|

市場調查報告書

商品編碼

1404560

圖形處理單元 (GPU) -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Graphics Processing Unit (GPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

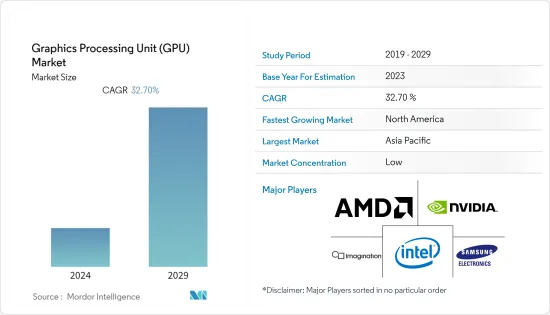

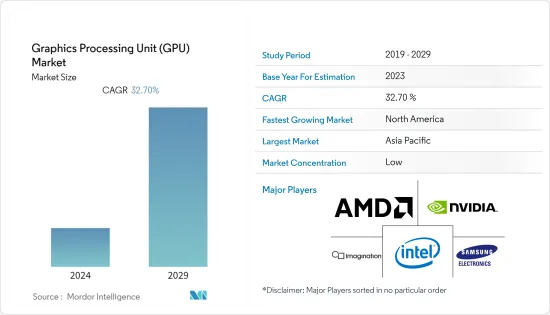

上年度圖形處理單元(GPU)市值為379億美元,預計未來五年複合年成長率為32.70%,達2069.5億美元。

近年來,高階個人電腦設備和遊戲機的需求激增。投資圖形附加板對微處理公司來說是有利的,因為 GPU 是成品的關鍵組件。

主要亮點

- 個人電腦(PC)和筆記型電腦等運算產品在全球的高普及,以及遊戲產業投資的增加,是近年來推動研究市場成長的關鍵因素。在預測期內,對高階圖形和運算應用程式的需求不斷成長,人工智慧等技術的擴展以及即時分析的趨勢,主要擴大了 GPU 技術的範圍。

- 遊戲產業是 GPU 市場的主要動力之一。全球遊戲產業投資的增加和遊戲開發的進步也推動了圖形的成長。即時刺激器等功能需要較高的圖形效能。此外,遊戲開發商主要透過開發與現實世界場景相符的高圖形遊戲來利用其競爭優勢。這些功能還需要先進的顯示卡。

- 對 AR、VR 和 AI 等先進技術不斷成長的需求進一步推動了對 GPU 的需求。因為這些技術需要快速分析,而 GPU 是理想的選擇。 AI晶片在效能和能源效率方面優於GPU。然而,GPU 對於高效能運算仍然至關重要。除了AI之外,GPU還擁有紮實的通用運算能力。

- 製造 GPU,尤其是單一 GPU 晶片成本高昂,並且需要高階機器。儘管原料具有成本效益,但公司需要大量初始投資來建造測試和製造實驗室。例如,英特爾推出了高效能消費性圖形解決方案Intel Arc。 Arc品牌涵蓋多代硬體、軟體和服務,首款基於Xe HPG架構的獨立GPU(Alchemist)已於今年第一季交付給OEM。

- COVID-19階段透過擾亂供應鏈對該行業產生影響。然而,市場報告指出某些細分市場的消費者需求增加,主要支持 GPU 技術的成長。今年 4 月,Nvidia 表示,研究人員使用配備 NVIDIA GPU 的超級電腦發現了 25 個哈伯資料趨勢。 NVIDIA GPU 的高效能運算被用來分析灼熱的大氣層,以便更好地了解所有行星。

圖形處理單元 (GPU) 市場趨勢

伺服器應用領域預計將佔據主要市場佔有率

- 由於各個最終用戶細分市場採用雲端普及,伺服器細分市場正經歷顯著成長。例如,在日本,著名電信業者之一的 KDDI 與 NVIDIA 合作,為其客戶提供 GeForce Now 遊戲串流服務。據報道,KDDI 正在與 NVIDIA 合作,透過低延遲寬頻和 5G 網路向日本遊戲玩家提供 PC 遊戲。 KDDI 將在東京的新資料中心安裝 NVIDIA RTX 遊戲伺服器。

- 此外,GPUaaS 可用於多種目的,包括訓練多語言人工智慧語音引擎和識別與糖尿病相關的失明的早期指標。現代 GPUaaS 為傳統通用處理器提供了一種有吸引力的替代方案,具有可變定價且無資本支出,使其成為獲得機器學習系統所需速度的一種方式。

- 此外,印度市場也有大量供應商投資。例如,宏碁在印度推出了新型 NVIDIA Tesla GPU 驅動的伺服器。該伺服器最多可託管八個 NVIDIA Tesla V100 32GB SXM2 GPU 加速器。 GPU 對包含一個用於高速互連的 PCIe(週邊組件互連)插槽。

- 高效能運算 (HPC) 的技術進步也可能為 GPU 供應商帶來機會。例如,2022 年 4 月,NVIDIA 表示研究人員使用配備 NVIDIA GPU 的超級電腦發現了 25 個哈伯資料趨勢。 NVIDIA GPU 的高效能運算被用來分析我們炎熱的大氣層,以便更好地了解所有行星。根據 Steam 統計,截至 2022 年 8 月,91.22% 的受訪者正在使用 DirectX 12 GPU 顯示卡。

亞太地區預計將佔據主要市場佔有率

- 在中國,風華GPU在廣泛普及方面取得了重要的里程碑。這款GPU是芯東科技和芯動科技於去年11月發表的。該GPU於2022年3月檢驗,運作穩定,同芯UOS作業系統效能優異。

- 同心UOS是中國重要的作業系統,因為它是主導政府創建的,其效能優於Windows。基於 Debian Linux 構建,並經過調整以與現代本土硬體配合使用。因此,風華 GPU 認證是重要的一步,同時也為兆芯 CPU 和 GPU 等中國設計的半導體裝置提供支援。

- 2022 年 4 月,Moore Threads 宣布推出適用於 PC 桌上型電腦和工作站的 MTT S60 以及適用於伺服器的 MTT S2000。兩者均基於基於 MUSA 的 12nm GPU。轉向人工智慧,基於MUSA的顯示卡可以支援各種流行的人工智慧框架,包括視覺處理、音訊處理和自然語言處理。

- 此外,許多公司正在與政府支持的中國新興企業和研究機構合作或投資。這也稱為間接滲透中國市場。商湯科技是一家總部位於中國的熱門人工智慧Start-Ups,擁有 700 家客戶和合作夥伴,其中包括麻省理工學院 (MIT) 和高通。

- 該公司在短時間內取得了成功,估值已達45億美元。商湯科技能夠如此迅速發展的原因之一是政府的支持以及對中國龐大資料庫的直接存取。該公司也與中國政府合作實施「中國製造2025」。該公司還透露了超過 160 petaflops 的總運算能力,這是透過分佈在 12 個 GPU叢集集中的 15,000 個 GPU 上的 5,400 萬個 GPU 核心實現的。

- 中國遊戲產業的成長主要得益於加強投入加強GPU技術研發能力。國內公司開發的獨立遊戲繼續主導中國市場的銷售。

圖形處理單元 (GPU) 產業概覽

圖形處理單元 (GPU) 市場由英特爾公司、Advanced Micro Devices Inc.、Nvidia 公司、Imagination Technologies Group 和三星電子等主要企業瓜分。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 5 月 - 聯發科技與 NVIDIA 合作,為下一代軟體定義車輛提供一整套汽車AI 座艙解決方案。透過此次合作,聯發科將開發整合全新 NVIDIA AGPU 小晶片以及 NVIDIA 人工智慧和圖形 IP 的汽車SoC。

- 2022 年 8 月:英特爾資料中心 GPU Flex 系列 Arctic Sound-M 宣布推出智慧視覺雲端。 Flex 系列 GPU 旨在滿足智慧型視覺雲端工作負載的要求,提供 5 倍的媒體轉碼吞吐量效能和多達 68 個同步雲端遊戲串流。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 遊戲圖形的演變

- 拓展AR、VR、AI的應用

- 市場抑制因素

- 初始投資高

第6章市場區隔

- 按類型

- 獨立GPU

- 整合GPU

- 按用途

- 桌面

- 行動電腦

- 工作站

- 伺服器/資料中心

- 汽車/自動駕駛汽車

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Intel Corporation

- Advanced Micro Devices Inc.

- Nvidia Corporation

- Imagination Technologies Group

- Samsung Electronics Co. Ltd

- Arm Limted(soft Bank Group)

- EVGA Corporation

- SAPPHIRE Technology Limited

- Qualcomm Technologies Inc.

第8章 供應商市場佔有率

第9章投資分析

第10章投資分析市場的未來

The Graphics Processing Unit (GPU) Market was valued at USD 37.9 billion the previous year and is expected to grow at a CAGR of 32.70%, reaching USD 206.95 billion by the next five years. The demand for high-end personal computing devices and gaming console effects has surged in recent years. Hence, investing in a graphics add-in board is helpful for micro-processing companies, as GPU forms a vital component of the finished product.

Key Highlights

- The high adoption of computing products, such as personal computers (PC) or laptops, globally and the increasing investment in the gaming industry have been major factors driving the studied market's growth in recent years. The growing demand for high graphics and computing applications and the expansion of technologies, like AI, along with the trend of real-time analysis, are mainly expanding the scope of GPU technology over the forecast period.

- The gaming industry is one of the significant driving forces for the GPU market. The growing investment in the global gaming sector and advancement in game development also fuel graphics growth. Features like real-time stimulators demand high graphics. Additionally, game developers mainly leverage competitive advantage by developing high-graphics games that match real-world scenarios. These features also require advanced graphics boards.

- The growing demand for advanced technologies, like AR, VR, and AI, is further fueling the GPU demand, as these technologies require high-speed analysis, for which GPU is an ideal option. AI chips have surpassed GPUs in performance and energy efficiency. However, GPUs are still an indispensable part of high-performance computing. Apart from AI, GPUs also have a solid general-purpose computing capability.

- GPU manufacturing, especially the standalone GPU chip, is costlier and requires high-end machines. Although the raw material is cost-effective, the companies need a high initial investment to build the lab for testing and manufacturing. For instance, Intel announced Intel Arc for consumer high-performance graphics solutions. The Arc brand would encompass hardware, software, and services over multiple generations of hardware, with the first discrete GPU (Alchemist) based on the Xe HPG microarchitecture delivered to OEMs in Q1 of the current year.

- COVID-19 impacted the industry by disrupting the supply chain in the initial phase. However, the market has reported increased consumer demand in a particular segment, mainly supporting GPU technology growth. In April this year, Nvidia stated that researchers discovered trends in Hubble data on 25 of them using a supercomputer with NVIDIA GPUs. To increase the understanding of all planets, high-performance computing is used with NVIDIA GPUs to analyze the torrid atmospheres.

Graphics Processing Unit (GPU) Market Trends

Servers Application Segment is Expected to Hold Significant Market Share

- The server segment is witnessing significant growth owing to the proliferation of the cloud in various end-user sectors. For instance, in Japan, KDDI, one of the prominent telecom companies, partnered with NVIDIA to offer GeForce Now game-streaming service to customers. KDDI reportedly partnered with NVIDIA to deliver PC games over low-latency broadband and a 5G network to gamers in Japan. It would place NVIDIA's RTX gaming servers in a new data center in Tokyo.

- Additionally, GPUaaS may be utilized for various purposes, including training multilingual AI speech engines and identifying early indicators of diabetes-related blindness. Modern GPUaaS, which provides a compelling alternative to traditional general-purpose processors with variable pricing and no CAPEX, is one way to achieve the speed required for machine learning systems.

- Moreover, the Indian market is also witnessing investment by many vendors. For instance, Acer launched new NVIDIA Tesla GPU-powered servers in India. The server can host up to eight NVIDIA Tesla V100 32GB SXM2 GPU accelerators. GPU pair includes one Peripheral Component Interconnect (PCIe) slot for high-speed interconnect.

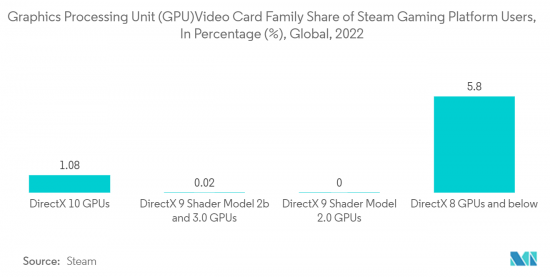

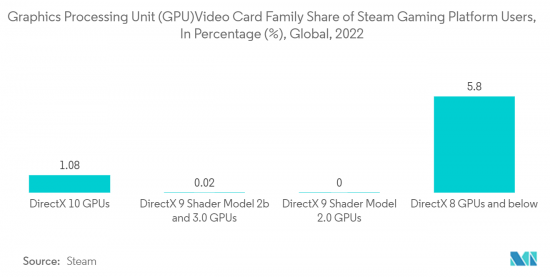

- Technological advancement in high-performing computing (HPC) may also develop an opportunity for GPU vendors. For instance, in April 2022, Nvidia stated that researchers discovered trends in Hubble data on 25 of them using a supercomputer with NVIDIA GPUs. To increase the understanding of all planets, high-performance computing is used with NVIDIA GPUs to analyze the torrid atmospheres. According to Steam, 91.22 percent of respondents used a DirectX 12 GPU graphics card as of August 2022.

Asia Pacific is Expected to Hold Significant Market Share

- In China, the Fenghua GPU achieved a significant milestone in terms of broad adoption. The GPU was announced in November last year by Xindong Technology and Innosilicon. The GPU was validated in March 2022 for stable operation and excellent Tongxin UOS operating system performance.

- Tongxin UOS is a significant operating system in China because it was created as a government-led effort to usurp Windows. It is built on Debian Linux and has been tweaked to work with the newest homemade hardware. As a result, alongside the development of support for Chinese-designed semiconductor devices such as Zhaoxin CPUs and GPUs, the Fenghua GPU certification represents a significant step.

- In April 2022, Moore Threads announced MTT S60 for PC desktops and workstations and the MTT S2000 for servers. Both are based on MUSA-based 12nm GPUs. Moving on to AI, MUSA-based graphics cards can support a variety of common AI frameworks, including those for visual processing, audio processing, natural language processing, and more.

- Many companies are also partnering or investing in Chinese start-ups or research laboratories, which are getting government support. This is also known as indirect penetration in the Chinese market. China-based popular AI start-up SenseTime has a portfolio of 700 clients and partners, including the Massachusetts Institute of Technology (MIT), and Qualcomm, among others.

- The company has become successful in very little time and has a valuation of USD 4.5 billion. One of the reasons SenseTime has been able to grow so quickly is that it has government support and direct access to China's vast databases. The company is also working with the Chinese government on Made in China in 2025. The company also revealed that its aggregate computing power is more than 160 petaflops, achieved with 54,000,000 GPU cores across 15,000 GPUs within 12 GPU clusters.

- The growth in the Chinese gaming industry is mainly due to increasing investment in enhancing R&D capability for GPU technology. Independent games developed by domestic firms have continued to dominate market sales in China.

Graphics Processing Unit (GPU) Industry Overview

The Graphics Processing Unit market is fragmented with the presence of major players like Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, Imagination Technologies Group, and Samsung Electronics Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - MediaTek partnered with NVIDIA to deliver a complete range of in-vehicle AI cabin solutions for the next generation of software-defined vehicles. MediaTek would develop automotive SoCs through this collaboration, integrating a new NVIDIA GPU chiplet with NVIDIA AI and graphics IP.

- August 2022: Intel Data Centre GPU Flex Series Arctic Sound-M was introduced for the Intelligent Visual Cloud. Flex Series GPU is designed to meet the requirements for intelligent visual cloud workloads, with 5x media transcode throughput performance and up to 68 simultaneous cloud gaming streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Graphics in Games

- 5.1.2 Growing Applications of AR, VR, and AI

- 5.2 Market Restraints

- 5.2.1 High Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Discrete GPUs

- 6.1.2 Integrated GPUs

- 6.2 By Applications

- 6.2.1 Desktop

- 6.2.2 Mobile PC

- 6.2.3 Workstation

- 6.2.4 Server/Datacenter

- 6.2.5 Automotive/Self-driving Vehicles

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Advanced Micro Devices Inc.

- 7.1.3 Nvidia Corporation

- 7.1.4 Imagination Technologies Group

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Arm Limted (soft Bank Group)

- 7.1.7 EVGA Corporation

- 7.1.8 SAPPHIRE Technology Limited

- 7.1.9 Qualcomm Technologies Inc.