Harris Technologies Inc.、ECA Group、Ultra、Polyamp AB 和 American Superconductor Corporation。 L3Harris Technologies Inc. 為德國海軍、泰國海軍、韓國海軍、西班牙海軍、土耳其海軍、葡萄牙海軍、印度海軍等提供各種設計和配置的消磁系統。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場抑制因素

- 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 船型

- 航空母艦

- 驅逐艦

- 護衛艦

- 護衛艦

- 潛水艇

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 其他中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- L3Harris Technologies Inc.

- Larsen & Toubro Limited

- ECA Group

- IFEN SpA

- Ultra

- Polyamp AB

- American Superconductor Corporatio

- Dayatech Merin Sdn Bhd

- DA Group

- Wartsila Corporation

第7章 市場機會及未來趨勢

The Degaussing Systems Market size is estimated at USD 794.36 million in 2024, and is expected to reach USD 953.04 million by 2029, growing at a CAGR of 3.71% during the forecast period (2024-2029).

There is a need for effective measures for magnetic signature control of the naval vessels for protection against sea mines and torpedoes, which ships' magnetic signatures can trigger. This requirement for suppressing a magnetic signature, fueled by a growing naval vessel fleet across the world, is generating demand for new degaussing systems onboard naval vessels. The development of advanced degaussing systems with new materials, like superconductors, which reduce the weight of the vessel and energy consumption of the degaussing equipment, is anticipated to propel the growth of the degaussing systems market in the future. However, the high cost of installation and retrofit and the use of fiber composite materials in warships can hinder the growth of the market in the future.

Degaussing Systems Market Trends

The Frigates Segment is expected to hold the highest market share

The high lethality and low detection capabilities of the frigates are the major reasons for navies around the world to increasingly procure frigates. The replacement programs in various countries to replace the current aging fleet of combat ships with modern detection and weapon systems equipped with frigates that have anti-ship, anti-submarine, and air-defense capabilities are propelling the demand for frigates.

In the coming years, there are several orders of frigates that are anticipated to be replaced and upgraded due to their aging fleet in various navies. For instance, at the beginning of 2022, the Taiwan Navy allocated a budget of USD 1.37 billion to upgrade its 6 Kang Ding-class (La Fayette) frigates. During the forecast period, the majority of frigate procurement is planned in Europe. In November 2022, the UK Ministry of Defence (MoD) awarded a USD 4.4 billion contract to BAE Systems plc to manufacture the five City Class Type 26 frigates for the Royal Navy in Glasgow. Thus, the frigates segment of the market studied is anticipated to witness steady growth during the forecast period.

Asia-Pacific Region Expected to Witness Rapid Growth During the Forecast Period

The escalated maritime border tensions between the countries of the region have led to an increase in their military spending. Countries like Australia, India, China, and Indonesia are investing in the modernization of their naval fleet with advanced capabilities. As a part of these plans, the countries are expected to develop, build, and procure new naval vessels during the forecast period. For instance, in December 2022, the Indian Navy took delivery of the INS Vagir, the fifth submarine under the Project-75 Kalvari class submarines. The submarine was constructed at Mazagon Dock Shipbuilders Limited (MDL) Mumbai in collaboration with the Naval Group. China, on the other hand, is building modern surface combatants and expanding its aircraft carrier and logistics force to grow its naval influence. By 2025, the People's Liberation Army Navy is expected to grow to 400 hulls, up from its fleet of 340. This modernization of the naval fleet is to strengthen the country's capabilities amid the South China Sea tensions. Similarly, the other Southeast Asian countries are also currently enhancing their naval capabilities, which is expected to propel the growth of the degaussing equipment market.

Degaussing Systems Industry Overview

The degaussing systems market is semi-consolidated, and the prominent players in the degaussing systems market are L3Harris Technologies Inc., ECA Group, Ultra, Polyamp AB, and American Superconductor Corporation. L3Harris Technologies Inc. provides various designs and configurations of degaussing systems to the German Navy, Thai Navy, Korean Navy, Spanish Navy, Turkish Navy, Portuguese Navy, and Indian Navy, among others. With a competitive market scenario, companies are investing in the development of new degaussing methods that will replace the existing and conventional degaussing systems. For instance, to capture new market opportunities, American Superconductor Corporation was the first to introduce high-temperature superconductor (HTS) degaussing cable. These HTS cables are proven to reduce 20% of the weight of cables, 40% of installation costs, and utilize lower operating voltages. With the introduction of such products into the market, the companies can strengthen their expansion plans with strong cash flows in the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vessel Type

- 5.1.1 Aircraft Carriers

- 5.1.2 Destroyers

- 5.1.3 Frigates

- 5.1.4 Corvettes

- 5.1.5 Submarines

- 5.1.6 Other Vessel Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Egypt

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 L3Harris Technologies Inc.

- 6.2.2 Larsen & Toubro Limited

- 6.2.3 ECA Group

- 6.2.4 IFEN S.p.A.

- 6.2.5 Ultra

- 6.2.6 Polyamp AB

- 6.2.7 American Superconductor Corporatio

- 6.2.8 Dayatech Merin Sdn Bhd

- 6.2.9 DA Group

- 6.2.10 Wartsila Corporation