|

市場調查報告書

商品編碼

1273447

qPCR 試劑市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)qPCR Reagents Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,qPCR 試劑市場預計將以 7.9% 的複合年增長率增長。

由於對聚合□鏈反應測試的需求增加以及 COVID-19 導致目標患者人數顯著增加,qPCR 試劑產品市場正在增長。 對於 COVID-19 的診斷,鼻咽拭子等上呼吸道樣本和最近使用唾液的免疫學檢測 qPCR 已成為最常見和最可靠的檢測方法。 因此,使用 qPCR 試劑進行疾病診斷已成為大流行管理的主要焦點。 根據 2021 年 5 月的 Cytiva 新聞稿,一家 qPCR 試劑製造商必須立即將產量提高 50 倍,以滿足對 COVID-19 測試的需求。 因此,在大流行期間對 qPCR 試劑的需求大幅增加,對市場增長產生了積極影響。 現在,隨著 COVID-19 數量的減少,市場需求正在放緩。 此外,由於慢性病患病率上升和 qPCR 檢測技術進步,預計該市場在預測期內將會增長。

傳染病和遺傳病患病率的上升增加了對有助於採取預防措施的診斷測試的需求。 人口老齡化也增加了對基因檢測的需求。 例如,根據“Breast Cancer Factsheet Now 2021”,英國每年約有 55,000 名女性和 370 名男性被診斷出患有乳腺癌。 乳腺癌在英國奪去了大約 600,000 人的生命。 到 2030 年,這一數字預計將上升到 120 萬。 此外,澳大利亞艾滋病組織聯合會2022年11月發布的報告估計,2021年澳大利亞將有29460名艾滋病病毒感染者。 在這 29,460 人中,估計到 2021 年底將有 91% 得到診斷。 因此,隨著傳染病的流行,診斷測試的需求預計會增加,從而推動預測期內市場的增長。

此外,由於老年人口更容易感染傳染病和慢性病,因此預計不斷增長的老年人口將推動市場擴張。 預計老年人口的增加將在預測期內推動市場增長。 例如,根據聯合國人口基金會公佈的2022年統計數據,美國大部分的生活人口年齡在15至64歲之間,到2022年將占到65%。 此外,根據同一數據,到 2022 年,17% 的人口將超過 65 歲。 因此,傳染病在老齡化人口中普遍存在,推動了對 qPCR 試劑的需求。

因此,傳染病負擔的增加和人口老齡化將支持預測期內的市場擴張。 然而,qPCR 設備的高成本和缺乏操作 qPCR 設備的高技術專長限制了市場增長。

qPCR試劑市場趨勢

染料基qPCR試劑有望主導市場

熒光 DNA 結合染料的使用是科學家使用的最簡單和最常用的 qPCR 方法之一。 將染料添加到反應中,並在每個 PCR 循環後測量熒光。 在雙鏈 DNA 存在的情況下,這些染料的熒光會急劇增加,從而可以通過熒光信號的增加來監測 DNA 合成。

基於染料的定性診斷 PCR 用於快速檢測診斷傳染病、癌症和遺傳異常等的核酸。 例如,根據“Breast Cancer Factsheet Now 2021”,英國每年約有 55,000 名女性和 370 名男性被診斷出患有乳腺癌。 乳腺癌在英國奪去了大約 600,000 人的生命。 到 2030 年,這一數字預計將上升到 120 萬。 因此,癌症疾病負擔的增加有望推動這一領域的增長。

此外,預計市場進入者推出的產品將在預測期內支持市場擴張。 例如,2021 年 12 月,Biotium 宣布了用於 qPCR 和 HRM 的“EvaRuby”染料。 這種光譜學上獨特的紅色熒光嵌入染料可以併入基於探針的 qPCR 測定中,擴展基於探針的 qPCR 的多重選擇。 EvaRuby 染料兼容~470nm 激發和~610nm 發射濾光片。

因此,上述所有因素和產品發布預計將在預測期內推動該細分市場的增長。

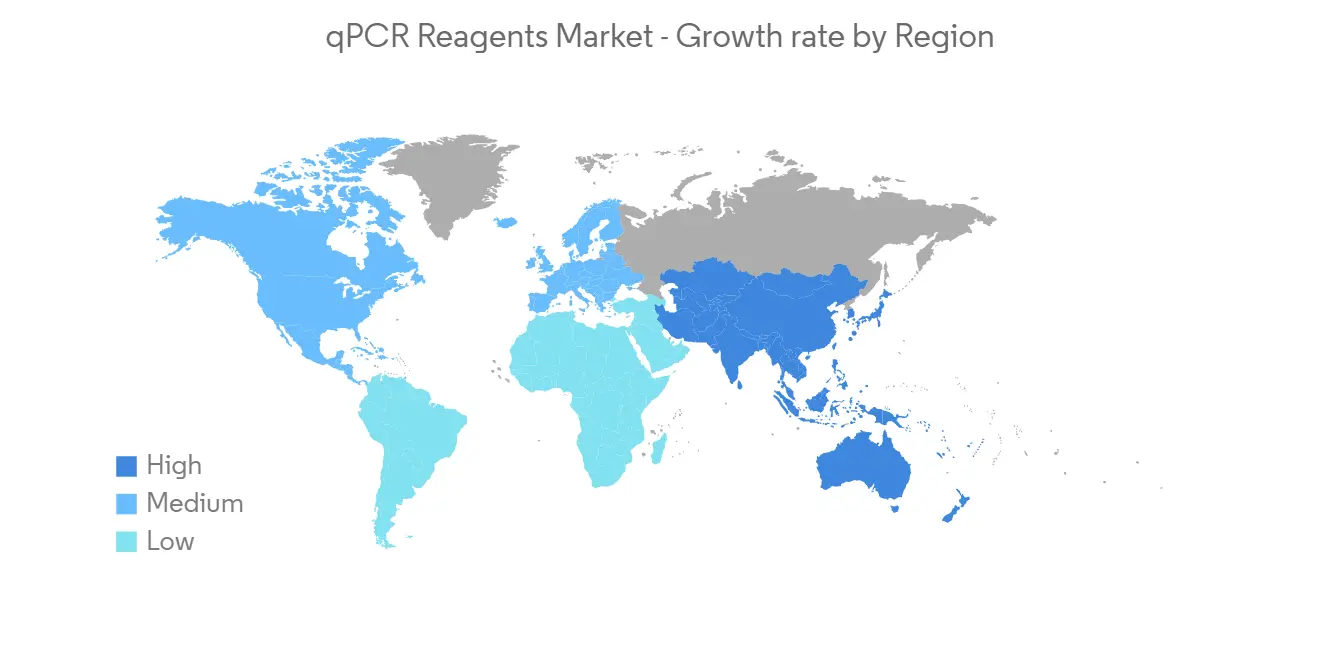

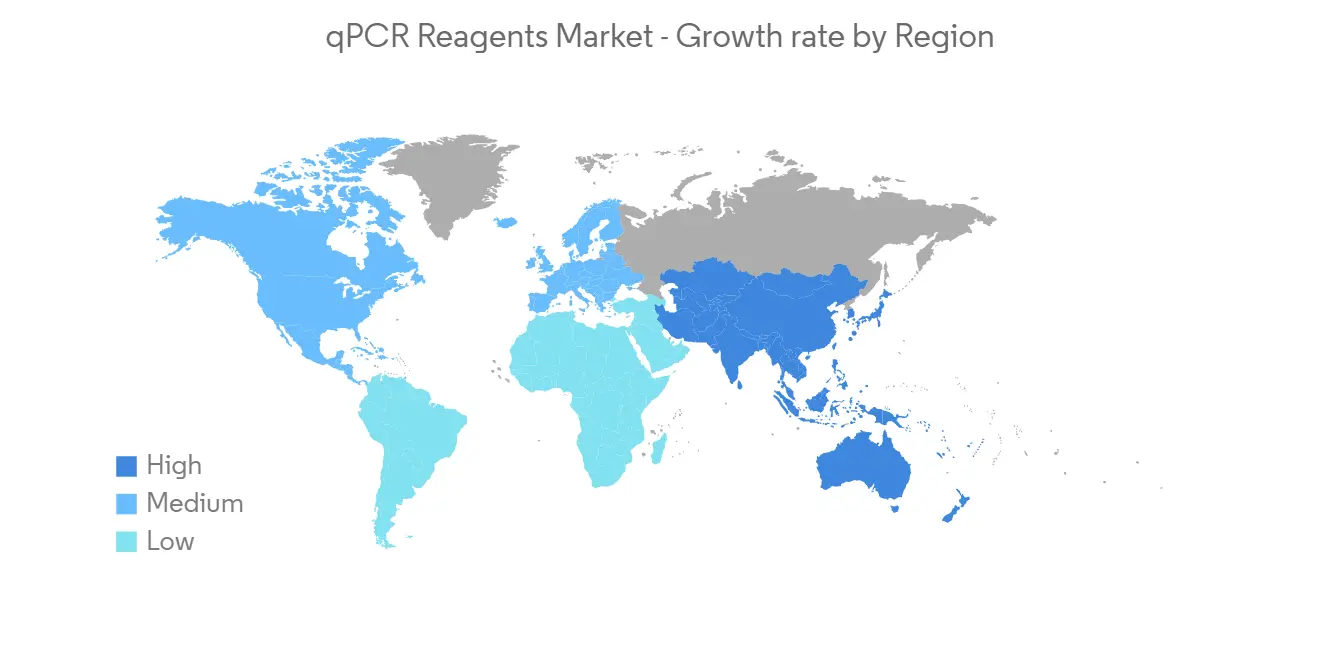

預計在預測期內北美將佔據很大的市場份額

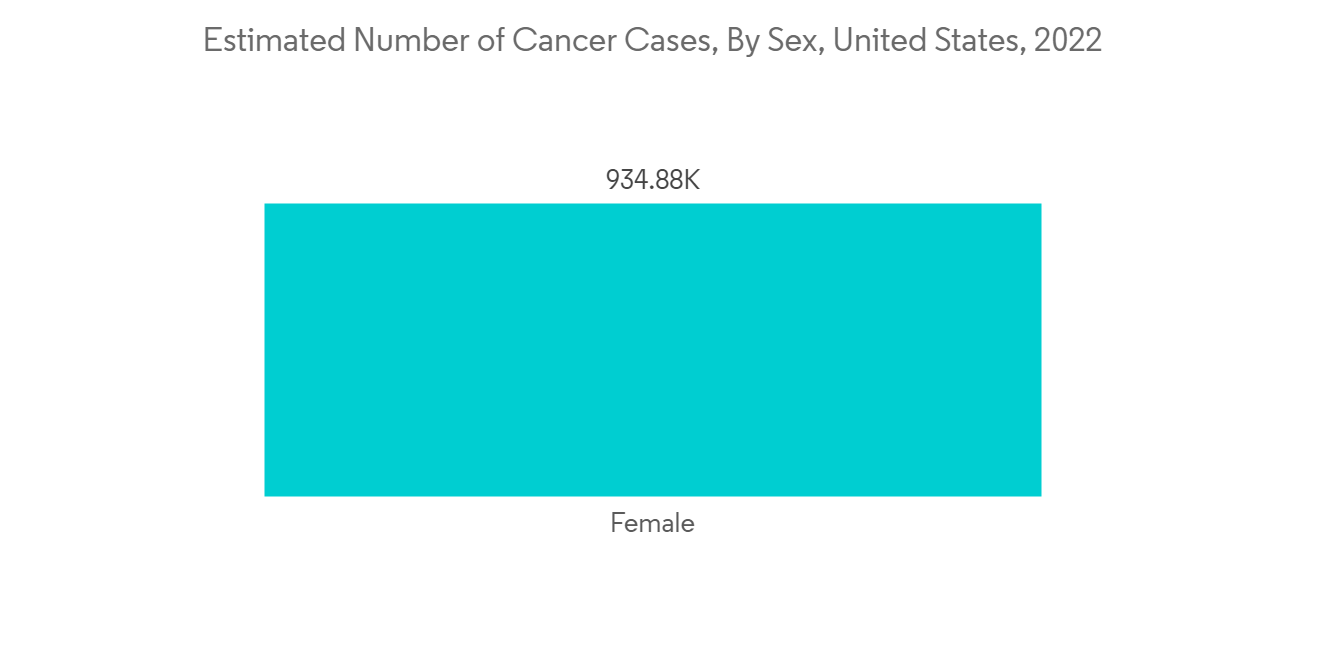

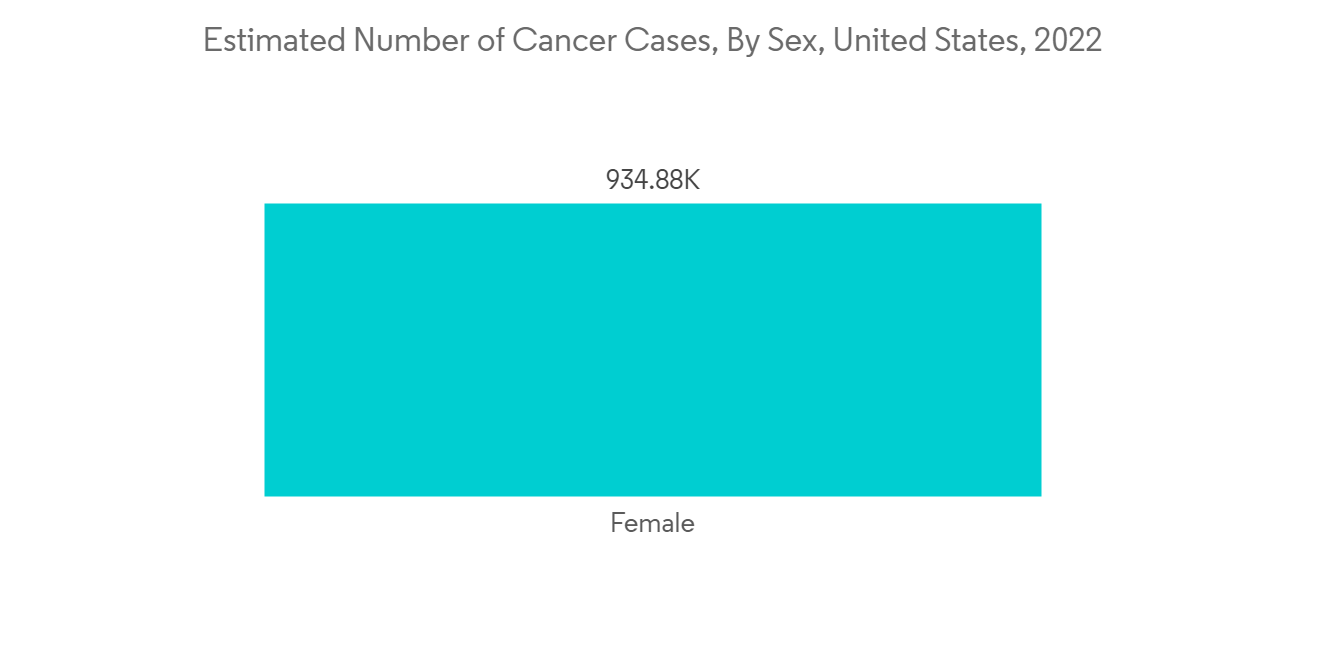

北美佔據了 PCR 試劑市場的主要市場份額。 疾病發病率上升、老年人口增加(老齡化)和技術進步是推動市場增長的因素。 尤其是近期,疫情也提振了qPCR試劑市場。 例如,根據美國癌症協會2022年1月發布的《Cancer Facts and Figures 2022》,估計2022年將診斷出190萬新癌症患者,其中180,000為前列腺癌,6,670,其次是肺癌和169,870,女性乳腺癌有 144,490。 癌症患病率的增加和其他慢性病的高負擔增加了對準確診斷和治療的需求。 這可能會增加 qPCR 試劑並最終促進市場增長。

此外,根據加拿大政府於2021年11月發布的統計數據,2021年約有229,200名加拿大人被診斷出患有癌症,其中前列腺癌是2021年最常見的癌症,預計將繼續成為最常見的癌症確診為癌症,佔確診總數的46%。 根據相同的數據,每 8 名女性中就有 1 名會在一生中的某個時刻被診斷出患有乳腺癌。 因此,隨著癌症患者數量的增加,對早期診斷的需求也將增加,從而推動預測期內對 qPCR 試劑的需求。

此外,市場進入者推出的產品有望支持市場增長。 例如,2022 年 2 月,New England Biolabs (NEB) 推出了 Fluorogenics 的第一個凍乾產品,即 LyoPrime Luna Probe One-Step RT-qPCR Mix with UDG。 這種凍乾主混合物具有與我們發布的液體 4X 混合物相似的適應性和穩健性能,能夠以室溫穩定形式對目標 RNA 序列進行靈敏和線性實時檢測。

因此,所有上述因素,例如日益增加的傳染病負擔,預計將推動該地區市場的增長。

qPCR試劑行業概況

qPCR 試劑市場競爭激烈,由幾家主要參與者組成。 擁有更多研究資金和更好分銷系統的市場領導者正在確立其在市場中的地位。 該市場的主要參與者包括 F. Hoffman-La Roche Ltd、Agilent Technologies、Bio-Rad Laboratories Inc、Merck KGaA(Sigma Aldrich Corporation)和 Thermo Fisher Scientific Inc。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 傳染病和遺傳病的發病率增加

- 老年人口增加

- 越來越關注人類基因組計劃

- 市場製約因素

- 試劑和 qPCR 設備成本高

- 缺乏操作 qPCR 設備的技術專長

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(市場規模:金額)

- 通過檢測方法

- 染料基 qPCR 試劑

- 基於探針和引物的 qPCR 試劑

- 按包裝類型

- qPCR 核心試劑盒

- qPCR 預混液

- 最終用戶

- 醫院和診斷中心

- 研究機構和學術機構

- 其他

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- Kaneka Eurogentec S.A.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffman-La Roche Ltd.

- Promega Corporation

- Quanta Biosciences, Inc.

- Sigma-Aldrich Corporation(Merck KGaA)

- Takara Bio Inc.

- Thermo Fisher Scientific

第7章 市場機會與將來動向

The qPCR reagents market is expected to register a CAGR of 7.9% over the forecast period.

The market for qPCR reagent products has increased as a result of COVID-19, owing mostly to rising demand for polymerase chain reaction tests and a significant increase in the target patient group. The qPCR test, which uses nasopharyngeal swabs or other upper respiratory tract specimens, such as throat swabs or, more recently, saliva for immunology assays, has been the most commonly used and reliable test for COVID-19 diagnosis. As a result, disease diagnosis utilizing qPCR reagents emerged as a primary emphasis for pandemic management. The press release by Cytiva in May 2021 revealed that a qPCR reagent manufacturing company had to immediately raise output 50-fold to satisfy the demand for COVID-19 tests. Thus, during the pandemic, the demand for qPCR reagents tremendously increased, which positively influenced the market's growth. Currently, the market demand has slowed down as the number of COVID-19 has declined. Moreover, it is expected that the market will grow over the forecast period due to the rise in the prevalence of chronic diseases and technological advances in the qPCR test.

The rising incidence of infectious and genetic diseases has increased the demand for diagnostic tests that may help people take precautionary measures. The growing geriatric population has also increased the demand for genetic tests. For instance, according to the Breast Cancer Factsheet Now 2021, around 55,000 women and 370 men in the United Kingdom are diagnosed with breast cancer yearly. Breast cancer has claimed the lives of an estimated 600,000 people in the United Kingdom. This figure is expected to climb to 1.2 million by 2030. Additionally, according to the Australian Federation of AIDS Organizations Report published in November 2022, in 2021, it was estimated that there were 29,460 people with HIV in Australia. Of these 29,460 people, an estimated 91% will have been diagnosed by the end of 2021. Thus, with the growing prevalence of infectious diseases, the demand for diagnostic tests is expected to increase, which propels the growth of the market over the forecast period.

Moreover, the growing geriatric population is expected to support market expansion as this population is more susceptible to infectious and chronic diseases. The increasing geriatric population is likely to increase market growth over the forecast period. For instance, according to the 2022 statistics published by the United Nations Population Fund, in the United States, a large proportion of the living population is aged 15-64 and accounts for 65% in 2022. Furthermore, according to the same source, 17% of the population will be 65 or older in 2022. Thus, infectious diseases are more prevalent in the geriatric population, boosting the demand for qPCR reagents.

Thus, the growing burden of infectious diseases and the ageing population support market expansion over the forecast period. However, the high cost of qPCR equipment and the lack of high technical expertise to operate qPCR equipment have been restraining market growth.

qPCR Reagents Market Trends

Dye-Based qPCR Reagents are Expected to Dominate the Market

The use of fluorescent DNA-binding dyes is one of the most straightforward and common qPCR approaches used by scientists. A dye is added to the reaction, and fluorescence is measured at each PCR cycle. Because the fluorescence of these dyes increases dramatically in the presence of double-stranded DNA, DNA synthesis can be monitored as an increase in fluorescent signal.

Dye-based diagnostic qualitative PCR is applied to rapidly detect nucleic acids that are diagnostic of, for example, infectious diseases, cancer, and genetic abnormalities. For instance, according to the Breast Cancer Factsheet Now 2021, around 55,000 women and 370 men in the United Kingdom are diagnosed with breast cancer yearly. Breast cancer has claimed the lives of an estimated 600,000 people in the United Kingdom. This figure is expected to climb to 1.2 million by 2030. Thus, the growing burden of cancer diseases is expected to propel the segment's growth.

Additionally, product launches by the market players are expected to support the market expansion over the forecast period. For instance, in December 2021, Biotium released 'EvaRuby' Dye for qPCR and HRM. This spectrally unique red fluorescent intercalating dye can be incorporated into probe-based qPCR assays, expanding multiplexing options for probe-based qPCR. EvaRuby Dye is compatible with ~470 nm excitation and ~610 nm emission filters.

Thus, all aforementioned factors with product launches are expected to boost segment growth over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America holds the major market share in the PCR reagent market. The rising incidence of diseases, the elderly population (aging), and technological advancements are attributed to market growth. Especially in recent times, pandemics have also boosted the qPCR reagent market. For instance, according to Cancer Facts and Figures 2022, published in January 2022 by the American Cancer Society, an estimated 1.9 million new cancer cases will be diagnosed in 2022, among which prostate cancer is estimated to be 186,670, followed by 169,870 cases of lung cancer, and 144,490 cases of female breast cancer. The increased prevalence of cancer and the high burden of other chronic diseases increase the demand for accurate diagnosis and treatment. This is likely to increase the qPCR reagent, ultimately boosting the market growth.

Furthermore, according to statistics published by the Government of Canada and released in November 2021, about 229,200 Canadians were diagnosed with cancer in 2021, and prostate cancer is expected to remain the most diagnosed cancer, accounting for 46% of all cancer diagnoses in 2021. According to the same source, breast cancer affects one out of every eight women at some point in their lives. Thus, as the number of cancer cases rises, so does the demand for early diagnosis, driving demand for qPCR reagents over the projection period.

Additionally, product launches by the market players are expected to support market growth. For instance, in February 2022, New England Biolabs (NEB) released the LyoPrime Luna Probe One-Step RT-qPCR Mix with UDG, its first lyophilized product manufactured by Fluorogenics. This lyophilized master mix has the same adaptable characteristics and strong performance as the previously published liquid 4X mix, allowing for sensitive, linear real-time detection of target RNA sequences in a room temperature-stable format.

Thus, all aforementioned factors, such as the growing burden of infectious diseases, are expected to boost the growth of the market in the region.

qPCR Reagents Industry Overview

The qPCR reagents market is highly competitive and consists of a few major players. Market leaders with more funds for research and better distribution system have established their position in the market. The key Companies in this market are F. Hoffman-La Roche Ltd, Agilent Technologies, Bio-Rad Laboratories Inc, Merck KGaA (Sigma Aldrich Corporation), and Thermo Fisher Scientific Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Infectious Diseases and Genetic Disorders

- 4.2.2 Growing Geriatric Population

- 4.2.3 Increasing Focus on Human Genome Projects

- 4.3 Market Restraints

- 4.3.1 High Cost of Reagents and qPCR Equipment

- 4.3.2 Lack of Technical Expertise to Operate the qPCR instrument

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD Millions)

- 5.1 By Detection Method

- 5.1.1 Dye-Based qPCR Reagents

- 5.1.2 Probes and Primer-Based qPCR Reagents

- 5.2 By Packaging Type

- 5.2.1 qPCR Core Kits

- 5.2.2 qPCR Mastermixes

- 5.3 By End-User

- 5.3.1 Hospitals & Diagnostic Centers

- 5.3.2 Research Laboratories & Academic Institutes

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Kaneka Eurogentec S.A.

- 6.1.2 Agilent Technologies, Inc.

- 6.1.3 Bio-Rad Laboratories, Inc.

- 6.1.4 F. Hoffman-La Roche Ltd.

- 6.1.5 Promega Corporation

- 6.1.6 Quanta Biosciences, Inc.

- 6.1.7 Sigma-Aldrich Corporation (Merck KGaA)

- 6.1.8 Takara Bio Inc.

- 6.1.9 Thermo Fisher Scientific